David_Bokuchava/iStock via Getty Images

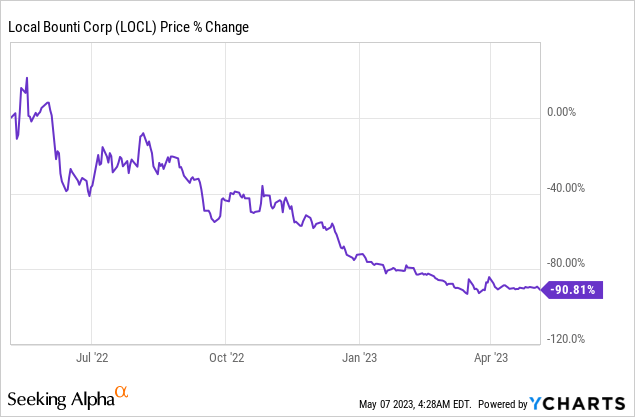

Leafy greens and herbs controlled environment agriculture grower Local Bounti (NYSE:LOCL) was previously facing a liquidity crunch that threatened its future. Its stock price had fallen 91% over the last year to reflect this stark near-binary future with less than two full quarters of cash left on its balance sheet as of the end of its fiscal 2022 fourth quarter. The situation was not great with the company now also racing to maintain compliance with the NYSE’s minimum listing requirement. This was set against a quarterly cash burn rate from operations that stood at $11.6 million during its fourth quarter. Bears, who form the 10.2% short interest, have won out with some waiting for what could have been a Chapter 11 filing if new funds were not raised.

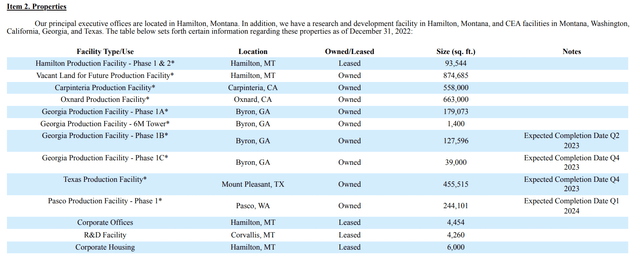

Local Bounti has been able to close on a series of secured financing that has dramatically expanded its cash runway and critically provided time for a ramp-up of its CEA footprint. Local Bounti completed a $35 million sale-leaseback for two of its California facilities in May with an unnamed net-lease REIT. This will be aggregated with a $110 million amendment to its credit facility with Cargill for total funds of $145 million. With cash and equivalents at $13.7 million exiting the fourth quarter, management of the Montana-based company has stated that they have the funding required to drive the business to positive adjusted EBITDA. This should provide at least 12 months of cash runway and should be sufficient capital for the company to meet its ambitious construction plans.

The promise of CEA has not only centered on its unique environmental footprint as it uses 90% less water and land, but it has also focused on its potential to drive stronger operational benefits than traditional farming. It allows for production year-round, improved taste, texture, and shelf life, and requires zero herbicides and pesticides.

Cash Ramps Up With Profitability In View

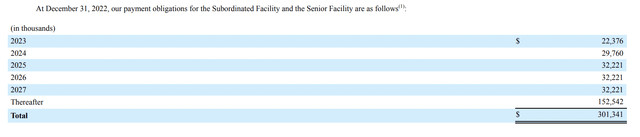

Bears would of course highlight that the amendment to its existing credit agreement with Cargill to expand its debt facility from $170 million to up to $280 million is not cheap. Interest is calculated based on a 12.5% interest rate for the subordinated facility and a 13.1% interest rate for the senior facility, this also includes an unused commitment fee of 1.25%. Local Bounti is set to repay at least $22.4 million this year, rising to $29.76 million next year. Further, the deal comes with deferred dilution but more downstream funding as Local Bounti issued Cargill 5-year warrants to purchase up to 69.6 million shares of common stock at a $1 per share exercise price.

Local Bounti

Local Bounti last reported fiscal 2022 fourth-quarter revenue of $6.64 million, a huge 1975% increase from its year-ago comp but a miss by $840,000 on consensus estimates. The company notched new operational wins last year with the start of more expansive commercial production, the growth of its distribution reach to over 10,000 doors, signing a leafy greens production off-take agreement with Sam’s Club in November, and closing on the strategic acquisition of Californian indoor farming company Pete’s.

Local Bounti

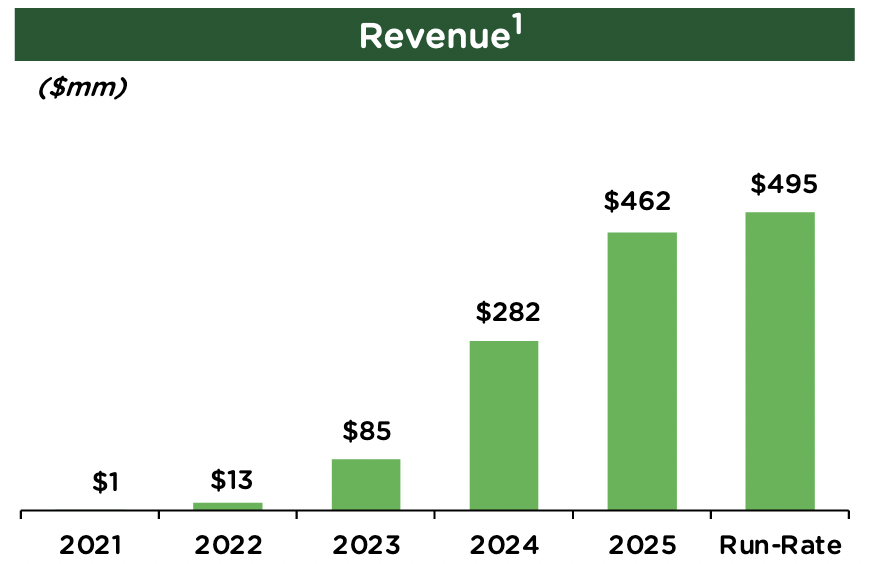

Phase 1B and Phase 1C of its Georgia facility as well as its Texas facility are set to be completed by the end of 2023. This large expansion of production capacity should see the company rapidly ramp revenue this year with management guiding for revenue of $34 million to $40 million in 2023. However, this will be far lower than the consensus of $42.85 million and significantly lower than the initial guidance provided when the company went public via SPAC.

Local Bounti SPAC Investor Presentation Revenue Guidance

The Valuation Against A Brighter Outlook

Local Bounti is undoubtedly facing a brighter future on the back of the $145 million fundraise. The company also received term sheets from a licensed United States Department of Agriculture lender that will provide roughly $80 million to use to reduce its use of more expensive construction financing. Local Bounti’s market cap at $48.7 million is now set against 2023 revenue of at least $34 million. This is for a roughly 1.43 price-to-forward sales multiple, dropping to 1.22x using the top end of its guided revenue range. Is the company a buy?

It depends. The current risk-off market sentiment will likely continue to mirror a Fed funds rate that’s been hiked to new highs. That Local Bounti now sits significantly below its $10 SPAC reference price is a reflection of a market that’s uncaring of loss-making high-growth stocks. Hence, more risk-averse investors should likely wait until the company reaches positive adjusted EBITDA to assess whether to take a position. At the other end of the risk spectrum, I believe the revenue ramp and the broadly nondilutive raised funds open up a significantly brighter future for Local Bounti. I’m rating the company as a hold against this.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

![Exclusive Interview: “[Ukraine’s] Sacrifices Are Our Sacrifices” Exclusive Interview: “[Ukraine’s] Sacrifices Are Our Sacrifices”](https://www.thecipherbrief.com/wp-content/uploads/2023/05/GettyImages-1460031831-scaled.jpeg)