Homebuilder Lennar Corp. plans to spin off its LENx funding division later this yr in an effort to develop into a “pure-play homebuilding firm,” citing volatility within the valuations of the publicly-traded corporations it holds a stake in, together with actual property tech startups Opendoor, Mix Labs and Sonder.

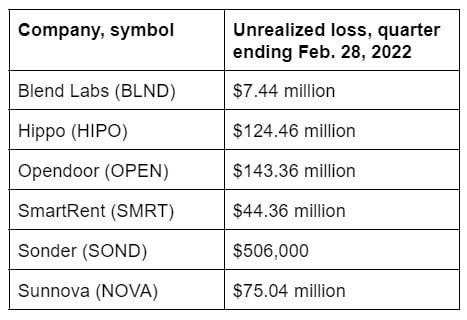

In its newest quarterly earnings report, Lennar on Wednesday acknowledged $395 million in paper losses throughout the quarter ending Feb. 28 from its investments in six publicly traded tech corporations.

Along with reigning iBuyer champion Opendoor and cloud banking software program developer Mix Labs, LENx reported unrealized losses on its investments in short-term rental supervisor Sonder, house insurance coverage startup Hippo, photo voltaic and power service supplier Sunnova, and self-guided tour supplier SmartRent. Though LENx can be a significant stakeholder in Doma, a publicly traded digital title, escrow and shutting supplier, it makes use of a unique accounting technique to estimate its worth.

Lennar Corp. unrealized losses from know-how investments

Supply: Lennar Corp. earnings report for quarter ending Feb. 28, 2022.

By means of LENx, Lennar has invested in a portfolio of two dozen corporations, specializing in three “core verticals” — multifamily, single-family for lease, and land methods. A lot of the corporations LENx has a stake in, together with Divvy Houses and Notarize, have but to go public.

On a name with funding analysts, Lennar Government Chairman Stuart Miller mentioned the homebuilder nonetheless likes the businesses LENx has invested in, which “are working to reshape varied elements of our firm and our trade,” and serving to Lennar lower prices.

“We have now made vital strategic investments in varied new know-how corporations which might be working to reshape varied elements of our firm and our trade,” Miller mentioned. “Some are disruptors and a few are enhancers. All of them are core to the way forward for, in addition to the presence of our core working platform.”

However Miller mentioned Lennar is working with regulators to spin LENx off as an impartial entity as a result of when corporations it’s invested in go public, they create volatility within the homebuilder’s earnings outcomes that “causes some confusion on each the upside and the draw back.”

Miller famous that within the first quarter of 2021, Lennar reported $470 million in paper beneficial properties on the know-how corporations it’s invested in.

“These are non-monetary and non-operational income and losses, and so they actually don’t replicate the state of the housing market, or the working efficiency of the corporate inside that market,” Miller mentioned.

That mentioned, Lennar chooses “to not promote the possession in these corporations simply because they go public. As an alternative, we’re strategically engaged within the companies as a result of — within the companies of those corporations and since we’re very keen about the way forward for these companies and our LENx technique.”

Spinning LENx off as a separate firm, which Lennar refers to as “SpinCo” for now, will enable Lennar to concentrate on “changing into a pure-play homebuilding firm,” Miller mentioned.

Miller mentioned Lennar has filed a confidential Type 10 registration assertion with the Securities and Alternate Fee in February, and obtained a primary spherical of feedback from the SEC, and initiated the method to have SpinCo listed on the New York Inventory Alternate.

He mentioned Lennar “can management the timing of the spin,” however that, “given the choppiness of the capital markets and the work that’s nonetheless being accomplished, we’re pushing our expectations for the precise execution to the third or fourth quarter of this yr.”

Title insurer First American Monetary has additionally been making huge bets on next-generation proptech investments, with investments in 16 venture-funded corporations together with digital title and settlement providers supplier Endpoint, in addition to Lev, Offerpad, Orchard, Pacaso, Ribbon, Aspect Inc., and Sundae.

E-mail Matt Carter