Shares of Lennar Company (NYSE: LEN) have been down over 2% on Thursday. The inventory has dropped 29% year-to-date and 20% over the previous 12 months. The corporate delivered encouraging outcomes for its first quarter of 2022 lately, with each the highest and backside line metrics surpassing expectations. Sturdy demand and constrained provide are two key elements which can be at the moment influencing the homebuilder’s efficiency trajectory. Listed here are just a few factors to notice:

Sturdy housing market

Lennar noticed energy within the housing market throughout all its main areas even within the midst of inflationary pressures and rising rates of interest. Demand developments stay robust on the again of accelerating household formation. Because of the shortage, rents and housing prices are rising and patrons are in search of a greater various which might be to personal a house with a fixed-rate mortgage.

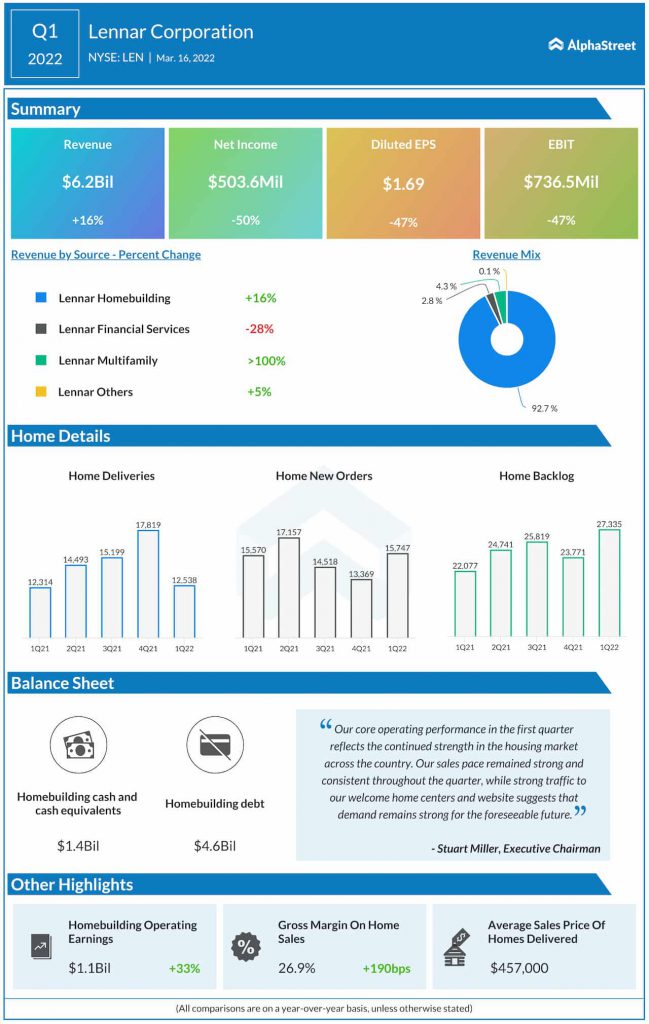

Through the first quarter, Lennar’s new orders and deliveries have been stable in every of its working areas. New orders elevated 1% to fifteen,747 properties and deliveries rose 2% to 12,538 properties. Markets like Florida and Atlanta are benefiting from restricted stock and powerful job creation.

On its quarterly convention name, Lennar acknowledged that Florida is seeing core native demand in addition to in-migration from the Northeast, Midwest, and West Coast, which is driving gross sales tempo and value. The Orlando market is benefiting from a rebound in tourism.

Texas is one other robust market seeing in-migration from the East and West. Its pro-business financial system is driving company relocations and job progress. Related developments are seen in Colorado. Within the first quarter, Lennar’s neighborhood depend elevated 4% year-over-year. The corporate expects its neighborhood depend to construct all year long and is projecting to finish 2022 with a low double-digit enhance in neighborhood depend year-over-year.

Provide chain

Lennar continues to take care of provide chain disruptions in addition to impacts from inflation on development prices. The Omicron variant led to labor shortages throughout Q1, notably in January, which then eased in February. There proceed to be constraints in classes reminiscent of electrical gear, HVAC condensers, and cupboards.

The availability chain challenges throughout Q1 led to elevated cycle instances and better direct development prices. The common cycle time elevated approx. two months year-over-year and two weeks sequentially from This autumn. Direct development prices have been up 23% YoY, and lumber accounted for round 60% of this enhance.

Seeking to the steadiness of the yr, Lennar is concentrated on accelerating begins to present it extra stock below development. It will present a cushion in opposition to increasing cycle instances, giving the corporate extra alternative to finish properties in step with its plans. The corporate goals to ship 68,000 properties in 2022.

Outlook

Trying into the second quarter of 2022, Lennar expects market situations to stay the identical with robust demand and restricted stock pushed by provide chain headwinds. In opposition to this backdrop, the corporate expects new orders to vary from 17,800 to 18,200 properties and deliveries to vary from 16,000 to 16,300. Common gross sales value needs to be about $470,000. The corporate expects EPS of $3.80-4.00 per share for Q2.

Click on right here to learn the total transcript of Lennar Company’s Q1 2022 earnings convention name