THEPALMER

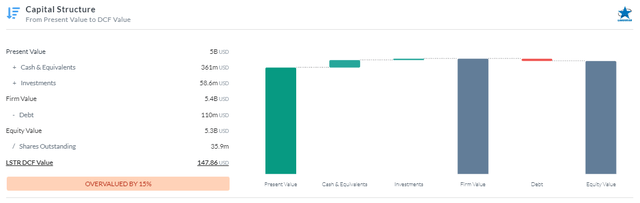

Landstar System, Inc. (NASDAQ:LSTR) has seen excellent price movement within the past year due to strong earnings. I believe that Landstar is currently a hold because although it has demonstrated its ability to outperform, has a solid balance sheet, and has an excellent opportunity to expand its network, the stock is currently overvalued assuming my DCF figures.

Business Overview

With operations in the United States, Canada, Mexico, and other countries, Landstar System, Inc. is a well-known provider of transportation management solutions. It is divided into two main business segments: insurance and transportation logistics.

An extensive range of transportation services are provided by the Transportation Logistics segment, including truckload and less-than-truckload transportation, intermodal rail, air and ocean cargo, expedited ground and air delivery for time-sensitive freight, specialized heavy-haul transport, cross-border services between the United States and Canada and the United States and Mexico, as well as intra-Mexico and intra-Canada transportation. They also deal with customs brokerage and project cargo logistics. Landstar serves a variety of markets, including those for automotive components, durable goods, construction materials, metals, chemicals, food products, heavy machinery, retail, electronics, and military hardware.

The Insurance division, in contrast, concentrates on risk management, claims support, and reinsuring risks related to the company’s independent contractors. Through independent commission sales representatives and third-party capacity suppliers, Landstar advertises its services and keeps a strong presence in the transportation and logistics sector.

Landstar

Financials

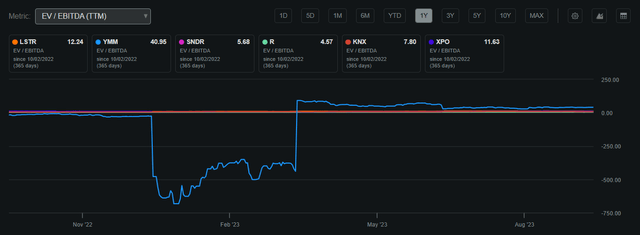

Landstar’s current market valuation stands at approximately $6.36 billion, accompanied by an impressive Return on Invested Capital of 31%. The existing stock price is set at $174.32 per share, slightly under its 200-day moving average of $181.83. Notably, the company’s EV/EBITDA ratio is at 12.24, reflecting a relatively elevated valuation. This ratio surpasses that of similar companies, suggesting a premium price in comparison to its industry counterparts.

Landstar EV/EBITDA Compared to Peers (Seeking Alpha)

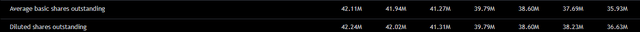

The firm also pays a dividend of 0.75% which represents a 12.79% payout ratio. This demonstrates the firm’s ability to provide shareholder value through core business improvements, and dividends. With a 31% ROIC, I believe that the small dividend is beneficial as the firm can utilize FCF to create greater growth within its business. Landstar has also repurchased shares over the years creating greater EPS for shareholders. I believe that the share repurchases, although prudent in previous years, may not be beneficial moving forward as buying expensive shares would not be a productive use of FCF.

Shares Outstanding Annual (TradingView) Share Performance (Seeking Alpha)

Earnings

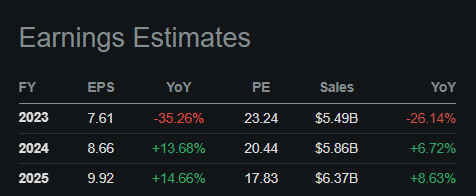

Landstar recently reported excellent Q2 2023 earnings with EPS surpassing expectations by $0.06 at $1.85 and revenues beating estimates at $30 million at $1.37 billion. With better-than-expected profitability and revenues amid fuel price volatility, I believe that the firm’s ability to hedge against macro headwinds has demonstrated management’s effectiveness in bringing value in all economic conditions. Landstar’s guidance also looks relatively sound with EPS and revenue recovery over the next two years.

Earnings Estimates (Seeking Alpha)

Performance Compared to the Broader Market

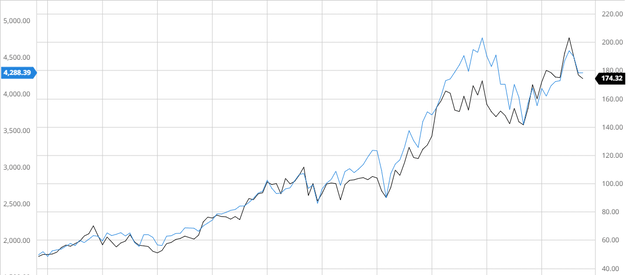

Landstar has also almost perfectly tracked the S&P 500 when adjusting for dividends in the last 10 years demonstrating the firm’s ability to effectively allocate capital. With promising future results, coupled with the firm’s strategy to continue expanding its network, I believe that Landstar has a very promising chance of outperforming in the long term.

Landstar Compared to the S&P 500 10Y (Created by author using Bar Charts)

Analyst Consensus

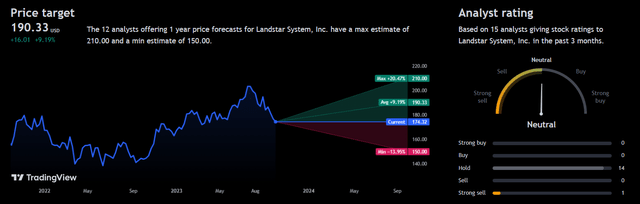

Analysts currently rate Landstar as a “hold” with a 1Y price target of $190.33 demonstrating a 9.19% upside. I believe that although analysts recognize the firm’s ability to outperform, overvaluation is a significant weight to their price targets hence the rather neutral estimates.

Analyst Consensus (TradingView)

Balance Sheet

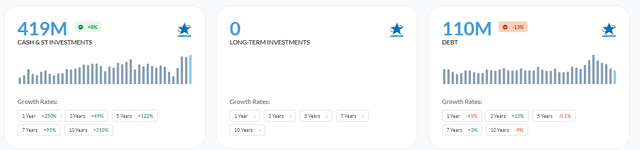

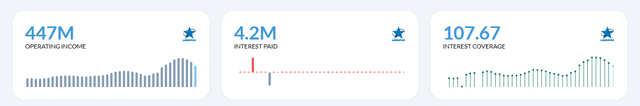

Landstar also holds a solid balance sheet with debt declining by 41% in the last year and interest coverage at 107.67. This demonstrates the firm’s resilience to macro headwinds as this strong balance sheet will give the firm room to leverage if income falls to maintain operations and outperform peers who are more debt-heavy. With a current ratio of 1.98 and an Altman-Z-Score of 11.46, Landstar is in an excellent position to remain solvent in the medium term.

Financial Position (Alpha Spread) Interest Coverage (Alpha Spread) Solvency Ratios (Alpha Spread)

Valuation

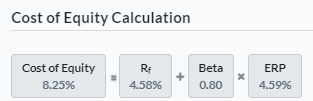

To provide an accurate valuation of Landstar, I decided to calculate an accurate discount rate by using the Capital Asset Pricing Model and then using that rate to find the WACC. To find the Cost of Equity, I utilized a risk-free rate of 4.58% based on the current 10-year treasury yield.

Cost of Equity Calculation (Created by author using Alpha Spread)

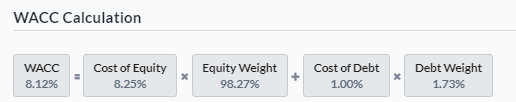

Given the previously applied Cost of Equity, I computed a Weighted Average Cost of Capital of 8.12% for Landstar. This WACC is lower than the industry average of 8.79%, illustrating the company’s proficiency in managing a cost-effective capital structure.

WACC Calculation (Alpha Spread)

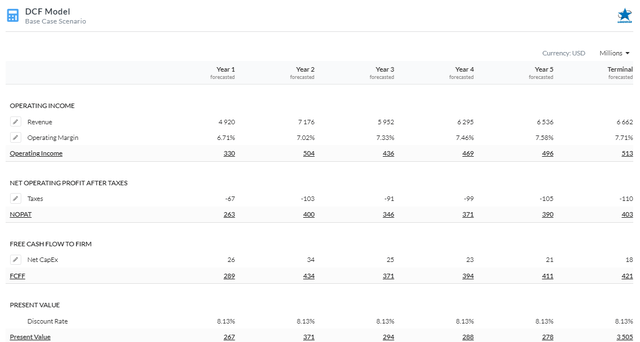

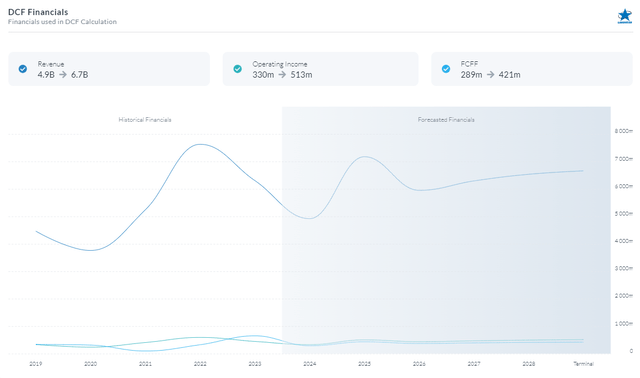

Now that I have an appropriate discount rate, I used a 5Y Firm Model DCF based on FCFF. For the DCF, my discount rate was 8.13% as I believed that adding a risk premium would not be needed due to the strong balance sheet and outperformance the firm has demonstrated. Furthermore, I estimated revenues and margins to grow in line with analyst estimates.

5Y Firm Model DCF Using FCFF (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Network Expansion Fostering Operational Synergies

In order to strategically grow its network, Landstar purchased Ontario-based NLM, a prominent provider of over-dimensional and heavy-haul freight services, in 2009. The improvement of their specialist transportation services and the expansion of their network capabilities were both aided by this acquisition.

Significant operational advantages resulted from this acquisition. Landstar improved its capacity to offer customized transportation solutions, notably for huge or unusual freight, by incorporating NLM into its current operations. In the heavy-haul industry, NLM contributed knowledge, experience, and a solid network that allowed Landstar to provide a wider range of services to its clientele. The combination established Landstar as a one-stop shop for both standard and specialized freight transportation needs by enabling seamless resource coordination, access to specialist equipment, and an increased pool of highly qualified drivers.

On the financial front, it was believed that acquiring NLM would increase profitability and spur sales growth. By broadening its selection of specialist services, Landstar may draw in a wider range of clients and command higher prices for the transportation of specialty cargo, increasing income streams. Additionally, through synergies, economies of scale, and streamlined processes, the acquisition offered potential cost efficiencies. Reduced operating expenses as a result of pooling resources, streamlining routes, and consolidating administrative tasks ultimately helped to increase margins and profitability.

The acquisition also demonstrated Landstar’s strategic vision and dedication to maintaining leadership in the sector by anticipating customer needs and pursuing inorganic growth possibilities. It proved their commitment to provide thorough and customized solutions, cemented their position as a market leader in specialist transportation services, and eventually paved the way for long-term growth and higher shareholder value.

The reason I am mentioning an acquisition from almost 15 years ago is that the firm’s FCF is much higher than the historic average as shown below. With excellent income, high FCF, low debt, and a high share price, Landstar has the ability to continue expanding its network through its core business or through acquisitions resulting in greater future performance and utility for its customers. Once macro headwinds cool off as inflation begins to decline and rates fall, we could see excellent use of this large pool of cash financed through several avenues in my view.

Landstar FCF Annual (TradingView)

Risks

Fuel Price Volatility: Fuel price fluctuations have a big impact on Landstar’s operational costs, which has an effect on profit margins and overall financial stability.

Regulatory Compliance and Changes: Numerous laws and regulations apply to the sector, and compliance with them is crucial. Law and rule changes, particularly those pertaining to safety, environmental standards, or trade, can raise compliance costs and have an impact on business operations.

Conclusion

To summarize, I believe that Landstar is currently a hold. Although it has demonstrated an ability to outperform and has a solid balance sheet, as well as an excellent opportunity to expand its network, the stock is currently overvalued assuming my DCF figures.