Sundry Pictures

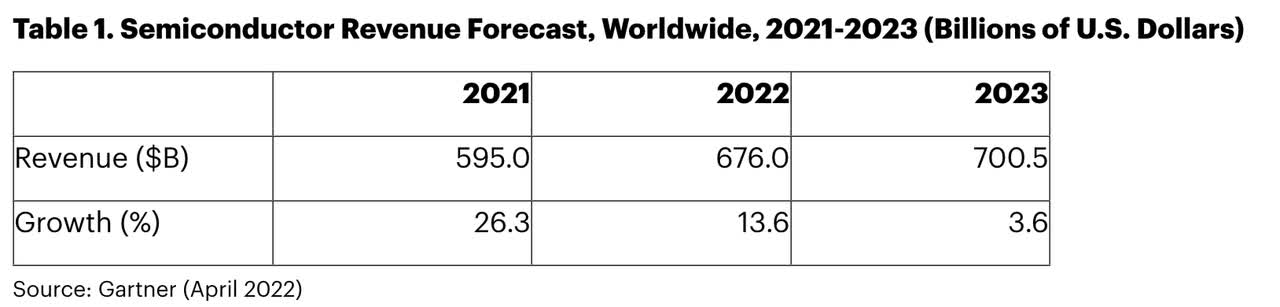

We’re bullish on Lam Analysis Company (NASDAQ:LRCX). Our purchase thesis relies on our perception that the corporate performs a pivotal position within the semiconductor manufacturing chain. We consider the semiconductor manufacturing business will develop exponentially in the long run as a result of it’s within the enterprise of etching and deposition, which is important for manufacturing semiconductor chips. Gartner forecasts worldwide semiconductor income to develop by 13.6% in 2022. We consider elevated demand for semiconductors will result in elevated demand for the front-end gear LRCX supplies. The next graph exhibits the semiconductor income forecasts.

Gartner

We consider the inventory is in a downward draft within the close to time period due to weakening client spending. We predict the inventory pullback creates a great entry level to purchase into semiconductor gear suppliers at a cheaper price. We consider the chance of weakening client spending is already factored into the inventory now and consider the draw back is restricted from right here.

LRCX is within the inexperienced zone as a result of WFE spending is powerful in the long run

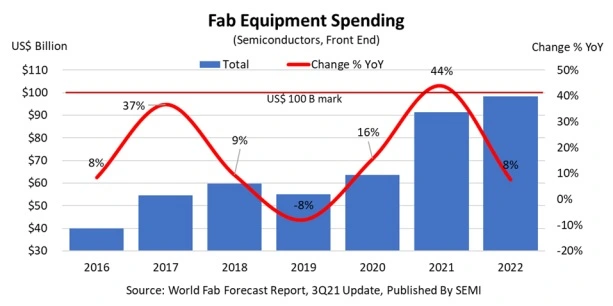

LRCX is a wafer fabrication gear (WFE) firm. The gear LRCX manufactures is important for producing end-user chips. The need of WFE in manufacturing semiconductors makes us optimistic in regards to the inventory’s long-term outlook. WFE spending correlates with semiconductor spending. The WFE spending is anticipated to drop within the close to time period resulting from weakening client demand. Nevertheless, we consider this weak point is priced into LRCX inventory. The next graph exhibits the expansion trajectory of WFE spending.

SEMI

WFE spending can be rising exponentially inside the reminiscence sector. The reminiscence sector achieved $38B in spending in 2022, based on EE Occasions Asia. The majority of LRCX’s income comes from its reminiscence phase. We acknowledged that weakening client spending will doubtless trigger CAPEX cuts within the reminiscence sector within the close to time period. Nonetheless, we aren’t too involved about this negatively impacting LRCX as a result of we consider a lot of the CAPEX lower expectations within the reminiscence sector have been priced into the inventory.

World WFE TAMs have been climbing

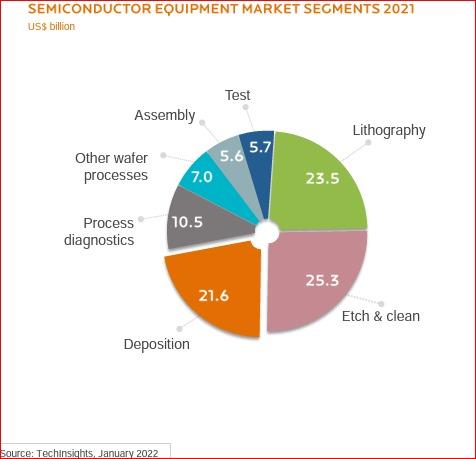

We’re optimistic in regards to the LRCX enterprise as a result of it really works within the enterprise of etching and deposition. Etch and Deposition processes are utilized in greater than 500 steps to make a semiconductor chip. The worldwide TAM for etching and deposition has been rising over the previous few years. Etching TAM was $25.3B in 2021, whereas solely $18.2B in 2020. The identical goes for deposition. Deposition TAM was $15.8B in 2020 and grew to $21.6B in 2021. Etching and deposition TAMs are on the rise. In flip, we consider LRCX, a primarily etch and deposition firm, is well-positioned inside the business to journey the wave up. We’re buy-rated on LRCX now as a result of we expect the inventory is close to the underside and supplies a sexy risk-reward. The next graph exhibits the semiconductor gear market segments.

TechInsights

NAND publicity is a double-edged sword

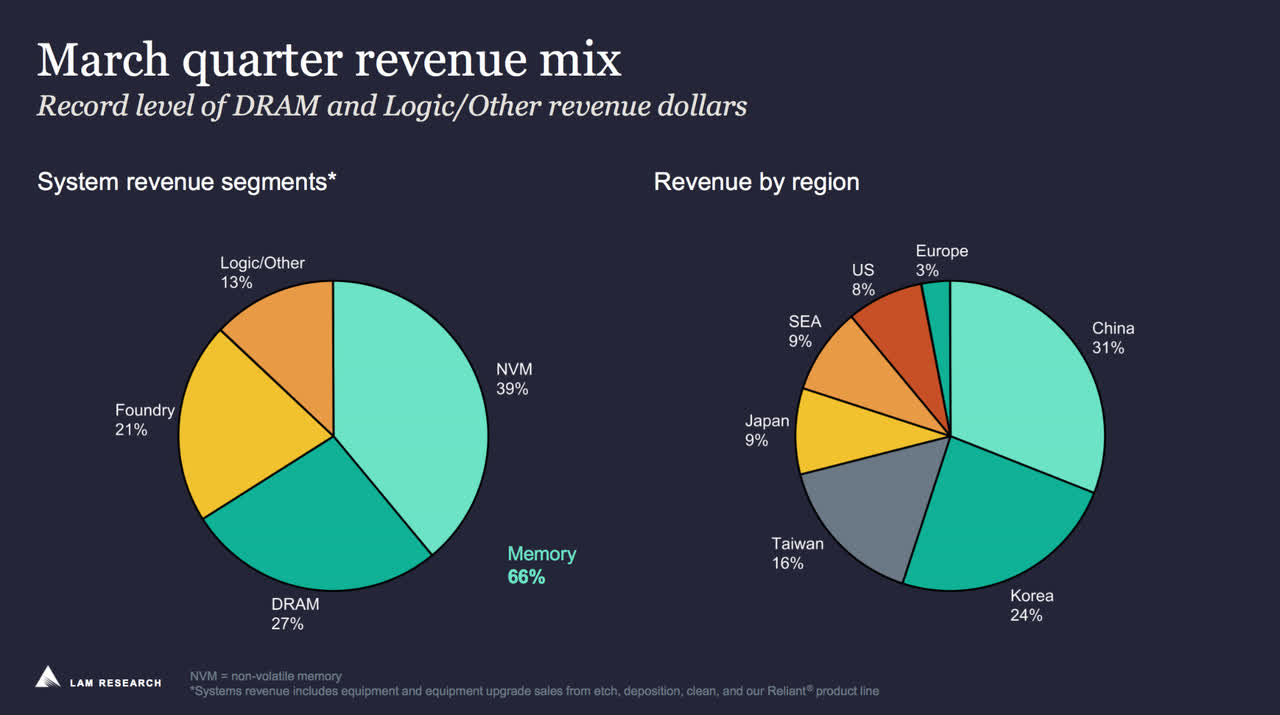

Most of LRCX’s enterprise comes from its reminiscence phase, with NAND and DRAM making up 66% of income. LRCX is especially uncovered to NAND at 39% of income over the last quarter. The corporate benefited from the business’s transition from 2D NAND to 3D NAND. In layman’s phrases, the corporate spearheaded the transition from one-story stage NAND to sky-scrapper NAND. The next graph exhibits LRCX’s income per phase.

Lam Analysis

Regardless of LRCX’s NAND income dropping in comparison with earlier quarters, we’re nonetheless bullish on the inventory. Within the September quarter of 2021, NAND made up 45% of the corporate’s income and solely 39% within the final quarter. We attribute the drop from 45% to 39% to weakening client spending. NAND is used primarily in PCs and smartphones. PC and smartphone shipments are projected to say no. Gartner forecasts worldwide PC shipments to say no 9.5% in 2022. IDC additionally forecasts smartphone shipments to say no by 3.5% to 1.31 billion models in 2022. Nonetheless, we aren’t nervous about LRCX’s publicity to weakening client spending. We consider the demand pullback is priced into the inventory.

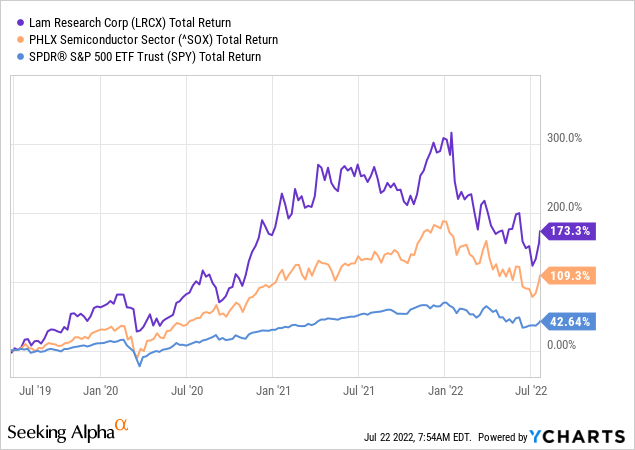

Inventory efficiency

LRCX has had a powerful run over the previous 5 years. The inventory rocketed 95% because the pandemic started. The inventory grew round 173% over the previous 5 years. LRCX inventory peaked at $732 and is now buying and selling at about $472, close to its 52-week low of $376. We suggest traders purchase the inventory on weak point. The inventory is at the moment in a downward draft resulting from market volatility and provide chain points within the semiconductor business. YTD, the inventory is down 34%. We consider the downward draft is kind of finished. We consider the inventory is near bottoming and can doubtless go up from right here.

The next graphs define LRCX inventory efficiency.

YCharts

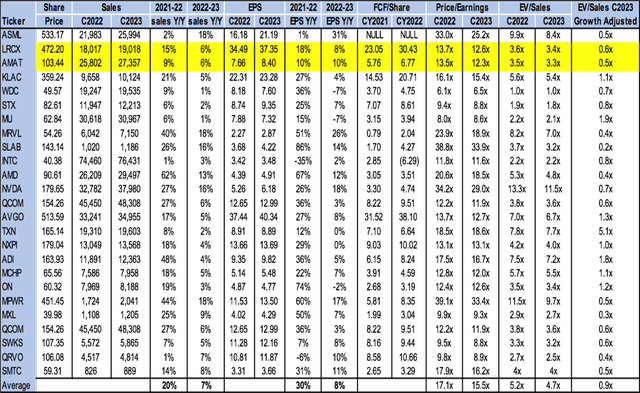

Valuation

LRCX is buying and selling at round $472 and within reason priced in comparison with its friends. On the P/E foundation, LRCX is buying and selling at 12.6x C2023 EPS of $37.35 in comparison with the group common of 15.5x. The inventory is buying and selling at 3.4x EV/C2023 gross sales versus the peer group common of 4.7x. Adjusted for development, LRCX is buying and selling at 0.6x C2023, in comparison with the group common of 0.9x. The next chart illustrates the semiconductor peer group valuation.

Techstockpros & Refinitiv

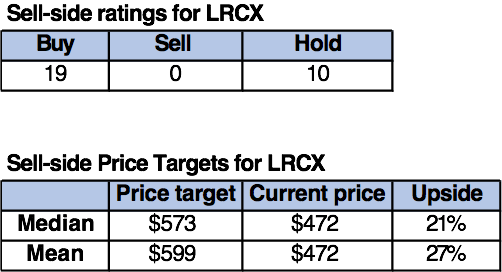

Phrase on Wall Avenue

Market consensus on LRCX is a purchase. Of the 29 analysts masking the inventory, 19 are buy-rated, and ten are hold-rated. Analyst optimism is mirrored within the upside introduced by the sell-side worth targets. LRCX is at the moment buying and selling at round $472. The sell-side median worth goal is $573, and the imply is $599, for an upside of 21-27%. The next chart signifies LRCX sell-side scores and worth targets:

Techstockpros

What to do with the inventory

We’re bullish on the LRCX. We consider the corporate is a main WFE provider, and now could be the time to purchase in as a result of the inventory is near bottoming. LRCX is well-positioned inside the reminiscence enterprise to develop in the long term. We consider the inventory is a sexy purchase for long-term traders.