allanswart/iStock via Getty Images

Chinese manufacturers imported $6.2 billion worth of semiconductor equipment (lithography, deposition, etch, inspection) in Q4 2022, down 20% QoQ and down 24% YoY, according to our report entitled Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends.

The drop in imported semiconductor equipment reflects the mounting pressure on China’s semiconductor industry as the US seeks to curtail China’s access to and ability to produce advanced chips and chip-making equipment. But other factors play a role, such as Covid, Covid lockdowns in China, a chip supply glut, and a slowing global economy.

Impact on Lam Research

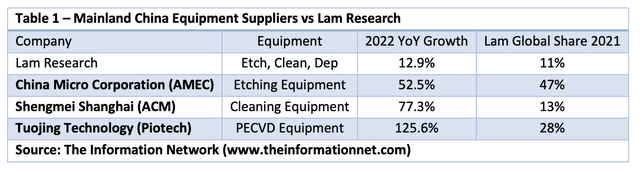

This article presents a comparative analysis of U.S. WFE equipment companies with Mainland Chinese companies, which will be shown below. Of these Mainland Chinese companies, Table 1 identifies three that directly compete against Lam.

In 2021, Lam Research (NASDAQ:LRCX) held an 11% share of the global WFE market, according to our report entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts. Lam was the #4 company after #1 Applied Materials, #2 ASML (ASML) and #3 Tokyo Electron.

The Information Network

According to Table 1:

- Lam held a 47% share of the Etching Equipment market in 2021, competing against AMEC. But Lam’s YoY growth of 12.9% in 2022 compares to AMEC’s YoY growth of 52.5%, indicating share erosion of Lam.

- Lam held a 13% share of the Cleaning Equipment market in 2021, competing against ACM (ACMR). But Lam’s YoY growth of 12.9% in 2022 compares to ACM’s YoY growth of 77.3%, indicating share erosion of Lam.

- Lam held a 28% share of the Plasma Enhanced Chemical Vapor Deposition (PECVD) Equipment market in 2021, competing against Piotech. But Lam’s YoY growth of 12.9% in 2022 compares to Piotech’s YoY growth of 125.6%, indicating share erosion of Lam.

Revenue Growth of Mainland Chinese Companies

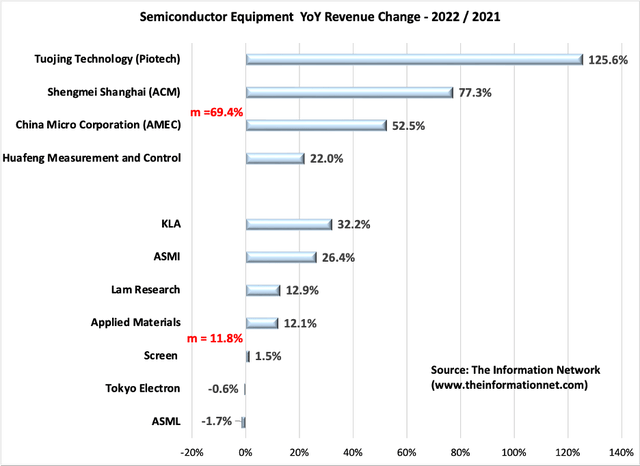

Chart 1 shows 2022/2021 revenue growth of the above three Chinese companies (Table 1) along with Huafeng Measurement and Control. These four companies had a mean average YoY growth of 69.4%, and compares to the mean average YoY growth of non-Chinese equipment companies of just 11.8%.

The Information Network

Chart 1

Investor Takeaway

The mean growth for Chinese companies was 69.2%, indicating that Chinese equipment companies are gaining in the market, although their revenues are significantly lower than non-Chinese counterparts.

Sanctions are responsible for a structural shift of Chinese semiconductor companies to push its “Made in China 2025” and other programs to their limits by not relying on foreign companies to encroach on its nascent industry.

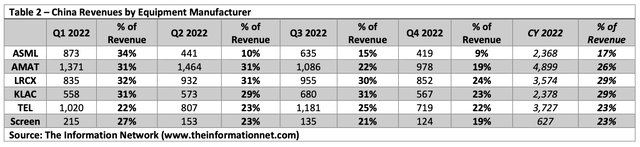

Table 2 shows the percentage of total WFE revenues by the top equipment companies in 2022 on a quarterly basis. On a revenue, Applied Materials (AMAT) had the greatest exposure, but on a percentage of revenue basis, Lam Research and Tokyo Electron (OTCPK:TOELY) had the greatest exposure.

This is important. With U.S. sanctions against China continuing to be expanded, these three companies will be most impacted in 2024. But all these companies will experience an impact. Table 1 shows that the % of revenues for all companies decreased QoQ in Q4 2022.

The Information Network

U.S. sanctions restrict equipment sales at:

Logic chips with non-planar transistor architectures (I.e., FinFET or GAAFET) of 16nm or 14nm, or below;

DRAM memory chips of 18nm half-pitch or less;

NAND flash memory chips with 128 layers or more.

LRCX also has high exposure to memory (primarily NAND) chips. I showed in my January 5, 2023 Seeking Alpha article entitled “Memory And Logic: Two Different Chips, Two Different Trajectories In 2023,” that LRCX equipment sales to global companies represented 55.5% of total revenues in 2022, significantly higher than KLA (KLAC) at 35.5%. The high exposure of LRCX will impact sales to China’s memory companies CXMT and YMTC.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.