Jasmin Merdan/Moment via Getty Images

Krispy Kreme, Inc. (NASDAQ:DNUT) recently reported significant internationalization efforts in 7 new countries, severance expenses, and shop closure expenses, which may bring future adjusted EBITDA growth. In addition, new products in new markets like Insomnia Cookies could bring significant net sales acceleration in the coming years. There are obvious risks from failed net leverage attempts, inflation issues, and supply chains. However, DNUT could certainly trade a bit more expensively. I believe that it is a buy.

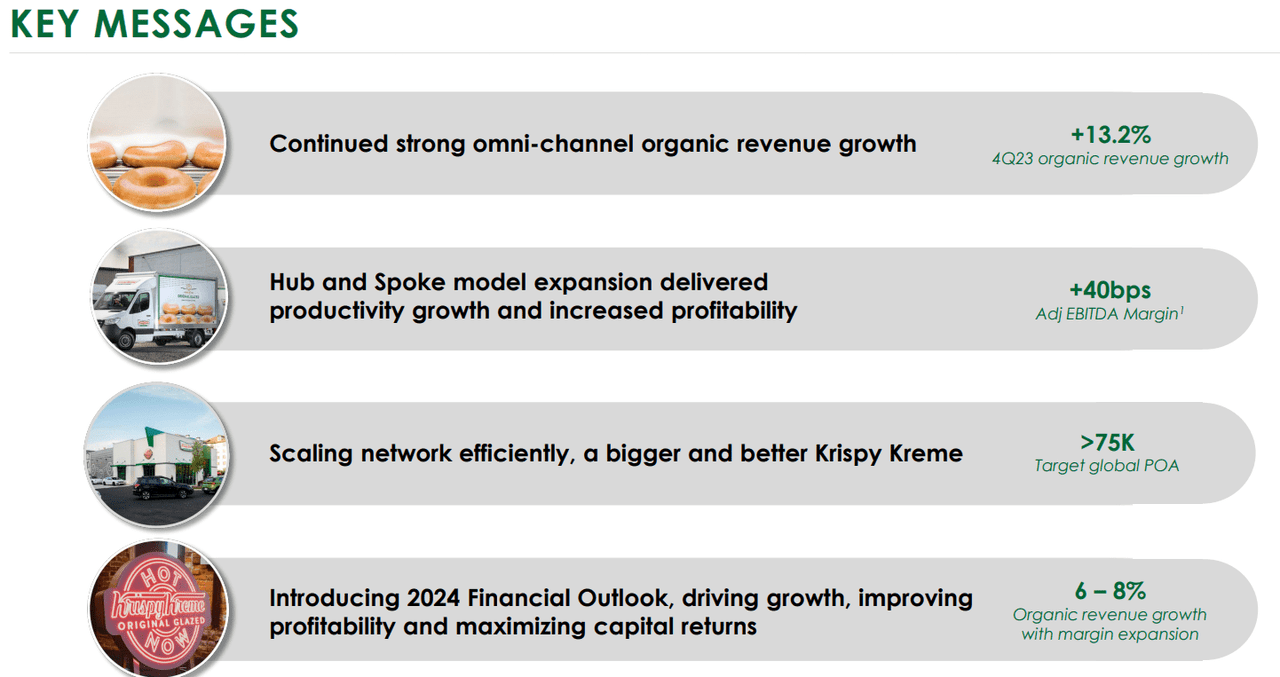

Beneficial 2024 Guidance Recently Reported

Krispy Kreme presents itself as one of the most beloved and well-known sweet treat brands in the world. Operating in more than 35 countries, the company offers fresh doughnuts with know-how accumulated since 1937.

With that quick take on the business model, I believe that it is worth noting that Krispy continues to deliver double-digit quarterly revenue growth thanks to its omnichannel strategy. In addition, in my view, Krispy Kreme appears to be a must-follow stock because of its 2024 guidance, which includes 6-8% net sales growth, and scaling network efficiency promised in the last quarterly report.

Presentation To Investors

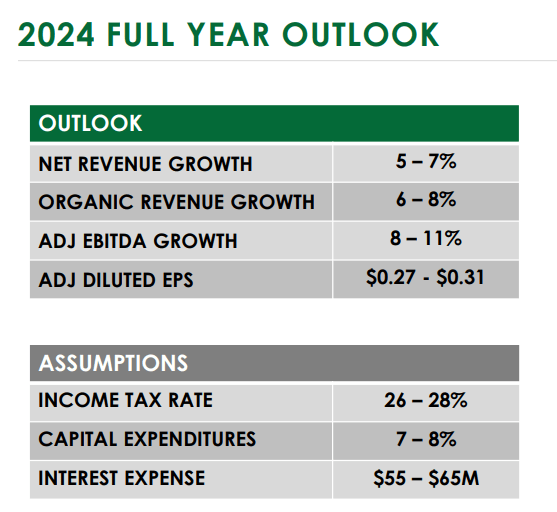

Other figures included in the last guidance include adjusted EBITDA growth of close to 8-11% and adjusted EPS of close to $0.27 and $0.31. Take a look at the table below, and note that the company also reported expectations for interest expenses and capital expenses. With such detailed expectations, I think that many financial analysts may decide to run DCF models.

Presentation To Investors

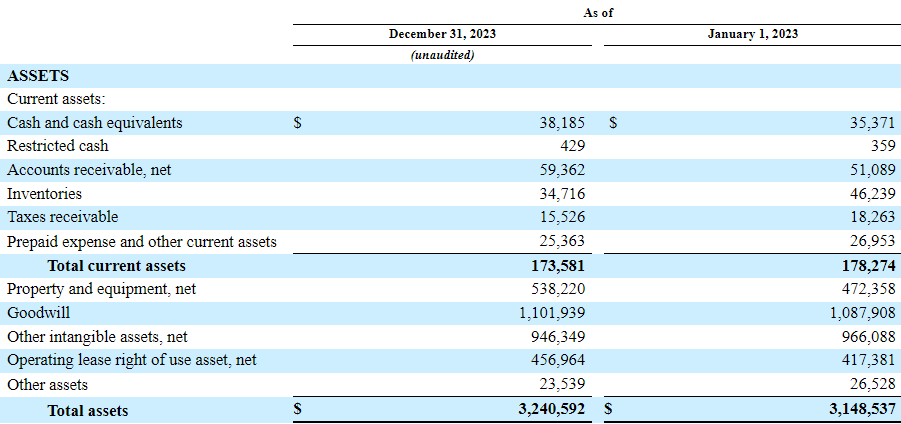

Balance Sheet: Large Amount Of Goodwill

The most remarkable about the company’s balance sheet is the large amount of goodwill and intangible assets reported. More than one-third of the total number of assets is represented by goodwill and intangible assets. These assets are mainly financed with debt, lease liabilities, and accounts payables.

In particular, the company noted accounts receivable worth $59 million, inventories of about $34 million, taxes receivable close to $15 million, and total current assets worth $173 million. The ratio of current assets/current liabilities is lower than 1x, which most investors out there may not appreciate. Given that the company has been operating since 1937, I believe that bankers would offer financing if necessary. The value of the brand may not be recognized in the balance sheet.

More in particular, the company noted property and equipment worth $538 million, goodwill of about $1101 million, other intangible assets close to $946 million, and total assets of $3.240 billion.

10-Q

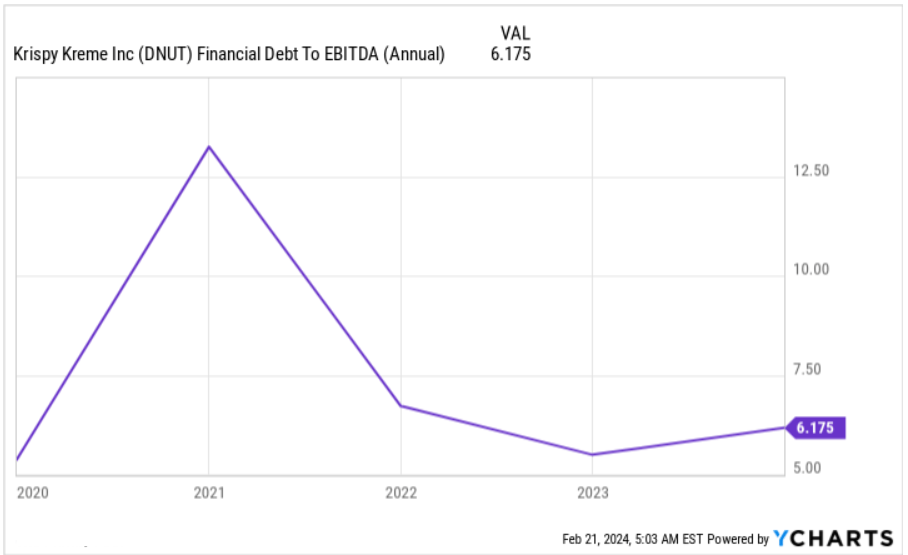

I do believe that the total amount of debt does appear significant. With that, it is worth noting that the company’s net debt/EBITDA ratio stood at close to 12x in 2021. The company managed to reduce its ratio to 6x. In my view, a further decrease in the total amount of debt may lead to better EV/EBITDA valuations.

YCharts

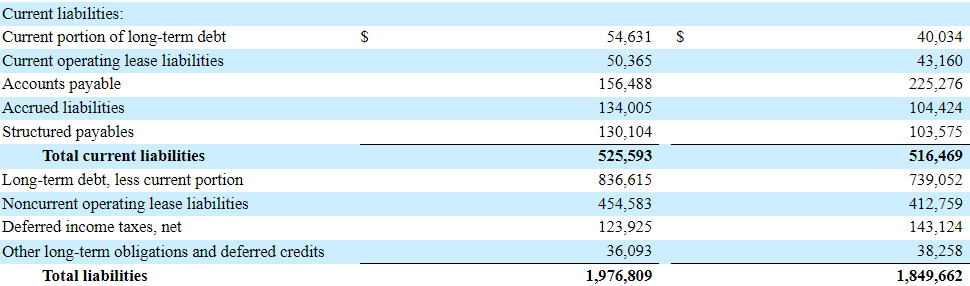

Regarding the list of liabilities, the company noted long-term debt of close to $54 million, accounts payable worth $156 million, accrued liabilities worth $134 million, and total current liabilities of about $525 million. Finally, with a long-term debt of $836 million, total liabilities stood at $1.976 billion.

10-Q

Ecommerce Efforts, Loyalty Memberships, And Media Impressions Are Net Sales Catalysts

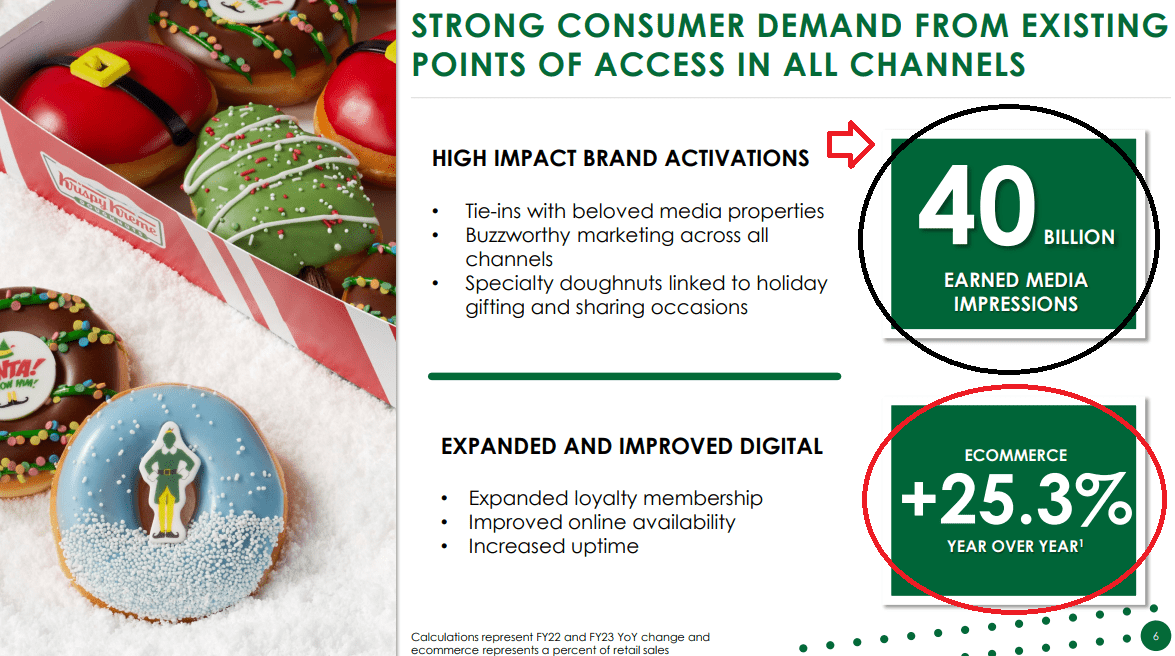

The recent information delivered in the last quarter about ecommerce results, which included growth of 25.3% y/y, and loyalty membership expansion may be net sales drivers in the future. In addition, it is worth noting that the company obtained close to 40 billion media impressions, which represents significant efforts in terms of marketing. With many more customers taking a look at the company’s doughnuts, I would expect significant net sales growth in the near future.

Presentation To Investors

In this regard, the company noted that organic revenue grew close to 13% driven by ecommerce efforts, brand activations, and seasonal offerings.

Total company organic revenue grew 13.2%, driven by high impact global brand activations and seasonal offerings, increased Points of Access and premiumization efforts. Ecommerce as a percent of retail sales increased 130 basis points to 19.3% of sales. Source: Quarterly Report

Internationalization Will Most Likely Be A Catalyst

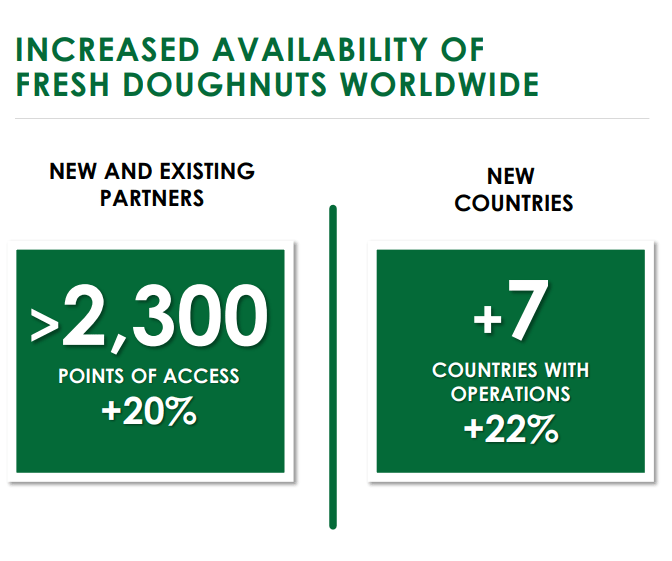

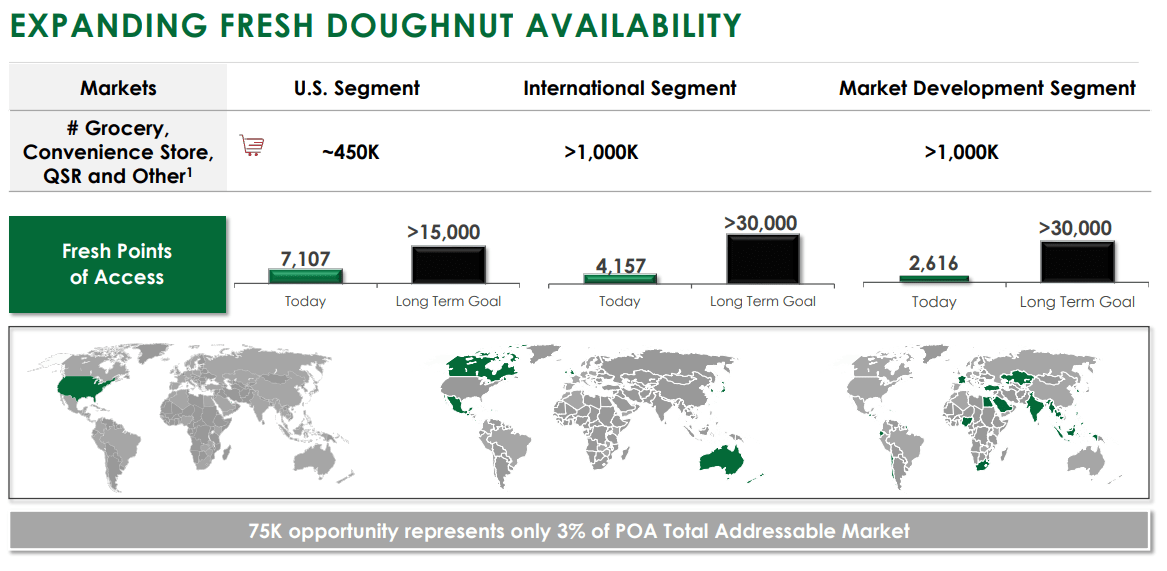

With know-how accumulated from operating in the United States for a long period of time, I believe that the company could sell successfully overseas. In the last quarterly presentation, the company noted new operations in 7 new countries and 20% more points of access with new existing partners.

Presentation To Investors

According to figures reported by Krispy Kreme, the U.S. segment represents close to 450k points of access in groceries and convenience stores. The international segment includes more than 1 million points of access. Hence, I believe that the potential opportunity for Krispy Kreme is significant.

Presentation To Investors

In the last quarterly report, the company noted impressive results in the international markets, including revenue growth of 9% driven by strength in Australia. Given these results, I believe that internationalization strategies are currently working pretty well.

In the International segment, net revenue grew $14.1 million, or 15.2%. International organic revenue grew 9.0%, driven by POA growth of 686, or nearly 20%, and continued premiumization efforts. 10-Q

International Adjusted EBITDA grew 7.8% to $22.1 million with adjusted EBITDA margin declining approximately 140 basis points, as strength in Australia was offset by lower volume in the U.K. leading to deleveraging throughout the statement of operations. 10-Q

New Products In New Markets Could Also Bring EPS Growth

I also expect significant net sales growth thanks to new products already tested in the United States, which the company makes available overseas. In this regard, it is worth noting the availability of doughnuts and Insomnia Cookies globally, which have a beneficial effect on the last quarterly EPS.

Adjusted Diluted EPS declined $0.02 to $0.09 from $0.11 in the same quarter last year, due to increased depreciation and amortization, as we expanded availability of our doughnuts and Insomnia Cookies globally. 10-Q

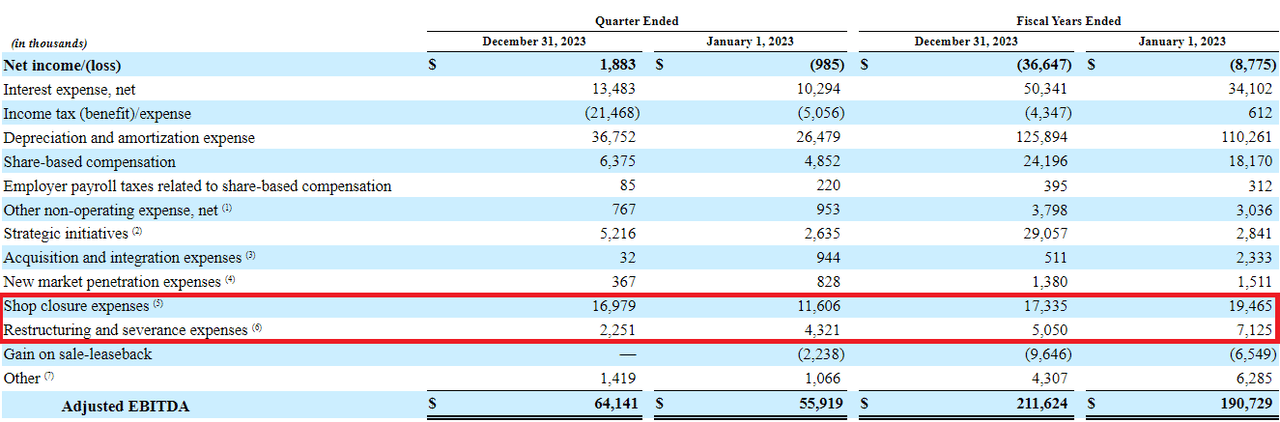

Severance Expenses, Shop Closure Expenses, And Strategic Initiatives

In the last quarter and in 2023, management reported shop closures, restructuring, and severance expenses, which may bring financial flexibility in the coming years. Given the expansion into new territories, it appears clear that DNUT is ready to close some locations, that do not perform, and open new stores.

10-Q

More in particular, in the last 10-Q, the company noted costs associated with global transformation and U.S. initiatives, such as the closure of the Branded Sweet Treats business, among other costs. The following lines offer further information in this regard.

Fiscal 2023 consists primarily of costs associated with global transformation and U.S. initiatives such as the decision to exit the Branded Sweet Treats business, including property, plant and equipment impairments, inventory write-offs, employee severance, and other related costs (approximately $17.9 million of the total). 10-Q

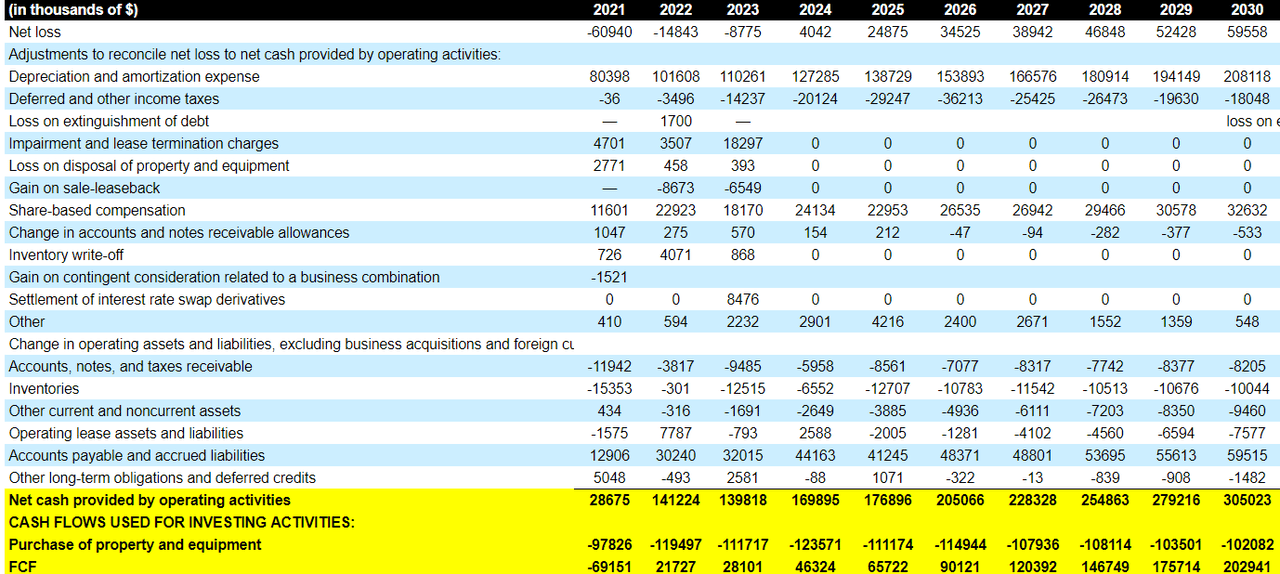

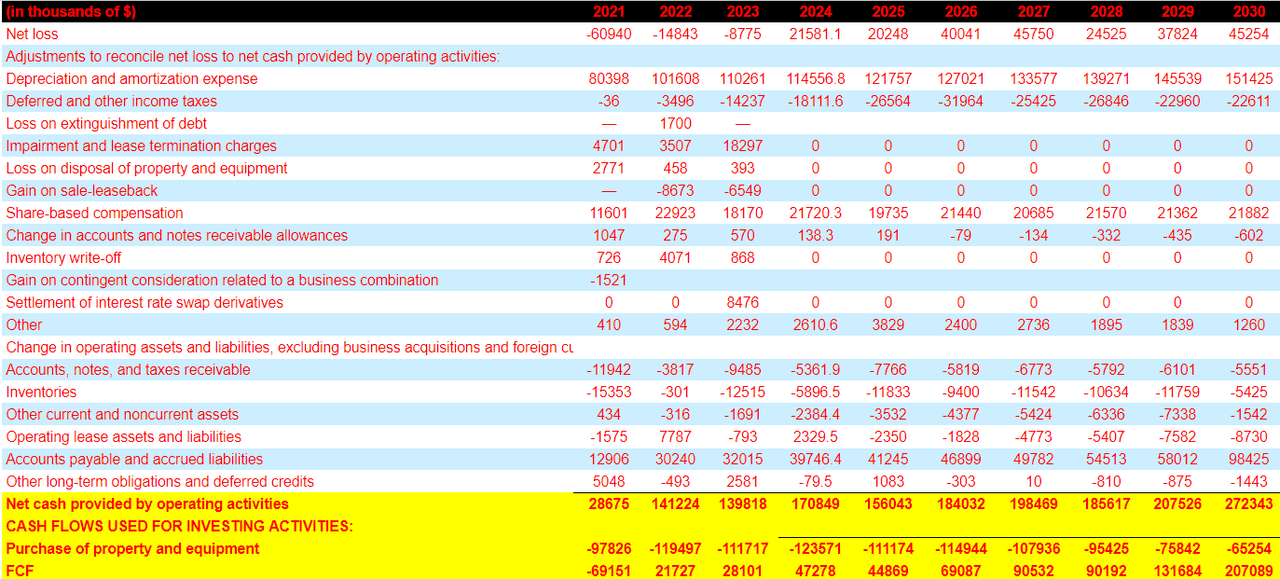

Best-Case Scenario

With previous beneficial assumptions, I designed my best-case scenario. First, I assumed a 2030 net income of $59 million, with depreciation and amortization expenses close to $208 million, but without loss on extinguishment of debt, impairment, and lease termination charges, losses on disposal of property and equipment, or gain on sale-leaseback. I assumed that these were extraordinary events.

In addition, I included share-based compensation of close to $32 million, with changes in accounts and notes receivable allowances worth -$1 million, notes, and taxes receivable of -$9 million, and changes in inventories of -$11 million.

Besides, if we also assume changes in accounts payable and accrued liabilities of about $59 million, 2030 net cash provided by operating activities would be close to $305 million. Finally, with 2030 purchase of property and equipment of about -$103 million, 2030 FCF would be $202 million.

Author’s Expectations

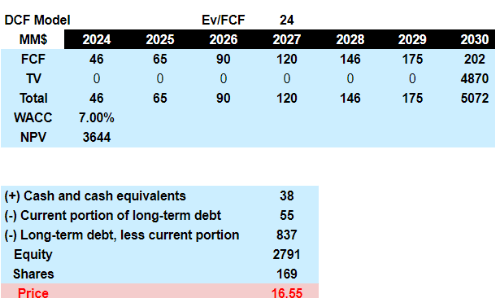

Given the current valuation of DNUT, I assumed an EV/FCF of 24x, which I assumed was conservative. If we also use a WACC of 7.05%, the implied enterprise value would be close to $3.6 billion. Adding cash and subtracting debt, the implied stock price would be $16.55 per share.

Author’s Expectations

Risks Applicable To My Worst-Case Scenario

Under my worst-case scenario, the cash flow statement could suffer from certain risks, which include the following. First, I believe that credit conditions may change in the near future. As a result, the company may not be able to finance its balance sheet like in the past. Interest expenses may also increase, which may push the EPS figures down. In this regard, the company mentioned the following in the last annual report.

We have significant indebtedness, which could adversely affect us, including decreasing our business flexibility and increasing our interest expense. Our indebtedness could also reduce funds available for working capital, capital expenditures, acquisitions, the repayment or refinancing of our indebtedness as it becomes due, and other general corporate purposes. It may also create competitive disadvantages for us relative to other companies with lower debt levels. If our financial performance does not meet current expectations, our ability to service our indebtedness may be adversely impacted. Source: 10-K

In the last quarterly report, the company noted that it expects a decrease in net leverage in 2024. I believe that it is quite beneficial. However, unexpected increase in net leverage could lead to pessimistic sentiment about the performance of the company. As a result, lower demand for the stock may push the stock price down.

The Company continues to expect to reduce its net leverage in 2024, as we make progress towards our 2026 goal of approximately 2.0x to 2.5x net leverage. 10-Q

Recent capex in the growth of Hub and Spoke model, among other IT capabilities, may lead to excessive expectations about capacity expansion and net sales growth. If capital expenditures don’t lead to increases in revenue growth and EBITDA margin expansion, I would expect some pessimism from market participants.

During the fourth quarter 2023, the Company invested $32.8 million in capital expenditures, driven primarily by investments in the growth of our Hub and Spoke model alongside selective remodeling activity and investments in information technology capabilities. 10-Q

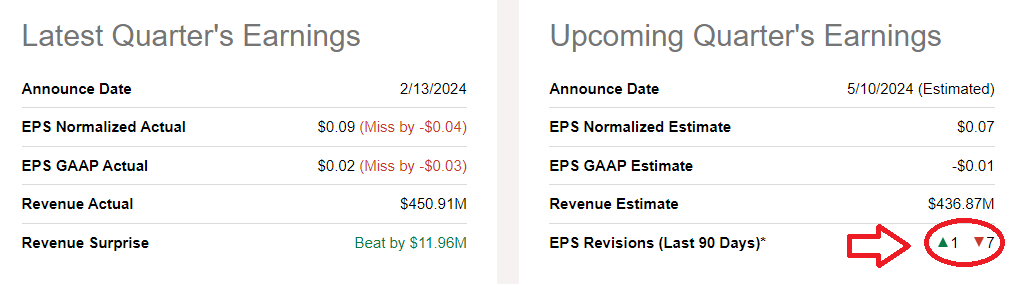

I would also be concerned about the recent EPS, which was lower than expected, close to $0.02, and the EPS revisions by 7 different analysts. If investment analysts out, there do not offer beneficial expectations for the future, demand for the stock could also decline.

Seeking Alpha

Finally, changes in the labor conditions, inflation, supply chain, or distribution problems may also arise in the coming years. As a result, the company could suffer from declines in the FCF margin, and the implied fair valuation could decline.

Worst-Case Scenario

Under my worst-case scenario, I included most of the risks previously noted and obtained the following cash flow statement projections. First, 2030 net income would stand at close to $45 million, with 2030 depreciation and amortization expense of about $151 million and share-based compensation of about $21 million.

In addition, with changes in accounts and notes receivable allowances of about -$1 million, changes in accounts, notes, and taxes receivable of -$6 million, and changes in inventories of -$6 million, I also included changes in accounts payable and accrued liabilities of $98 million.

In addition, with changes in other long-term obligations and deferred credits of -$2 million, I obtained 2030 net cash provided by operating activities of close to $272 million. Finally, with purchase of property and equipment close to -$66 million, 2030 FCF would be $207 million.

Author’s Expectations

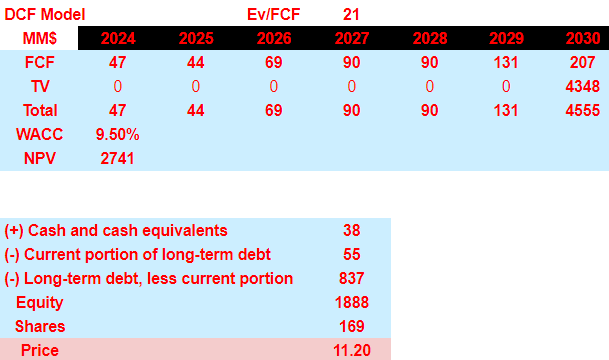

If we also assume an exit multiple of 21x FCF and WACC of 9.49%, the implied enterprise value would be close to $2.741 billion. Adding cash in hand of $38 million and subtracting debt, the implied equity valuation would stand at $1.8 billion. Finally, the fair price would not be far from $11.2 per share.

Author’s Expectations

Competitors

The company appears to compete with a significant number of domestic and international competitors, which include retailers of doughnuts and other treats, coffee shops, and other bakery concepts. Retailers with sweet treats and ice cream shops were also highlighted as competitors in the last annual report. With that about the list of competitors, I am not really concerned about competition because the company has operated for many decades and knows its clients well. In this regard, management provided the following explanation.

We view our brand engagement, overall consumer experience and the uniqueness of our Original Glazed doughnut as important factors that distinguish our brand from competitors, both in the doughnut and broader indulgence categories. Source: 10-K

Conclusion

Krispy Kreme recently promised a significant decrease in net leverage and announced significant internationalization efforts in 7 new countries and a large international market opportunity. These efforts in combination with recent severance expenses and shop closure expenses could bring significant FCF margin enhancements and financial flexibility. If we also take into account the beneficial guidance of Adjusted EBITDA growth close to 8-11%, I believe that the company looks like a buy. There are clear risks coming from the total amount of debt, inflation issues, or supply chain issues. However, in my view, Krispy Kreme could be a bit more expensive.