MF3d/E+ by way of Getty Photos

To say know-how shares have struggled so far in 2022 could be one of many largest understatements of the yr. Yr-to-date by means of June 17, 2022, the Nasdaq composite (QQQ) is down 31%. Though that’s a wide ranging quantity, imagine it or not, down 31% considerably understates the declines skilled by the common Nasdaq inventory. It is because, like most indexes, the Nasdaq is market capitalization weighted, and subsequently, the mega cap leaders, akin to Apple Inc. (AAPL), Microsoft (MSFT) and Google Inc. (GOOGL) have held up higher on a relative foundation.

If you’re a contrarian, opportunistic, and a inventory picker then you might be licking your chops as the sort of market drawdown can imply that so many good firms commerce at valuations which can be fully disconnected from their intrinsic values.

Regardless of probably the most difficult markets ever, behind the scenes, I’ve been a busy bee, within the analysis weeds doing my elementary analyses and considering past the present sentiment of rooster little (the sky is falling) and the pervasive mindset that the macro headwinds are too stiff to be lengthy.

Right this moment, I write to share an replace on Kopin Company (NASDAQ:KOPN). Like so many know-how shares which can be at present Adj. EBITDA adverse, the market has fully thrown the child out with the bathwater right here by extrapolating that its Adj. EBITDA losses will go on perpetually. And primarily based on these extrapolations, together with terribly adverse sentiment, Kopin’s inventory is buying and selling as if the corporate will merely run out of money and the inventory will go to zero.

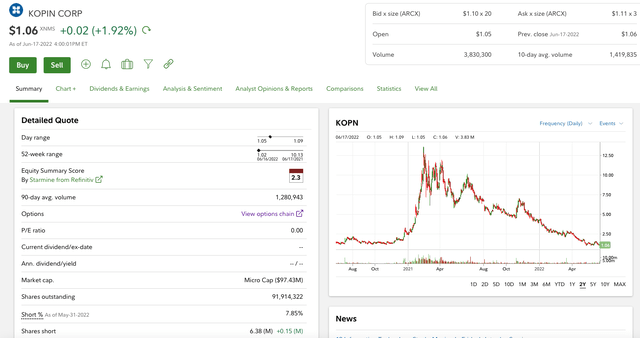

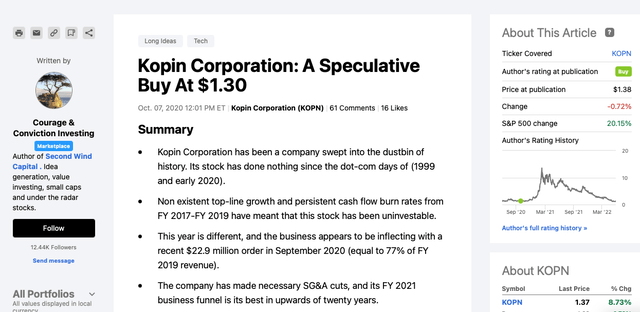

By the way, again in October 2020, I wrote up Kopin with shares then buying and selling at $1.30. Lo and behold, by February 16, 2021, shares closed at $13.56. For anybody with good timing, that could be a good outdated vogue ten bagger in lower than six months. That mentioned, February 2021 have been the halcyon days of Nasdaq euphoria and coincided with the interval when Cathie Wooden was actually the Queen of Wall Road.

In search of Alpha

Why Kopin Is So Compelling

In at this time’s piece, I write to clarify why the chance/ reward, at $1.06 per share (as of June 17, 2022), is dramatically skewed to the bullish facet right here.

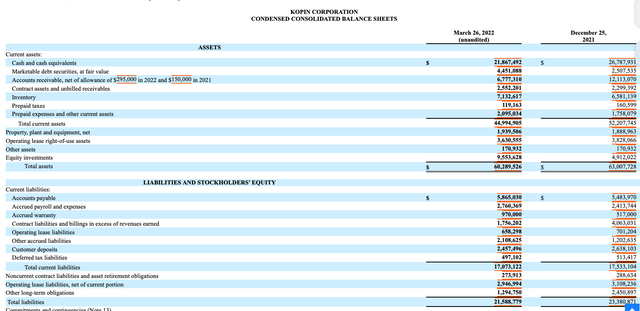

1) As of March 26, 2022, Kopin has $26.3 million in money and no debt. The corporate additionally has $27.9 million in optimistic working capital.

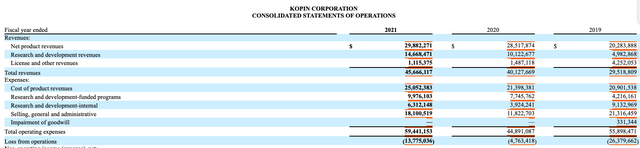

KOPN FY 2021 10-Ok

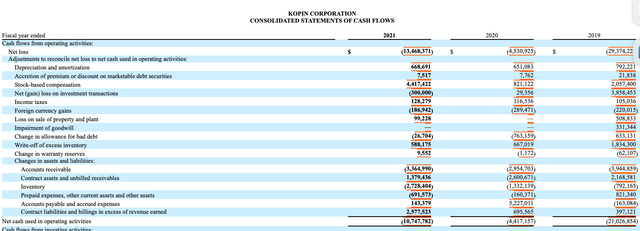

2) The corporate’s money burn price is not elevated, so the corporate has an extended enterprise runway than the market is pricing in.

As you possibly can see, adverse working money movement was solely $10.7 million for the complete yr FY 2021.

KOPN FY 2021 10-Ok

3) Kopin has a sturdy backlog, however hasn’t actually been capable of absolutely execute on it attributable to provide chain points.

On its Might 3, 2022 Q1 FY 2022 convention name, CEO, Dr. Fan, mentioned Kopin’s very robust backlog.

We entered 2022 with very robust backlog of orders, and we imagine 2022 can be one other yr of excellent progress. We’re excited for the expansion of coping as we see a wave of rising curiosity in AR/VR and MR product purposes. Our know-how advances and present [Indiscernible] situations are very favorable. And we imagine coping may be very well-positioned to capitalize it. Lastly, I want to make a touch upon the fairness achieve in Q1. As a few of you already know, coping may be very robust in IPs with over 2,000 — with over 200 patents and patent purposes offering show optics and module assemblies.

And subsequently to the top of Q1 FY 2022, the corporate bought a observe on $4.8 million order for the F-35 joint fighter program.

Furthermore, on the Might 3, 2022 convention name, CFO, Richard Sneider, famous that a lot of its buy orders, gained throughout This autumn FY 2021, ought to ship throughout FY 2022. In different phrases, a whole lot of the backlog ought to flip throughout FY 2022.

We did point out that we had a $19.8 million quarter PO in December. In November, we had a 2.3 after which there was one other million one thing for one more these have been all in November, December. So you possibly can assume that is all transport this yr and presumably into the start of subsequent yr. However the bulk of it is going to be this yr.

For perspective, in FY 2021, Kopin did $30 million in web product income, so once more, its FY 2022 backlog is powerful. The one caveat is securing entry to sufficient low-end semiconductors is required to construct its completed merchandise.

KOPN FY 2021 10-Ok

Qualitative Nuances

1) Kopin owns an intensive IP portfolio.

At $1.06 per share, you might be primarily paying subsequent to nothing for Kopin’s patent portfolio. Given this terribly low valuation, I extremely doubt Dr. Fan needs to promote the corporate at this juncture, however fairness buyers can reap the benefits of the present market malaise. And I might argue that this patent portfolio is a valuable-hidden asset that the market is totally overlooking and underappreciating. That is what occurs throughout extreme bear markets. The market primarily losses its potential to precisely worth companies.

As a few of you already know, coping may be very robust in IPs with over 2,000 — with over 200 patents and patent purposes offering show optics and module assemblies.

One of many IP monetization technique is to license a few of our IPs to startup firms. As — and as a duplicate, as part of a dialog, we frequently obtain equities within the startups. We have accomplished just a few of these transactions and our purpose is to do extra. A number of the early transactions usually are not going to a extra mature phases. We’re really very excited with this IP enterprise mannequin.

(Supply: Kopin’s Might 3, 2022 – Q1 FY 2022 Convention Name)

As mentioned on the decision, the corporate licenses these patents to startups, and a few of these startups are reaching the mid-cycle of their progress section. RealWear is an effective instance of this. By the way, in early June 2022, Ford (F) ordered 3,000 of RealWear’s Head Mounted Tablets.

So, if any of those firms are profitable, Kopin will get to triple dip. This implies they will earn royalties if/ when the startups efficiently convey a industrial product to market, can generate income by promoting its parts/ shows to them, and so they get fairness, like a enterprise capitalist agency.

Right here is how Dr. Fan described it on the convention name.

I am glad you talked about it. These are the businesses that we license and so they in truth, pay equities in. I do not wish to go lots to purchase into it clearly, a few of them are already making progress and so [Indiscernible] fairness achieve. And I feel that that might proceed. The one that may type three, 4, 5 years in the past is rather like a VC scenario. A few of them change into mature stage now, and you are going to have a collection of hopefully monetizes in [Indiscernible] like VC, we’re going get issues come again and with some important fairness achieve. However keep in mind our purpose is greater than the fairness achieve. We’ll tip in 3 ways. We have now royalty and we additionally promote them parts plus fairness grant achieve so this fashion [Indiscernible] that is [Indiscernible] excellent.

So I feel that is the one space that is not well-known by the shareholders. We have now a number of methods to generate income for the shareholders. As soon as we do promote merchandise, [Indiscernible] our merchandise not solely simply promoting show now. We will do increasingly more into assemblies within the Amex automobiles, [Indiscernible] the complete system. And you may [Indiscernible] what number of [Indiscernible] going to be. They usually’re with IP fashions.

(Supply: Kopin’s Might 3, 2022 – Q1 FY 2022 Convention Name)

Additionally, to jog readers’ reminiscences, again on January 3, 2022, RealWear chosen Kopin’s microdisplays for considered one of its merchandise.

2) Gentle At The Finish Of The Tunnel (With A Caveat)

Each Dr. Fan and Richard talked extensively about how the semiconductor shortages for very mundane and low know-how chips has delayed fulfilling orders. Furthermore, Dr. Fan explains that a whole lot of Kopin’s enterprise is in protection, and you may’t merely swap out one chip for one more because it needs to be permitted by its finish clients, so suppose companies just like the Division of Defensive or defensive contractors. Subsequently, given the intensive testing required, by each Kopin, the DoD, or protection contractors, this has been problematic.

Nonetheless, and for perspective, throughout FY 2021, Kopin’s CFO has been conservative and trustworthy about its provide chain challenges, but he was guardedly optimistic on the Might 3, 2022 name. Optimistic that Kopin has sufficient vendor commitments to satisfy its robust backlog, and optimistic that there are indicators that the worldwide provide chain cluster is enhancing.

Effectively, we have now commitments from distributors, which might point out that we’re in good condition for the remainder of the yr. However we’re simply placing up the caveat there that I feel given the scenario, I feel, it is unrealistic to suppose that we’re out of the woods. We do see — we speak to individuals within the business, they do see gentle on the finish of the tunnel. They usually — however we simply wish to be sure that we get a few extra quarters underneath our belt earlier than anybody begins declaring that we’re out of the woods.

(Supply: Kopin’s Might 3, 2022 – Q1 FY 2022 Convention Name)

Dr. Fan mentioned very low tech microcontroller is the linchpin.

Yeah. I feel as you properly know, a whole lot of provide chain drawback is agonizing, as a result of car business is affected by that too. What you are lacking is a microcontroller, which is a really low tech product. It is made by all people in the entire world; Taiwan, Korea, and China, Japan. However they’re quick. And as soon as they’re quick, you possibly can’t even a automotive too. All people that set the client of microcontroller, not superior IC. Is it actually keep ICs? So for us, it simply in regards to the car, you possibly can’t discover an IC that is put within the there. You bought to get your clients the confirmed and date of compliances so that you slowdown issues. But it surely’s not elementary. It isn’t that IC can’t get it wherever. It is vitally frequent IC.

(Supply: Kopin’s Might 3, 2022 – Q1 FY 2022 Convention Name)

3) AR/VR And The Meta Verse

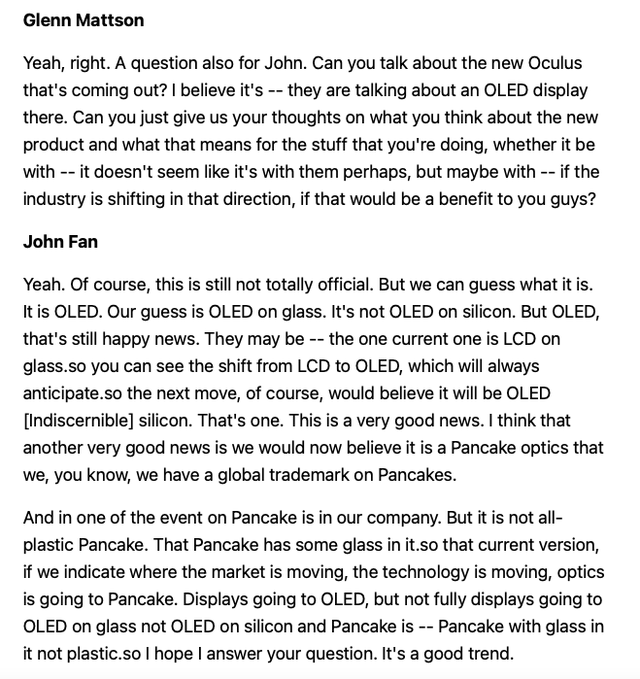

Dr. Fan mentioned how Kopin is properly positioned to reap the benefits of the elevated curiosity in AR/ VR and the Meta verse. Secondly, he mentioned how business is shifting towards OLED. Kopin’s know-how is OLED on silicon, not on glass, however the transfer again to OLED is a step in the precise route.

Kopin’s Q1 FY 2022 Convention Name

(Supply: Kopin’s Might 3, 2022 – Q1 FY 2022 Convention Name)

4) Kopin Is Working With Two Foundry Companions On Micro Shows

Exhibit A

Below our mannequin, we both promote completed OLED shows to our clients, working with our OLED foundry companions or we promote a [Indiscernible] wafers to our OLED OEM companions who full the micro shows on the market to their very own buyer base. This enterprise mannequin offers us a whole lot of visibility to fulfill buyer calls for with out incurring the main fastened capital funding related to our lead deposition course of. We proceed to work on design wins with different new clients. Relating to to our analysis and growth packages. We proceed to make wonderful progress on our buyer funded protection growth packages, which embrace armored car concentrating on methods, rotary wing plane, pilot helmets, and extra weapon sight packages.

(Supply: Kopin’s Might 3, 2022 – Q1 FY 2022 Convention Name)

Exhibit B

Micro OLED, as you all know, some individuals all the time contemplate their final show, which it’s true. It turned — we developed and producing a value efficient means. It is laborious to resolve all the things that we wished to do AR/VR and MR. We work with a Chinese language firm, Monochrome Micro OLED and we work with Japan’s firm to do full coloration Micro – LEDs. And each of them are very tremendous excessive superior Micro – LEDs. And a big buyer funded so this can be a buyer funded actions, and the progress is nice. I feel China was, once more as a result of there’s lots shopping for in China, [Indiscernible] as just a few weeks. In any other case, you may have already got one thing, [Indiscernible] to announcer for this quarter. Generally, issues are going properly and a few lockdown has slowed down a number of the issues, however we’re nonetheless making good progress.

(Supply: Kopin’s Might 3, 2022 – Q1 FY 2022 Convention Name)

Placing It All Collectively

Over the previous three months, if I had a greenback for the variety of instances I’ve learn in print or been advised that know-how firms haven’t got present optimistic Adj. EBITDA are nugatory, then I might be a rich man. That elementary statement is now so extensively held that it needs to be greater than priced into so many of those know-how shares, given the loopy rout that has taken place all through the know-how inventory panorama. Furthermore, not surprisingly, the child appears to get thrown out with the bathtub water in the case of small caps and micro-caps, as these shares are sometimes owned by a diffuse group of holders. Far too usually, these holders have been conditioned by this bear market to be overly centered on quick time period value actions, tremendous delicate to unrealized quick time period losses as a lot much less inquisitive about investing in companies, with the understanding exactly timing the underside is almost inconceivable.

As for Kopin, you have got an organization has $26 million in money, a comparatively low money burn price, a sturdy IP portfolio, considered one of its highest backlogs in its historical past, in addition to the intermediate time period pleasure / risk on the AR/ VR Meta verse frontiers.

At $1.06 per share, we’re speaking about an organization with solely a $98 million market capitalization (there are solely 92 million shares excellent).

I might argue Kopin shares are ridiculously mispriced and supply compelling worth buyers a beautiful threat/ reward setup. That mentioned, you must be keen to personal this inventory for a time period (at the least 12 months or till the market wakes up) and watch for the sentiment to enhance (this is not a inventory to waste your time timing it for $0.10 to $0.20 strikes). Additionally, that is comparatively larger threat because the steadiness sheet is wholesome, however definitely not sturdy. Subsequently, if you dimension this, dimension it within the context of different larger beta names inside your portfolio.

Constancy