Shutthiphong Chandaeng

I had first recommended Klaviyo as the marketing automation guru in December 2023, and continue to rate it a buy. I’m summarizing the main reasons for buying the stock from the previous article here:

- The strength of its integrated data platform, combining customer and marketing data.

- Shopify’s stake and strategic partnerships, which supports Klaviyo’s revenue growth.

- A very reasonable valuation at 8x sales with 30% growth, compared to bigger rival HubSpot’s (HUBS) 12x sales with 20% growth.

- Strong competitive advantages over plain vanilla email marketing providers without a comprehensive data platform with several additional features and offerings.

- Even as a high growth revenue story, they had a strong emphasis on profitability and cash flow generation, with adjusted operating margins of 11% and cash flow of 16%.

I’m re-iterating my buy recommendation, Q4-2023 earnings came in slightly above expectations, with good guidance, which confirms my thesis that Klaviyo continues to have the competitive advantages listed above, and will continue to grow revenues with a strong emphasis on cash generation as well.

The earnings call revealed further competitive advantages of autonomous AI, a foray out of their comfort zone of e-commerce, and a focus and push towards bigger clients needing more marketing spend – features I’d like to highlight in this article.

Q4-2023 and 2023 earnings tell a good story

Klaviyo (NYSE:KVYO) reported earnings last evening, 02/27/2024, and they were on target with good guidance as well for Q1-24 and FY2024. Let’s take a closer look.

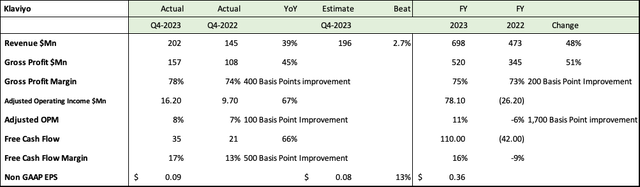

Klaviyo’s Q4-2023 Earnings (Klaviyo, Seeking Alpha, Fountainhead)

Klaviyo’s 4th quarter performance was uniformly good, as we see from the table above.

Q4 Revenue increased 39% YoY, beating estimates by 5.4Mn or 2.7%, and full year 2023 revenues increased 48% to $698Mn.

Q4 non-GAAP EPS of $0.08 also beat estimates by a penny or 13% and full year non-GAAP EPS came in positive at $0.36.

Gross profits improved faster, increasing to $157Mn or 45% and full year gross improved to 520Mn or 51%. Gross margins improved 400 basis points in Q4 and 200 basis points for the full year.

With operating leveraging kicking in, adjusted operating margins turned into the green, improving 1,700 basis points to 11% for the year. Klaviyo’s founders have a history of bootstrapping, and clearly they didn’t let much go to waste. Free cash flow also improved significantly by 66% for the quarter to $35Mn and by a whopping $152Mn in 2023 to a positive $110Mn or 16% of sales.

These are really good numbers and for a fledgling <$1Bn company, less than one year post IPO is fairly remarkable.

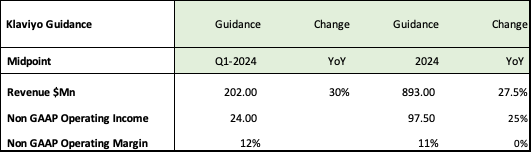

Klaviyo 2024 Guidance (Seeking Alpha, Klaviyo, Fountainhead)

As we see above, guidance was also pretty good, with Q1 revenues growing 30% and full year revenues expected to grow 27.5%. My own estimates had a 30% Q1-growth as well and a slightly higher 28% growth to $895Mn for the full year. These are very reasonable numbers and confirm their growth trajectory.

Klaviyo’s non-GAAP operating profits are not expected to grow as fast with only 25% growth, with margins remaining flat at 11% for 2024 because of higher sales and marketing spending.

Key takeaways from Q4-2024 earnings call:

Tackling new anti-spam rules

The new anti-spam rules haven’t hurt them so far, and from the looks of it Klaviyo seems to be using it to their advantage – as a selling point to make their customers compliant.

As CEO and Co-founder Andrew Bialecki said on the earnings call, emphasis mine.

For example, one of the requirements is one-click unsubscribe, which we built into our product in January, so it is a frictionless experience for our customers. To give you like a couple of data points, we measure unsubscribe rates from email, and we’ve seen that increase by only 0.007%, so really small number. On the consumer side, we’re also watching that as well, and thus far, we haven’t seen any changes in consumer behavior. And then we also watch for things like spam rates. And while we don’t have perfect visibility into that, when we talk to customers anecdotally, we’re not hearing of any broad changes in the reports of SpamPort.

The CEO emphasized that they were actually succeeding in their goal to have their customers do even less work – as most of the spam compliance was being taken care of by the platform and that eventually less spam delivered to the customer through a better product with higher personalized sales messages and less noise would actually result in better revenues.

Capturing good customers

According to their earnings call, Klaviyo captured 8 of the Numerator top 10 fastest-growing CPG brands and 7 of Retail Dive’s top 8 DC brands. There has been a conscious and focused approved to capture larger customers, and that cohort >$50,000 in annual revenue grew the fastest at 80%. And the key differentiating strategy in winning these customers is offering tech stack consolidation to make better use of all their data. As an example, the CEO mentioned.

During the quarter, we saw a European Wax Centers consolidate their SMS channel with their existing Klaviyo email subscription. They are now able to create unified customer journeys across email and SMS from marketing and customer outreach to appointment reminders and updates.

Going beyond e-commerce

Klaviyo’s strength is in e-commerce. Email and SMS marketing is a cornerstone of e-commerce marketing and Klaviyo is seeing some success by getting out of its natural habitat and getting customers in new verticals. Adding F45 Training, a fitness center with 1,800 locations, was a high point in Q4 and proof of their ability to scale beyond retail e-commerce. Again, it’s the platform approach that seems to be a key differentiator.

Artificial Intelligence, AI, at scale for actionable solutions

Klaviyo took pains to address why AI wouldn’t be just a buzz word. They have been using machine learning in all parts of their business; predictive AI for sending the right message at the right time, generative AI for content creation and what they’re calling autonomous AI for a complete seamless/friction less process of customer outreach and conversion. In Andrew Bialecki’s words, from the Q4-2024 earnings call, emphasis mine.

It’s not just about AI that makes messages more personal and saves you time, it’s about empowering you to generate and refine revenue-driving ideas effortlessly. Imagine a platform that not only creates tailored experiences for each individual consumer, but continuously learn and adapt, refining strategies for the best outcome in a fraction of the time.

The brand who will win won’t just be using one type of artificial intelligence. They’ll be using predictive, generative and autonomous AI to save time, executing today’s vision and building tomorrow’s strategy.

A few examples – a customer Proozy, with brands like Oakley and Reebok, saved 45 minutes a day in subject line creation and their SMS unsubscribe rate dropped by 20%. Another, Aura Frames saved 10 hours a week consolidating their data under one roof.

Growth and other operating metrics remain excellent

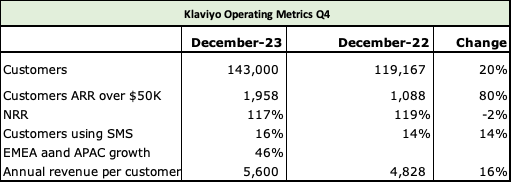

Klaviyo Operating Metrics (Seeking Alpha, Klaviyo, Fountainhead)

Customer additions came in at 20%, a number that was questioned by analysts as a possible sign of slowdown, but it’s the same rate of growth as Q3. Customers with ARR (Annual Recurring Revenue) grew 80% to 1,958 customers – that is their focus area, but Dollar Based NRR (Net Retention Revenue) dropped 2% to 117% from 119% – management is confident of 115% NRR looking forward, and they haven’t gone below this rate for about 10 quarters now. There were improvements in SMS usage, another priority with 14% growth. The ARPC, (Annual Revenue Per Customer) increased 16% to 5,600 another sign of improving fortunes. The growth in ARPC is important, as the unit economics of large customers using more features on their platform is much more profitable in the long run.

Spend more to earn more, and share price be dammed.

Perhaps not in these words, but management did reiterate their focus on investing in marketing spend. From Klaviyo’s CFO, Amanda Whalen, on the earnings call, emphasis mine.

Sales and marketing expense was $77.3 million or 38% of revenue for the quarter. As we said last quarter, areas we are investing in include marketing program spend and sales headcount to grow our capacity.

Some of our investments in the mid-market take a bit longer to yield than SMB investments that drive strong overall ROI.

Based on the timing of these investments, we expect to see some deleverage year-over-year in operating margin in the first half of the year as we front-load investments. We expect more leverage in the latter part of the year as we head into our seasonally strong fourth quarter. We measure our sales cycles in weeks, not in months. And so these investments tend to have a pretty nice payback period as they ramp up.

There will be short term pain for long term gain, and I like their candor, focus and conviction in spending for the right reasons. When your target customer is larger, you need more boots on the ground, your sales cycles get longer even though they’re in weeks and not months in Klaviyo’s case. They are preparing well for their biggest season, the Cyber Monday, Thanksgiving weekend, which has the maximum impact on their sales.

Reiterating buy – the valuation and investment thesis remain intact

I bought a nice chunk of shares on Friday morning between $26 and $27, taking full advantage of a very opportune drop.

And as I mentioned in my last article, Klaviyo is in an enviable position for a startup as it doesn’t have to choose between growth and profitability with 16% of free cash flow generation, and about $739Mn cash on its balance sheet. It is frugal from its bootstrapping roots and spends cash wisely. The 8-10% drop post earnings because of operating margins getting hit due to spending for two quarters is short term, weak behavior from the market and a godsend to pick up shares on the cheap.

Longer term, I’m very comfortable with Seeking Alpha’s consensus and my estimates for revenue growth from 2023 to 2026 of $698Mn to $1.4Bn or a CAGR of 26%. Management guided to $893Mn for 2024, which is 27.5% higher and given the extra marketing spend in Q1 and Q2, and focus on larger customers, this is likely a conservative estimate. Given the 20% customer additions in 2023, and 16% higher Annual Revenue Per Customer, the revenue estimates for 2025 and 2026 at $1.13Bn and $1.4Bn are also likely conservative; Klaviyo can achieve the same growth in 2025 and 2026 with 15% new customers and a 10% increase in Annual Revenue Per Customer. Their dollar based NRR hasn’t crossed below 115% in the last 10 quarters, so I’m confident that these numbers are reasonable and conservative.

At a Market Cap of $7.26Bn, that’s just 8x 2024 sales of $893Mn, dropping to just 5x 2026 sales of $1.4Bn. This is a bargain for a 26% grower with adjusted operating margins of 11% and free cash flow margin of 16%. I believe that beyond 2026, Klaviyo should continue to grow revenues in the low to mid-twenties and should get a sales multiple of at least 8X $1.4Bn, leading to a market cap of $11.2Bn. Closest competitor Hubspot has a revenue multiple of 13X with growth of 18%, so I do believe Klaviyo is comparatively a much better bargain. These projections are consistent with my earlier projections as well. There are other catalysts that could help growth, if they continue to execute beyond e-commerce, or increase their Net Retention Rate, or increase the number of customer using their SMS feature, which is still very low at 16% of their customer base. Besides, they haven’t monetized the AI features that they spoke about, something I would be closely monitoring in the future. The main risks for Klaviyo would be a) growth deceleration, given that this is primarily a revenue growth story, and b) I would also be closely checking for anti-spam measures and see if that is curtailing their reach and business model.

In addition to all reasons summarized in the beginning of this article, I further believe that the higher marketing spend, the focus on larger customers, the automated AI emphasis, and the virtues of an integrated platform are all good reasons to buy the stock.