onurdongel

Kinder Morgan (NYSE:KMI) is one of those stocks with a highly alluring dividend yield, but management execution had kept me away. The company is slated to report earnings next Wednesday after the close when investors will learn if the company is making progress towards its ambitious 2024 targets. Management expects leverage to tick down below 4x by the end of the year, but interestingly continues to target 4.5x as their ideal leverage ratio. I do not have a positive view on management’s history of execution, as cash flow growth is arguably modest given the high amount of reinvestment in the business. That said, the valuation looks attractive relative to the broader market if we can assume low single digit growth from here. I am upgrading the stock to buy.

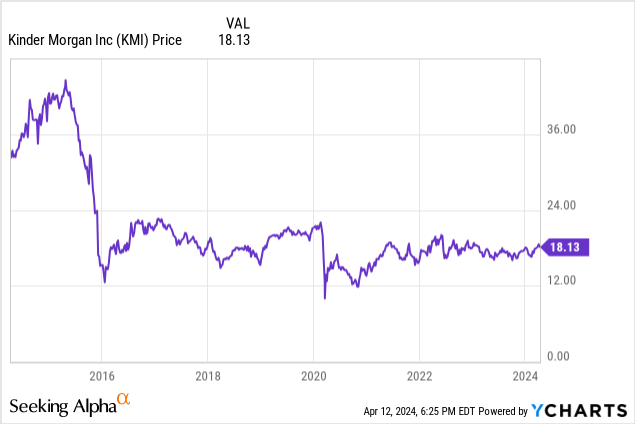

KMI Stock Price

When I last covered KMI in July, I explained why I was downgrading the stock on account of the high leverage and poor management execution. The stock has underperformed the index by 11% since then (or 6% inclusive of dividends).

With the broader market getting more and more expensive, my view towards KMI stock has improved enough for a ratings upgrade.

KMI Stock Key Metrics

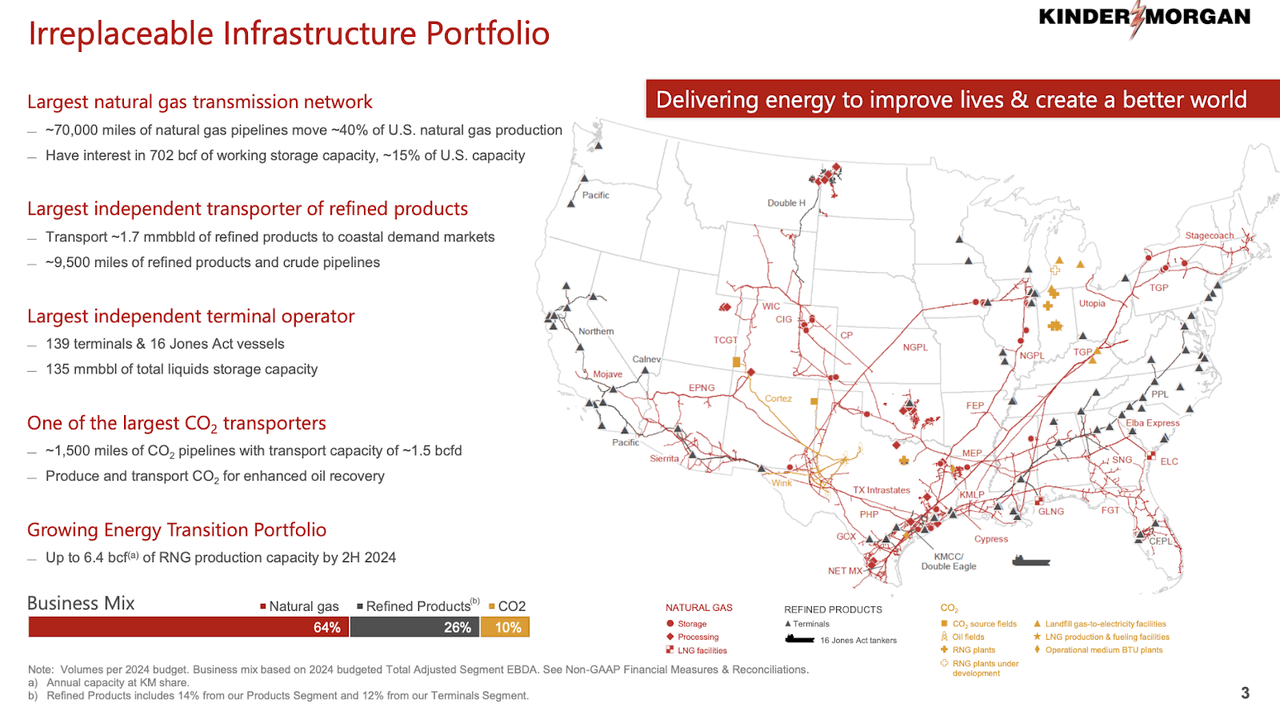

KMI has the largest natural gas network in the country, highlighted by around 70,000 miles of natural gas pipelines which account for 40% of the country’s natural gas production.

2023 Q4 Presentation

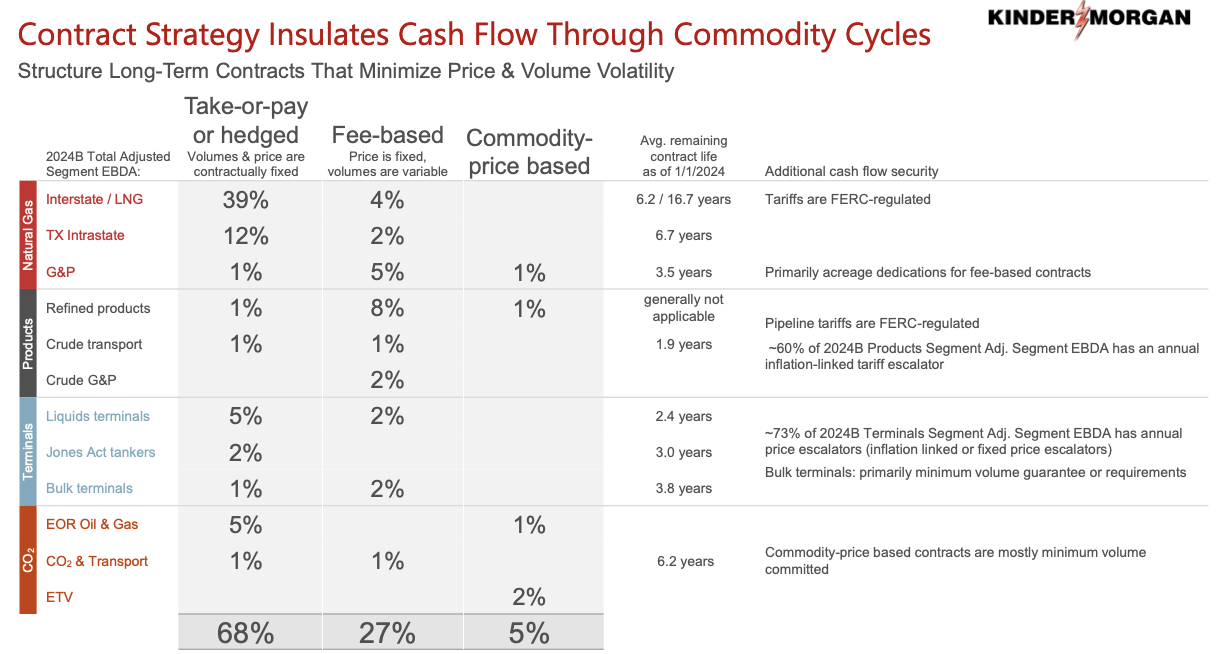

Income investors have long favored pipeline investments due to their high dividend yields (courtesy of investor prejudice against energy stocks) backed by fee-based cash flows that have proven to be resilient across commodity cycles.

2023 Q4 Presentation

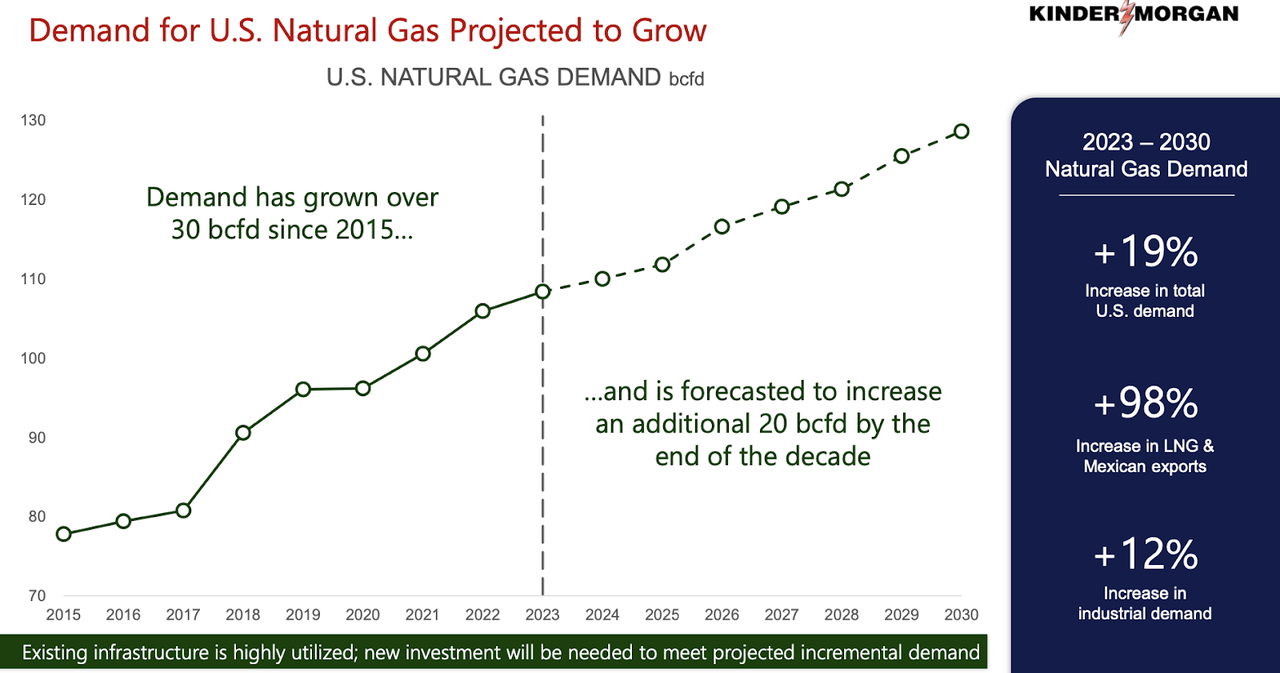

KMI is a typically favored pick for two reasons. First, unlike many pipeline stocks which issue K-1 tax forms, KMI is a corporation and is not subject to the same tax treatment. Second, KMI has a high concentration in natural gas. Natural gas is often considered to be one of the safer energy sub-sectors from an investment perspective due to its lower carbon footprint, which may shield it from climate change headwinds. Management expects natural gas demand to grow incessantly moving forward, with their pipeline infrastructure standing to benefit.

2023 Q4 Presentation

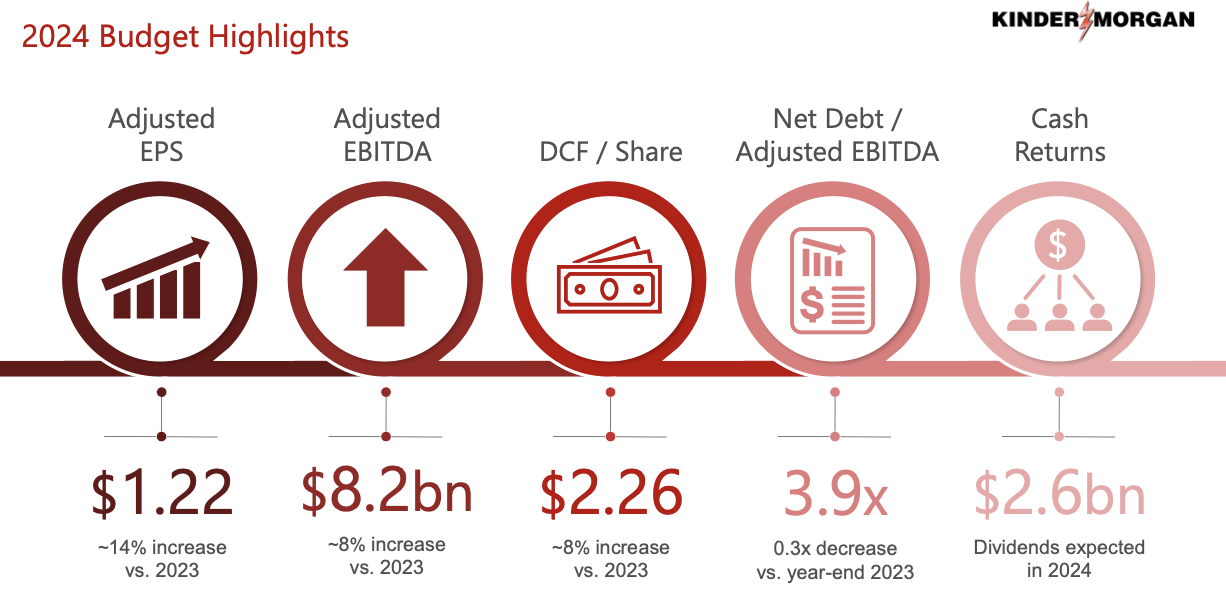

Consensus estimates call for the company to generate $4.36 billion in revenue and $0.34 in non-GAAP EPS in the first quarter. I suspect that investors may pay less attention to quarterly results but may pay more attention to progress related to management’s 2024 targets. Management has guided for 2024 to see 14% adjusted EPS growth, 8% adjusted EBITDA growth, 8% DCF per share growth, and a 0.3x reduction in debt to adjusted EBITDA.

2023 Q4 Presentation

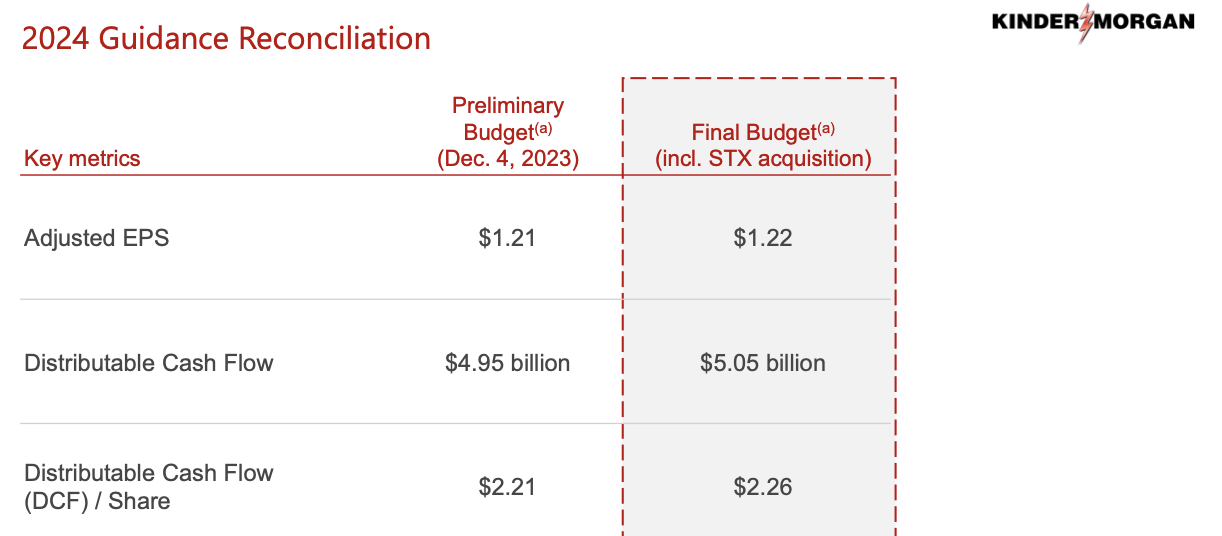

I note that the recently closed $1.8 billion acquisition of STX midstream is expected to boost results only slightly. This is because KMI is a $40 billion company with this tuck-in acquisition being just enough to slightly move the needle.

2023 Q4 Presentation

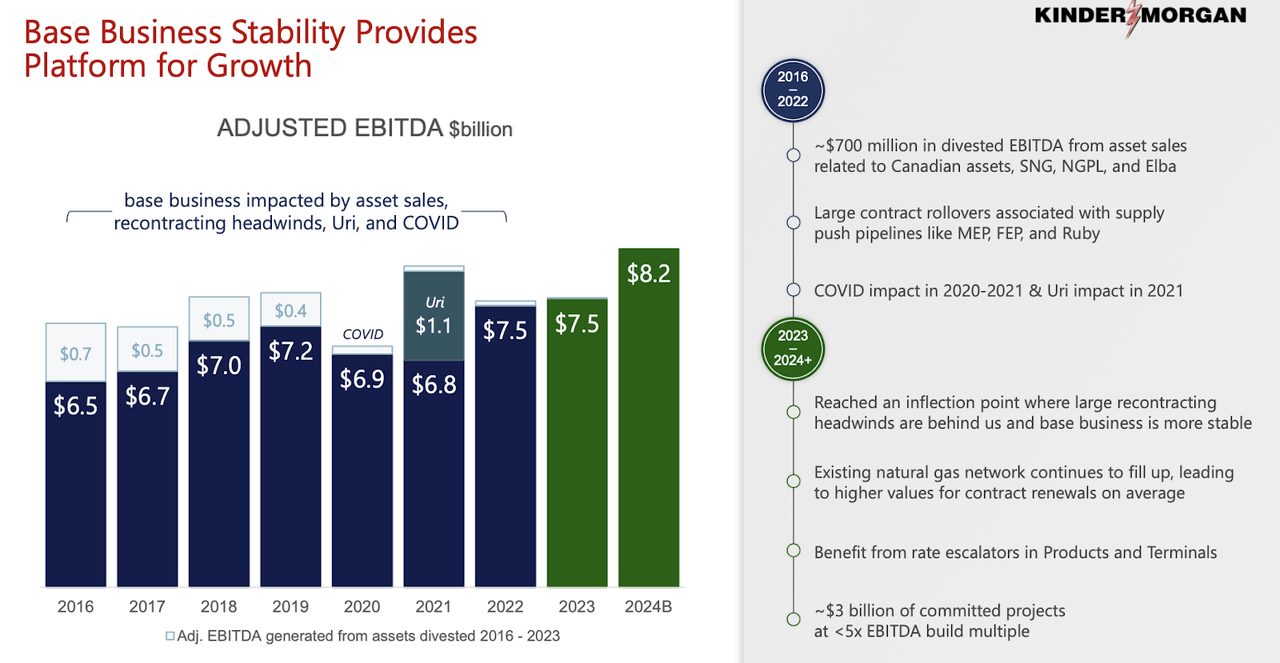

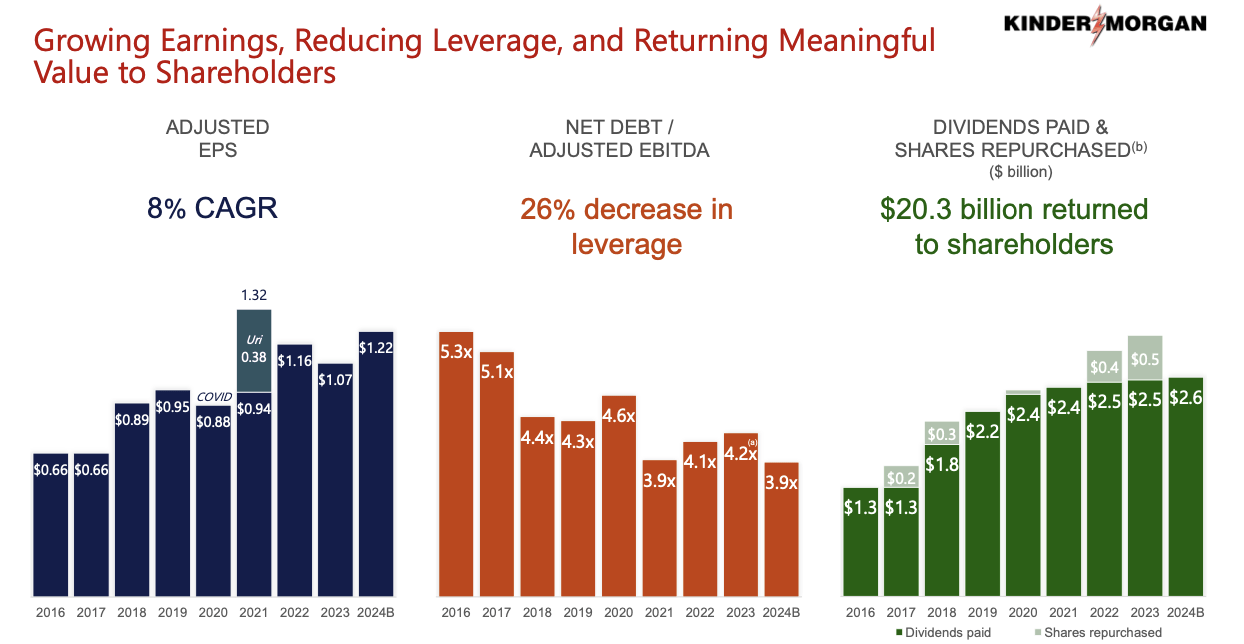

The 2024 forecast looks promising, but long-time investors in the name might point out the lack of growth over the long term. Indeed, KMI has seen adjusted EBITDA remain flat since 2016. I note that management had guided for 2023 to see $7.7 billion in adjusted EBITDA but ended up at $7.5 billion. On the conference call, management blamed the disappointment on “lower commodity prices.” Management has owned up to the disappointing results and believes that their recontracting and asset recycling headwinds are now features of the past. I will need to see before I can believe, but if the optimism can be backed up by real results, then investors might stand to benefit from accelerated growth.

2023 Q4 Presentation

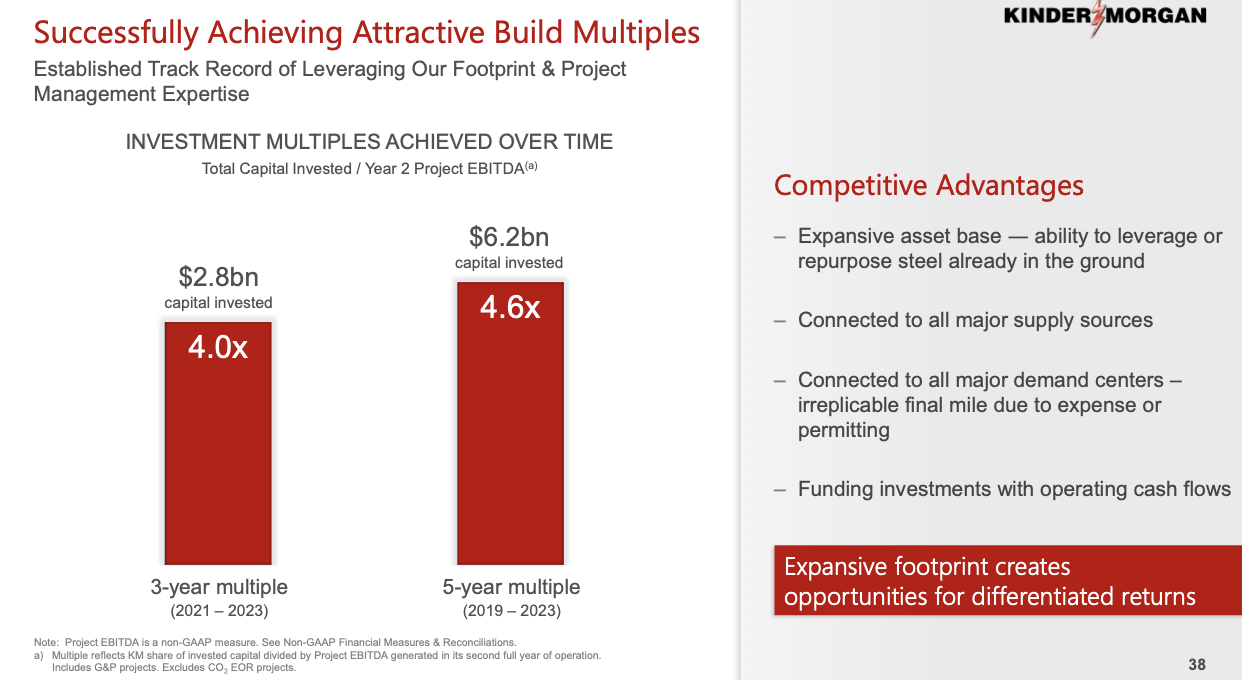

Management has touted their attractive returns on invested capital in recent years, which has been apparently offset by the aforementioned headwinds.

2023 Q4 Presentation

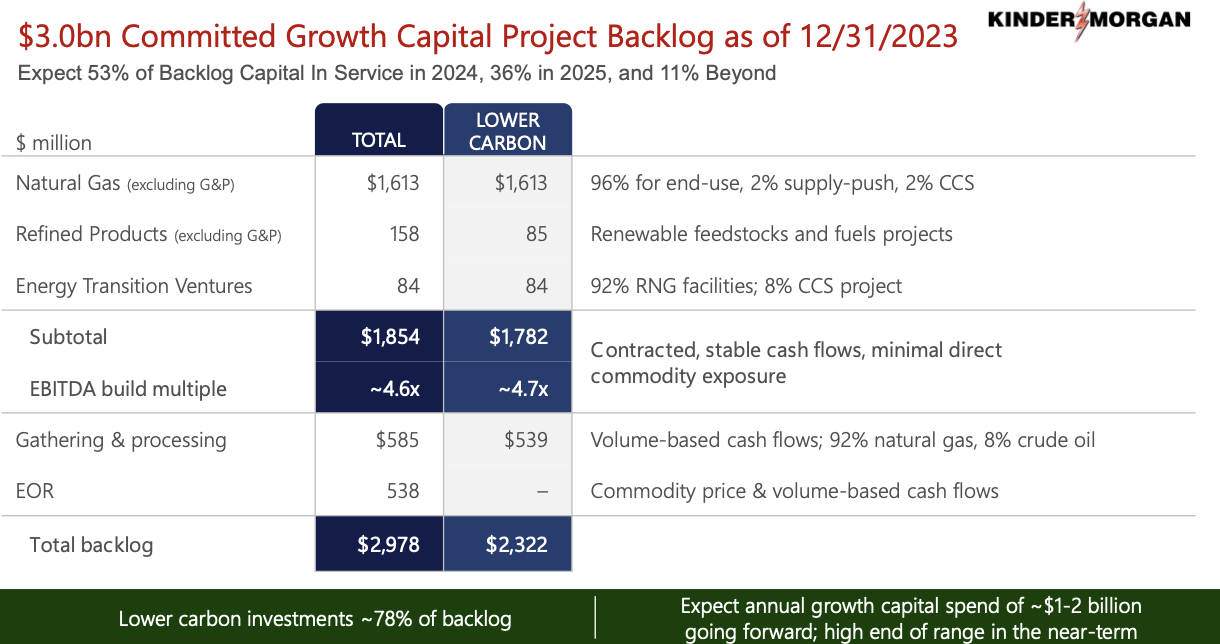

Management expects growth capital expenditures to total around $1 billion to $2 billion annually over the long term, with the near term being at the high range. I remain skeptical of these pipeline companies actually reducing their CapEx budgets, as this has been a promise for many years now.

2023 Q4 Presentation

With management guiding for debt to adjusted EBITDA to fall below 4x and end up at around 3.9x by the end of the year, some analysts (including yours truly) appeared optimistic that management might finally be ready to bring down leverage. However, management directly refuted such hopes, stating that they remain “comfortable at 4.5 times.” My interpretation is that KMI is likely to engage in M&A activity like the STX midstream acquisition over the coming years to keep leverage around the 4.5x range.

Is KMI Stock A Buy, Sell, or Hold?

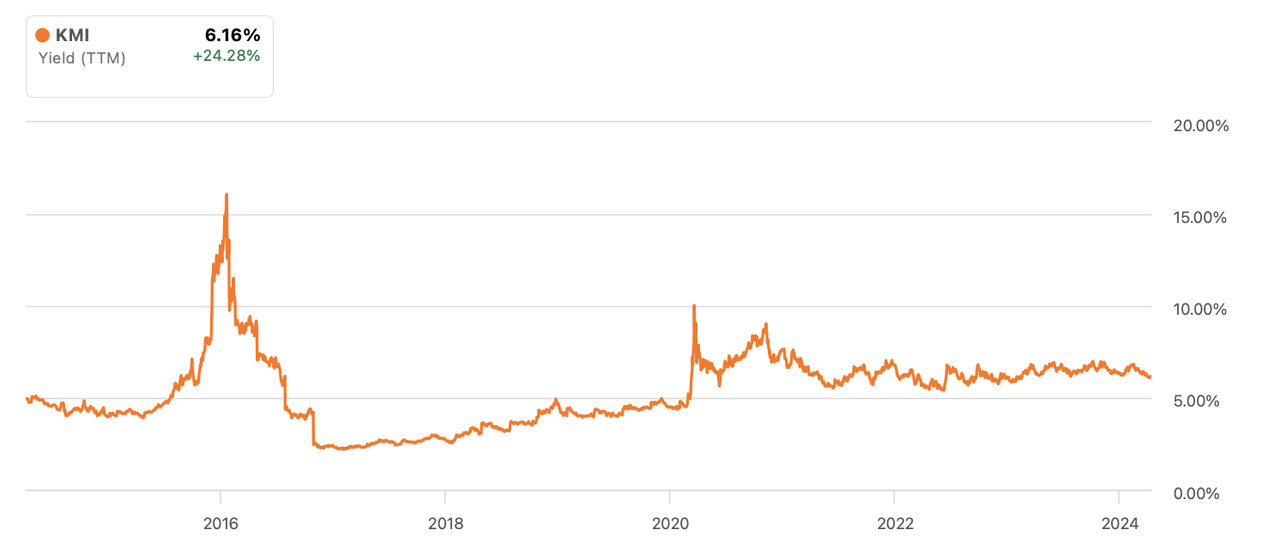

KMI may be an attractive investment due to its high dividend yield, which is high in its own right at over 6% and also high historically. I note that the yield is not that much higher relative to pre-pandemic levels even though interest rates have risen.

Seeking Alpha

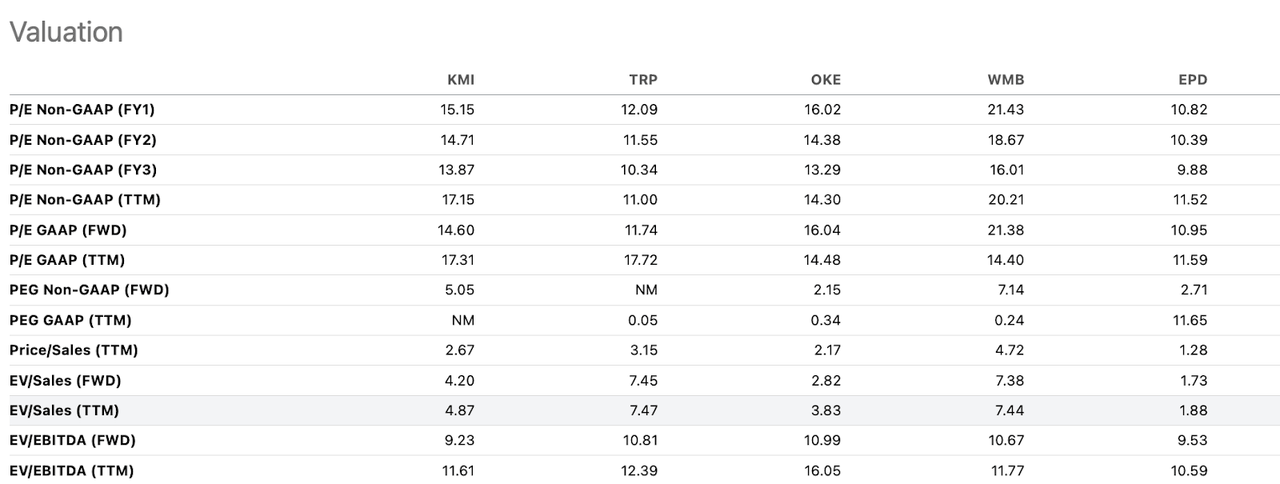

I should also note that KMI and other c-corps appear to be enjoying a material premium relative to K-1 issuing partnerships. For example, KMI is trading at a pronounced premium to Enterprise Products Partners (EPD) on a P/E and dividend yield basis in spite of EPD holding less leverage and having top tier management execution. That said, this report is about KMI and not EPD.

Seeking Alpha

Many energy investors might be used to valuing midstream companies on the basis of distributable cash flow. However, I do not hold such views for KMI because the company has not historically generated meaningful cash flow growth against their high amount of asset reinvestment. I instead prefer to value KMI on the basis of adjusted EPS (depreciation and amortization tends to correlate quite closely with CapEx spend).

2023 Q4 Presentation

KMI trades at 15x earnings, but just 8x 2024e DCF. Management does not have a track record of translating retained earnings into cash flow growth, and retained earnings represents 5.7% of the market cap. However, if we assume that at least 50% of retained earnings can lead to growth, then the company might be able to grow earnings (and its distribution) by around 3% annually. Compared against the 6.2% dividend yield, that might be enough to keep up or even slightly beat the market index.

The real upside might come if investors increase their favor towards natural gas infrastructure investments. KMI might be able to experience a re-rating to trade more in-line with utility stocks like natural gas company Atmos Energy (ATO). ATO recently traded hands at around 17.3x earnings and 12.2x forward EBITDA, implying solid double-digit re-rating upside.

What are the key risks? Climate change remains an important risk, even if natural gas appears to be more insulated to the threats. It is possible that management is unable to execute against 2024 targets or engages in expensive acquisition activity. The latter might lead to leverage rising instead of declining, which might pressure valuations. As mentioned earlier, the stock trades at a relative premium to partnership peers. That relative premium might reverse itself as not everyone holds the view that this premium is deserved. Valuation is an important risk given that absent a re-rating, the stock is only priced for around market index returns. There is great risk that KMI underperforms the broader market index if the re-rating thesis or management execution disappoints.

Conclusion

I do not expect any big surprises from the upcoming earnings release, but KMI looks like a reasonably valued bet on increased investor enthusiasm for natural gas infrastructure. The stock might perform strongly if management can execute against 2024 targets, though the recent track record does not lend much hope there. I am upgrading the stock to buy and may increase my bullishness if management can show stronger execution.