JasonDoiy

Kinder Morgan (NYSE:KMI) is one of the largest energy infrastructure companies, with a market capitalization of almost $40 billion. The company has seen its share price stagnate for the most part; however, it’s continued to pay a dividend of almost 6.5%, while focusing on growth.

We discussed the company’s performance in December. However, with its recent earnings and full 2023 results, along with its stagnation in share price as the rest of the market improves, we feel it’s important to highlight how the company has both share repurchases and the financial strength to drive long-term shareholder returns.

Kinder Morgan Infrastructure

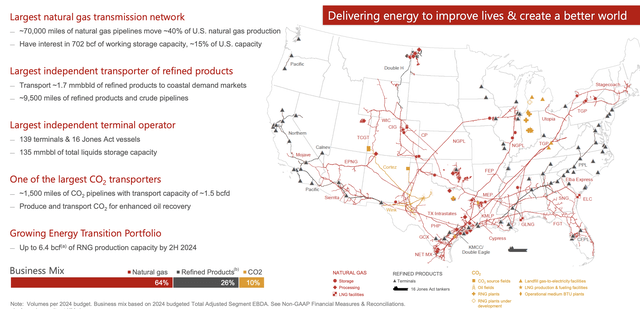

Kinder Morgan was an early mover into natural gas infrastructure and has the largest natural gas network in the country.

Kinder Morgan Investor Presentation

The company moves 40% of U.S. natural gas production and has an interest in 15% of U.S. storage capacity, across 70 thousand miles of natural gas pipelines. The company is also the largest transporter of refined products, and largest independent terminal operator, moving 1.7 million barrels a day. The company is building a CO2 business that could see demand explode.

Most excitingly is the company’s nascent RNG business, which enables the benefits of natural gas to be provided in a low-carbon manor. RNG is only 0.5% of the market today, but we expect that to explode as natural gas consumers look to reduce their carbon footprint. Kinder Morgan’s stake there could help it substantially.

Kinder Morgan Shareholder Value

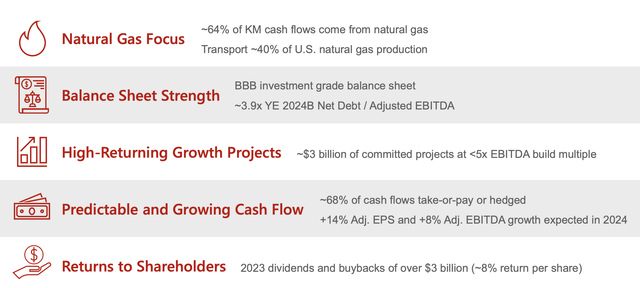

The company has a long history of turning these assets into shareholder value.

Kinder Morgan Investor Presentation

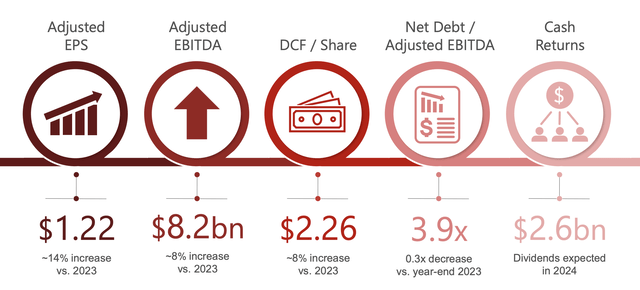

64% of the company’s cash flows come from natural gas. The company has an investment grade balance sheet, and a 3.9x YE net debt / adjusted EBITDA ratio, one of the strongest levels in the industry. The company has ~$3 billion in committed projects, expected to provide more than $600 million in EBITDA for the company.

The company’s growth investments are expected to provide +14% adjusted EBITDA and 8% adjusted EBITDA growth in 2024. The company has a 6.5% dividend with 2023 shareholder returns of 8% / year, and we expect that to increase even further in 2024, showing a commitment to shareholders.

The stagnation in the company’s share price is due to prior burning of shareholders, in our view.

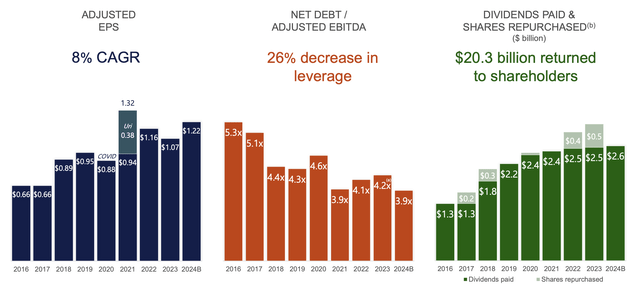

Kinder Morgan Historic Performance

Here shows the company’s performance since the 2016 oil crash, despite a volatile market.

Kinder Morgan Investor Presentation

The company has managed to decrease leverage by 26%, from a much riskier low interest environment level of >5.0x. Shareholder returns have been more than $20 billion total, and the company’s steady dividend increases will mean a strong 2024 return even without buybacks. The company returning more than half of its market cap in 8 years shows its strength.

That performance will reliably continue into the future.

Kinder Morgan Future

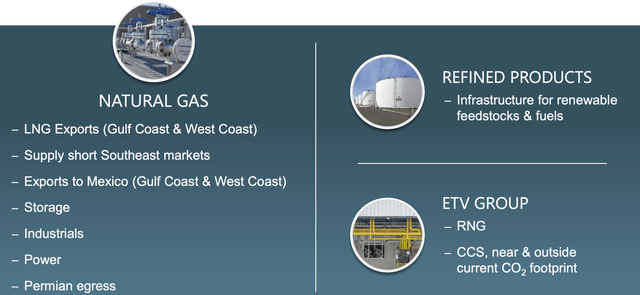

The company’s future is based on growing demand for its key products and assets as midstream assets are harder to build.

Kinder Morgan Investor Presentation

The company’s natural gas is taking advantage of rapid growth in LNG demand, particularly from companies that are allies and are no longer interested in Russian LNG. Major projects worth $10s of billions have been developed with cheap natural gas, and we expect them to keep being developed. Increased development here is also important.

The company is also building up its ETV group and refined products, more local infrastructure that’s much harder to replace.

Kinder Morgan Investor Presentation

The above shows the company’s forecasts for 2024. The most important number is an 8% increase in DCF / Share to $2.26 / share. That’s a DCF of just under 13%, very respectable given the company’s incredibly low debt yield. The company expects to finish the year with a debt load of just a hair under $32 billion.

At current interest rates that’s more than manageable, although a further reduction would always be nice. We’d like to see the company focus more on share buybacks though, at its current valuation, increasing buyback rates to more like 2-3% annually on top of the dividend. That will enable consistent dividend increases with no additional cash investment.

The company does have $3 billion in growth capital projects it’s working on, expected to provide ~$400 million in DCF, with ~$1.6 billion placed into service in 2024 (4% of its market cap). The company can comfortably afford that with its current DCF, even counting its dividend. The company expects to stay on the high end of $1-2 billion in annualized growth capital.

As long as the opportunities continue for a <5.0x EBITDA ratio, we concur with the company’s decisions.

Thesis Risk

Kinder Morgan’s largest risk in our view is a long-term structural decline in volumes. The company is right that the outlook towards 2030 is exciting, however, into 2040 and 2050 there are many scenarios where demand declines. That can be affected by changing renewables demand and more. All of that can impact Kinder Morgan’s ability to drive long-term returns.

Conclusion

Kinder Morgan has worked hard to improve its balance sheet and commitment to shareholders after its dividend cut (wow, it’s been a long time) almost a decade ago. The company was caught in a bad position, but it’s cleaned up its act. Its debt is now more than manageable, even in a rising interest rate environment.

Going forward, we expect the company to steadily increase its dividend and cash flow to shareholders. However, we also expect the company to grow rapidly from growth investment opportunities, especially in renewable natural gas. We’d like to see the company ramp up share repurchases, but it seems reluctant to do so. Let us know your thoughts in the comments below!