Up to date on March ninth, 2022 by Nikolaos Sismanis

Kevin O’Leary is Chairman of O’Shares Investments, however you in all probability know him as “Mr. Great”.

He will be seen on CNBC in addition to the tv present Shark Tank. Traders who’ve seen him on TV have probably heard him talk about his funding philosophy.

Mr. Great seems to be for shares that exhibit three most important traits:

- First, they should be high quality corporations with robust monetary efficiency and strong steadiness sheets.

- Second, he believes a portfolio needs to be diversified throughout totally different market sectors.

- Third, and maybe most vital, he calls for earnings—he insists the shares he invests in pay dividends to shareholders.

Notice: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You possibly can obtain the entire listing of all of O’Shares Funding Advisor 13F submitting inventory holdings, together with quarterly efficiency, by clicking the hyperlink beneath:

OUSA owns shares that show a mixture of all three qualities. They’re market leaders with robust earnings, diversified enterprise fashions, and so they pay dividends to shareholders. The listing of OUSA portfolio holdings is an fascinating supply of high quality dividend development shares.

This text analyzes the fund’s largest holdings intimately.

Desk of Contents

The highest 10 holdings from the O’Shares FTSE U.S. High quality Dividend ETF are listed so as of their weighting within the fund, from lowest to highest.

No. 10: UnitedHealth Group (UNH)

Dividend Yield: 1.19%

Share of OUSA Portfolio: 2.51%

UnitedHealth Group operates as a diversified well being care firm in the US. As it is not uncommon on this trade, regardless of UnitedHealth’s large revenues which exceed $250 billion per 12 months, its internet margins stay razor-thin.

In that regard, the danger of unprofitable quarters throughout a recession needs to be fairly excessive. But, UnitedHealth’s high quality operations and recurring money flows haven’t led to a single unprofitable quarter in over 23 years.

UnitedHealth reported fourth-quarter and full-year earnings on January nineteenth, 2022, and outcomes have been as soon as once more higher than anticipated. Earnings-per-share got here to $4.48, beating estimates by 17 cents. Income was up 13% to $73.7 billion, which beat estimates by almost $900 million. Optum drove the income enhance as soon as once more, including 14% year-over-year development to $41.4 billion, whereas UnitedHealthcare was up 12% to $56.4 billion.

The medical care ratio was 83.7%, which continues to be fairly robust and displays a good medical reserve improvement of $440 million. The total-year working value ratio was 14.8% of income, down from 16.2% within the year-ago interval. Our preliminary estimate for this 12 months is $21.65 in earnings-per-share as administration supplied bullish steering as soon as once more for the approaching 12 months.

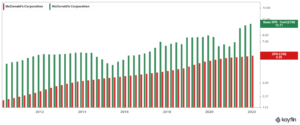

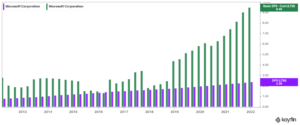

No. 9: McDonald’s Company (MCD)

Dividend Yield: 2.48%

Share of OUSA Portfolio: 2.76%

McDonald’s, based in 1940 and headquartered in Chicago IL, is the world’s main international foodservice retailer with almost 40,000 places in over 100 international locations. Roughly 93% of the shops are independently owned and operated. The $165.6 billion market cap firm has raised its dividend yearly since paying its first dividend in 1976, qualifying the corporate as a Dividend Aristocrat. In September McDonald’s declared a $1.38 quarterly dividend, marking a 7.0% year-over-year enhance.

Associated: The Greatest Quick Meals Inventory Now: Rating The 6 Largest U.S. Quick Meals Shares

On January twenty seventh, 2022, McDonald’s reported This autumn and 2021 outcomes for the interval ending December thirty first, 2021. For the quarter, whole income got here in at $6.009 billion, a 13.1% enhance in comparison with This autumn 2020. Internet earnings equaled $1.639 billion or $2.18 per share in comparison with $1.377 billion or $1.84 per share in This autumn 2020. On an adjusted foundation, earnings-per-share equaled $2.23 versus $1.70 prior.

For the 12 months McDonald’s generated gross sales of $23.223 billion, a 20.9% enhance in comparison with 2020. Income development was robust in each company-operated eating places and franchised eating places. Internet earnings equaled $7.545 billion or $10.04 per share in comparison with $4.731 billion or $6.31 per share in 2020. On an adjusted foundation earnings-per-share equaled $9.28 versus $6.05 beforehand.

No. 8: Lockheed Martin Company (LMT)

Dividend Yield: 2.49%

Share of OUSA Portfolio: 3.47%

Lockheed Martin Company is the world’s largest protection firm. About 60% of the corporate’s revenues comes from the US Division of Protection, with different US authorities companies (10%) and worldwide purchasers (30%) making up the rest. The corporate consists of 4 enterprise segments: Aeronautics (~40% gross sales) – which produces army plane just like the F-35, F-22, F-16 and C-130; Rotary and Mission Programs (~26% gross sales) – which homes fight ships, naval electronics, and helicopters; Missiles and Hearth Management (~16% gross sales) – which creates missile protection methods; and Area Programs (~17% gross sales) – which produces satellites. The corporate has vital energy and publicity in army plane. The corporate had whole income of over $65.4B in 2020.

Lockheed Martin reported improved outcomes for This autumn 2021 on January twenty fifth, 2022. Companywide internet gross sales elevated to $17,729M from $17,032M and diluted GAAP earnings per share elevated to $7.47 from $6.38 on a year-over-year foundation. The Aeronautics section’s internet gross sales rose 6% to $7,127M from $6,714M within the prior 12 months because of larger volumes of F-35 and categorised contracts. The Missiles and Hearth Management section gross sales elevated 12% to $3,219M from $2,866M in comparable intervals because of larger gross sales of tactical and strike missiles and built-in air and missile protection offset by international sustainment and sensors.

Rotary and Mission Programs internet gross sales have been up 6% to $4,460M from $4,212M within the prior 12 months because of will increase in built-in warfare methods, C6ISR, and coaching and logistics options.

The Area section gross sales fell (-10%) to $2,923M from $3,240M because of renationalization of the Atomic Weapons Institution program and decrease volumes in civil house packages offset by larger gross sales for strategic and missile protection packages. For the 12 months, Lockheed Martin had income of $67,044 million, up from $65,398 million whereas diluted earnings per share have been right down to $22.76 from $24.50 because of a non-cash pensions cost.

Lockheed Martin’s backlog is roughly $135.36B with solely a rise in Area. Federal Commerce Fee sued to dam Lockheed Martin’s $4.4B acquisition of Aerojet Rocketdyne. Lockheed Martin is reviewing the choice. Lockheed Martin guided for ~$66B in gross sales and ~$26.70 diluted earnings per share in 2022.

The corporate has grown its DPS for 20 consecutive years, with the newest enhance coming in at 7.7%

We anticipate the dividend to develop ~8% on common yearly and the payout ratio to vary from 35% to 45%.

No. 7: Pfizer Inc. (PFE)

Dividend Yield: 3.33%

Share of OUSA Portfolio: 3.59%

Pfizer Inc. is a world pharmaceutical firm that focuses on pharmaceuticals and vaccines. It’s a mega-cap inventory with a market cap of $266.7 billion. You possibly can see our full listing of mega-cap shares right here.

Pfizer’s new CEO accomplished a sequence of transactions in 2019 considerably altering the corporate construction and technique. Pfizer fashioned the GSK Shopper Healthcare Joint Enterprise with GlaxoSmithKline plc (GSK), which is able to embody Pfizer’s over-the-counter enterprise. Pfizer owns 32% of the JV.

Pfizer additionally accomplished an $11 billion deal buying ArrayBioPharma. The spinoff of the Upjohn section was introduced as properly. Pfizer’s high merchandise embody Eliquis, Ibrance, Prevnar 13, Enbrel (worldwide), Chantix, Sutent, Xtandi, Vyndaqel, Inlyta, and Xeljanz.

Pfizer’s present product line is anticipated to supply strong top-line and bottom-line development within the medium time period. This needs to be powered by a sturdy demand outlook for its medicines in addition to the continuing vaccine rollout which can lead to recurring revenues going ahead because of the risk for a number of photographs wanted to battle COVID-19.

Development will come from rising U.S. and worldwide gross sales for permitted indications and extensions. However, development is offset by patent expirations and in addition competitors for Enbrel and Prevnar 13. Going ahead Pfizer additionally has a robust pipeline in oncology, irritation & immunology, and uncommon ailments. We expect a 5% EPS development every year.

Pfizer reported glorious This autumn 2021 and full-year outcomes on February 8, 2022. For the quarter, companywide income rose 105% to $23,838M from $11,634M, and adjusted diluted earnings per share rose 152% to $1.08 versus $0.43 on a year-over-year foundation. Diluted GAAP earnings per share rose to $0.59 from $0.15 vs. the comparable quarters. For its COVID-19 vaccine, Pfizer is the worldwide chief with a 70% market share.

The corporate is increasing utility of the mRNA expertise. The drug large is pursuing two protease inhibitor antiviral compounds, a flu vaccine, a shingles vaccine, a breast most cancers remedy, hemophilia gene remedy, a Lyme vaccine, RSV Grownup vaccine, and others. Pfizer is partnering with a number of smaller corporations (BioNTech, Acuitas, Beam, and Codex DNA) to deliver new therapies to market. Cibinqo (atopic dermatitis) and Paxlovid (antiviral) acquired EU and US regulatory approvals, respectively. Pfizer guided for $98B – $102B in income and adjusted diluted EPS of $6.35 – $6.55 for 2022.

Pfizer additionally pays a strong 3.33% dividend. In all, we anticipate 14.7% annual returns over the following 5 years, making Pfizer a pretty dividend inventory to purchase now.

No. 6: Apple (AAPL)

Dividend Yield: 0.55%

Share of OUSA Portfolio: 3.70%

Apple is the biggest firm on the earth by market capitalization. Contemplating that Kevin O’Leary prefers corporations that return capital to shareholders, this weighting could be a shock.

Associated: The ten Largest Dividend Paying Tech Shares Ranked

Apple is the youngest dividend-paying inventory analyzed on this article (based mostly on dividend historical past), having solely distributed earnings to shareholders since 2012. Since then, the dividend has grown greater than 8x in a really brief quantity of interval. That is along with the huge variety of shares which have been repurchased over time.

Apple’s sub-1.0% dividend yield, nonetheless, is the bottom yield among the many high 10 largest holdings, however traders probably approve of this trade-off in earnings for the potential for prime capital returns forward.

On January twenty seventh, 2022, Apple reported Q1 fiscal 12 months 2022 outcomes for the interval ending December twenty fifth, 2021. (Apple’s fiscal 12 months ends the final Saturday in September). For the quarter Apple generated income of $123.9 billion, an 11.2% enhance in comparison with Q1 2021. Product gross sales have been up 9.1%, led by a 9.2% enhance in iPhones (58% of whole gross sales). Service gross sales elevated 23.8% to $19.5 billion and made up 16% of all gross sales within the quarter. Internet earnings equaled $34.63 billion or $2.10 per share in comparison with $28.76 billion or $1.68 per share in Q1 2021.

Earnings development and dividend yield could also be offset by a big headwind from valuation reversion because the inventory trades with a a number of of 25x earnings in comparison with our goal a number of of 18x earnings.

Due to this fact, we anticipate the inventory to supply subpar shareholder returns over the medium time period.

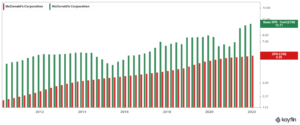

No. 5: House Depot (HD)

Dividend Yield: 2.40%

Share of OUSA Portfolio: 4.14%

House Depot was based in 1978, and since that point has grown into the main residence enchancment retailer with nearly 2,300 shops within the U.S., Canada, and Mexico. In all, House Depot generates annual income of roughly $130 billion.

House Depot reported fourth quarter and full-year outcomes on February twenty second. The corporate reported fourth-quarter gross sales of $36 billion, a ten.7% year-over-year enhance. Comparable gross sales within the quarter rose 8.1%. Internet earnings equated to $3.4 billion, or $3.12 per share, in comparison with $2.65 per share in This autumn 2020.

For the total fiscal 12 months, House Depot had gross sales totaling $151 billion, up 14.4% from 2020. Comparable gross sales rose 11.4% within the 12 months, and comparable gross sales rose 10.7% within the US. Internet earnings amounted to $16.4 billion, or $15.53 per share, 30% larger than $11.94 per share earned in 2020.

The corporate spent $14.8 billion in frequent inventory repurchases throughout fiscal 2021, an enormous enhance from the $791 million spent in 2020. The common ticket rose 11.7% in comparison with final 12 months, from $74.32 to $83.04.

Moreover, there was an 11.2% enhance in gross sales per retail sq. foot, from $543.74 to $604.74. As of the top of fiscal 2021, House Depot has money and money equivalents equal to $2.3 billion. Management has resumed speaking steering.

For fiscal 2022, administration expects gross sales development and comparable gross sales development to be barely optimistic, with a flat working margin in comparison with fiscal 2021. The corporate will even pay $1.5 billion in internet curiosity expense for 2022. Lastly, diluted EPS development is anticipated to be within the low single digits.

House Depot’s most compelling aggressive benefit is its management place within the residence enchancment trade. Not solely is demand for residence enchancment merchandise rising at a excessive price within the U.S., however the trade is very concentrated with simply two main operators (House Depot and Lowe’s) taking the overwhelming majority of market share. House Depot has additionally confirmed to be extraordinarily resilient to recessions, together with the coronavirus pandemic, which has arguably helped House Depot as customers spend far more time at residence.

The corporate has generated robust earnings development up to now decade, because it has efficiently capitalized on the housing and development growth that ensued following the Nice Recession of 2008-2010. E-commerce is one other development catalyst for House Depot, as the corporate has invested closely to broaden its digital footprint.

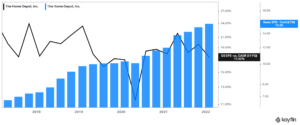

No. 4: Microsoft Company (MSFT)

Dividend Yield: 0.89%

Share of OUSA Portfolio: 4.45%

Microsoft Company, based in 1975 and headquartered in Redmond, WA, develops, manufactures, and sells each software program and {hardware} to companies and customers. Its choices embody working methods, enterprise software program, software program improvement instruments, video video games and gaming {hardware}, and cloud companies.

Associated: 5 Prime Gaming Shares.

On September 14th, 2021, Microsoft declared a $0.62 quarterly dividend, marking the twentieth consecutive yearly enhance. On January 18th, 2022, Microsoft introduced that it’s going to purchase Activision Blizzard (ATVI), a pacesetter in online game improvement and content material, for $68.7 billion. The deal is anticipated to shut within the fiscal 12 months 2023 and is topic to evaluation.

On January twenty fifth, 2022, Microsoft reported Q2 fiscal 12 months 2022 outcomes for the interval ending December thirty first, 2021. (Microsoft’s fiscal 12 months ends June thirtieth.) For the quarter, the corporate generated income of $51.7 billion, a 20% enhance in comparison with Q2 2021. The expansion was throughout the board with Productiveness and Enterprise Processes, Clever Cloud and Private Computing rising 19%, 26%, and 15% respectively. Azure, Microsoft’s high-growth cloud platform, grew by 46% year-over-year. Internet earnings equaled $18.77 billion or $2.48 per share in comparison with $15.46 billion or $2.03 per share in Q2 2021.

After years of strong development, Microsoft had a tough time rising its earnings through the 2011 by means of 2015 timeframe. After some change-up in its administration and a strategic shift in direction of cloud computing and cell, Microsoft’s development has been reinvigorated. Development charges for revenues and particularly earnings have been compelling throughout latest years.

Microsoft’s cloud enterprise is rising at a speedy tempo because of Azure, which has been rising tremendously for just a few years. Microsoft’s Workplace product vary, which had been a low-growth money cow for a few years, is displaying robust development charges as properly after Microsoft modified its enterprise mannequin in direction of the Workplace 365 software-as-a-service (SaaS) system. Resulting from low variable prices, Microsoft ought to be capable to preserve a strong earnings development price for the foreseeable future. Buybacks are an extra issue for earnings-per-share development, though this type of capital allocation turns into much less enticing with an elevated valuation.

Additional, Microsoft shows a tremendous dividend development report, numbering 20 years of consecutive annual dividend will increase.

Microsoft has an amazing moat within the working system & Workplace enterprise items and a robust market place in cloud computing. It’s unlikely that the corporate will lose market share with its older, established merchandise, whereas cloud computing is such a high-growth trade that there’s sufficient room for development for a number of corporations.

The corporate has a famend model and a world presence, which offers aggressive benefits. Microsoft can be comparatively resilient in opposition to recessions and has a AAA credit standing.

Sadly, Microsoft inventory seems overvalued, with a ahead P/E ratio of 32. Our truthful worth estimate is a P/E ratio of 24. Anticipated EPS development of seven% and the 0.89% dividend yield will increase returns, however general whole returns seem relatively restricted on the inventory’s present ranges.

No. 3: Verizon Communications (VZ)

Dividend Yield: 4.67%

Share of OUSA Portfolio: 4.65%

Verizon is a telecommunications large. Wi-fi contributes three-quarters of revenues, and broadband and cable companies account for a couple of quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S. Verizon has now launched 5G Extremely-Wideband in a number of cities because it continues its rollout of 5G service. Verizon was the primary of the foremost carriers to activate the 5G service.

Verizon introduced fourth-quarter and full-year earnings outcomes on 1/25/2022. For the quarter, income grew 4.8% to $34.1 billion, topping estimates by $120 million. Adjusted earnings-per-share of $1.31 in contrast favorably to $1.21 within the prior 12 months and was $0.03 higher than anticipated.

For the 12 months, income grew 4.1% to $133.6 billion whereas adjusted earnings-per-share was larger by 10% to $5.39. Wi-fi retail postpaid internet provides have been 1.058 million, forward of consensus estimates of 978K. Of those, 558K have been postpaid telephone internet provides.

Whole retail connections stood at almost 143 million. On a sequential foundation, retail postpaid telephone churn was larger by 7 foundation factors to 0.81%. Income for the patron section grew 7.4% for the quarter, pushed by larger charges of 5G-phone adoption and 55K Fios internet additions. The common income per account additionally elevated companywide. Enterprise income was down 3% to $7.8 billion as beneficial properties in enterprise wi-fi companies have been offset by weak spot within the public sector. This section had 391K wi-fi retail postpaid internet additions, together with 222K telephone internet additions.

Verizon supplied steering for 2022. The corporate expects adjusted earnings-per-share of $5.40 to $5.55 for the 12 months. Wi-fi income is projected to develop 9% to 10%, with natural service income of shut to three%. We’ve initiated our forecast for the 12 months accordingly.

We anticipate 4% annual EPS development over the following 5 years. The inventory additionally has a 4.67% dividend yield. Along with a substantial bump from an increasing P/E a number of, we anticipate whole returns of ~13.6% per 12 months for Verizon inventory. This makes Verizon a excessive yielding safety with first rate development potential.

No. 2: Procter & Gamble (PG)

Dividend Yield: 2.28%

Share of Portfolio: 4.97%

Procter & Gamble is a stalwart amongst dividend shares. It has elevated its dividend for the previous 65 years in a row. This makes the corporate considered one of solely 40 Dividend Kings, an inventory of shares with 50+ years of rising dividends.

It has carried out this by changing into a world shopper staples large. It sells its merchandise in additional than 180 international locations world wide with annual gross sales of greater than $70 billion. A few of its core manufacturers embody Gillette, Tide, Charmin, Crest, Pampers, Febreze, Head & Shoulders, Bounty, Oral-B, and plenty of extra.

These merchandise are in excessive demand whatever the state of the economic system, making the corporate relatively recession-proof. Many of those product classes noticed strong natural development charges in 2021.

On April thirteenth , 2021, Procter & Gamble elevated its dividend 10.0% to $0.8698 per quarter from $0.7907.

On January nineteenth, 2022, Procter & Gamble launched Q2 fiscal 12 months 2022 outcomes for the interval ending December thirty first, 2021. (Procter & Gamble’s fiscal 12 months ends June thirtieth.) For the quarter, the corporate generated $20.95 billion in gross sales, a 6% enhance in comparison with Q2 2021.

This end result was led by gross sales will increase of three%, 4%, 8%, 7%, and 5% within the firm’s Magnificence, Grooming, Well being Care, Cloth & House Care, and Child, Female & Household Care segments, respectively. Adjusted earnings-per-share equaled $1.66 versus $1.64 within the year-ago quarter. Procter & Gamble additionally raised its fiscal 2022 steering, anticipating 3% to 4% gross sales development (from 2% to 4%) and three% to six% adjusted earnings-per-share development (unchanged).

Procter & Gamble is seen as delivering 4% earnings development going ahead. Nevertheless, the inventory can be overvalued on the present degree, buying and selling for a P/E ratio of 26.7 in contrast with our truthful worth estimate of 20. If shares have been to revert from the current price-to-earnings ratio to our goal of 20, then valuation could be a ~6.1% headwind to annual returns over the following 5 years.

Whereas we don’t at the moment price P&G inventory as a purchase because of its valuation, P&G is a robust inventory for long-term dividend development and present yield.

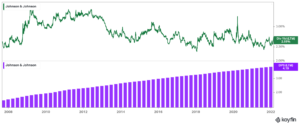

No. 1: Johnson & Johnson (JNJ)

Dividend Yield: 2.51%

Share of OUSA Portfolio: 5.30%

Johnson & Johnson is among the most well-known dividend shares within the market, so it ought to come as no shock that it’s a high holding for OUSA.

Johnson & Johnson is a healthcare large with a market capitalization of round $443.6 billion. It has very massive companies throughout healthcare, together with prescribed drugs, medical units, and shopper well being merchandise. The corporate has annual gross sales in extra of $93 billion.

On 11/12/2021, Johnson & Johnson introduced plans to spin off its shopper well being enterprise right into a standalone firm. The transaction is anticipated to be accomplished throughout the subsequent 18 to 24 months.

On 1/25/2022, Johnson & Johnson launched fourth-quarter earnings outcomes for the interval ending 12/31/2021. For the quarter, income grew 10.3% to $24.8 billion however missed estimates by $490 million. Adjusted earnings-per-share of $2.13 was a $0.27, or 14.5%, enhance from the prior 12 months and $0.01 above expectations.

For 2021, income grew 13.6% to $93.8 billion whereas adjusted earnings-per-share elevated 22% to $9.80. Pharmaceutical had one other quarter of double-digit development as income improved 16.5%.

Oncology stays robust with a ten% enhance in gross sales. Darzalex, which treats a number of myeloma, elevated market share but once more because of robust uptake charges. Imbruvica, which treats lymphoma, confronted aggressive pressures however retained its market share worldwide.

Immunology grew 6.1% pushed by larger demand for Stelara, which treats immune-mediated inflammatory ailments, in Crohn’s Illness and Ulcerative Colitis. Infectious Ailments grew greater than 167%, largely because of the firm’s COVID-19 vaccine.

Shopper gross sales inched larger by 1.1%. Over-the-counter grew by almost 16% because of a restoration in cough, chilly, and flu product traces. Pores and skin Well being & Magnificence was down 8% because of divestitures.

Medical Gadgets continues to get well, with income enhancing 4.1%. Interventional Options continues to see a market restoration, resulting in a 14.1% enhance in outcomes. Surgical procedure was up 3.5%, largely because of energy in biosurgery and power merchandise. Johnson & Johnson additionally supplied steering for 2022.

The corporate expects adjusted earnings-per-share of $10.40 to $10.60 for the 12 months. On the midpoint, this could be a 7.1% enhance from 2021. Income is anticipated to be between $98.9 billion and $100.4 billion.

Johnson & Johnson’s key aggressive benefit is the dimensions and scale of its enterprise. It invested over $14.7 billion in R&D within the final quarter alone to develop its market share. J&J is a worldwide chief in numerous healthcare classes, with 26 particular person merchandise or platforms that generate over $1 billion in annual gross sales every. J&J’s diversification permits it to develop every year. It has elevated its adjusted working earnings for 38 consecutive years.

It is usually one of the crucial recession-resistant companies traders will discover. Within the Nice Recession, earnings-per-share grew by 10% in 2008, and 1% in 2009, at a time when many different corporations have been struggling. This resilience provides J&J regular earnings, even throughout recessions, which permits it to proceed rising its dividend every year.

We anticipate earnings-per-share to develop at a price of 6% per 12 months by means of 2027 because of beneficial properties in income and share repurchases. That is in step with Johnson & Johnson’s earnings development composition up to now, nonetheless, most development will come from income growth because the buyback is sweet for a low-single-digit achieve yearly.

On 4/20/2021, Johnson & Johnson introduced a 5% dividend enhance, ensuing within the firm counting 59 consecutive years of dividend development. Therefore, J&J is a Dividend King. It additionally featured a superb steadiness sheet to assist preserve its dividend development. It has a AAA credit standing from Commonplace & Poor’s.

Ultimate Ideas

Kevin O’Leary has turn out to be a family identify because of his appearances on the TV present Shark Tank. However he’s additionally a widely known asset supervisor, and his funding philosophy largely aligns with Certain Dividend’s. Particularly, Mr. Great sometimes invests in shares with massive and worthwhile companies, with robust steadiness sheets and constant dividend development yearly.

Not all of those shares are at the moment rated as buys within the Certain Evaluation Analysis Database, which ranks shares based mostly on anticipated whole return because of a mix of earnings per share development, dividends, and modifications within the price-to-earnings a number of.

Nevertheless, a number of of those 10 shares are useful holdings for a long-term dividend development portfolio.

Extra Sources

See the articles beneath for evaluation on different main funding companies/asset managers/gurus:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].