Robert Way/iStock Editorial via Getty Images

On October 20, after the market closed, Kering (OTCPK:PPRUF) released its Q3 whose results beat analysts’ estimates. Revenues of €4.98 billion were expected versus the reported €5.14 billion. So, it would seem to be good news for the company, but not for the market as Kering lost 3.30% the next day. In this article I will analyze the quarterly report and give my reasons for disagreeing with the market sentiment.

Q3 2022 analysis

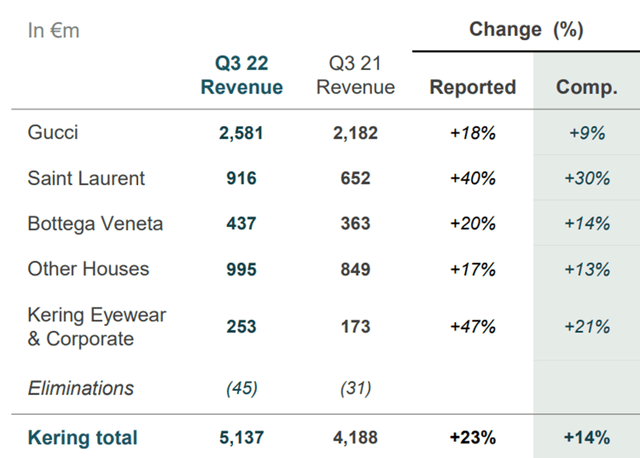

Kering Q3 2022

Kering’s Q3 2022 saw strong growth compared to Q3 2021, driven mainly by its core brands and the favorable exchange rate derived from the depreciation of the euro against the dollar. Specifically, there was 23% revenue growth compared to Q3 2021, of which 9% came from the positive exchange rate effect and 14% from organic growth. Let’s now look in detail at how Kering’s individual segments performed.

Gucci

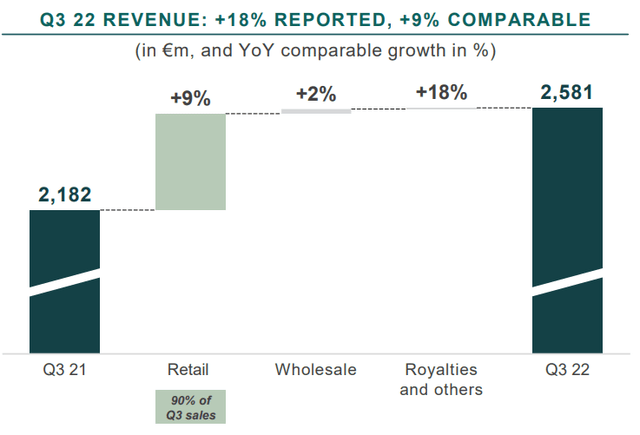

Kering Q3 2022

Gucci reported overall growth of 18%, of which 9% was organic. This brand is by far the most important for Kering, in fact it was responsible for 50% of total revenues this quarter. According to the company, momentum remained very strong especially in Western Europe thanks to tourist purchases. In particular, the company emphasizes the importance of American tourists: with such a favorable exchange rate, it has never been so convenient for them to travel to Europe in the last 20 years. In addition, high-fashion brands such as Gucci are known to be cheaper in Europe (above all in France and Italy) than in the rest of the world. As a result, some American tourists have taken advantage of this double opportunity to buy high-fashion products at a discount during their vacation.

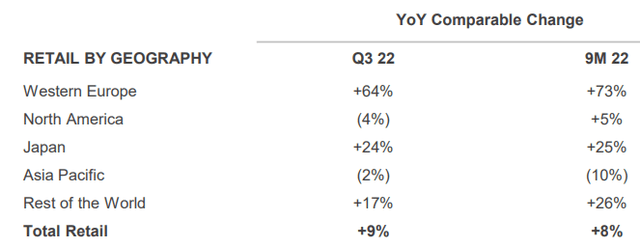

Kering Q3 2022

This dynamic just explained is reflected in the data reported by the company. In fact, Gucci’s retail sales increased 64% in Western Europe, while in North America there was a 4% decrease. This makes sense because American tourists have been buying their products at a discount in Europe, and are discouraged from buying them again once they return to the United States. Finally, the excellent performance achieved in Japan and the rest of the world is worth noting. Asia Pacific continues to have problems because of the continued lockdowns adopted by China, but if the policy to combat Covid-19 were to change, I would not be surprised to see sales grow again. This geographic area is the most important for Gucci since it generates 38% of the entire brand’s revenues.

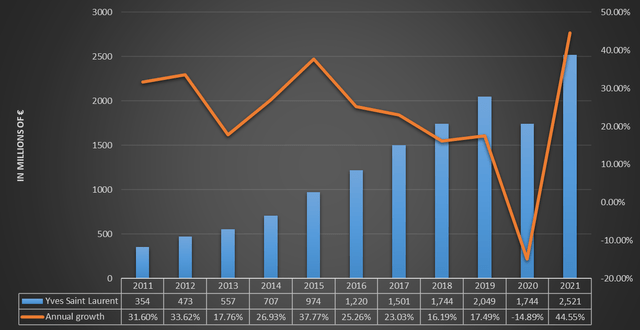

Yves Saint Laurent

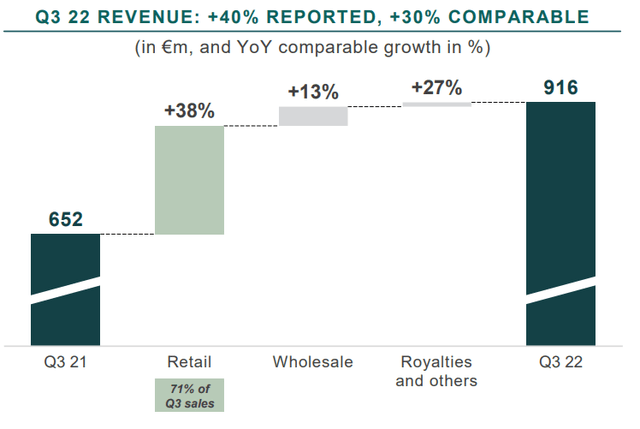

Kering Q3 2022

Yves Saint Laurent reported 40% overall growth, 30% of which was organic. This is the most important brand for Kering in terms of potential growth as no other brand can keep up with it. It is worth noting that such growth over Q3 2021 is not an isolated event but belongs to a long-term trend that has been going on for at least 10 years.

TIKR Terminal

With the exception of 2020, the year of the pandemic, Yves Saint Laurent has always recorded double-digit growth, often exceeding 20%. However, this strong growth has not ended; in fact, the figures for the first 9 months of 2022 are surprising. This brand has already generated €2.39 billion in revenues in 2022, and it is still missing the last quarterly, probably the most profitable as it coincides with the Christmas holidays. I would not be surprised at all if Yves Saint Laurent generates more than €3.20 billion in revenues in 2022, especially considering that the exchange rate is still very favorable. If my estimates are correct, this would be a YoY growth of at least 27%.

Gucci remains Kering’s main brand, but Yves Saint Laurent has had higher revenue growth for years. From a long-term perspective, 10-15 years, if this divergence in annual revenue growth were to continue, I would not rule out the possibility of Gucci becoming Kering’s No. 2 brand. Either way, the company can only benefit from this situation.

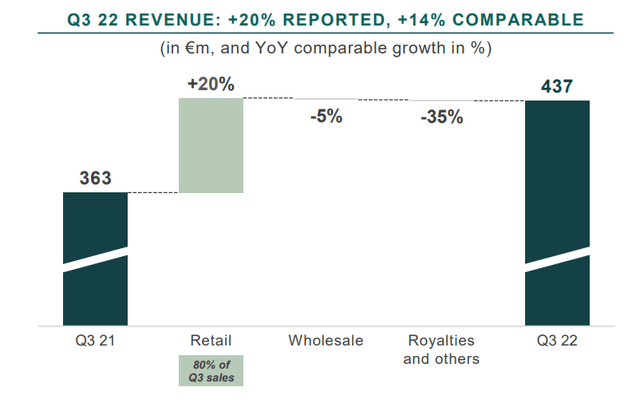

Bottega Veneta

Kering Q3 2022

Bottega Veneta is the third most important brand for Kering since it generates 8.50% of total revenues. In terms of revenue growth, there was a 20% increase over Q3 2021, 14% of which was organic. Wholesale sales decreased by 5%, however this decrease was on the agenda as Kering is trying to streamline this brand by making it less accessible to third-party sellers. In addition, Matthieu Blazy first collection (Winter 22) and recent Fashion Show (Summer 23) were a success for Bottega Veneta.

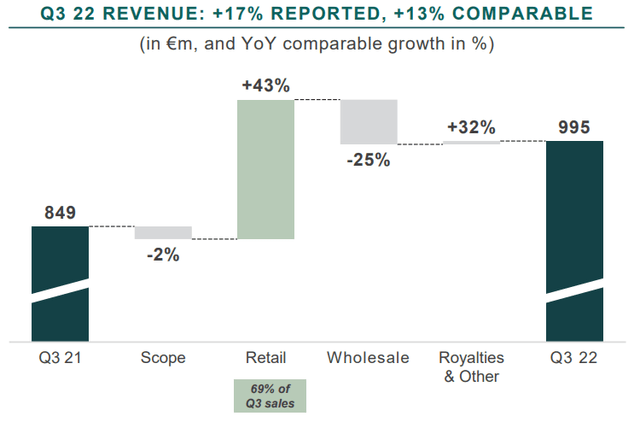

Other Houses

Kering Q3 2022

This segment is also growing compared to Q3 2021, in fact revenues increased by 17%. Unlike the other segments, in this one the positive exchange rate impact was only 3%. Within it we find several brands, including Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, Dodo, and Qeelin.

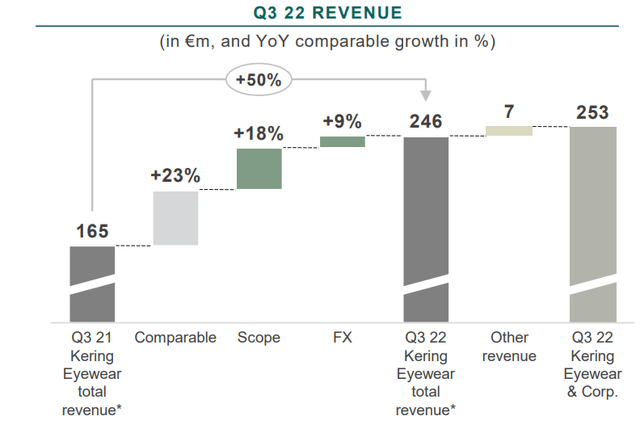

Kering Eyewear

Kering Q3 2022

The Kering Eyewear segment recorded an overall growth of 50% over Q3 2021, of which 23% was organic. In terms of revenue, this segment does not have a major overall weight, moreover, it is the only one that is still unprofitable. It should be pointed out, however, that management is focusing heavily on growth in this segment, which is why a few weeks ago it was formalized the acquisition of Maui Jim, a well-known luxury eyewear brand. The figures of the deal have not yet been made public, but Exane BNP Paribas estimated total cost around €1.50 billion. Maui Jim’s annual revenues are around €300 million and the operating margin around 20%. According to Kering, this purchase will bring Kering Eyewear’s annual revenues above €1 billion. Maui Jim is the second acquisition made in this segment within a month; in fact, a few days earlier it was Lindberg that joined Kering. I expect more strategic acquisitions in the future.

Price multiples are too low

When I wrote my first article on Kering months ago, price multiples were already low, which is why my rating was buy. As of today, price multiples are even lower and have reached lows over the past 10 years.

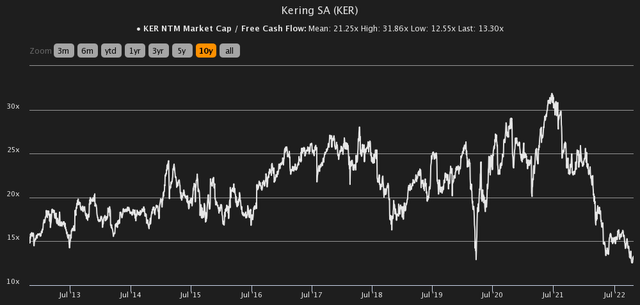

TIKR Terminal

NTM Market cap/ Free cash flow is only 13.30x, while the historical average for the past 10 years has been 21.25x. We have reached levels comparable to those during the pandemic outbreak. I don’t understand why there is so much pessimism for a company that is growing sustainably and owns some of the most valued brands in high fashion.

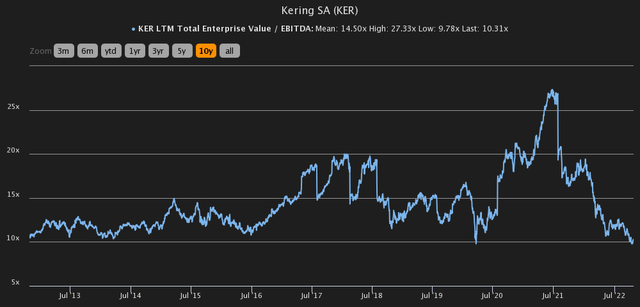

TIKR Terminal

EV/EBITDA touched the 10x threshold, a value that has acted as a support for the past 10 years. It has never fallen below this level.

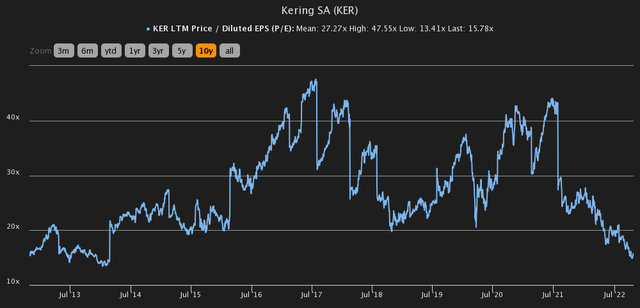

TIKR Terminal

The P/E is at an all-time low, a signal that the market is not very confident about Kering’s future. Certainly a potential global recession cannot be good for Kering’s revenues, however at the same time I believe that those who can afford to buy a €2000 Gucci sweatshirt now will probably be able to do so again next year.

Overall, I don’t see how this can be considered a bad quarterly. Every segment increased by double digits, especially Yves Saint Laurent, and Gucci continued to be the benchmark in high fashion. In addition, the company began the fourth tranche of the buyback plan, which corresponds to the purchase of up to 650,000 shares. I personally find the timing of this buyback correct since the shares are now at a discount. My rating a few months ago was a buy, and after this quarterly report it remains so. The company continues to grow, multiples are very low, and the competitive advantage is very strong given the influence of its core brands in high fashion. In any case, the price per share could continue to fall, so better to build the position over time than to go all in. We have not yet reached a level of undervaluation to invest the full amount planned.