Author’s note: This article was released to CEF/ETF Income Laboratory members on August 26th, 2022.

ridvan_celik/E+ via Getty Images

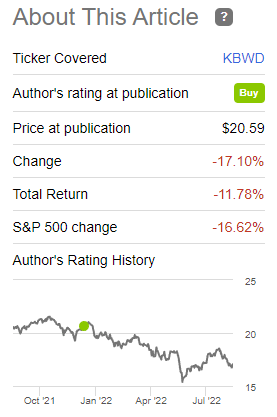

Earlier in the year I wrote about the Invesco KBW High Dividend Yield Financial ETF (NASDAQ:KBWD) an index ETF, focusing on high yield financials, including mREITs, BDCs, and regional banks. I was bullish about the fund at the time, due to its strong, fully-covered, growing dividend yield, and cheap valuation. The fund has outperformed since, for the same reasons.

KBWD Previous Article

Conditions have somewhat changed since, so I thought an update was in order.

KBWD’s investment thesis remains intact, with the fund offering investors a strong, fully-covered, growing 9.7% yield, and cheap valuation. Yields are materially higher, due to declining asset prices and underlying dividend growth. Dividend growth is much higher as well, due to higher interest rates. Valuations technically remain low, but other industries and market segments have gotten much cheaper since, so the fund offers much less relative value than it used to.

KBWD remains a buy, but is mostly appropriate for more aggressive, risk-seeking investors and retirees.

KBWD – Basics

- Investment Manager: Invesco

- Underlying Index: KBW Nasdaq Financial Sector Dividend Yield Index

- Dividend Yield: 9.72%

- Management Fee: 0.35%

- Total Returns CAGR 10Y: 5.64%

KBWD – Overview

KBWD is an index ETF, tracking the KBW Nasdaq Financial Sector Dividend Yield Index, an index of high yield U.S. financials. It is a simple index, investing in the highest-yielding U.S. financials, subject to a basic set of inclusion criteria. It is a dividend-weighted index: the higher the yield, the greater the weight. Said weighting scheme serves to increase the fund’s yield, but also risk, volatility, and potential losses during downturns, as high yield securities tend to be riskier than average. Said weighting scheme makes KBWD a high-yield high-risk investment opportunity, an important fact for investors to consider. The index has security and industry caps, meant to ensure a modicum of diversification.

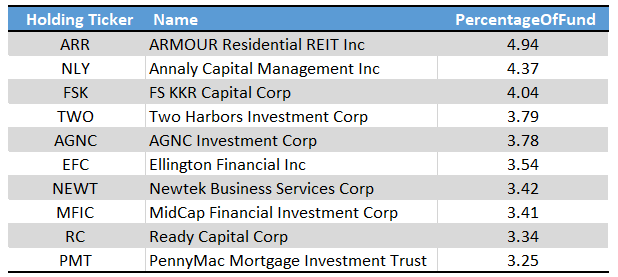

KBWD currently invests in 40 securities, a reasonably good amount for a niche industry fund.

KBWD

KBWD’s holdings are roughly evenly divided between:

- BDCs, which focus on loans to small and medium-sized private equity companies

- mREITs, which focus on leveraged mortgage investments

- Community banks and other small-cap financials, which focus on more traditional financial services

The above are the three highest-yielding financial industry sub-segments, so it is only natural for a high-yield financial ETF to focus on the same.

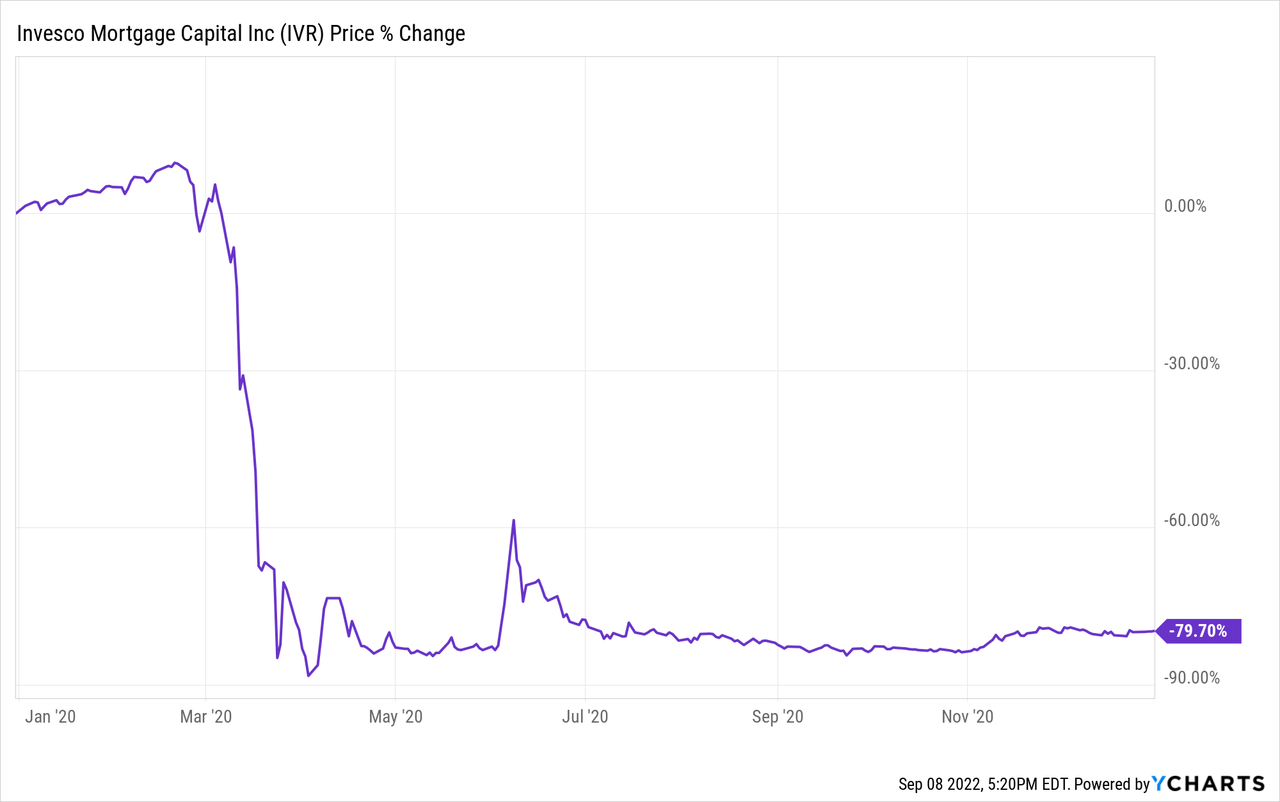

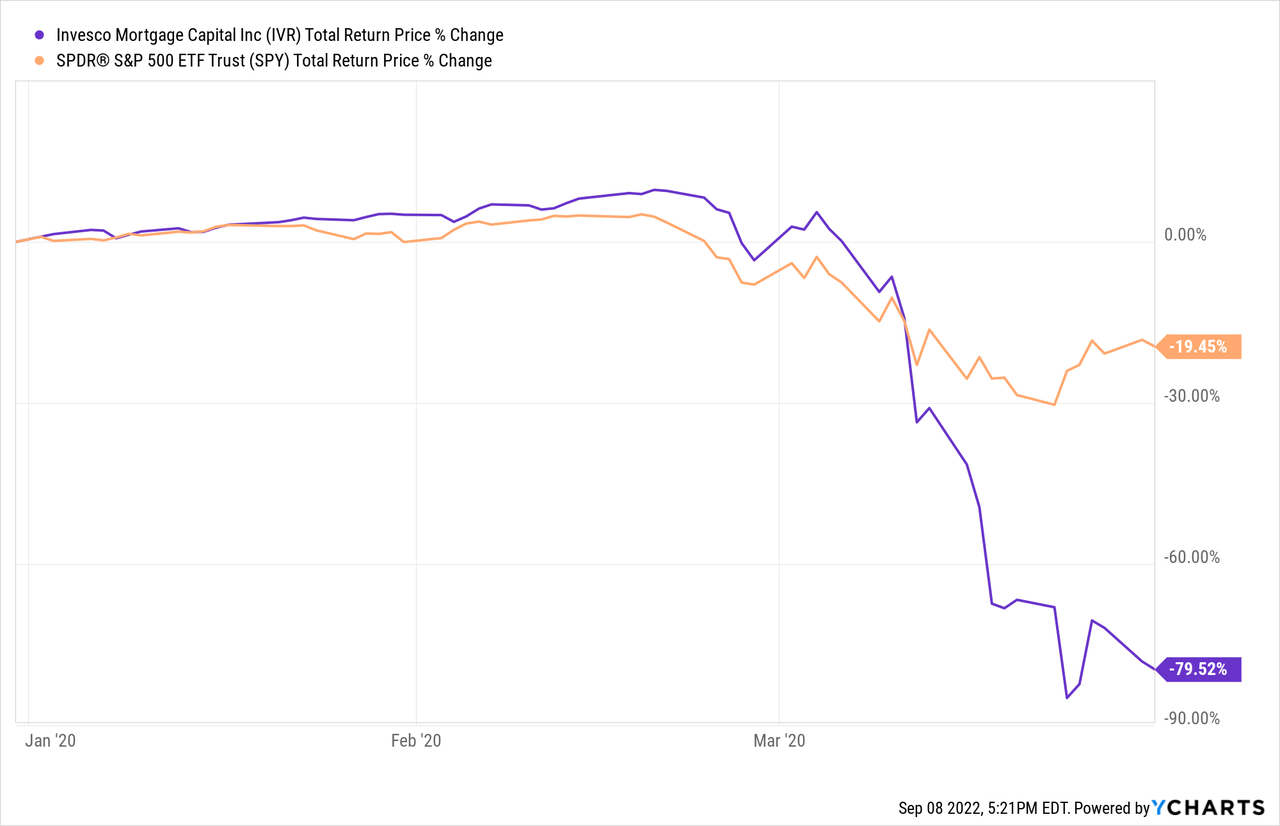

In general terms, the above are all high-yield high-risk companies and investments. I’m much more partial to BDCs and small-cap financials than to mREITs, as the latter are sometimes excessively leveraged, leading to forced asset sales and disastrous performance during downturns. For example, the Invesco Mortgage Capital (IVR), an mREIT, suffered capital losses of almost 80% in 2020. Losses this large are effectively irrecoverable, so IVR’s investors will almost certainly never be made whole.

Although most mREITs, BDCs, and community banks are fine investments, some are excessively leveraged and risky. An actively-managed fund or portfolio can, with some effort and luck, focus on the strongest ones, and avoid the worst. Passively-managed index funds, including KBWD, generally can’t do so, as they simply track an index, and will almost never make discretionary investment decisions. KBWD will almost never decide to sell IVR, or a similar company, before losses like the ones above materialize, because the fund is simply not designed to do so. This makes KBWD a relatively risky, volatile, fund, and one which should see significant, above-average losses during downturns and recessions. KBWD suffered losses of almost 50% during 1Q2020, the onset of the coronavirus pandemic, as it held worst-performing companies like IVR.

KBWD’s risks are high, but so are its prospective returns, income, and yield. Let’s have a look.

KBWD – Dividend Analysis

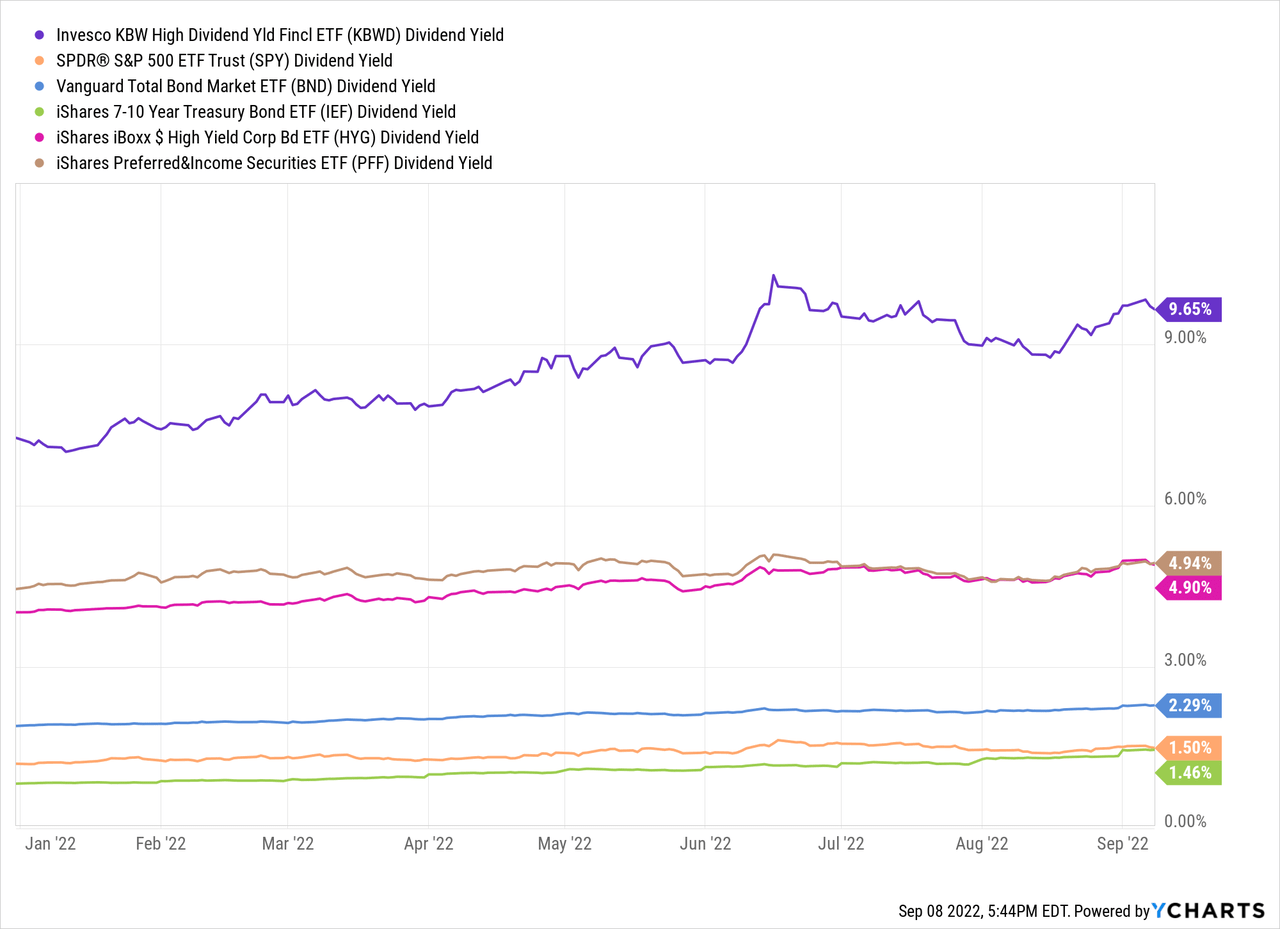

KBWD focuses on high-yield U.S. financials which are, by definition and construction, high-yield securities. These securities provide the fund with quite a bit of income, which is then distributed to shareholders as dividends. KBWD itself currently yields 9.7%, an incredibly strong yield on an absolute basis, and significantly higher than that of most asset classes.

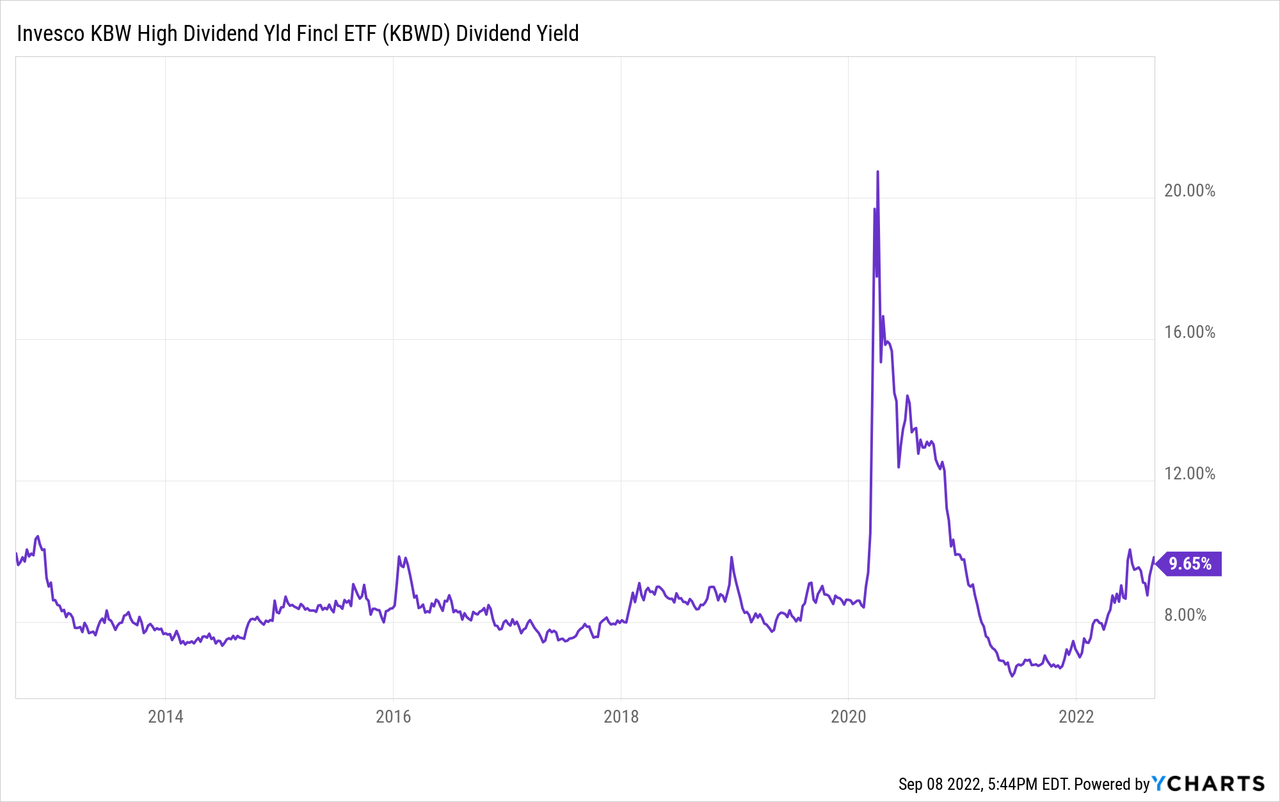

KBWD currently yields a bit more than its 8.9% historical average, although fund yields have fluctuated wildly in the past. At current prices, the fund presents a reasonably good entry point for new investors.

Strong yields are sometimes unsustainable, uncovered by income, or dependent on destructive ROC distributions, but that is not the case for KBWD. The fund currently sports a SEC yield, a standardized measure of short-term generation of income, of 10.3%. So, the fund generates 10.3% in income, which more than covers the 9.7% in dividends. KBWD’s strong generation of income is due to focusing on BDCs, mREITs, community banks, and other high-yield financials. The fund is specifically constructed / intended to generate significant income, and it succeeds at that task.

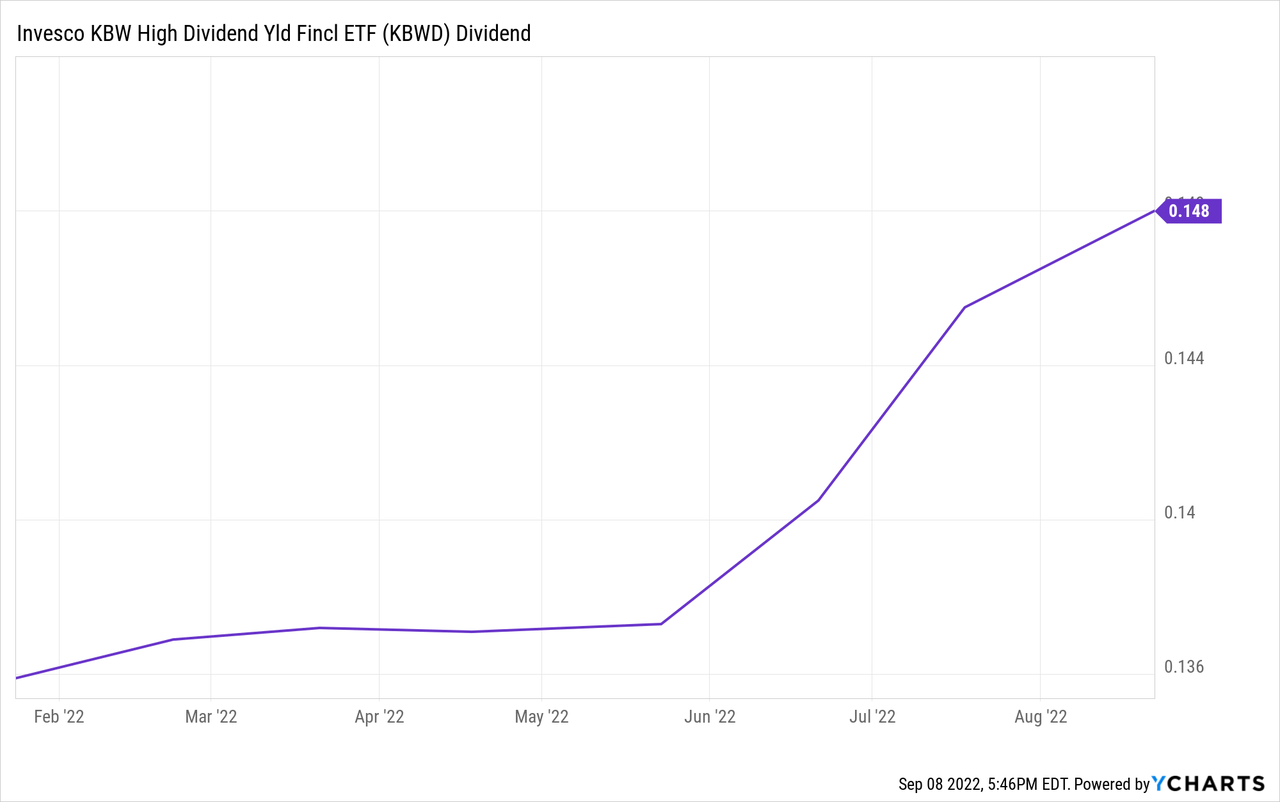

KBWD’s dividends should see moderate growth moving forward, due to rising interest rates. The process is somewhat complicated, but can be summarized thus. Higher interest rates means bonds, loans, and other fixed-income investments and securities have higher yields. BDCs and mREITs directly hold these and similar securities, and so should see higher earnings moving forward. Higher earnings should result in dividend hikes for these BDCs and mREITs, which means higher income for their investors, including KBWD. Community banks also benefit from higher interest rates as these tend to lead to wider credit spreads, but the effect is somewhat more muted. In any case, as KBWD receives more in income, dividends should grow, as has been the case YTD.

In my opinion, considering increased interest rates, current SEC yields, and recent history, KBWD’s dividends should see healthy growth rates in the coming months.

KBWD’s strong, fully-covered, growing dividend yield directly increases shareholder returns, is a significant benefit for the fund and its shareholders, and forms the core of the fund’s investment thesis. KBWD is an income vehicle, meant for income investors looking for yield, and the fund excels in these areas.

KBWD – Performance Analysis

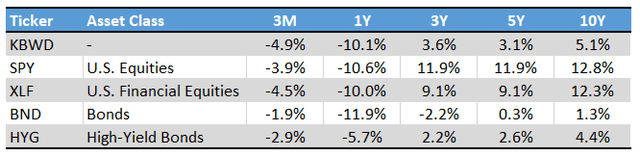

KBWD’s performance track-record is subpar, at best. The fund has significantly underperformed relative to all relevant U.S. equity indexes, including the S&P 500, and U.S. financial equity indexes. Performance has materially improved in the past few months, but the long-term track-record remains quite negative. The fund has outperformed relative to most bond indexes, but at a significantly increased level of risk, so risk-adjusted returns remain below-average. KBWD’s performance is as follows.

ETF.com – Chart by Author

KBWD’s underperformance was due to three reasons.

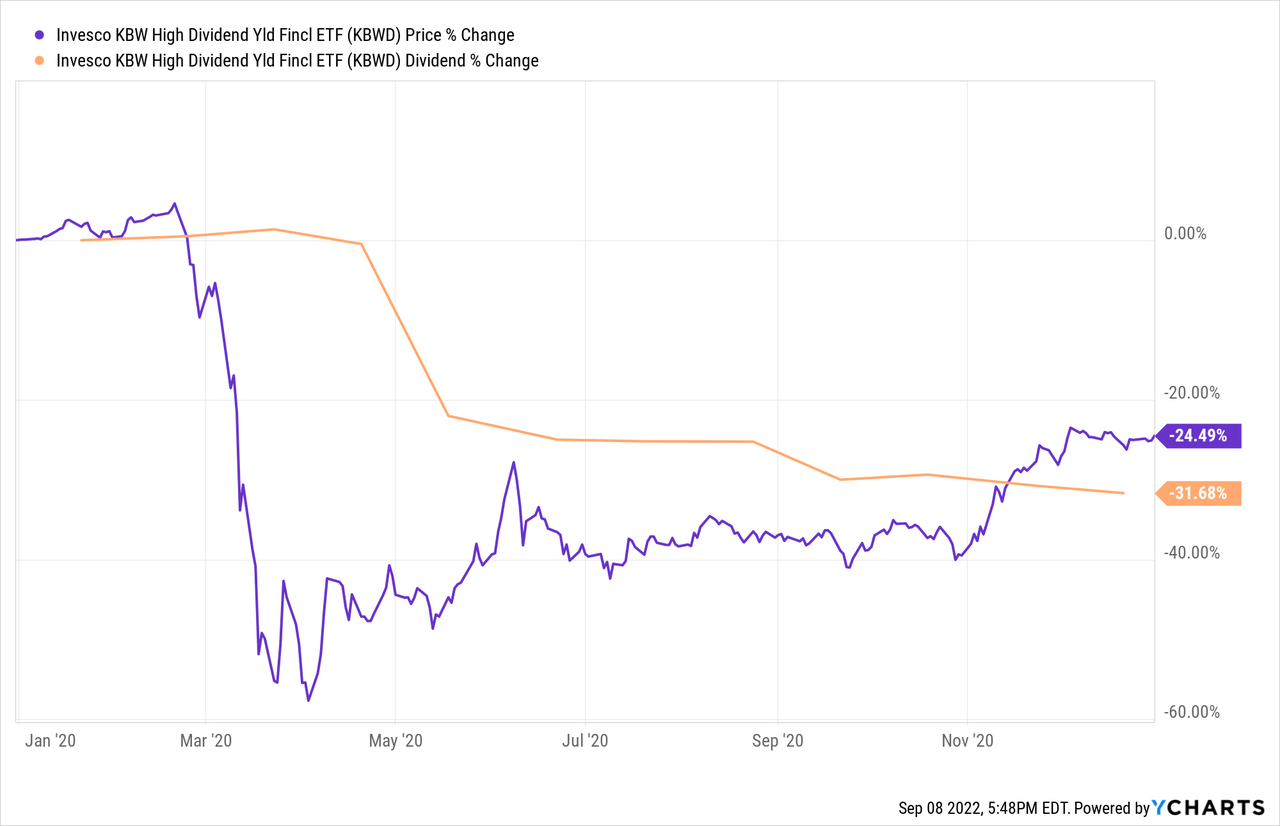

First, KBWD is a relatively risky fund, and so suffered above-average capital losses during early 2020, the onset of the coronavirus pandemic. A portion of these losses were effectively irrecoverable, and led to permanently-reduced or long-lasting reductions in share prices and dividends.

Third, KBWD is ultimately an income vehicle, and yields and dividend growth were both somewhat lower in the past. The combination was incredibly negative, and particularly harmful for long-term income investors, who saw significant reductions in their income.

In my opinion, although KBWD’s past performance is definitely subpar, future performance will be materially stronger, as conditions have materially improved. KBWD currently yields more than average, has seen strong dividend growth these past few months, and will likely see even greater growth as higher interest rates spread across the economy / financial markets. As such, and in my opinion, KBWD’s performance will improve moving forward. Importantly, the fund’s performance has materially improved these past few months, for the aforementioned reasons.

Conclusion – Buy

KBWD’s strong, fully-covered, growing 9.7% yield makes the fund a buy.