We’re nearing the tip of the This fall Earnings Season for the Gold Miners Index (GDX), and some of the latest corporations to report its outcomes is Karora Sources (OTCQX:KRRGF). True to kind, the corporate had one other unimaginable yr regardless of a number of headwinds being thrown at it, beating manufacturing and value steerage, advancing two main discoveries, and ending the yr with a good stronger steadiness sheet. Given Karora’s uncommon mixture of industry-leading development at declining prices and a workforce that continues to execute flawlessly on its plans, I might view sharp pullbacks as shopping for alternatives.

agnormark/iStock by way of Getty Pictures

All figures are in United States {Dollars} and transformed at 0.80 to 1.0 CAD/USD trade price except in any other case famous.

Karora Operations (Firm Presentation)

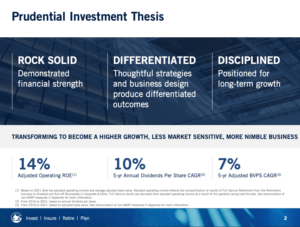

Karora Sources (“Karora”) launched its This fall and FY2021 outcomes final week, reporting annual manufacturing of ~112,800 ounces at all-in sustaining prices [AISC] of $1,012/oz. This translated to a virtually 3% beat on the corporate’s manufacturing steerage mid-point and a ~2% beat on value steerage. Notably, this was achieved regardless of uncommon labor tightness, a large chunk out of Karora’s workforce attributable to federal vaccination mandates in December, and inflationary pressures. Let’s take a more in-depth look beneath:

Karora – Annual Manufacturing & Ahead Steerage/Estimates (Firm Filings, Writer’s Chart)

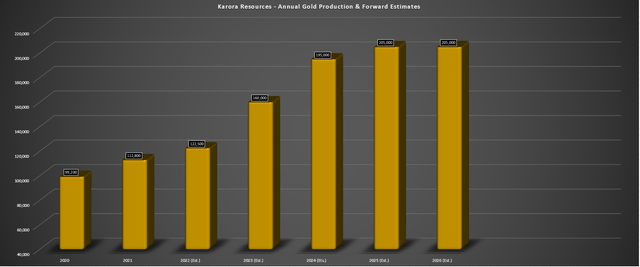

As proven within the chart above, Karora reported one more yr of document manufacturing and managed to come back in solidly above FY2021 steerage. This was helped by increased throughput (~1.44 million tonnes) for the yr at barely increased restoration charges and a ten% enchancment in gold grades. The rise in gold grades was pushed by improved grades at each operations, with Beta Hunt’s milled grades coming in at 2.95 grams per tonne gold (FY2020: 2.77 grams per tonne gold) and Higginsville grades improved by practically 10% to 2.05 grams per tonne gold.

Karora – Quarterly Tonnes Milled/Head Grade (Firm Filings, Writer’s Chart)

With the Section 1 Mill Enlargement now accomplished and mill throughput elevated to ~1.6 million tonnes each year, Karora will see further manufacturing development this yr. As soon as its second decline at Beta Hunt is full and the mill is expanded to ~2.5 million tonnes each year, manufacturing will develop to nearer to 200,000 ounces each year, making Karora the most effective development tales sector-wide by a large margin. Karora shared that growth of the second decline started forward of schedule and had superior 60 meters as of year-end, which is encouraging given the labor tightness in Australia.

Monetary Outcomes

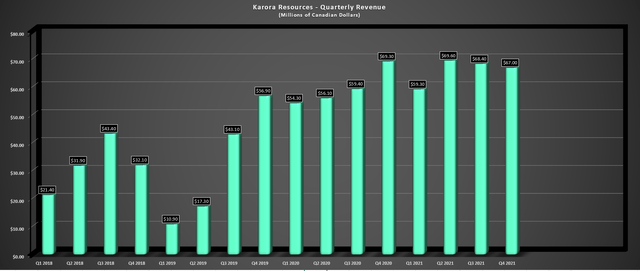

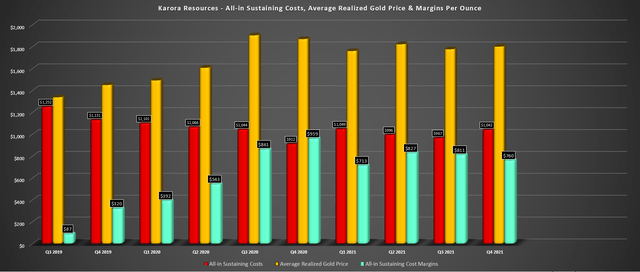

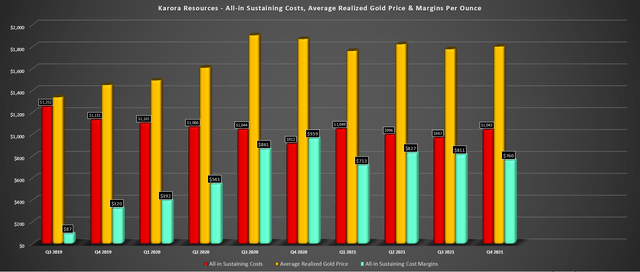

Transferring over to Karora’s monetary outcomes, quarterly income got here in at C$67 million [US$53.6 million], and annual income soared to greater than US$200 million, up greater than 10% year-over-year. This was pushed by a ~13% enhance in gold ounces bought to ~113,600 ounces at a mean realized worth of $1,792/oz. Whereas increased working prices for many corporations partially offset their enhance in FY2021 gross sales, this was not the case for Karora. In reality, Karora’s all-in sustaining prices declined year-over-year, dipping from $1,026/ozto $1,012/oz.

Karora – Quarterly Income (Firm Filings, Writer’s Chart)

Karora Sources – All-in Sustaining Prices & AISC Margins (Firm Filings, Writer’s Chart)

Though prices will likely be elevated this quarter and will likely be increased in H1 2022 attributable to 2022 manufacturing being back-end weighted, the gold worth ought to be capable to choose up most of this slack. It is because the gold worth is already sitting greater than $70/ozhigher than This fall 2021 ranges with a quarter-to-date common worth of ~$1,870/ozand will common no less than $1,880/ozfor Q1. So, whereas I might not be shocked by slight margin compression sequentially in Q1, we might see a slight enchancment in margins year-over-year in Q2 and better margins on a year-over-year foundation in H2 2022.

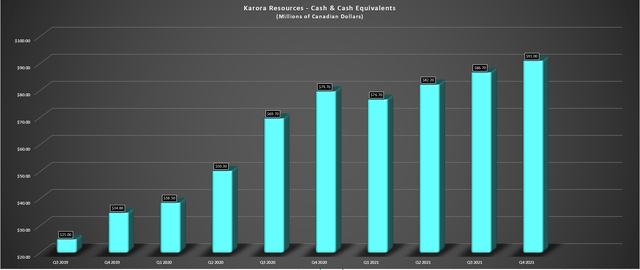

Karora – Money & Money Equivalents (Firm Filings, Writer’s Chart)

Notably, regardless of the numerous funding in exploration and the mill enlargement, Karora completed the yr with C$90 million [US$72 million] in money and should not have any drawback funding its multi-year development plan internally. So, whereas some corporations within the mid-tier area are rising manufacturing by means of share dilution like First Majestic (AG), Fortuna Silver (FSM), and Equinox (EQX), this isn’t the case with Karora, which is a rarity within the sector. The opposite differentiator to this development is that the expansion is coming similtaneously improved margins, making Karora a really particular development story.

Exploration Success & 2022 Price range

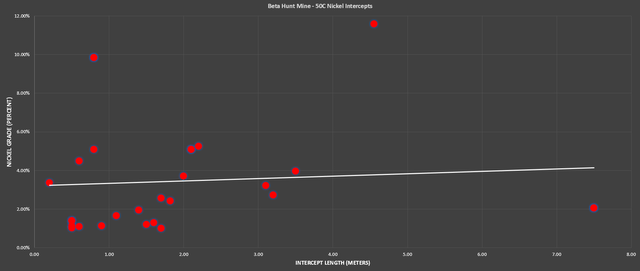

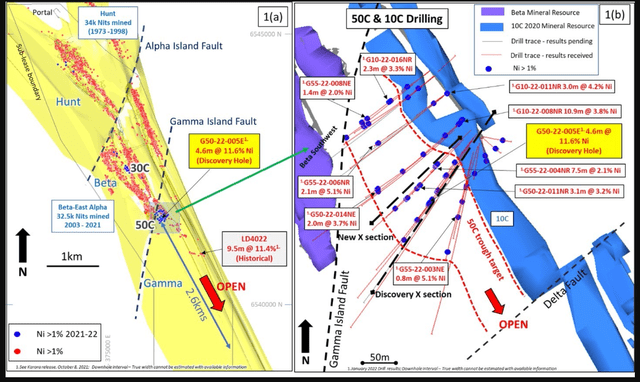

Earlier this month, Karora launched new intercepts from the 10C, 30C, and 50C zones and introduced that it had prolonged its 50C nickel trough discovery to over 200 meters in strike size and as much as 120 meters in width. The brand new and current intercepts at 50C are plotted on the beneath chart, and the typical of practically 30 important intercepts launched is available in at ~2.0 meters at ~3.4% nickel. This can be a slight enchancment from a mean intercept of ~2.0 meters at ~3.15% nickel beforehand, and it is over a a lot bigger database, suggesting extra confidence on this discovery (greater pattern dimension).

Beta Hunt Mine – 50C Nickel Intercepts (Firm Filings, Writer’s Chart)

In the meantime, at 10C, the place there may be an current useful resource, infill drilling returned two spectacular intercepts, together with 10.9 meters at 3.8% nickel and three.0 meters at 4.2% nickel. Lastly, at 30C, there have been a number of distinctive holes launched, with three spotlight holes being as follows:

- 8.9 meters at 2.0% nickel

- 2.3 meters at 2.4% nickel

- 1.3 meters at 3.9% nickel

Whereas these spotlight holes could not characterize the typical grade of all intercepts, the grades at 30C look like above 3.0% nickel throughout the ~20 intercepts launched. This means that we might see a significant enhance within the nickel useful resource base at Beta Hunt and doubtlessly at barely increased grades. Because it stands, Karora’s nickel mineral sources sit at ~16,100 tonnes at 2.9%, and we must always get a greater thought of the up to date useful resource base by the tip of Q2 with a brand new useful resource estimate set to be launched.

50C & 10C Drilling – Beta Hunt Mine (Firm Presentation)

Whereas this doesn’t carry total manufacturing (nickel is handled as a by-product), it does have a constructive influence on prices, with increased by-product credit from nickel. It is also value noting that this huge nickel discovery might prolong additional, with a historic gap of 9.5 meters of 11.4% nickel 1 kilometer southeast of present drilling. The nice information is that Karora is not placing its ft up after a yr of main discoveries and is as a substitute budgeting for ~$17 million in exploration spending this yr, a price range that dwarfs most junior producers.

In reality, Karora is likely one of the few corporations that has a comparable price range to Kirkland Lake Gold in its interval of huge outperformance, with an exploration price range of ~$17 million in FY2022, translating to ~8.1% of prior yr income (~$211 million). Compared, Kirkland Lake Gold budgeted for ~$80 million in FY2018, or simply north of ~11% of income primarily based on its FY2017 outcomes throughout its excessive development section.

If we examine this to budgets elsewhere within the sector, Fortuna (FSM) plans to spend simply ~$30 million (~3.9%), regardless of annualized income of nearer to ~$790 million (This fall income: ~$199 million). That is despite the fact that the corporate is in one of many worst positions sector-wide from a reserve life standpoint, with two of its mines having sub-4-year mine lives. Elsewhere, whereas Victoria (OTCPK:VITFF) has practically twice Karora’s manufacturing profile, it spends to spend solely barely extra with a price range of ~$20 million in 2022.

The above level is not meant to be a knock in opposition to different corporations; it is extra to level out that Karora is rather more aggressive than its friends from an exploration standpoint. This can be a main differentiator for the corporate and one cause I count on it to be a long-term outperformer. The reason being that it ought to proceed to develop reserves per share, a metric that many producers wrestle with, and one cause why a number of producers need to go to market and purchase reserves in acquisition vs. develop organically. After all, it would not damage that Karora firm is sitting on a world-class ore physique at Beta Hunt, with two main discoveries within the final 18 months alone (50-C and Larkin).

Karora – All-in Sustaining Prices & AISC Margins (Firm Filings, Writer’s Chart)

Manufacturing & Value Steerage

Karora’s FY2022 steerage of ~122,500 ounces at ~$1,000/ozmay have disenchanted some traders, on condition that it got here in beneath the beforehand outlined steerage mid-point of ~130,000 ounces in FY2022. Nevertheless, it is vital to notice that the corporate has needed to cope with labor tightness and provide chain headwinds. It additionally noticed the lack of ~8% of its workforce in early December attributable to federal vaccination guidelines in Australia. Given this extra headwind, the corporate has guided extra conservatively, which makes full sense for my part.

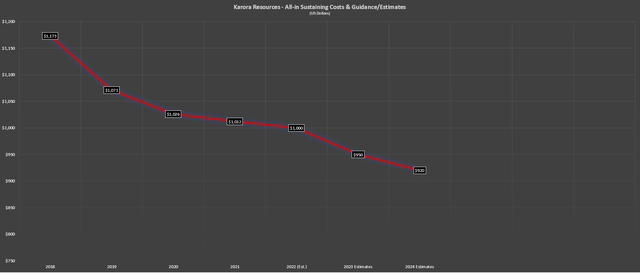

As a result of continued inflationary pressures and labor tightness, we have additionally seen a big enhance in value estimates in FY2022, with the AISC steerage mid-point up from $945/ozto $1,000/oz. Whereas that is additionally a slight downgrade, it is vital to notice that that is partially a operate of the decrease anticipated gold gross sales vs. earlier estimates, in addition to the truth that inflationary pressures have continued to worsen, with gasoline being one more latest headwind. Nevertheless, this isn’t company-specific to Karora, and practically each producer is coping with these points. The excellent news is that Karora’s prices will stay nicely beneath the {industry} common (~$1,100/oz), and it has a tailwind that different producers don’t.

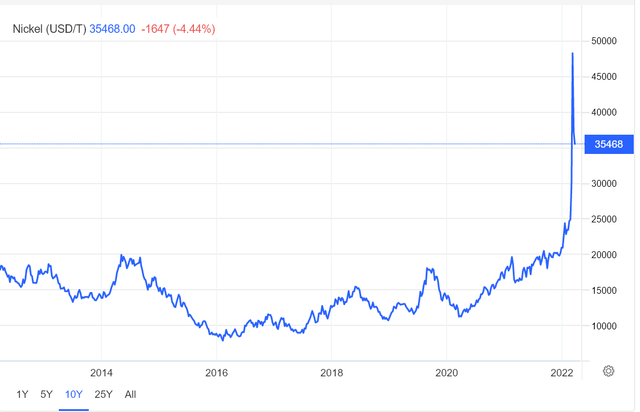

As famous by the corporate, the plan is to provide as much as 550 tonnes of nickel this yr, and it has used a nickel worth assumption of $16,000/tonne in its forecast. With the nickel worth at the moment sitting nearer to ~$35,000/tonne, we must always see Karora claw again a number of the margin losses from inflationary pressures. Given the volatility of nickel costs, I actually would not price range or assume a $35,000/tonne nickel worth or perhaps a $30,000/tonne nickel worth for the yr. Nevertheless, I do not assume an assumption of $25,000/tonne nickel is unreasonable, and this could assist Karora are available in beneath its value steerage.

Nickel Worth Per Ton (TradingEconomics.com)

Whereas this can be a minor tailwind in FY2022, it could possibly be a extra important tailwind going ahead, with the potential that the corporate might step up nickel manufacturing in 2023. The corporate famous that mine planning for the Gamma Block is already underway, with the chance that first mining at 50 C (lower than 150 meters from current mine growth) might happen in 2023. Suppose we mix a a lot increased worth with elevated nickel manufacturing in 2023. In that case, we must always see Karora proceed to enhance its AISC, which is a large differentiator in a sector the place most producers are seeing increased costs.

Karora Estimated All-in Sustaining Prices (Firm Filings, Firm Steerage, Writer’s Chart & Estimates)

It is tough to forecast if inflationary pressures will worsen, however I nonetheless assume $925/ozor decrease AISC is doable in FY2024, helped by increased by-product credit and better manufacturing. Assuming Karora can meet these estimates and are available in on the decrease finish of its FY2024 preliminary value steerage ($885/oz – $985/oz), it will be one of many lowest-cost producers in 2024, and this could permit the corporate to command a premium a number of. It is because, as it’s, there may be already a dearth of solely Tier-1 jurisdiction producers. Nevertheless, adjusting for these with sub $950/ozcosts, the record will get even smaller, and I might count on this to put Karora in excessive demand amongst treasured metals and generalist traders.

Valuation

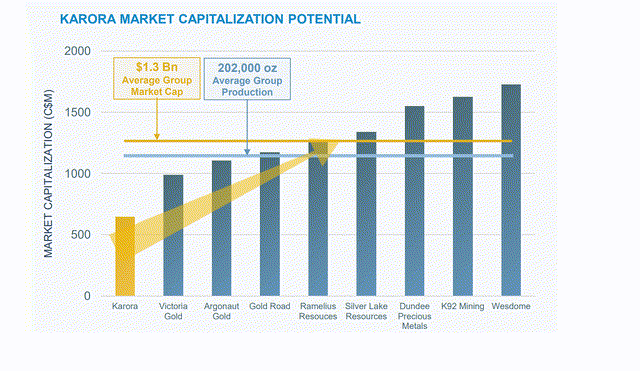

As identified in my earlier articles, there was clear re-rating potential for Karora, and the inventory has loved a good portion of this re-rating, massively outperforming the Gold Juniors Index (GDXJ) with a virtually 90% return since September. That is an outperformance of 7500 foundation factors in just six months, and it has pushed Karora’s market cap as much as C$981 million [US$785 million] at a share worth of C$6.10 [US$4.88]. Following this rally, the inventory has achieved greater than half of the re-rating I anticipated however in a extra compressed timeframe, now buying and selling at an identical valuation to Victoria Gold (OTCPK:VITFF).

Karora Market Capitalization Potential (Firm Presentation)

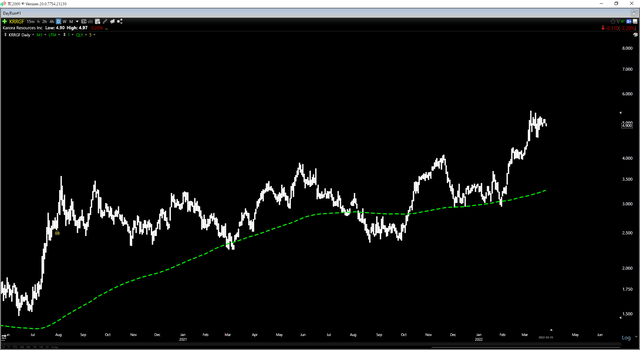

Assuming the corporate can ramp as much as its purpose of ~200,000 ounces each year in 2024 at all-in sustaining prices of $935/oz, there may be nonetheless significant upside to this story. Having mentioned that, with Karora reaching greater than 60% of this re-rating forward of the ramp-up, I do not see the inventory at a low-risk purchase zone at the moment. That is the case from a technical standpoint as nicely, with Karora greater than 40% above its key shifting averages, with the most effective time to purchase the inventory being corrections in the direction of its shifting common proven beneath (inexperienced line).

KRRGF Every day Chart (TC2000.com)

This doesn’t suggest that the inventory cannot go increased, and I might argue the story has improved since Q3, with elevated nickel manufacturing forecasts, a better nickel worth, and continued exploration success. Nevertheless, I choose to purchase high-quality corporations after they’re out of favor, and that is not the case after Karora’s important outperformance. So, whereas I stay lengthy, I’ve no plans so as to add to my place at present ranges.

Spargos Deposit (Firm Presentation)

Karora is undoubtedly a top-10 producer sector-wide, with a uncommon mixture of industry-leading development, bettering margins, and an enviable nickel part. When it comes to administration, the corporate continues to under-promise and over-deliver, and I proceed to be impressed with the corporate’s dedication to spending nicely above the sector common on exploration. This can be a key attribute of many winners within the sector, like Kirkland Lake Gold, and it is clearly paying dividends for Karora. Given this distinction, which ought to make it a long-term outperformer, I might view sharp pullbacks as shopping for alternatives.