Zorica Nastasic

Introduction

I give a hold rating to Kala Pharmaceuticals (NASDAQ:KALA). I think the company has an exciting product for a niche market, and I want to follow it. Also, I like that the company has successfully brought drugs to market. However, The company is not far enough along for me to comfortably invest. I prefer to lose potential gain by waiting and receiving more data to make a more informed investment decision.

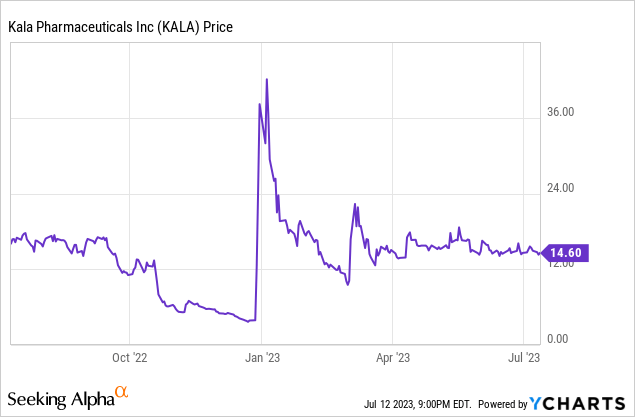

Kala Pharmaceuticals is a clinical-stage biopharmaceutical company specializing in developing innovative therapies for rare eye diseases. The company was founded in 2009 by Dr. Justin Hanes, a professor of biomedical engineering at Johns Hopkins University, who invented the proprietary mucus-penetrating particle (MPP) technology that enables better drug delivery to mucosal tissues. Kala has two commercial products: EYSUVIS, the first and only prescription therapy for the short-term management of dry eye disease, and INVELTYS, the first twice-a-day corticosteroid for post-operative ocular inflammation and pain. In July 2022, Kala sold its commercial products to Alcon Inc. (ALC), a global leader in eye care. The deal was for $65 million, with sale milestones of up to $325 million. In November 2021, Kala acquired Combangio, Inc., a company developing a novel secretome therapy called KPI-012 to treat persistent corneal epithelial defect (PCED) and other severe ocular diseases driven by impaired corneal healing. Kala’s pipeline also includes KPI-014, a pre-clinical candidate for inherited retinal diseases. The company currently sits at a $34 million market cap.

PCED

Persistent corneal epithelial defect (PCED) is a severe and rare condition that affects the healing of the cornea, the transparent layer that covers the front of the eye. PCED can have various causes, such as infections, injuries, surgeries, or diseases that damage the corneal nerves or stem cells. PCED can lead to severe complications, such as corneal ulceration, perforation, scarring, infection, and vision loss. The incidence of PCED is not well known, but some estimates suggest that it affects about 100,000 people in the United States and about 780,000 people worldwide.

Currently, no approved treatment for PCED can address all its underlying etiologies. Conventional therapies, such as artificial tears, bandage contact lenses, antibiotics, or surgical interventions, are often ineffective or associated with significant risks and side effects. The company believes its orphan drug may have more than a $1 billion market opportunity in a market where it would be the only player.

Corporate Slides

KPI-012

KPI-012 is a novel therapy that aims to provide a comprehensive solution for PCED by modulating the complex wound-healing process in the cornea. KPI-012 is a cell-free secretome derived from human bone marrow mesenchymal stem cells (MSCs). MSCs are multipotent cells that can secrete various biomolecules, such as growth factors, cytokines, protease inhibitors, and matrix proteins, with anti-inflammatory, anti-fibrotic, anti-angiogenic, and neuroprotective effects. KPI-012 contains a rich and diverse mixture of these biomolecules that can restore the balance of the corneal microenvironment and promote rapid and complete epithelial closure. KPI-012 is administered twice daily as a topical eye drop solution for up to four weeks.

Trial Data

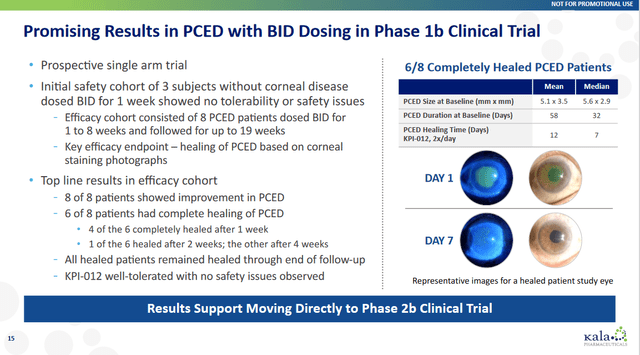

Corporate Slides

The company had impressive trial data; in a Phase 1b clinical trial, KPI-012 showed promising safety and efficacy results in patients with PCED of various etiologies. Out of eight evaluable patients treated with KPI-012, six achieved complete healing of their PCED within four weeks of treatment. Four healed within one week, one in two weeks, and one in four weeks. The remaining two patients showed improvement in their PCED lesion size but did not heal completely. All six patients recovered throughout the follow-up period up to 12 weeks after the last dose.

In addition to healing the PCED, KPI-012 improved other clinical outcomes, such as pain, visual acuity, and corneal opacity. Pain decreased in all six patients who reported pain at baseline. Visual acuity improved by an average of 0.38 logMAR units from baseline to end of treatment. Corneal opacity scores improved in five out of eight patients from baseline to end of treatment and remained stable in one patient.

All patients well tolerated KPI-012, and no serious adverse events were reported. The most common adverse events were mild ocular irritation and foreign body sensation that resolved spontaneously or with lubricant eye drops. The Phase 1b trial results suggest that KPI-012 is a safe and effective therapy for PCED across different etiologies. The company initiated phase 2 of this drug in Q1 2023.

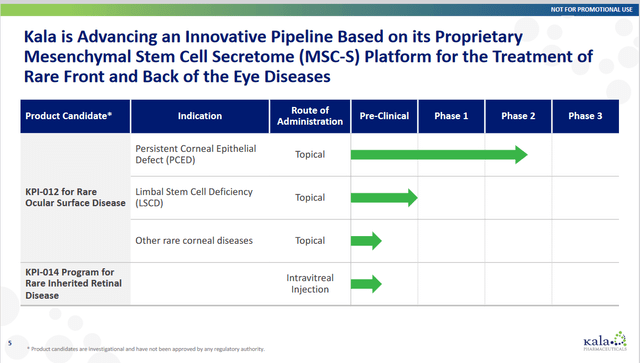

Below is a slide showing the clinical pipeline:

Corporate Slides

The company has an upcoming milestone in 1Q 2024 for CHASE Phase 2b data in PCED. The company states, “If positive, this trial could serve as the first of two pivotal trials needed to support the submission of a Biologics License Agreement (BLA) to the FDA.” This phase two trial is a 90-patient 1:1:1 placebo-controlled trial.

Financials

Based on the company’s last quarterly filing, it had an impressive $63 million in cash from its previous sale and only $5 million in current liabilities. Offset this with an $11 million quarterly loss, and the company should have about a year before needing to raise capital. Considering that they released data for Q1 2024, I would expect if the data was positive, the company would look to raise money shortly after on the stock price rise. Therefore, any stock gain would likely be short-lived. This could all change if some of the sale milestones from the company’s previous drugs occur, which would lead to an influx of new cash and prevent the need for financing.

Risks

The risks around Kala are primarily around it being an early-stage biotech company. Any delays or poor trial results will cause a significant decline in the company’s value. Additionally, the economy has been shaky for a while, which has made money tighter and has limited risky investments like early-stage biotech companies. This tightening around the capital will likely make it more difficult for the company to do its next raise, which I project around Q1 of 2024. The company’s track record of developing drugs significantly decreases the risk of this company compared to a similar company without that track record.

Conclusions

Overall I like the company and want to keep an eye on them. They are too early for my investment, but I would consider investing with positive data in Q1. The company has a track record of developing drugs and has a drug that appears to have good data in a niche field. I think Kala is one to keep your eye on.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.