Printed on July 18th, 2022

This text first appeared on SoFi.

Recession Angst Intensifying

Whereas efficiency throughout most property has been lower than inspiring to date in 2022, there’s been a notable tone shift of late. Whereas inflation and financial coverage have been the first market drivers for a lot of the yr, recession fears have been selecting up. Financial knowledge is displaying indicators of cooling, with the Atlanta Fed’s GDPNow mannequin estimating Q2 actual GDP progress of -2.1%.

Such an consequence could be the second consecutive quarter of destructive GDP progress, which might point out recession. Nonetheless, similar to in Q1 when a decline in Internet Exports weighed down GDP, Q2 is anticipated to be dragged down by the “Change in Inventories” part of Personal Funding—the Atlanta Fed’s mannequin estimates that inventories will shave 2.4% off Q2 GDP. In different phrases, GDP progress could be barely optimistic with out the drag from inventories.

Regardless of extra financial savings and a traditionally tight labor market, client spending is beginning to crack beneath the immense strain of inflation. As late as Jun 28, the mannequin had consumption including 1.8% to GDP—three days later and its anticipated contribution to GDP fell to 0.5%.

Crypto Winter In Full Impact

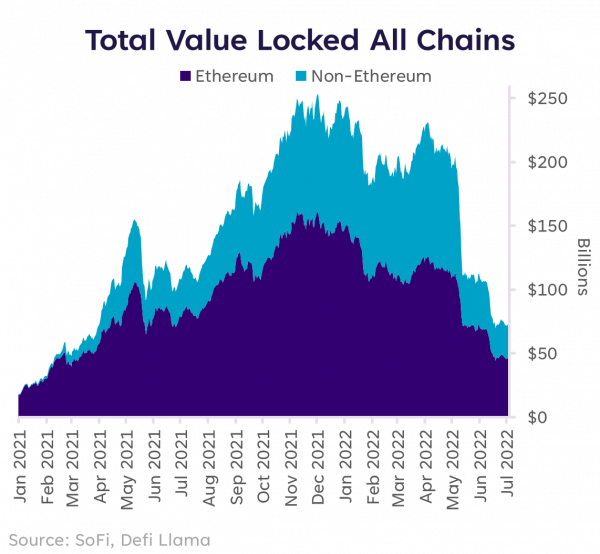

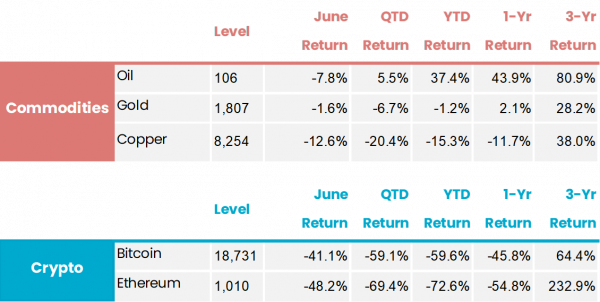

It appeared as if issues couldn’t get a lot worse for cryptos in Might, but that’s precisely what occurred in June. Spurred by the collapse of the TerraUSD algorithmic stablecoin and the final tightening of monetary circumstances, capital has been fleeing from DeFi (decentralized finance) lenders and the crypto house total. These capital outflows continued in June, with quite a few lenders ultimately pausing withdrawals as a result of liquidity dried up.

Identical to important debt can amplify returns in a bull market, debt amplifies losses in a bear. Many traders have been compelled to liquidate their positions as the worth of cryptos fell, which snowballed into additional value declines and liquidations. Whole Worth Locked, a measure of how a lot cash is deposited within the DeFi house, is down 34% for the reason that finish of Might and 69% YTD. It’s unclear if this destructive suggestions loop has run its course, however the fallout has been significant.

With the speedy sell-off and compelled liquidations that took maintain in June, a giant pullback in value was unavoidable. Most cryptos misplaced a further 40-50% in June, after having already been down 30-40% for 2022 in the beginning of the month.

Macro

• The unemployment charge remained at 3.6% in Might, above the consensus of three.5%.

• CPI in Might accelerated to eight.6% y/y and 1.0% m/m, an upside shock pushed by excessive vitality prices and a broadening of companies inflation.

• In response to fears of rising inflation expectations, the Fed hiked charges by 75bps on Jun 15.

• 30-Yr fastened mortgage charges reached 6.04% on Jun 21, the very best stage since 2008.

• Oil costs peaked at $122/barrel on Jun 8, earlier than sharply falling to $104 on Jun 23 as demand issues intensified.

Equities

• World shares broadly bought off in Jun, as investor fears pivoted from inflation to potential recession.

• Development shares barely outperformed worth shares as a consequence of their perceived resilience throughout instances of slowing progress.

• Defensives continued to outperform as traders rotated towards much less dangerous, greater high quality areas of the market.

• Monitoring oil costs, Vitality peaked on Jun 8 earlier than declining 23% by Jun 24, its sharpest drawdown since Mar 2020.

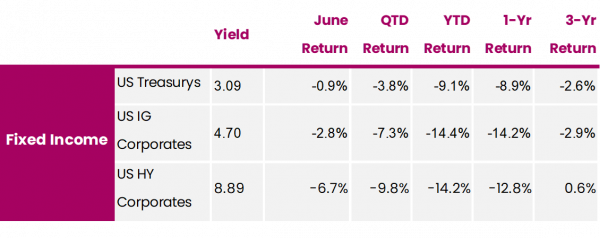

Fastened Revenue

• Rate of interest volatility was elevated for a lot of the month—beginning the month at ~2.90%, 10-Yr Treasury yields rose to ~3.50% mid-Jun earlier than declining to three.01% on the finish of the month.

• Shorter-term rates of interest elevated greater than longer-term charges, buoyed by expectations of aggressive Fed charge hikes.

• Credit score unfold widening continued in Jun, with spreads between authorities and excessive yield bonds now at their highest since mid-2020.

Crypto

• Insolvency points amongst crypto lenders led to a wave of defaults and liquidations, resulting in report losses within the month of Jun.

• Bitcoin’s -59.1% quarterly return was its worst since 2011, whereas Ethereum’s -69.4% quarterly return was its worst ever.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].