subman

JPMorgan Chase (NYSE:JPM) CEO Jamie Dimon didn’t surprise us as his team communicated that the coming downturn in the US would likely be a “mild recession” at its recent Q4 earnings release.

We updated investors in our previous article that Dimon’s previous downcast messaging likely gave ammo to the market bears from one of America’s most prominent bankers. Dimon’s communication is closely-watched, given the size and scale of JPMorgan as the pre-eminent banking institution in the US.

As such, investors should be assured even as JPMorgan revised its “central base” and increased its loan loss reserve build that’s appropriate for a less sanguine economic outlook. Notably, JPMorgan was joined by its leading banking peers “expecting only a mild downturn later this year.”

As such, we believe the optimism stemming from the leading US banks augurs well for the market’s continued recovery from the malaise in 2022.

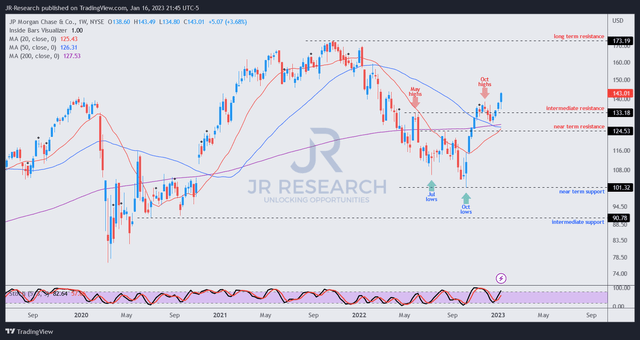

As such, savvy investors who picked JPM’s lows in October have been duly rewarded. JPM has recovered more than 40% from its October lows, breaking above its May and October highs last week.

However, the meat of the move was captured well before its Q4 earnings report, as astute market operators anticipate a better-than-expected performance from Dimon and his team.

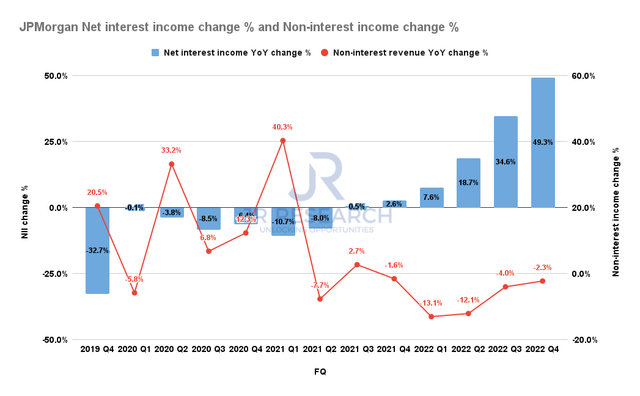

JPMorgan NII change % and NIR change % (Company filings)

Despite that, JPMorgan highlighted that investors need to temper their net interest income (NII) expectations in 2023, even as its NII rose by 49.3% YoY in Q4.

With the Fed likely to temper its rate hikes, the NII growth tailwinds are expected to level out. Coupled with the needed rise in deposit rates to improve its competitiveness, JPMorgan highlighted a solid FY23 NII ex-Markets outlook of $74B, below the Q4’22 annualized $79B NII ex-Markets metrics.

A big question concerns the growth drivers in its non-interest revenue (NIR), given the dislocation in investment banking. Moreover, with the macroeconomic climate worsening, as seen in the recent Goldman Sachs (GS) job cuts, investors’ expectations are likely low.

However, CFO Jeremy Barnum argued that the potential for normalization shouldn’t be ruled out as valuations in the market have improved. We also noted that VCs have continued to raise funds even though deal activity has fallen. Hence, it suggests that investors are priming to seize the opportunities in anticipation of an improvement in the macro outlook. Barnum highlighted:

And as we look into 2023, it’s possible that the actual economic environment will be worse. That could conceivably make you pessimistic about the Investment Banking wallet outlook. And to be sure, it’s not as if we’re super optimistic. But it’s important to note that part of the issue here is how quickly things change in 2022, specifically with respect to rates as that affects the debt business and valuations as it affects M&A and DCM as well. And one of the sort of necessary conditions for people to do deals or decide to raise capital is just getting comfortable with valuations in the open market. So I think there’s a chance that, that actually winds up helping in 2023 in the Investment Banking world. Of course, we don’t know. But those are some of the things that we’re thinking about. (JPMorgan FQ4’22 earnings call)

With Goldman Sachs and Morgan Stanley (MS) slated to release their Q4 results today (January 17), investors will get a first-hand look at their outlook for deal activity in 2023.

However, we also noted in our recent GS article that Solomon was observed to be more pessimistic than his strategists. So, investors are encouraged to read between the lines and search for more clues from Goldman’s economists and strategists when assessing Solomon’s commentary.

JPM price chart (weekly) (TradingView)

JPM appears to have broken above its intermediate resistance zone, which kept buyers at bay in May and October.

However, the rapid surge also lifted JPM’s NTM P/E of 11.3x back toward its 10Y average of 11.5x, as investors anticipate a better-than-expected 2023 performance.

We don’t expect JPM’s October lows to be retaken, even though we could move into a potential recession in 2023.

Despite that, it’s prudent to be cautious and not underestimate the Fed’s resolve to meet its medium-term inflation targets.

Furthermore, BlackRock’s (BLK) Vice Chairman Philipp Hildebrand accentuated that investors could be making a grave mistake if they believe that the Fed could be pushed to pivot earlier, even as the economy weakens further.

He enunciated that while inflation rates could continue to “drop very, very quickly (from 9% to 4%),” the tricky part of pushing it down toward the Fed’s 2% price stability goal could prove excruciatingly challenging.

As such, we believe it could put the brakes on any sustained recovery of above-average valuations as market operators assess the impact of the Fed’s likely path before piling in further.

Hence, we believe it’s prudent for investors not to chase momentum spikes in JPM’s price action. Instead, they should consider waiting patiently for deep pullbacks when fear is in the air, helping to improve their reward/risk markedly.

Rating: Hold (Reiterated).