With futures sinking for a third day and set to take out the 200dma (S&P cash at 3938), traders are bracing for a potential air pocket lower in today’s session, one which could drag stocks sharply lower if 3900 is also taken out. And while we will have more to say about the technicals in a follow up post, here is a quick snapshot from the trading desk of the largest US bank, JPMorgan.

We start with the overnight market snapshot from JPM index trader Jason Hunter who writes that the move lower can accelerate rapidly if key support around 3,900 is taken out:

The S&P 500 Index slide from anticipated resistance in the 4100s threatens key chart levels surrounding 3900. A move through that support has the strong potential to accelerate bearish price pressures, in our view. Other markets that have been sensitive to the China rebound story are testing key chart levels as well. A break there has the potential to feedback into western markets as global macro sentiment may sour.

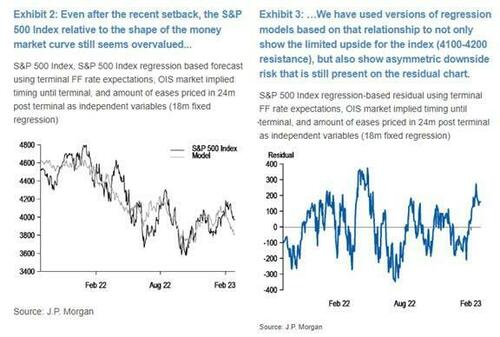

Even after the recent setback, the S&P 500 Index still looks overvalued relative to the shape of the money market curve. We have used versions of regression models based on that relationship to not only show the limited upside for the index (4100-4200 resistance), but also show asymmetric downside risk that is still present on the residual chart.

An 18-month relationship that uses the expected terminal rate and overall amount of easing priced after terminal rate is achieved currently shows the index fair value just below 3800. A retest of the 3491 4Q22 low would roughly equate to 2 standard deviations oversold, all else equal. That study has a 0.75 r-squared and 160pt standard error.

And here is some additional color from JPM TMT trader Ron Adler who notes that “This tape is nearing max frustration” to wit:

This tape is nearing max frustration. The desk and TMT are again very balanced from a flow perspective. We continue to see LO demand in the MegaCap, some idiosyncratic positioning in software ahead of tonight. A TON of paper hit the market (I believe ~$2.9B), and this doesn’t account for the heightened VC distributions seen as windows open post earnings. Yields are the issue today (though the dollar is not reacting in tow, though EUR/USD is stronger); still, all things considered, the market is hanging in ok (famous last words)

The red headline guy has almost hit the “send” button on the “10-year yields hit 4% for the first time since November 2022” headline 17 times today. Growth investors anxiously await that catalyst to sell the stocks they sold in November again (you know, the same ones they subsequently bought in January). That trigger finger is very, very itchy.

APP BASED DELIVERY | Received a few questions on the NYC Minimum wage issue. Remember that time when NYC said it would decide about a minimum wage for delivery workers by February 15, then on February 15 changed the language on the website to say it “now expects to issue a final rule by February 2023.” Today is March 1. I haven’t seen anything yet (language on the website still says end of February .

Finally, as a bonus, here are the key factors that Goldman’s equity desk is focusing on:

- DESK ACTIVITY… B/S skew on the floor finished roughly flat. LOs finished 320bps better to buy driven by mega-cap tech and ETFs (ETF volumes tracked ~36% of the tape). HFs finished 415bps better to buy, with notable buy skews in HC and tech. Continue to see corporates and sponsors monetize in block form – desk saw blocks in OPCH & HAYW post close

- CHINA…China will make a push at the G20 foreign ministers meeting on Thurs for peace talks to commence in the Ukraine war, but Washington is very skeptical Russia has any intention to negotiate in good faith and end its aggression – NYT.

- PB ONE LINERS…Looking back on Feb: Overall Prime book saw the largest notional net selling in 8 months (-1.2 SDs one-year), driven by elevated short sales outpacing long buys ~4 to 1. Single Stocks were net bought for a 3rd straight month and saw the largest notional net buying in 5 months (+0.9 SDs one-year), driven by risk-on flows with long buys outpacing short sales ~6.5 to 1 (in contrast to January during which short covering dominated the flows).

- GEOPOLITICAL TENSIONS…Tensions continue to simmer, reportedly the US is sounding out close allies about the possibility of imposing new sanctions on China if Beijing provides military support to Russia for its war in Ukraine. However, on the bright side the WSJ reports that a senior Treasury Department official recently traveled to Beijing and met with Chinese counterparts for technical, staff-level discussions on macroeconomic and financial issues. Meanwhile, China’s Vice Minister of Commerce said his country is willing to conduct candid talks with the US to reduce trade and investment restrictions, in order to implement consensus reached by leaders of the two countries in Bali. (TY Fred Yin).

- CTAs…Updated numbers: In a flat tape ($27B for SALE – $20B in SPX).

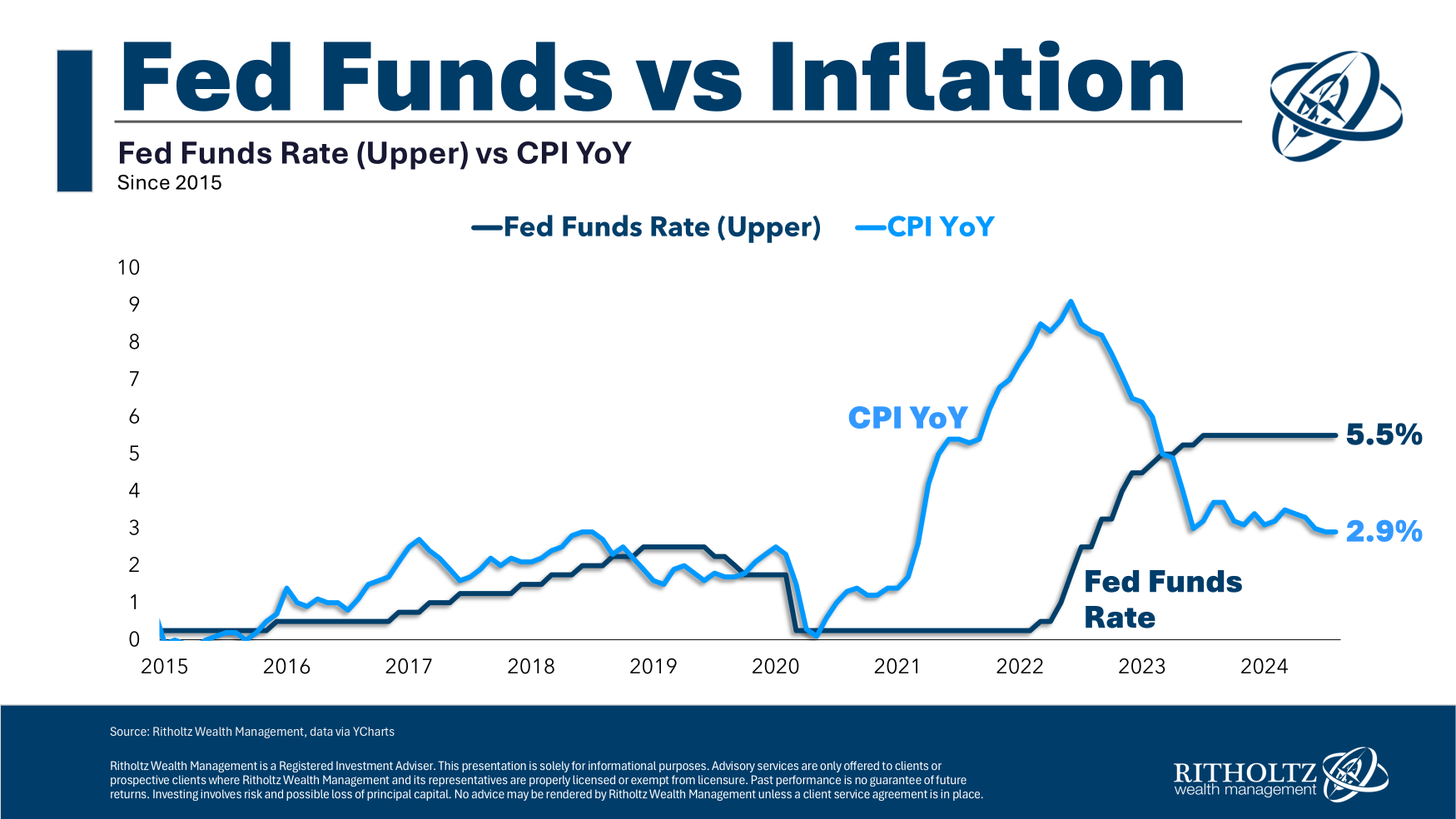

- 10 YEAR YLDS…3.4% to start Feb…4.08% currently…