pepifoto

There’s the man, and then there’s the index. There’s the index, and then there’s the ETF. A lot of people are familiar with media personality Joe Terranova. He’s got an index and a fund that seeks to track that index which is rules-based. The methodology is worth taking a look at independent of Mr. Terranova himself.

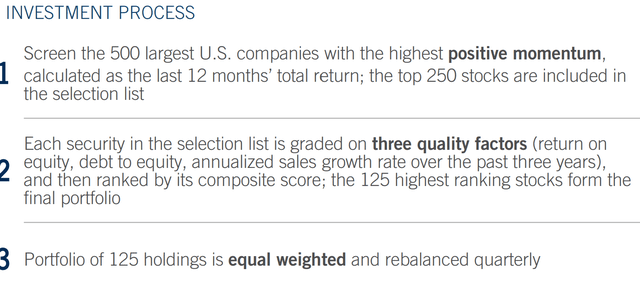

The Virtus Terranova U.S. Quality Momentum ETF (NYSEARCA:JOET) is primarily designed to offer exposure to U.S.-listed large-cap companies that exhibit strong quality fundamentals along with positive momentum technical trends. The ETF seeks to mimic the performance of the Terranova U.S. Quality Momentum Index, before fees and expenses. This index focuses on the 500 largest U.S. companies and filters them based on positive technical momentum, subsequently ranking them by measures of fundamental quality. Consequently, this results in an equally weighted portfolio of 125 well-established U.S. securities.

The screening process has solid fundamental underpinnings, which I’m a fan of because it removes the risk of having a portfolio with so-called “zombie companies” that have high debt and which fundamentally are ranked by Return on Equity and growth. When you then combine the momentum technical filter, it enhances the appeal relative to passive market-cap weighted averages.

virtus.com

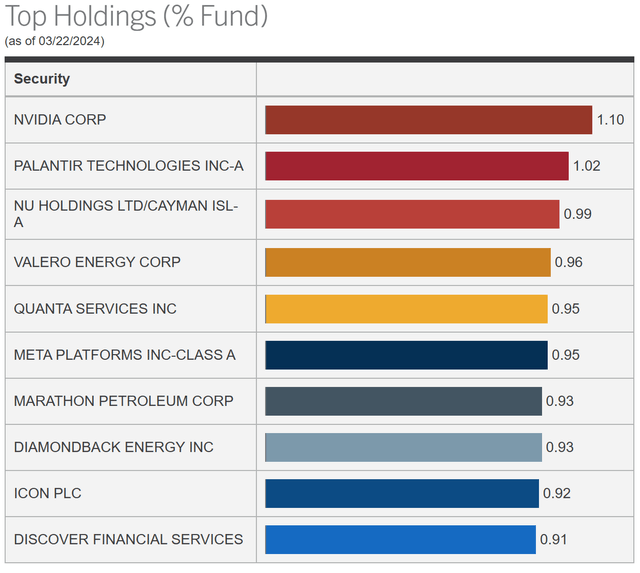

Unraveling the Key Holdings of JOET

A closer examination of the ETF’s holdings provides a clearer picture of the fund’s investment strategy and the potential risks and rewards associated with it. The fund’s holdings include the below. Note that because this is equal weight, no single stock is a big driver of performance overall.

virtus.com

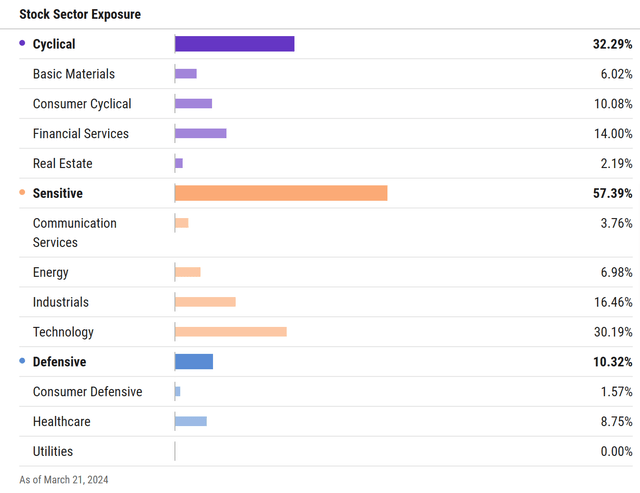

JOET is well-diversified across a variety of sectors. Its largest exposure is in the Information Technology sector, accounting for roughly 30.19% of the fund’s portfolio. This is followed by Industrials (16.46%), Financials (14%), Consumer Cyclical (10.08%), Healthcare (8.75%), and Energy (6.98%).

ycharts.com

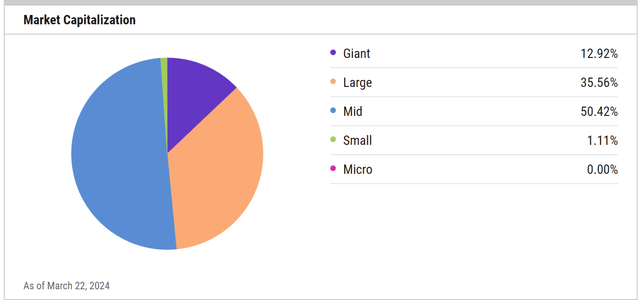

One of the things I like about the fund is that it’s got a heavy mid-cap allocation. About half is mid with the rest being in the large-to-mega-cap range. Given my overall concerns around large-cap dominance at this point in the cycle, it’s nice to have a fund like this which tilts smaller without necessarily taking on the risk of small-cap stocks.

ycharts.com

Comparison With Peer ETFs

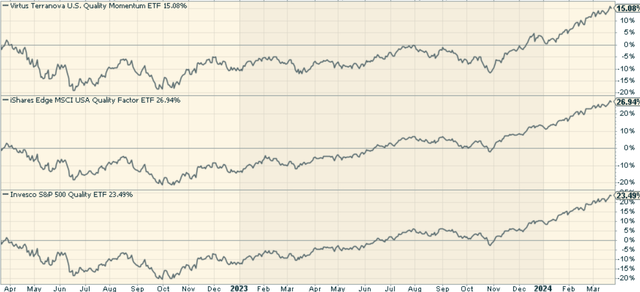

The Virtus Terranova U.S. Quality Momentum ETF (JOET) is distinct from the iShares MSCI USA Quality Factor ETF (QUAL) and the Invesco S&P 500 Quality ETF (SPHQ) in its investment approach and methodology. QUAL is designed to track the MSCI USA Quality Index, focusing solely on quality factor without the momentum aspect, while SPHQ tracks the S&P 500 High Quality Rankings Index, also concentrating on quality metrics of large-cap U.S. stocks. Both QUAL and SPHQ are passively managed and strive to replicate their respective indices closely.

In terms of portfolio characteristics, JOET employs an equal-weighted approach at each quarterly index rebalance, which is intended to ensure balance and diversification, and to mitigate the risks of over-concentration in particular stocks or sectors. This can be contrasted with the market cap-weighted strategies that typically govern passively managed funds like QUAL and SPHQ. Clearly this explains a large portion of why JOET has underperformed QUAL and SPHQ over the past two years.

stockcharts.com

Pros and Cons of Investing in JOET

Like any investment, JOET comes with its own set of advantages and disadvantages. On the positive side, its quality and momentum-based strategy could offer attractive risk-adjusted returns over the long haul. It provides exposure to a diverse range of large-cap U.S. companies with robust fundamentals, potentially reducing the risk of over-concentration in a single sector or company.

However, on the downside, the ETF’s strategy is largely technical and retrospective, potentially overlooking the importance of idiosyncratic and qualitative risk factors. Furthermore, the ETF may not be the best choice for income-focused investors.

Concluding Thoughts: To Invest or Not to Invest?

The Virtus Terranova U.S. Quality Momentum ETF offers a unique investment strategy combining quality and momentum factors. It provides exposure to a diversified portfolio of U.S.-listed large-cap companies and has demonstrated a solid risk management approach. However, like all investments, it comes with its own set of risks and considerations. I like the filtering methodology overall and the equal weight approach, so even though performance has been underwhelming given the cycle we have been in, I still think it’s worth considering in a portfolio.