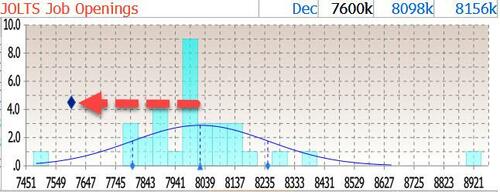

One month after we reported that job openings “unexpectedly” soared on “a file 2 month surge in skilled providers”, moments in the past the BLS reported that the most important rollercoaster collection within the US information set simply collapsed, when December job openings “unexpectedly” cratered by 556,000, from 8.156 million to simply 7.600 milion, the second lowest print because the covid crash…

… and beneath all Wall Road estimates aside from one, SocGen’s 7.5 million job openings forecast.

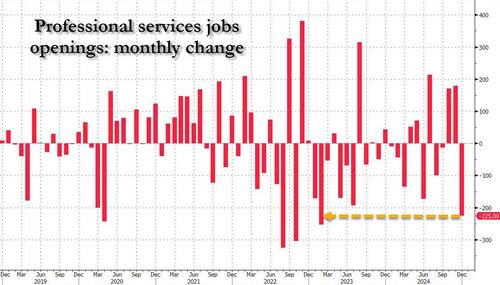

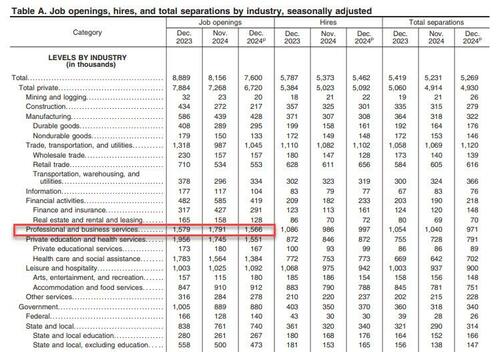

In accordance with the BLS, the variety of job openings decreased in skilled and enterprise providers (-225,000), a pointy reversal from final month’s +273,000 surge, in addition to well being care and social help (-180,000), and finance and insurance coverage (-136,000). Job openings elevated in arts, leisure, and recreation (+65,000). This

As a reminder, final month – when commenting on the then surge in skilled service job openings – we mentioned “How lifelike is that this surge in skilled providers JOLTS? We do not know, however we all know that the 2-month improve in professional providers job openings was the biggest on file!”

Now we all know simply how “lifelike” it was.

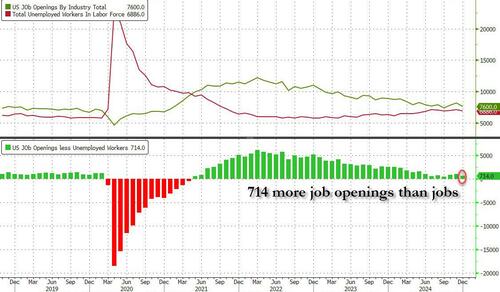

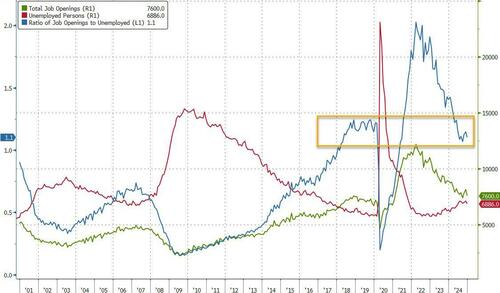

In the context of the broader jobs report, in November the variety of job openings was solely 714K greater than the variety of unemployed employees (which the BLS reported was 6.886 million), down from final month’s 1.03 million and one of many lowest differentials because the covid crash.

Mentioned in any other case, in July the variety of job openings to unemployed was 1.1, a modest drop from final month, and on the low finish of the pre-covid vary in 2018-2019.

Whereas the job openings information was an draw back shock (and a reversal of final month’s shock surge), the place the silver lining was this month (once more a reversal of final month) was within the variety of hires, which staged a modest bounce, rising by about 90K to five.462 million, simply whereas the variety of quits additionally rose modestly to three.2 million from 3.13 million, a glimmer of hope in a labor power the place the bulk are actually clearly far much less optimistic they’ll discover a larger paying job elsewhere, and would slightly be fired than stop.

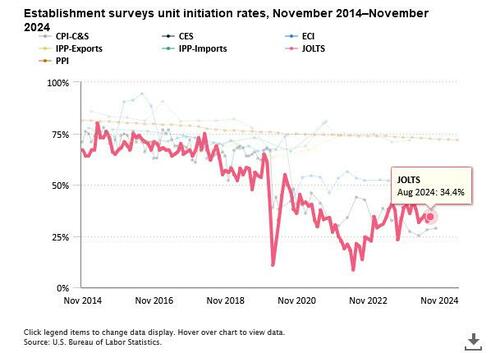

Lastly, it doesn’t matter what the “information” exhibits, let’s not overlook that it’s all simply estimated, and it’s protected to say that the actual variety of job openings stays nonetheless far decrease since half of it – or some 70% to be particular – is guesswork. Because the BLS itself admits, whereas the response fee to most of its numerous labor (and different) surveys has collapsed lately, nothing is as unhealthy because the JOLTS report the place the precise response fee stays close to a file low 34%

Conclusion: learn how to make sense of this sudden collapse within the labor market? Easy: as we mused again in December, all Trump must do to get the Fed to restart slicing charges is to inform the BLS to indicate a sudden collapse within the labor market. In the present day was the preview. The principle present comes on Friday at 8:30am.

Lastly, it doesn’t matter what the “information” exhibits, let’s not overlook that it’s all simply estimated, and it’s protected to say that the actual variety of job openings stays nonetheless far decrease since half of it – or some 70% to be particular – is guesswork. Because the BLS itself admits, whereas the response fee to most of its numerous labor (and different) surveys has collapsed lately, nothing is as unhealthy because the JOLTS report the place the precise response fee stays close to a file low 33%