georgeclerk

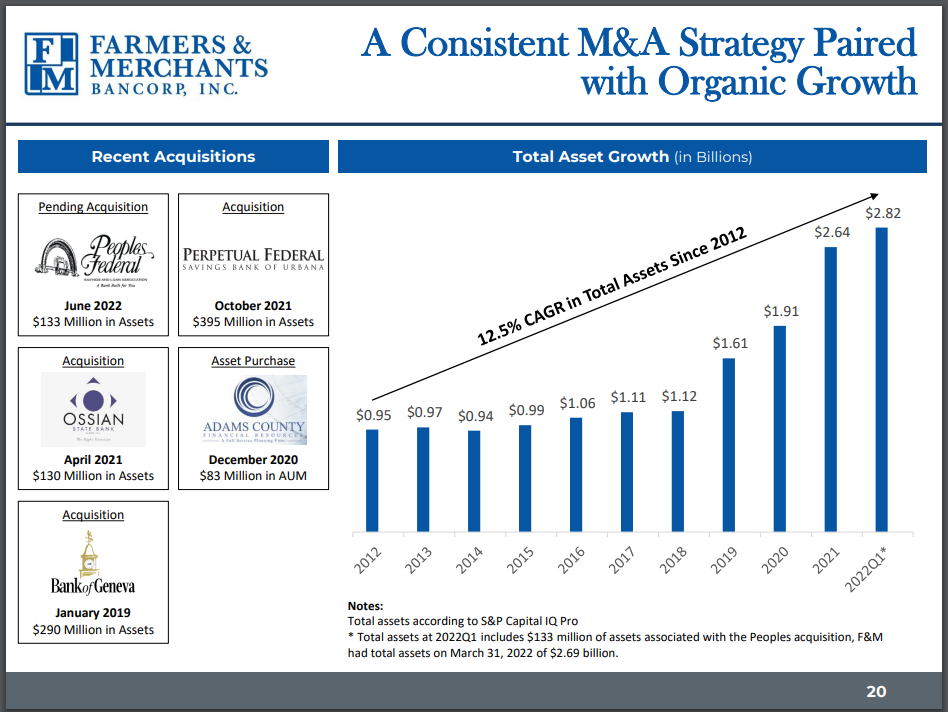

Zero-days-to-expiration or 0DTE options now represent close to half of the overall volume in the options market. As speculation and bullish sentiment return to markets after a bear market in 2022 and so many doubters during last year’s 26% S&P 500 total return. One new ETF seeks to take advantage of the put side of the 0DTE market.

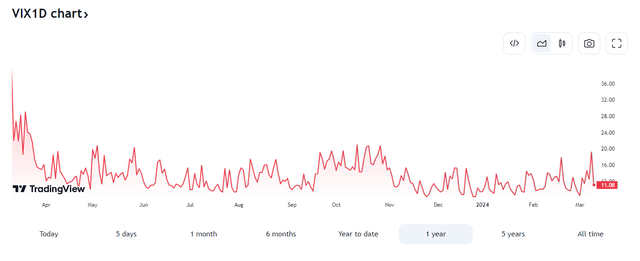

I have a hold rating on the Defiance S&P 500 Enhanced Options Income ETF (NYSEARCA:JEPY). The options-based fund has done what it should so far in its less than six-month life. It has underperformed the S&P 500 Total Return Index since inception last September – to be expected given the equity market’s sharp rally since the low in Q4 last year. Moreover, implied volatility levels, which directly translate into JEPY’s yield, have been muted for months on end.

0DTE Options Trading Volume Has Surged Relative To The Entire S&P 500 Options Market

Goldman Sachs

For background, JEPY aims to achieve consistent monthly yield distributions for investors coupled with equity market exposure to the S&P 500. JEPY is an actively managed ETF that seeks enhanced income, constructed of treasuries and S&P 500 index options. The strategy’s objective is to generate outsized monthly distributions by selling option premiums on a daily basis. The fund uses daily options to realize rapid time decay by selling in the money puts with 0DTE, according to Defiance ETFs.

JEPY has hit the ETF marketplace with much vigor. Its total assets under management sum to just $139 million as of March 11, 2024. The fund is also expensive, which is to be expected given the complex strategy and active management – JEPY’s annual expense ratio is 0.99%. The fund’s highlight is undoubtedly its high 23.9% current trailing 12-month yield. Now, investors must recognize that its yield is by no means comparable to a traditional long-only equity ETF. The total distribution comes from selling 0DTE put options, with a synthetic long position in the S&P 500 using options.

Momentum is weak relative to the S&P 500 while its liquidity profile is not too bad given its 30-day median bid/ask spread of six basis points. Still, I would encourage investors to use limit orders to avoid bad fills during the more illiquid period of the trading day.

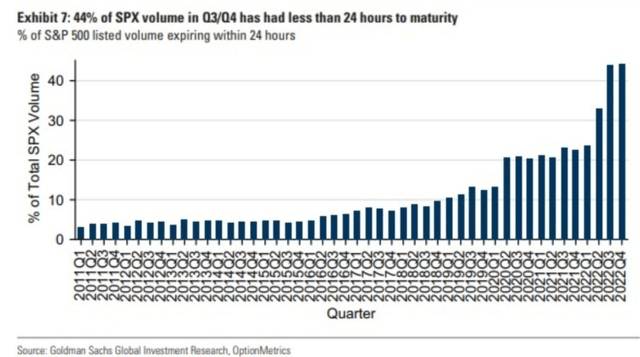

JEPY: Recent Distributions

Seeking Alpha

JEPY’s most recent dividend was $0.60, or about 3.4% of the market price. I should also note that JEPY is priced very close to its net asset value per share. JEPY makes an accurate claim that its distribution rate is now slightly more than 40%. JEPY works similarly to the more widely traded $33 billion AUM JPMorgan Equity Premium Income ETF (JEPI) which utilized a covered call approach – different from JEPY’s 0DTE covered put approach. Returns between the two are comparable since they both are effectively long the S&P 500 equity basked while selling option premium.

I would expect JEPI to outperform the SPX should a correction take place, or if we just see a broadening out of the market rally that changes to favor small and mid-sized stocks. In general, a put-write play does well when the underlying is flat or rising slightly – it should outperform during equity pullbacks and underperform in strong uptrending markets.

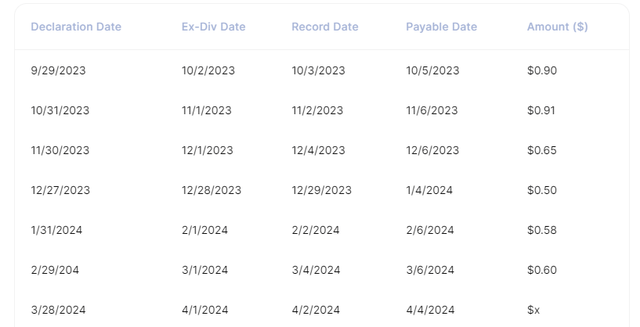

One aspect of today’s market that is not favorable for JEPY is that option pricing is very cheap. While the 1-day VIX Index jumped to fresh highs dating back to October last year ahead of the February CPI report, I expect short-term volatility to remain muted. We have not seen the usual bearish seasonality reveal itself so far in the first quarter – something I thought might come about.

JEPI would benefit from a period of high short-term implied volatility and low realized volatility, but with the 1-day VIX Index (pictured below) generally oscillating between 9 and about 15, that is just not much juice to squeeze out of put options. Then, when a volatility event arises, JEPI could be hurt by selling cheap in-the-money puts that turn out to be quite valuable. The sweet spot is after a volatility event, when actual volatility retreats faster than implied volatility.

1-Day VIX Index History: Low Recent Near-Dated Implied Volatility

TradingView

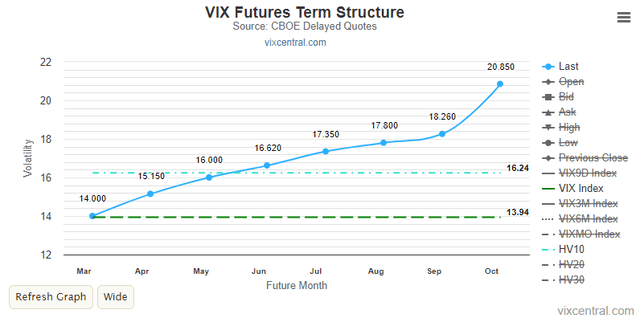

As it stands, the VIX forward curve is upward-sloping. There is a kink higher as the November general election nears, too. But also take a look at the chart from VIX Central below – it shows that historical 10-day volatility is significantly above the 9-day VIX Index (which gauges implied volatility). That’s not an ideal setup for something like JEPY since it is effectively short implied volatility relative to realized.

While not a tremendous gap, it illustrates that selling near-dated in-the-money S&P 500 puts just doesn’t produce much yield, despite the very high distribution rate reported by the issuer.

VIX Term Structure: Muted Near-Term Implied Volatility

VIX Central

The Bottom Line

Overall, I have a hold rating on JEPY. I expect the fund to outperform should we see equities retreat after a stellar run – now up 17 of the past 20 weeks if we assume the current week finishes in the green. But longer-term, the put-write play has not yet been tested in extremely volatile markets, so that remains an outstanding risk.