Justin Sullivan/Getty Images News

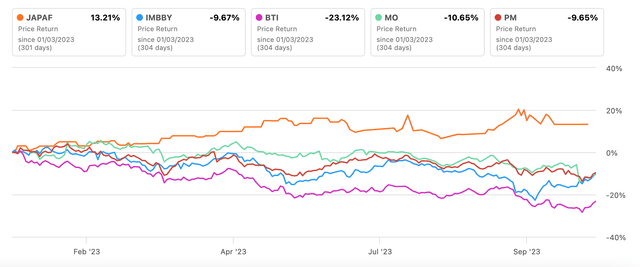

There’s an interesting trend with the stock price of cigarette manufacturer Japan Tobacco (OTCPK:JAPAF). With a rise of 13.2% year-to-date [YTD], its increase might be slightly behind that of the S&P 500 (SP500) index, which has seen a rise of almost 14%. But here’s the catch. Its higher volume ADRs (OTCPK:JAPAY) are up by more than the index at 23.1%.

There’s more. It has significantly outperformed its peers as well. Among the biggest five tobacco companies by market capitalisation, with the other four being Philip Morris International (PM), Altria (MO), British American Tobacco (BTI) and Imperial Brands (OTCQX:IMBBY), it’s the only one to see a price rise YTD (see chart below).

This is then an interesting starting point, which raises the question, what about Japan Tobacco sets it apart from its peers? And can the trend continue?

Price Returns, Comparison with Peers (Source: Seeking Alpha)

Why’s the price rising?

It’s worth highlighting that since it released its third quarter (Q3 2023) results last week, the Camel cigarettes manufacturer’s price is up by almost 7%. There are good reasons for this.

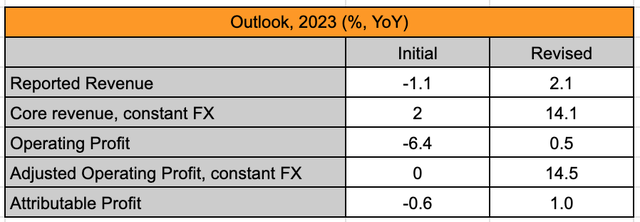

Upgraded outlook

The first is that it has upgraded its outlook for 2023. While its reported revenue and earnings were expected to shrink from 2022 as per the initial guidance, they are now seen as improving slightly. At constant FX, the company now actually expects a double-digit rise in both revenues and operating profit (see table below).

Source: Japan Tobacco

Better than expected performance

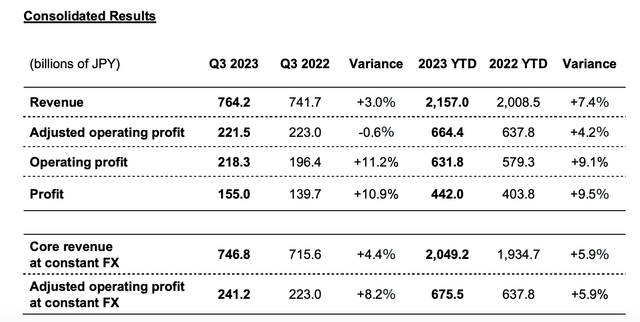

Underpinning the improved guidance is the company’s strong YTD performance, supported by a depreciation in the Japanese yen, even as Q3 2023 revenue growth has softened. Reported revenue growth of 7.4% for the first nine months of 2023 (9M 2023) is far better than what the full-year forecast even now indicates, as is the operating and attributable profit (see table below).

By contrast, though, adjusted revenue and operating profit have actually seen a much smaller 5.9% growth so far in the year than indicated by the latest forecasts. Essentially, this implies that the company could still be cautious of currency trends in Q4 2023 but the demand is expected to stay strong going by the trends for numbers at constant FX.

Key Financials, 9M 2023 (Source: Japan Tobacco)

Tobacco volumes rise

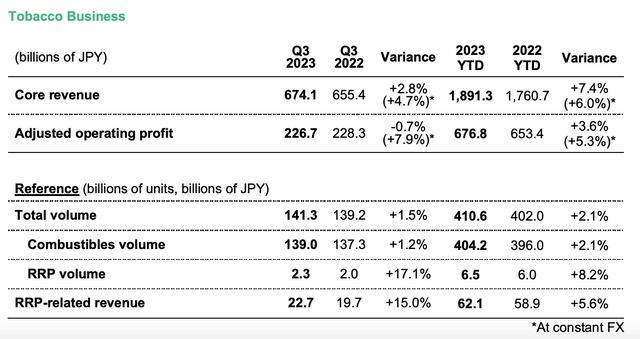

The company’s tobacco segment saw healthy trends as well, which is important considering that it brings in the bulk of the revenue for Japan Tobacco. Its core revenue at constant FX rose by 6%, which is about the same as the total revenue growth. Core revenue growth was dragged down only by its agricultural business, which saw a fall of 1.3%, while the pharmaceuticals business also did well, with revenue growth of 10.1%. However, these segments have a limited impact on the total revenues, with a combined 8% share in revenue.

The tobacco segment’s adjusted operating profit at constant FX, however, grew by 5.3%, lower than the 5.9% rise seen in total. This was on account of unfavourable currency movements, the impact of higher inflation and the company’s investments in reduced-risk products [RRPs].

Interestingly, a 2.1% increase was seen in combustibles’ volumes for 9M 2023, an acceleration from the 0.7% decline seen in 2022. The volume uptick is also notable considering that global tobacco volumes are expected to see a 3% decline this year, as British American Tobacco (BTI) points out. Encouragingly, RRPs have also seen robust growth of 8.2% in volume terms, though revenues have grown more slowly (see table below).

Tobacco Business, Financials, 9M 2023 (Source: Japan Tobacco)

Healthy dividend yield

A discussion on the company is incomplete without mentioning its healthy trailing twelve months [TTM] dividend yield of 6.05%. It’s significantly better than the 2.8% for the consumer staples sector, though it doesn’t compare favourably to the tobacco sector. Among the other four big tobacco stocks, it’s better only than that for Phillips Morris International.

However, I’d take the comparison of yields with a pinch of salt considering that it’s the only big tobacco stock to see a price rise the year. While others have seen improved yields as the price shrank, it’s been the opposite for Japan Tobacco.

The market multiples

Based on the company’s forecasts for attributable profits, the forward earnings for 2023 are expected to be USD 2.99 billion. This in turn results in a forward GAAP price-to-earnings (P/E) ratio of 14.5x.

Comparing it to the other four biggest tobacco companies by market capitalisation reveals that this ratio is second only to PM at 18x. On average, the four stocks have a forward ratio of 10.6x. Similarly, Japan Tobacco’s TTM GAAP P/E is also relatively higher at 13.4x compared to the 10.6x average for the other four stocks.

There’s some case for a premium on the stock though, considering that besides BTI, it’s the only other tobacco company to have seen growth in both revenue and EPS over the past twelve months. But then again, its market multiples are not competitive compared to BTI either.

What next?

Essentially, the market multiples indicate there’s little case for further upside to Japan Tobacco for now, even going by the justified premium on it. It has outperformed peers for good reasons YTD, though. Its significantly improved outlook backed by its better than expected performance has added to investor optimism, evident from the uptick seen since its results last week. The highlight of its latest numbers is the surprising rise in tobacco volumes. And it’s encouraging that its RRPs continue to see healthy growth too.

The TTM dividend yield is less competitive compared to peers, but that’s on account of its price rise. At 6.1% it looks good otherwise, though. The only stumbling block for the company is its relatively elevated market multiples.

If it continues to outperform its outlook in the final quarter of 2023, there may well be more upside to the stock. But that’s a wait-and-watch. A softening in revenue growth in Q3 2023 could be an indication that it can slow down further. It’s definitely a stock to have on the investing watchlist, though. I’m going with a hold on Japan Tobacco.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.