da-kuk

@NeilKSethi over on X is a prolific contributor of economic and market data every day. The man truly works hard at his task.

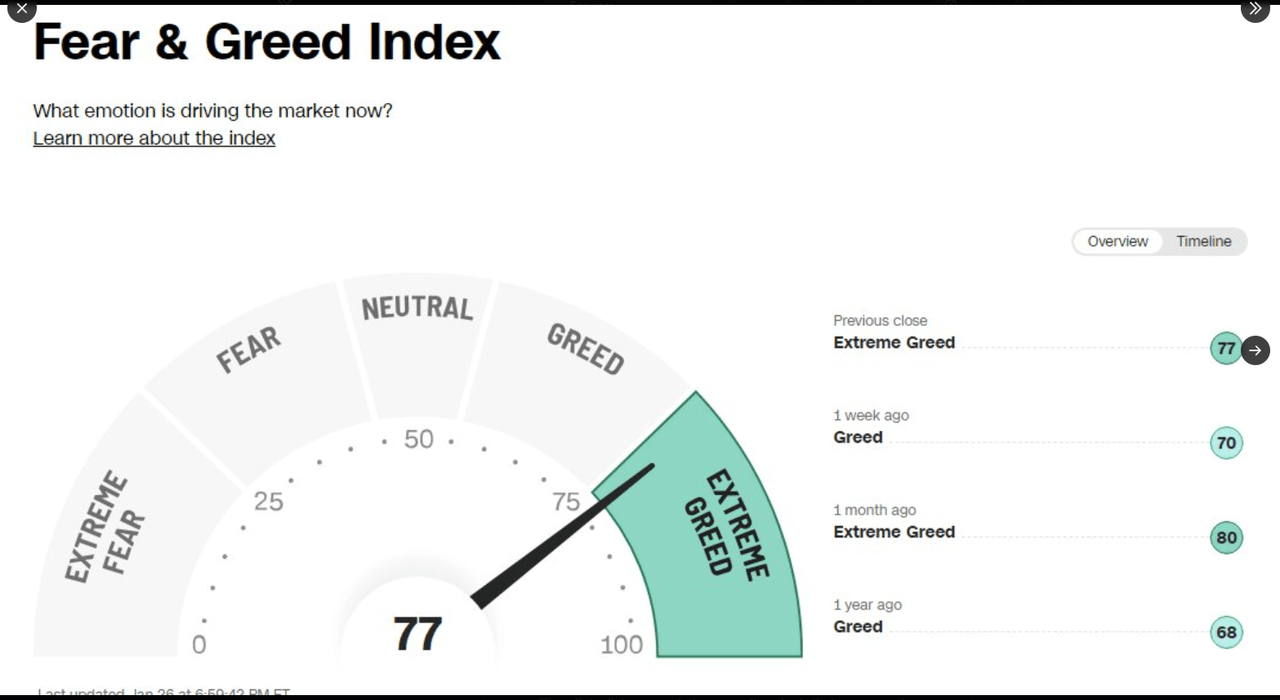

Neil posted the above graphic in the last few days. While I understand the sentiment, speaking with another advisor the other day, this individual noted that not one of his clients was bullish coming into 2024. My own clients rarely offer a market opinion, but I know that I remain cautious which – bizarre as it seems – is a contrarian indicator. So I wind up gauging my own sentiment around the stock and bond markets, and then – like George Costanza – doing the opposite. (A poor attempt at some self-deprecating weekend humor.)

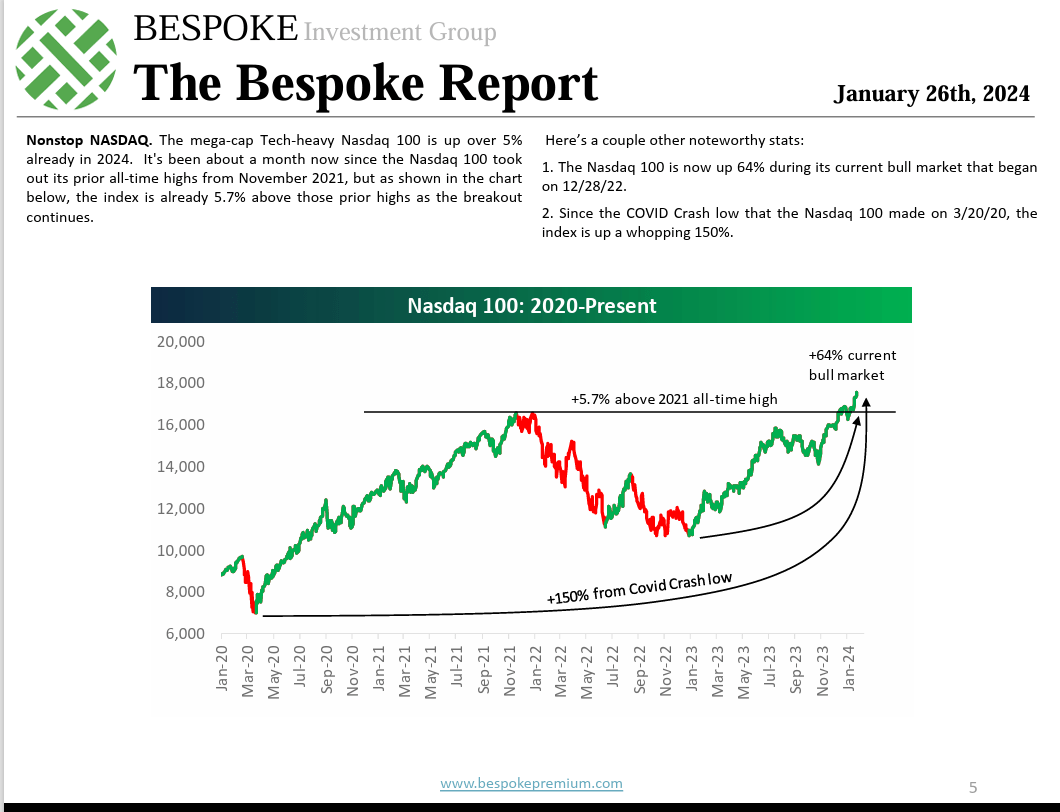

The above chart from the Bespoke Report this weekend notes the breakout in the Nasdaq 100, a critical chart for investors given that Microsoft (MSFT), Alphabet (GOOGL), Apple (AAPL), Amazon (AMZN) and Meta (META) report this week.

It was a narrow stock market in 2023, in terms of annual returns, with the so-called “Mag 7” leading the way. That may not change in 2024 either.

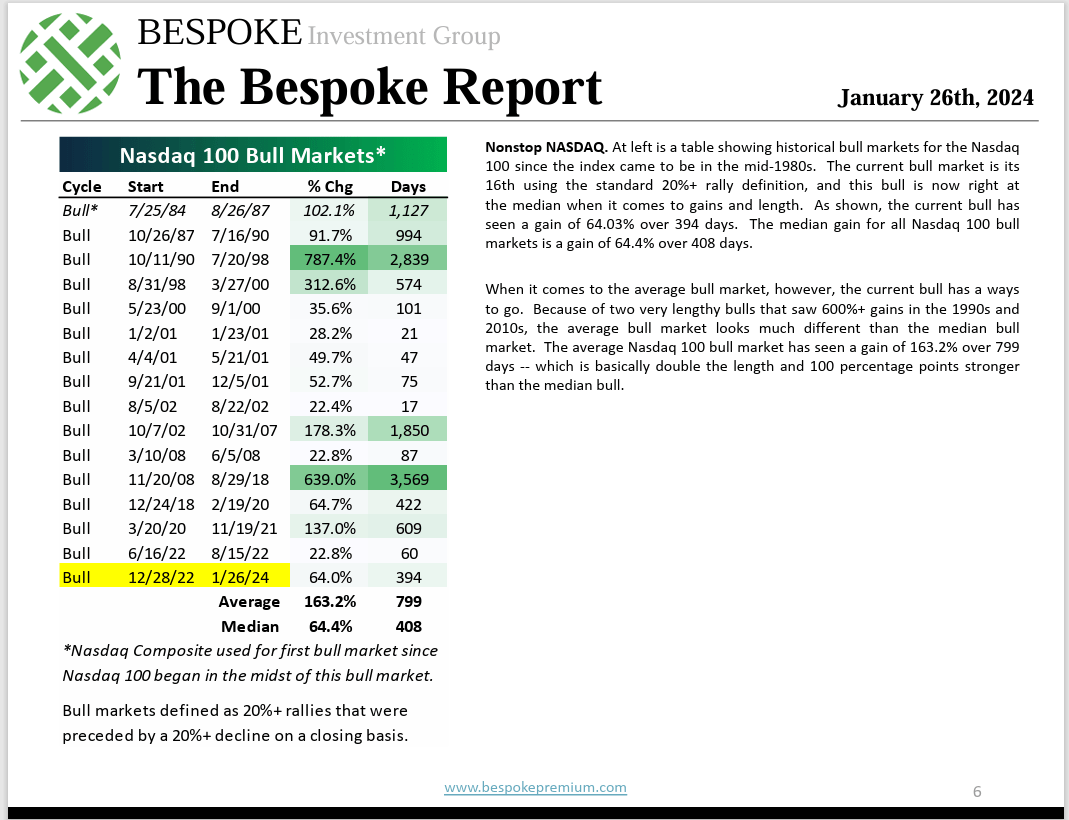

According to this table and explanation from the Bespoke Report, it’s still an ordinary bull market for the Nasdaq 100, with more room for the upside.

If there is a problem with the market cap-weighted indices, we’ll probably know it this week given the number of mega-caps reporting. Here’s an earnings preview of Microsoft and Alphabet.

Economic data:

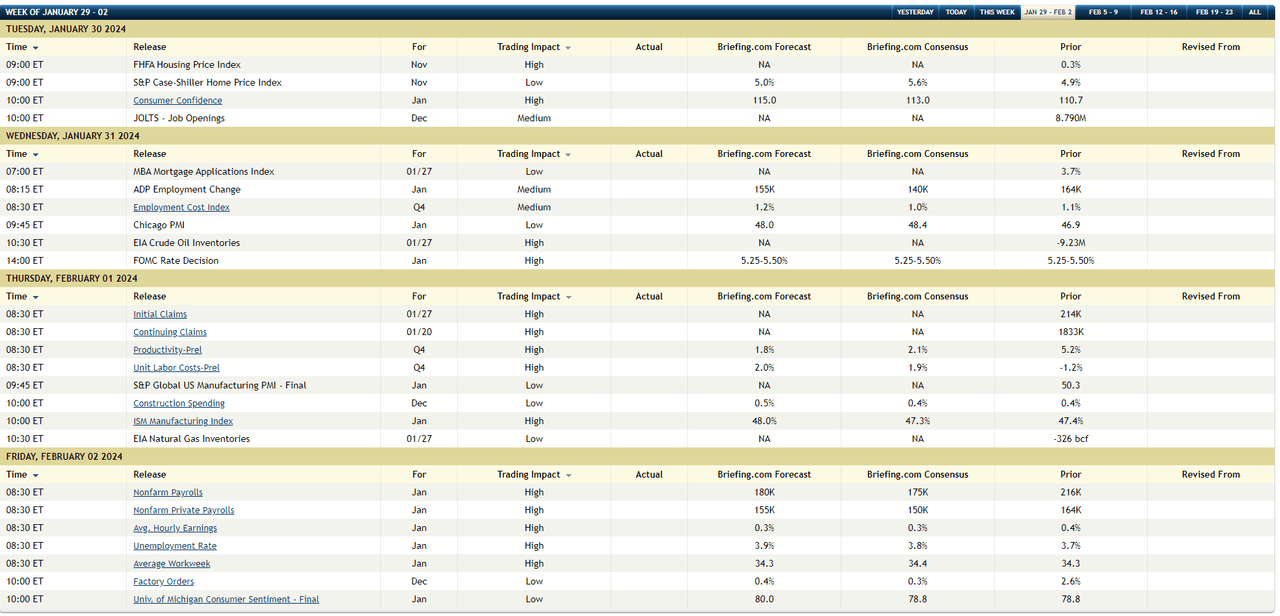

Here’s the week’s economic calendar from Briefing.com. Briefing does a good job of laying out the expected releases and the consensus expectations.

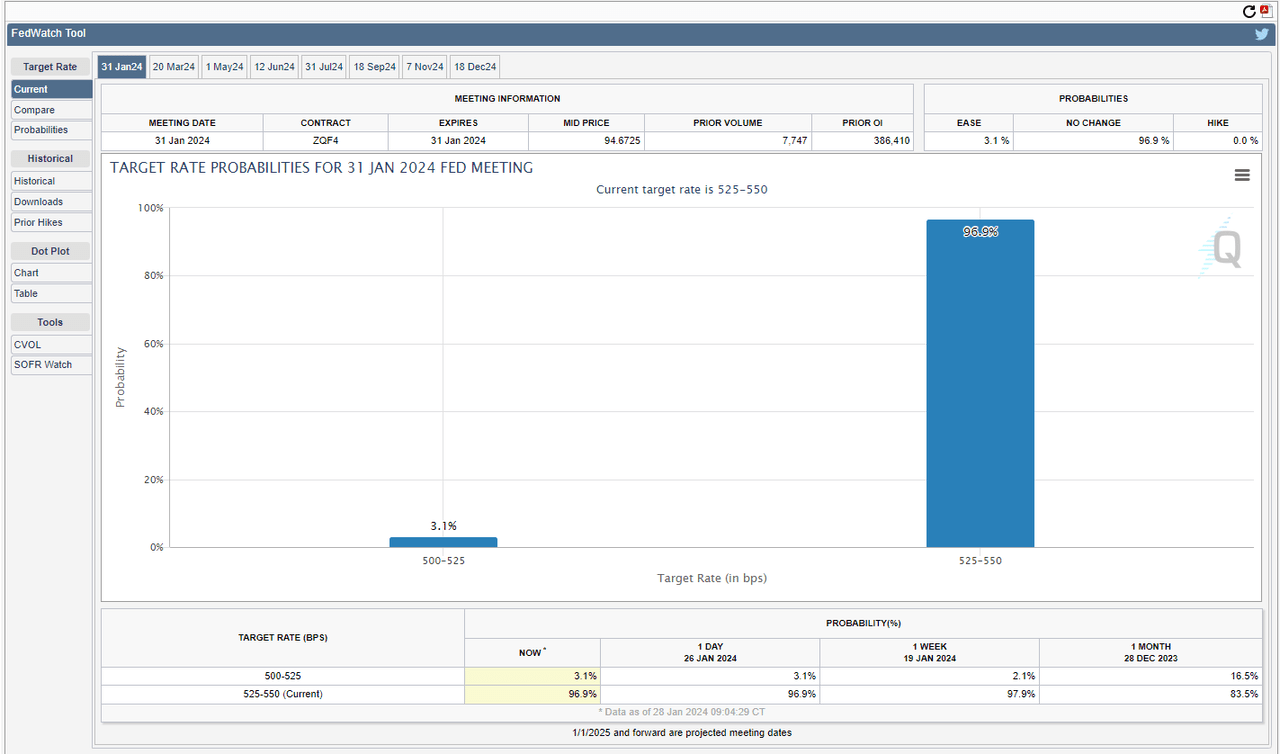

While the Fed announcement will get a lot of attention on Wednesday afternoon, there will be no change to Fed funds. All the Fed announcements really do is give the mainstream financial media a reason to burn a few hours of airtime, and breathlessly expound with market opinions that will be forgotten almost as soon as they are uttered.

There is just a 3.1% chance of the FOMC moving away from the 5.25-5.50% Fed funds range this coming Wednesday, January 31 ’24.

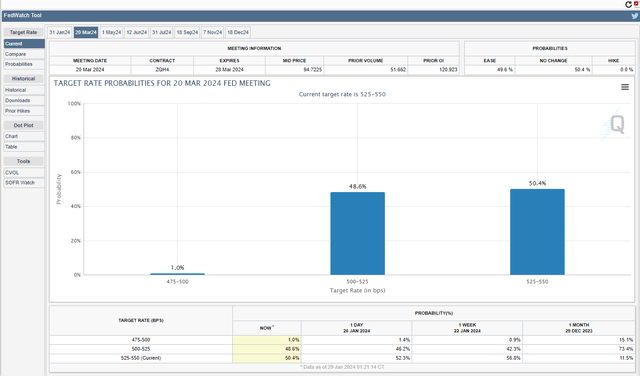

Here’s the March ’24 meeting probability: a little more interesting. Looking at the bottom rows, the odds of a fed funds rate reduction in March ’24 have fallen from 78% in Dec ’23 to just below 50% as of Friday, Jan 26, ’24.

That makes sense given the strength in retail sales, the stubborn nature of jobless claims remaining around 200,000, and the healthy Q4 ’23 GDP report from last week of 3.3%.

The four jobs-related releases this coming week will matter much to how the probability changes for a March ’24 FOMC policy change.

- JOLTS – Tuesday morning, Jan 30 – has started to decline, meaning corporations are pulling back on job openings, but nothing dramatic yet;

- ADP – Wednesday, Jan 31 – private sector payroll growth – Dec ’23 was 163k net new jobs vs the 114k consensus;

- Jobless claims: Thursday, Feb 1 – one of my personal favorites – still hovering around 200k, 214k last Thursday, 1/25/24. Telling us labor market remains reasonably well-bid;

- January ’24 nonfarm payroll release – Friday, Feb 2nd – 180k and 155k consensus per the above Briefing.com data.

Summary/conclusion: David Kelly, JPMorgan’s world-class economist and Chief Global Strategist, noted in one of his conference calls a few weeks ago that the US economy has few “excesses” which is a valid and credible point that’s always overlooked. It requires a “big picture” perspective, but JPMorgan and its global reach do offer that. What David means is unlike the late 1990s and 28% annualized return for the S&P 500 from 1995 to 1999, and then the commodity explosion that lasted from the early 2000s to 2007, which was driven by China’s 12-15% annual GDP growth from the late 1990s through 2009 or so. However the “mother of all excesses” was the mortgage and credit availability driving housing prices from 2000 through late 2007, which nearly took down the US economy.

The credit markets today seem to be in fairly good shape and that’s a big green flag if you’re an equity bull. With constant ads for private credit being seen and given it’s a new asset class and seems to be promoted to retail investors, private credit is a credit subset of the fixed-income asset class that won’t be bought for clients until it sees some kind of shakeout.

High-yield credit spreads tightened a little last week, although – as an asset class – they appear to still remain a little wider than in late December ’23.

Commercial real estate and CMBS seem to be one problem area that I’ve read about the last year, but it hasn’t shown up in bank conference calls yet, although I haven’t read all the call notes.

Technical positives:

- The S&P 500 broke out to an all-time high last Friday, January 19th, 2024;

- The Nasdaq 100 broke out to a new all-time high in late December ’23, coincident with Microsoft’s trade to an all-time high;

- Even the Dow 30 traded to a new all-time high in the last few weeks;

- The Nasdaq Composite is still shy of its November ’21 high;

How many Dow Jones Industrial Average hats did you see on the NYSE floor touting 38,000 for the average, and CNBC anchors wearing their Dow 38,000 hats to celebrate, as was the case in early 2000?

The general stock market sentiment just doesn’t seem that bullish to me personally, despite the first graph posted at the top.

None of this is advice or a recommendation. Take all of this with a healthy grain of skepticism. Past performance is no guarantee or suggestion of future results. Investing can involve the loss of principal, sometimes for long periods. Capital markets change quickly for both the good and the bad. Readers should gauge their own comfort with market and portfolio volatility and adjust accordingly.

As always thanks to Paul Hickey and the Bespoke staff for all of their excellent technical and fundamental work.

As always, thank you for reading.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors