Igor Kutyaev

Author’s Note: I have previously covered Jackson Financial Inc. (NYSE:JXN) and Jackson Financial Series A (NYSE:JXN.PA) in previous articles. This piece builds on insights previously discussed, so I recommend revising the earlier coverage for context.

Investment Thesis

In the world of finance, risk management is key. This is a lesson that every shareholder in Jackson Financial Inc. must remember when analyzing the company’s performance. JXN, like many financial institutions, engages in a hedging program to offset the risk of fluctuations in the value of its policyholder liabilities. While this is common practice, what is striking about JXN is the company’s candid admission: the results of its hedging program may not always align with the changes in its liabilities in the short run.

This can be seen in the company’s quarterly report. In the first quarter of 2023, JXN reported a significant net loss on derivatives and investments amounting to $3.4 billion, a steep increase from the $538 million loss posted last year. While this might initially appear alarming, it is important to remember that these figures reflect market-driven changes in the value of derivatives used in the company’s hedging program and not actual cash losses.

The company’s hedging strategy is based on cash inflows and outflows, not GAAP accruals. This can result in some mismatch between the value of the hedged obligations and the value of the derivates used for hedging, leading to volatility in the company’s reported revenue, which was the case in the Q1 earnings results released last week. Although I have noticed some weaknesses in other areas on JXN’s earnings report, I believe the loss from derivatives and the negative sales figure of $749 million do not indicate a fundamental problem within the company. Instead, it results from a mismatch between the value of its liabilities and the underlying hedging derivatives.

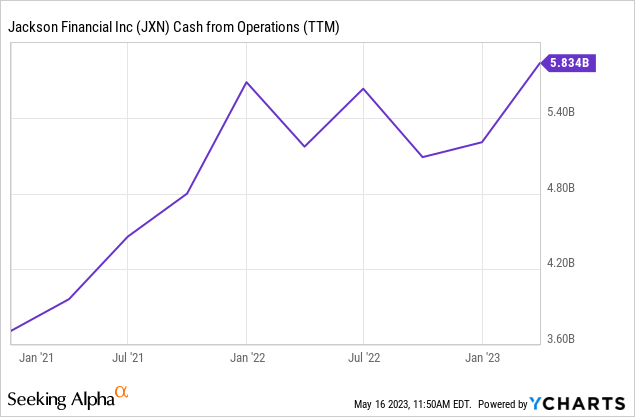

Looking at JXN’s cash flow dynamics, we can see that JXN’s various financial obligations, such as dividends on equity, debt interest, preferred share distribution, and share buyback program, are all comfortably supported by a robust influx of operational cash flow.

During the recent quarter, JXN realized a substantial cash flow from operations totaling $1.4 billion. This sizeable sum starkly contrasts the company’s comparatively modest cash outlays. For instance, the quarterly dividend payments currently yield an attractive 7.8% but constitute a small sum ($51 million) of operating cash flows. Furthermore, interest expense on its sizable $2.6 billion long-term debt comes at a mere $43 million. In addition, the company allocated $70 million towards its stock repurchase program and is expected to spend approximately $42 million on the newly-issued $533 million Series A preferred equity (JXN.PA), which is now trading below liquidation value at $23 per share, carrying an enticing yield of 8.7%. Summing all these shareholders’ returns sums up to about $200 million, a drop in a bucket compared to its $1.4 billion operating cash flows.

Beyond strong financials, good corporate governance plays a crucial role in ensuring the consistency of payment of dividends, especially for investors looking for stable income from JNX.PA perpetual non-cumulative Series A Preferred Stock. It is critical for management to consistently pay the preferred dividend as this plays a pivotal role in building trust with Wall Street and its investor base. By delivering on its preferred dividend promises beyond what is legally required, JXN solidifies its reputation as a trustworthy and reliable investment. This trust can be beneficial in various scenarios, such as if the company decides to borrow more. Lenders will be more willing to extend credit to a company with a strong record of fulfilling its non-cumulative preferred stock commitments.

The buy rating for JXN and JXN.PA is predicated on the company’s robust cash flow generation, attractive valuation, and good corporate governance (as mirrored in management’s repeated commitment to returning capital to shareholders). These factors are weighed against a challenging macroeconomic environment and a subsequent change in customer behavior, resulting in net deposit outflows during the quarter. Management is proactively addressing this issue by innovating and introducing new offerings, such as the Registered Index Linked Annuities “RILA,” which has already demonstrated a successful launch, showing promising signs of the company’s adaptability in an ever-changing financial landscape.

Deep Dive

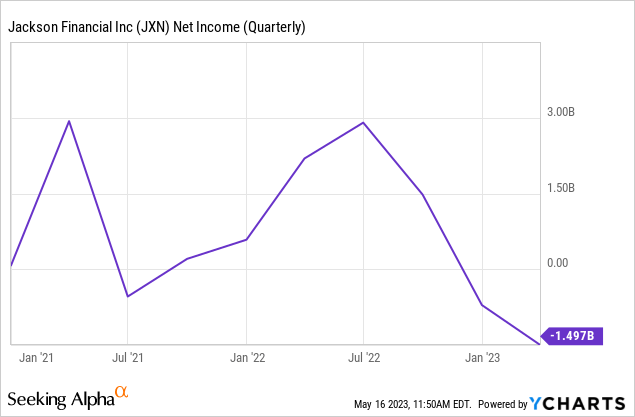

JXN Q1 2023 results, as reported under GAAP, might raise eyebrows with a net loss of $1.5 billion compared to a net income of $2.2 billion in the previous year. However, carefully examining their non-GAAP measure, Adjusted Operating Earnings, can provide valuable insights and a different perspective on the company’s performance.

First, let’s decode the non-operating adjustments contributing to this stark difference. The biggest contributor to JXN’s GAAP sales and net income volatility is movements in derivatives fair value, which dragged GAAP sales and net income to negative territory, swinging the YoY bottom line figure from a $1.5 billion in Q1 2022 to a $2.3 billion net loss in Q1 2023. This $4 billion year-over-year change is attributed to the company’s hedging program and market conditions, which are inherently unpredictable and do not reflect the core operations of JXN.

In the reconciliation of adjusted operating earnings to GAAP net income, management also omits fees associated with guaranteed benefits. These fees echo the modifications that JXN applies to some of its guaranteed benefits in its insurance and annuity products. From my understanding, these fees are intertwined with the company’s hedging activities and don’t reflect the underlying performance of the company.

Finally, gains related to Market Risk Benefits have also been excluded from management’s non-GAAP adjusted operating earnings, given that they are not operating items. The MRBs are measured at fair value and reflect the company’s assets and liabilities related to some of its products, such as guaranteed minimum withdraws, death benefits, and minimum income benefits. Rising interest rates had a positive impact on the company’s expected obligations but do not mirror the quarter’s sales activity or interest in JXN’s products. This line item is also most likely hedged and balanced out by the decline in the fair value of derivatives.

After accounting for these adjustments and operating income taxes, we arrive at management’s Adjusted Operating Earnings of $271 million for 2023, down from $377 million in 2022. This decline of about 28% could be concerning, but it is certainly more stable than the company’s GAAP sales and net income figures.

Net deposits also declined in Q1 2023, indicating changing dynamics in the annuities market. First, it is important to note that variable annuities sales, which have been a major revenue driver for JXN in the past, showed a considerable dip from $4.6 billion in Q1 2022 to $2.5 billion in Q1 2023. This slump reflects a broader market trend away from the complex, fee-heavy products like variable annuities towards simpler and more transparent financial instruments, possibly government bonds, which now yield rates between 3.5% to 5%.

Despite offering attractive features such as lifetime income benefits, JXN’s variable annuities come with risks tied to market performance. Moreover, they often entail high fees and intricate withdrawal rules, which can be off-putting for many investors. As customers become increasingly risk-averse and seek more straightforward investment options, it’s not surprising that sales of variable annuities have suffered.

On a positive note, JXN’s newly-introduced RILA “Registered Index Linked Annuities” sales showed a promising uptick, increasing from $199 million in Q1 2022 to $533 million in Q1 2023. RILAs offer a blend of protection from market downturns and growth potential, making them an appealing choice for customers seeking a balance of risk and return. This boost in RILA sales suggests that JSN is successfully capitalizing on this growing market segment and the effectiveness of its distribution network. Fixed annuities sales also tripled from $20 million to $61 million during the quarter, mirroring investors’ interest in locking down high rates of return in a high-yield environment.

However, despite these bright spots, total customer deposits declined by $2 billion from Q1 2022, reflecting decreased interest from retail and institutional investors. This overall decline is another source of concern revealed during the quarter.

Summary

JXN’s Q1 2023 results may raise eyebrows at first glance, with significant net losses on derivatives and investments and a decline in variable annuity sales. However, a deeper analysis reveals that these losses do not reflect fundamental problems within the company but rather result from the inherent unpredictability of hedging programs and market conditions.

A more consistent picture of the company’s performance emerges when considering the non-GAAP measure, Adjusted Operating Earnings. The decline in variable annuity sales is aligned with broader market trends as investors seek simpler and more transparent financial instruments. On the other hand, the growth in sales of RILA and fixed annuities indicates that JXN is successfully adapting to changing market dynamics and leveraging its distribution network effectively.

Despite these positives, the overall decline in total customer deposits (annuity sales) is a cause of concern. As the financial conditions change, so does JXN customers’ behavior. It is crucial that JXN monitors these trends and adjust its product portfolio accordingly to maintain its competitive edge and meet the changing needs of its customers.

My buy rating mirrors the company’s valuation dynamics discussed in the previous article and my confidence that the challenges faced during Q1 2023 will lessen as the market conditions improve.