hapabapa

J.Jill, Inc. (NYSE:JILL), the ladies’s attire retailer with operations in the US, reported the corporate’s fiscal Q2 outcomes, ending August third, on the 4th of September in pre-market hours exhibiting a secure efficiency within the quarter regardless of weak spot throughout the trade amid a weak shopper sentiment. Whereas Q2 financials got here in above the anticipated stage, the market reacted very negatively with a -17% inventory decline resulting from JILL’s lowered FY2024 steerage.

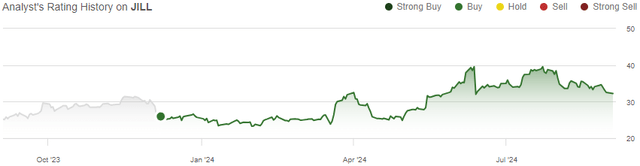

In my earlier article on the inventory, “J.Jill: Improved Profitability With Fewer Shops“, I initiated JILL at a Purchase ranking as the corporate’s retailer community optimization had resulted in clearly higher earnings, creating a lovely valuation. After the article was printed on the seventh of December, JILL has now solely returned 3% in comparison with S&P 500’s higher return of 20% as a earlier fairness increase and the lowered steerage have pushed JILL’s inventory down significantly.

My Score Historical past on JILL (Searching for Alpha)

JILL’s Q2 Report: Stable Revenues, Weak Margins In Difficult Business Backdrop

JILL’s Q2 revenues got here in at fairly a great stage. Whereas the revenues of $155.2 million declined -0.9% year-on-year, adjusting for retailer depend adjustments and a 53rd week within the prior fiscal 2023 12 months, comparable gross sales grew at a optimistic 1.7% tempo, beating Wall Road’s expectations by a small $1.0 million margin.

The comparable revenues have been, in my view, comparatively good as attire retailers have general skilled weak spot associated to a weak Q2 shopper sentiment. For instance, City Outfitters (URBN) confirmed an analogous 2.0% comparable development in the identical fiscal Q2 interval, The Buckle (BKE) has proven immense comparable development weak spot as I’ve beforehand written together with a -6.8% decline in July, and the already beforehand weak Cato Company (CATO) confirmed a -2% comparable decline. American Eagle Outfitters (AEO) did outpace JILL significantly, with a 4% development, although.

Attire inflation within the US has additionally been extremely gradual all through JILL’s Q2, starting from 0.8% in Might to simply 0.2% in July, additional showcasing JILL’s comparable gross sales’ fairly good efficiency.

Alternatively, JILL’s profitability took a substantial hit in Q2. The gross margin contracted 1.2 proportion factors to 70.5%, and as SG&A additionally elevated reasonably, adjusted working revenue declined by $4.2 million into $24.9 million. The adjusted EPS got here in at $1.05, declining $0.10 year-on-year however beating Wall Road’s estimates by $0.14 because the Q2 adjusted EBITDA decline was already guided for with the Q1 report.

Altogether, the Q2 financials got here in at a effective stage. Whereas revenues have been fairly sturdy contemplating the trade backdrop, JILL’s already guided-for weaker profitability was a unfavorable issue. The weaker profitability included non-recurring prices resembling a communicated $0.5 million SG&A improve associated to OMS (Order Administration System) challenge implementation, the fiscal 12 months’s shift, and better freight prices because of the scenario within the Crimson Sea, however the revenue decline was nonetheless fairly sharp in comparison with JILL’s secure revenues.

The Lowered FY2024 Steering Disenchanted The Market

Whereas the Q2 outcomes themselves have been above Wall Road’s expectations, the lowered steerage dissatisfied the market – after elevating the FY2024 steerage with the Q1 report, JILL now reconsidered the outlook with a decreasing in Q2 because of the unsure trade backdrop.

JILL now expects FY2024 gross sales to develop simply 0-1% in comparison with a 1-3% development vary beforehand. Adjusted EBITDA is now anticipated to fall -4% to -9%, down from JILL’s earlier -1% to -3% decline expectation. Excluding the 53rd week in fiscal 2023 and the OMS challenge’s non permanent SG&A, the brand new vary displays wholesome gross sales development of 2-3% and a small AEBITDA hiccup of -1% to -6%.

For Q3, gross sales are anticipated to be down -1% to up 2%, and for AEBITDA to be $23.0-27.0 million in comparison with $28.3 million in Q3/FY2023, anticipating fairly an analogous year-on-year efficiency as JILL reported in Q2 with barely higher mid-point income development. The corporate has seen particularly weakening visitors developments from July ahead, as instructed within the Q2 earnings name, inflicting the lowered steerage ranges and weaker-than-expected Q3.

I do not consider that the lowered steerage is an indication of structural deterioration in JILL’s enterprise; the trade has very apparently suffered from a weak shopper sentiment. As I’ve beforehand written, City Outfitters has additionally seen weakening retail developments from late July ahead, main the competitor to anticipate development deceleration in Q3 in comparison with JILL’s remaining expectation of slight sequential acceleration. As such, the inventory’s very massive fall looks as if an overreaction.

June Share Providing Deleverages Steadiness Sheet

In June, JILL introduced a 1 million share fairness increase and an extra 1 million share providing from JILL’s largest shareholder as a public providing, priced at $31.00 per share. The inventory additionally reacted very strongly to the proposed providing, falling -19% on the thirteenth of July.

The proceeds have been primarily used to pay down JILL’s interest-bearing debt, and after Q2, roughly $73.2 million of interest-bearing debt stays on JILL’s steadiness sheet. I consider that the fairness increase was fairly pointless, as the corporate’s leverage wasn’t too excessive even earlier than the latest paydowns. The transactions did nonetheless stabilize JILL’s financing in a great way, though I consider the fairness increase to have been nonessential.

JILL’s Valuation Stays Low cost

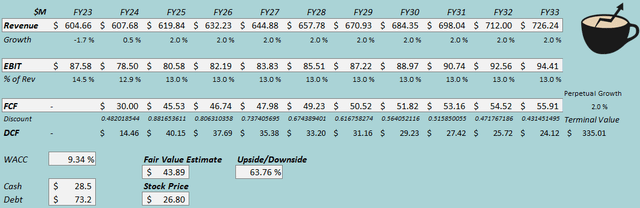

As JILL’s curiosity bills have blended lease-related curiosity bills, I consider that estimating levered money flows is extra consultant of JILL than my prior methodology of together with leases as debt. As such, I up to date my discounted money move [DCF] mannequin to not subtract debt from the truthful worth estimate, however for the mannequin to now subtract curiosity bills from the money move estimates. With $3.7 million in Q2 curiosity bills, I estimate $14.9 million in annualized curiosity money flows.

In any other case, I’ve stored the mannequin fairly secure general. I now estimate low 0.5% income development for FY2024 because of the weak steerage, however nonetheless fixed 2% development after the 12 months. I’ve adjusted the EBIT margin estimate barely downwards right into a sustained 13.0% stage in comparison with a 13.4% estimate beforehand because of the weaker guided FY2024 profitability.

Excluding the adjustments to my mannequin concerning curiosity bills, JILL’s money move conversion ought to nonetheless stand good over the long run.

DCF Mannequin (Writer’s Calculation)

The estimates put JILL’s truthful worth estimate at $43.89, 64% above the inventory value on the time of writing – I consider that the inventory stays a lovely funding because the inventory offers a secure and good money move yield. With the FY2025 money move estimate and the share value of $26.80 the money move yield stands at almost 11% for the 12 months mixed with secure anticipated 2% development going ahead.

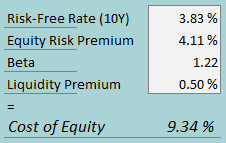

CAPM

A weighted common value of capital of 9.34% is used within the DCF mannequin. The used WACC is derived from a capital asset pricing mannequin:

CAPM (Writer’s Calculation)

As I now estimate levered money flows for JILL, I solely estimate the price of fairness for the price of capital. To estimate the price of fairness, I take advantage of the 10-year bond yield of three.83% because the risk-free charge. The fairness danger premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, up to date in July. For the beta, I now use Aswath Damodaran’s estimates – with the typical of the final retail beta of 1.25 and the attire trade beta of 1.19, the brand new beta estimate stands at 1.22. With a liquidity premium of 0.5%, the price of fairness stands 9.34%.

Takeaway

JILL’s Q2 financials got here in barely above expectations as revenues stayed resilient amid weak shopper spending and margins declined lower than the market anticipated. Whereas the Q2 financials have been effective, the market in my view overreacted to a barely lowered FY2024 outlook as shopper spending within the trade has remained weak. For my part, the inventory stays undervalued, and as such, I stay with a Purchase ranking for J.Jill.