Sakorn Sukkasemsakorn

The iShares S&P 500 Value ETF (NYSEARCA:IVE) is an exchange-traded fund that provides investors with exposure to large U.S. companies that are potentially undervalued relative to comparable companies. IVE’s benchmark is the S&P 500(R) Value Index, whose factsheet reports its selection criteria consisting of price-to-book, price-to-earnings, and price-to-sales. In other words, the greater the book value, earnings and/or sales that a stock offers per $1 of share price, the more likely IVE will include that stock.

I am usually critical of these kinds of selection methodologies, especially in this case; IVE draws constituents from the S&P 500, of which there are 500 companies, while IVE had 408 holdings as of March 16, 2023. So, IVE is really just approaching a beta of 1x with the S&P 500 index, while possibly finding itself a victim of its own adverse selection of picking lower-growth stocks. Growth stocks have beaten value stocks over the long run, so IVE is quite contrarian, but in an unintelligent (mostly indiscriminate) way.

Still, “every dog has its day”, and IVE did out-perform SPDR S&P 500 Trust ETF (SPY) during 2022 (see chart below which measures IVE’s price against SPY’s price).

TradingView.com

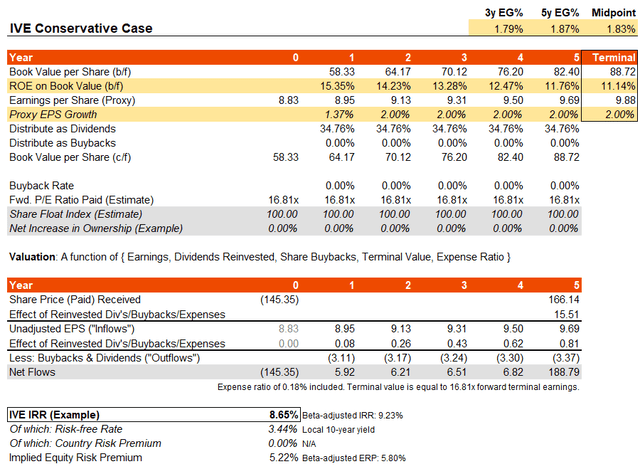

Based on the most recent factsheet for IVE’s benchmark, using this index as a proxy for IVE’s portfolio itself, the fund’s implied trailing and forward price/earnings ratios were 17.04x and 16.81x, respectively. This implies very modest earnings growth of 1.37% in year one. However, this is during a downturn in corporate earnings. Morningstar’s consensus growth estimate is 10.69% on average over the next three to five years. Bear in mind IVE’s benchmark index reported a price/book ratio of 2.58x too, implying a forward return on equity of over 15%. In the longer run, it is likely that IVE’s collection of large-cap stocks are likely to return to stronger earnings growth rates after this short-term period of lower growth.

Nevertheless, I will draw a base conclusion of assuming no more than 2% earnings growth from year two through to year six in my forecast as a conservative base. That is no more than G10 central banks’ conventional inflation targets of circa 2% per annum, implying zero real earnings growth during my six-year forecast period. Additionally, I will assume no share buybacks. Given the current U.S. 10-year yield (risk-free rate proxy) of 3.44% at the time of writing, the implied equity risk premium for IVE based on this conservative forecast is a healthy 5.22%. That is, after IVE’s expense ratio of 0.18%.

Author’s Calculations

As the U.S. equity risk premium should generally fall into the 3.2-5.5% range, this ERP is healthy. In fact, the equity risk premium is on the higher side, especially for this low-beta, large-cap U.S. equity portfolio.

What about the long-term earnings multiple? I have assumed 16.81x prevails. If we assume a long-term earnings growth rate of no more than 2%, a terminal 10-year yield of no more than 3%, and an equity risk premium of 4-5%, we arrive at a fair forward earnings multiple of 16.67-20x. Therefore, I am comfortable with carrying over the present earnings multiple, into the future.

All considered, I think IVE is trading at a minor discount. The headline IRR is almost 9%. This should provide investors with some comfort. If I create a ‘base case’ scenario alternatively, whereby earnings growth averages not <2% over the six-year forecast horizon but picks up to a (still below-consensus) average of circa 5%, the IRR potential rises to 11.6%. That would indicate an underlying equity risk premium of over 8%. This would also indicate upside potential on valuation alone of 30-50%.

I think that once inflation begins to settle more sustainably, or we have some kind of surprise positive news (for example, in relation to the Russo-Ukrainian War), funds like IVE should perform very well. In any event though, I think IVE is trading at a discount, and therefore it should perform strongly over the next 12-24 months regardless. Only a strong, surprise negative catalyst such as a much deeper banking crisis (following recent debacles, such as SVB, Signature, First Republic, Credit Suisse, even Silvergate), but that would naturally not be my base case.