creisinger

General Electric (NYSE:GE) exceeded consensus estimates for its fourth-quarter last week as a strong demand situation in its largest segment by profits boosted its financial results. General Electric reported a significant increase in its free cash flow in FY 2023 and its free cash flow margins expanded as well. Given a strong demand setup from the aviation industry, I believe that General Electric’s business trends in the near future will remain favorable. However, General Electric is trading at a massive premium to the industry average P/E ratio which suggests to me that shares are overpriced and have a negative risk profile!

General Electric exceeded Q4 consensus estimates

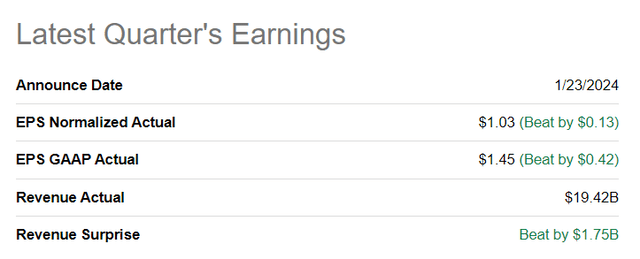

General Electric easily beat estimates for its fourth-quarter. The company earned an adjusted $1.03 per-share in Q4’23 compared to a consensus estimate of $0.90 per-share, as per Seeking Alpha. General Electric also beat on the top line, by $1.75B.

Seeking Alpha

General Electric’s business is in an upswing, especially Aerospace

General Electric is one of the oldest companies in the U.S. and its current business setup consists of three distinct segments: 1. Aerospace, 2. Renewable Energy and 3. Power. With the U.S. economy still being in great shape, General Electric had an expectedly strong quarter.

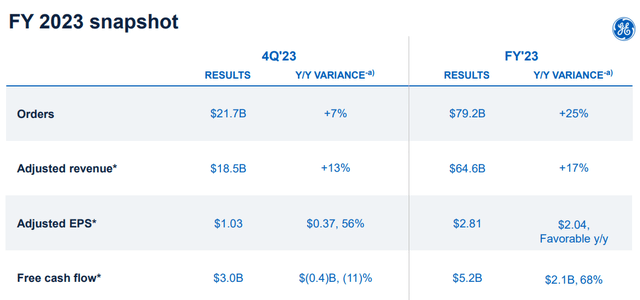

In Aerospace, Renewable Energy and Power, General Electric saw double-digit revenue growth in the fourth-quarter which helped the company cap off a very successful year as well. General Electric reported 13% growth in organic revenues in Q4’23 in total and generated a cumulative $18.5B in revenues across its three main businesses.

General Electric

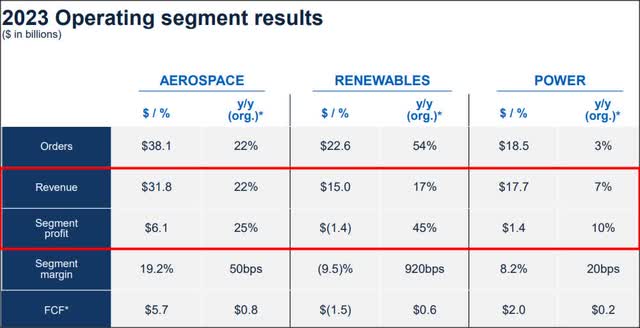

General Electric’s revenues in Aerospace increased 22% year over year to $31.8B in FY 2023 which made it by far the most successful segment. This growth was due chiefly to growing order volumes from the aviation industry. Renewables saw 17% top line growth to $15.0B while Power lagged behind with 7% behind General Electric’s two largest businesses. Power is set to get separated from General Electric via a spin-off in April 2024, so this segment’s lagging top line growth is not going to drag down General Electric’s revenue and earnings potential going forward.

General Electric’s Aerospace business is the company’s crown jewel and truly producing impressive results. Backed by a recovering aviation industry, General Electric has been able to generate $6.1B in segment-related earnings in FY 2023, showing 25% year over year growth. Renewables, General Electric’s green energy business that builds wind, hydro, solar and hybrid power installations has been struggling with profitability in FY 2023 due to high costs. As a result, this segment generated a cumulative loss of $1.4B. Power, like I said, is to be spun-off and will be its own business going forward, but it was reasonably profitable in FY 2023 with a segment profit of $1.4B.

Unfortunately, the strength of General Electric’s Aerospace operations also reveals a vulnerability: Aerospace generated more than 4 times more profits than the second-largest segment, Power. With $6.1B in segment profits coming from Aerospace alone, General Electric would be set to suffer if the aviation market turned against the company.

General Electric

Positive outlook for FY 2024

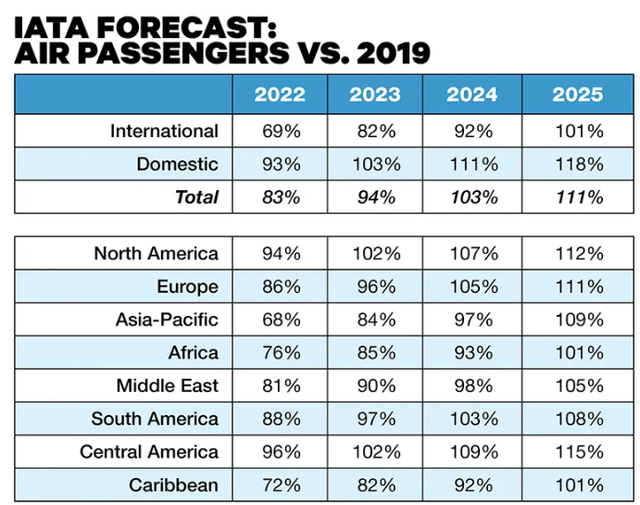

The momentum in the Aerospace business relates to a roaring comeback of the aviation industry post-pandemic which has translated to record results for companies like Delta Air Lines (DEL) and American Airlines (AAL) recently (see my work here). The International Air Transportation widely expects FY 2024 to be a second consecutive record year for the air travel industry, indicating that the demand outlook for engines remains very favorable. With General Electric separating itself from the Power business in the near term, the outlook for the aviation industry is likely to matter even more for General Electric’s stock outlook going forward.

IATA

Free cash flow surge and FCF margin expansion

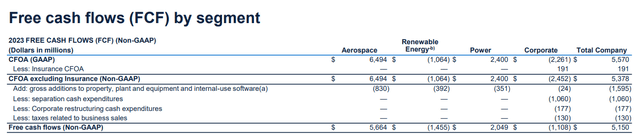

General Electric reported an 11% drop-off in its free cash flow in Q4’23 Y/Y, but the company nonetheless benefited from soaring free cash flow on a full-year basis, helped chiefly by demand for engines in its Aerospace operations. The Aerospace segment generated $5.7B in free cash flow in FY 2023, showing a year over year increase of 16%. In total, General Electric generated $5.2B in free cash flow in FY 2023, almost all of which came from Aerospace, which calculates to a free cash flow margin of 8.0%. In FY 2022, General Electric achieved a free cash flow margin of only 5.5%, implying a margin expansion of 2.5 PP, or 45% growth year over year.

General Electric

General Electric’s valuation

General Electric’s Aerospace segment performance, a strong engine order backlog and the recovery in passenger travel are all favorable trends that currently support General Electric’s pro-cyclical business setup. The U.S. economy is currently also strong and provides support: the latest GDP report said that the economy grew significantly faster than expected in Q4’23, at an annualized rate of 3.3%.

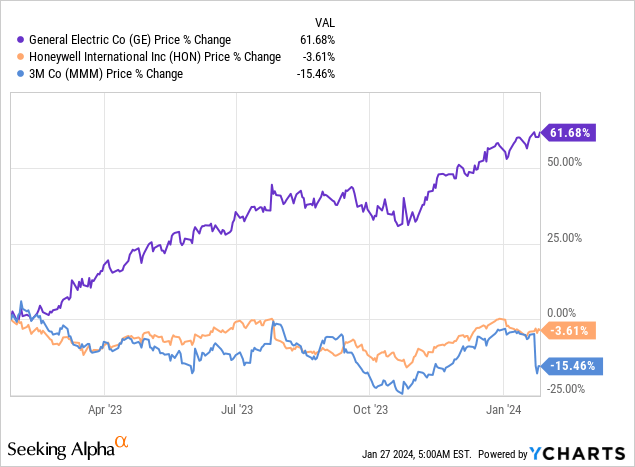

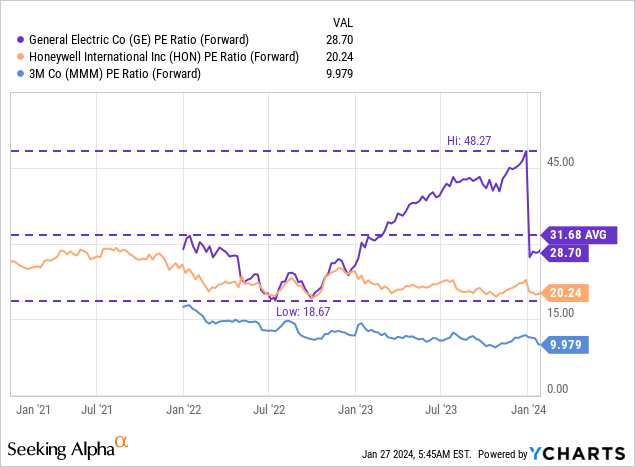

What I don’t like, however, despite seeing a significant free cash flow margin improvement in General Electric’s business, driven by Aerospace, is that shares are trading at a rather significant premium to the industry group average P/E. General Electric currently has a very high P/E ratio of 28.7X, in large part due to a well-executing Aerospace segment. On the other hand, rivals like Honeywell (HON) or 3M (MMM) are trading at much lower P/E ratios because they are more diversified and have exposure to non-cyclical businesses. 3M also has had other issues in FY 2023, including legal troubles related to earplugs which weighed on the company’s valuation.

General Electric could reasonable trade, in my opinion, at 20X P/E ratio which is what I would be comfortable with paying for a cyclical company with high-single digit free cash flow margins… this P/E ratio would also be in line with the industry group average P/E. A 20X earnings multiple implies a fair value of ~$90 and implies, at a current share price of $131, 30% correction potential.

Risks with General Electric

The biggest risk, as I see it, relates to a cyclical contraction in earnings and free cash flow margins. Additionally, General Electric is already dependent on the Aerospace segment for its financial performance (earnings and free cash flow) which likely translates into more correction potential for General Electric’s shares than for its more diversified competitors if the U.S. economy corrects to the downside.

Final thoughts

General Electric had an impressive fourth-quarter that saw double-digit top line growth in all three businesses. Aerospace sees favorable tailwinds from the aviation industry which seems to be in a multi-year, post-pandemic recovery setup, at least according to the IATA. General Electric also managed to deliver decent free cash flow growth as well as a 45% increase in its free cash flow margin in FY 2023. What I don’t like, however, is General Electric’s premium valuation which I find hard to justify. As a result, I see an unattractive risk profile and rate General Electric a sell!