EXTREME-PHOTOGRAPHER/E+ through Getty Pictures

Introduction

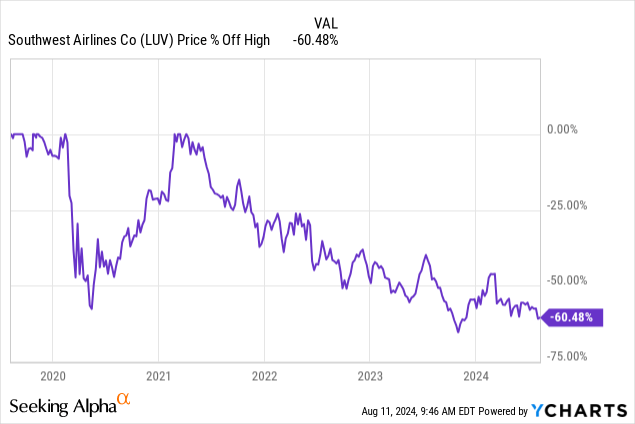

After a long time of profitable execution, even throughout difficult environments like these post-9/11 and the Nice Recession, the current pandemic severely broken Southwest Airways’ (NYSE:LUV) enterprise. The inventory value is now down greater than -60% off its highs after initially staging a full restoration in 2021 off the pandemic lows.

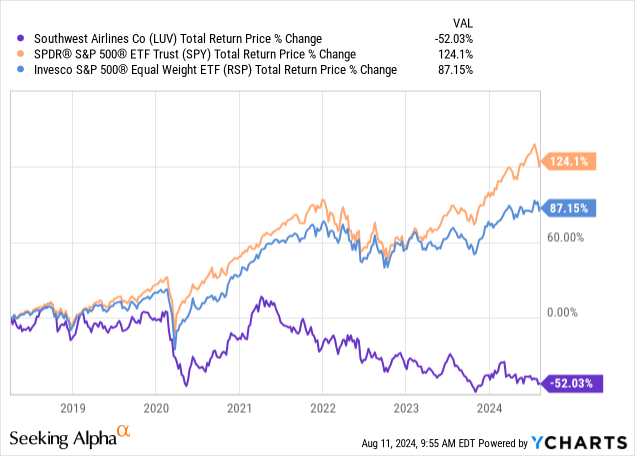

I’ve been bearish on Southwest Airways inventory since my April 4th, 2018 article “How Far May Southwest Airways Fall?” by which I shared the inventory’s historic cyclical draw back danger although the enterprise was prime quality. Right here is how the inventory has carried out since then:

Even earlier than the pandemic, Southwest inventory had been underperforming each the cap-weighted S&P 500 index and the equal-weighted (RSP).

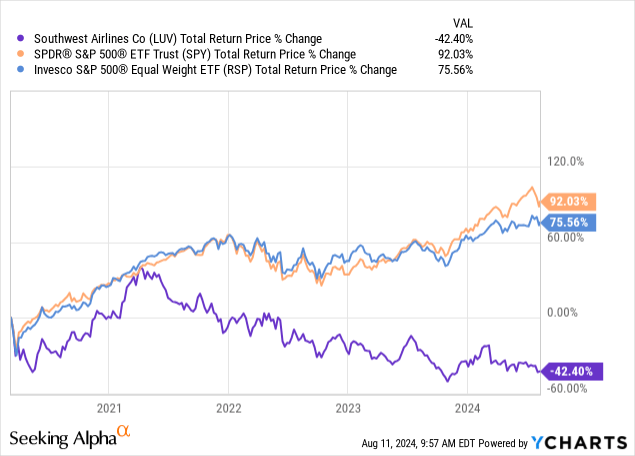

Additionally, close to the start of the pandemic, on March sixth, 2020, when many have been downplaying the seriousness of the drawback, I wrote the “Promote” article “Re-Evaluating My Bearish Southwest Airways Thesis“. Right here is how the inventory has carried out since then:

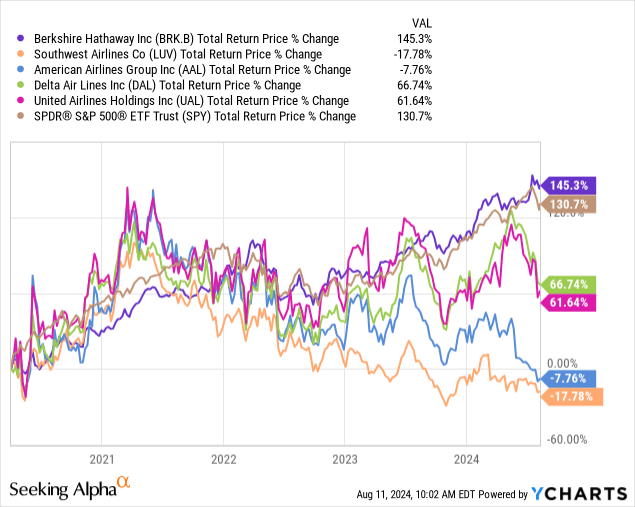

Initially, all airline shares staged a giant rally into the spring of 2021. In the event you recall, Warren Buffett bought his 4 US airline shares towards the tip of March 2020, and only a few months later many traders declared him silly for doing so. Basically, what Buffett did was take the cash from these gross sales and purchase again Berkshire inventory, so let’s examine how Berkshire has carried out since April 2020 versus the airline shares he bought.

Berkshire Hathaway (BRK.B) has greater than doubled the efficiency of the very best airline shares, carried out 5x higher than the basket of airline shares Buffett bought, and likewise carried out higher than the S&P 500 (SPY). So, over the medium time period (2-5 years), which is the timeframe I usually deal with with cyclicals, Buffett’s choice was appropriate. And the preliminary bounce off the underside of the March 2020 lows for airline shares was irrational.

It is essential to level out, right here, that I hardly ever write articles on shares that I do not think about excessive sufficient high quality for me to think about shopping for on the proper value. So, my bearish articles are usually on shares I believe might be close to cyclical highs, are very overvalued, or that have been as soon as prime quality, however could also be displaying indicators of getting that high quality diminish. Southwest has historically had the very best airline enterprise within the US, that is why I lined it within the first place. The query has all the time been one among shopping for on the proper value, with out the cloud of a world pandemic hanging over it, slightly than enterprise high quality. So, again in January of this yr, I wrote an article titled “Here is The Worth I am going to Purchase Southwest Airways Inventory” the place I shared the worth I believed Southwest could be an excellent purchase. Right here is the conclusion of the article:

Placing all this data collectively, my purchase value for Southwest Airways inventory is $23.45 per share. Typically readers misinterpret my “purchase costs” as goal costs or predictions about the place the inventory will commerce. They don’t seem to be. My purchase costs are the costs at which I believe 1) have an affordable probability of occurring (affordable being 10% to twenty% probability), 2) have a margin security, and three) have a excessive likelihood of manufacturing the longer term returns I would like (often a 15% medium-term CAGR or higher). On this article, I’ve proven through historical past why the purchase value has an affordable probability to hit and likewise recuperate in a well timed method, thereby producing the extent of returns I am after. I are likely to purpose for a much bigger margin of security and better returns than most traders. Nevertheless, I believe traders with totally different targets can nonetheless use the methodology I shared within the article. If I find yourself shopping for this one, I am going to write a follow-up article explaining the tactic in additional element.

Not too long ago, LUV bottomed at $23.58, nearly proper at my purchase value. I believed the current addition of Elliot Administration’s activist stake within the enterprise, may be sufficient of a catalyst to probably put a backside within the inventory value, so I’ve taken a place in LUV and I believe now could be an affordable time to purchase the inventory as a medium-term funding. This text will clarify the technique behind my choice.

Historical past Is A Good Predictor Of The Future

Underpinning my funding technique for cyclical shares is a vital assumption. That assumption is that if the market was keen to pay a sure value for a inventory previously, then if comparable circumstances come up once more, and never an excessive amount of has modified with the enterprise, there’s about an 80% probability the market might be keen to pay the same quantity once more.

Hopefully, at the least in a common sense, readers suppose it is a affordable assumption with which to begin. And, truthfully, it is the idea that any imply reversion technique and most valuation analyses implicitly make with any elementary evaluation, so I do not suppose it needs to be too controversial.

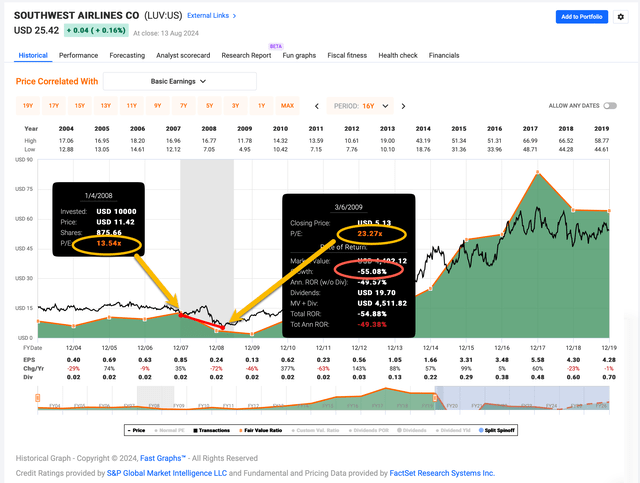

The issue with deeply cyclical companies like Southwest is that earnings can fluctuate a lot, {that a} conventional earnings-based evaluation is not very helpful for traders. I illustrate this within the FAST Graph beneath that focuses on the Nice Recession interval.

FAST Graphs

I used Fundamental Earnings as a substitute of adjusted earnings within the FAST Graph above as a result of it higher illustrates my level concerning conventional earnings valuations and cyclicality. In January 2008, LUV’s P/E ratio was 13.54 and earnings had been rising at an excellent tempo. That is historically fairly low cost, or at the least on the undervalued aspect utilizing an earnings evaluation. 5 quarters later, LUV’s P/E ratio was 23.27, which is nearly double the P/E 5 quarters earlier than that. So, on the floor, it regarded like LUV was fairly low cost in early 2008 and fairly costly in March 2009 close to the market backside, although the inventory value had dropped about -55% throughout that point. The earnings valuation was giving exactly the incorrect sign to traders. It signaled a purchase simply earlier than the inventory misplaced half its worth, and it signaled a promote close to the market backside. That is precisely the other of what we wish to do as traders.

The rationale for this drawback is that earnings fell quite a bit throughout that point. Utilizing fundamental earnings within the above graph, EPS fell about -85% from 2008 to 2010. When earnings fall, the P/E rises. However what would not get taken into consideration on this calculation is that earnings of high-quality cyclical companies recuperate in a well timed method, so they do not keep down there. That is what makes them cyclical.

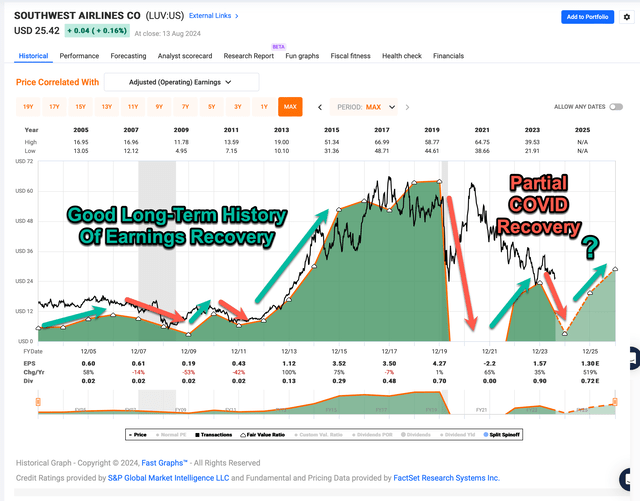

FAST Graphs

Zooming out the timeframe and switching to adjusted EPS, the FAST Graph above exhibits that LUV’s earnings have skilled 3 important declines through the previous 2 a long time, and are at the moment experiencing a 4th. The inventory value recovered throughout all these declines, and earnings recovered from all of them besides COVID, by which it staged a partial restoration earlier than experiencing current hassle. Any wager on LUV inventory right here over the medium time period assumes there’s a good probability, through the subsequent 5 years, LUV can stage an earnings restoration. So, we all know that LUV is a cyclical enterprise, and we all know they’re at the moment in a deep downcycle that was began through the pandemic, however which they’re having problem recovering.

Southwest’s earnings historical past matches the profile of a deeply cyclical enterprise. Due to this dynamic, I do not use earnings to information once I purchase cyclical companies, I take advantage of historic inventory value patterns, underneath the idea that they may most likely repeat in a similar way as they’ve accomplished previously.

Southwest Airways’ Historic Inventory Cyclicality

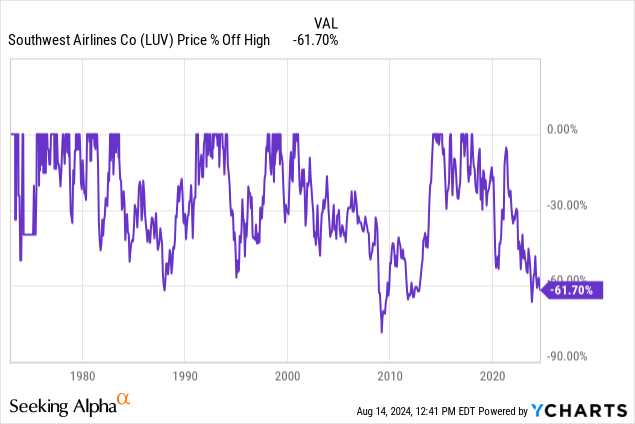

As a result of I’ve written on Southwest inventory a number of instances previously, I’ve shared a few of this knowledge earlier than. I’ve up to date the parts the place new data is accessible. First, let’s look at LUV’s long-term historic value patterns with a really long-term drawdown chart:

The massive image view, going all the best way again to the Nineteen Seventies, we will see Southwest inventory had 4 or 5 very important drawdowns, they usually have recovered from all of these in a well timed method. These are the types of cyclical shares I wish to put money into when they’re properly off their highs.

A few of the key components present LUV shareholders would possibly wish to think about are the pace at which the inventory value may fall, how deep the plunge might be, and the way lengthy they may count on the inventory to remain beneath the worth at which it’s at the moment. Over the previous 50 years, LUV has had ten sell-offs of 35% or extra as depicted within the desk beneath:

| ~Yr | ~Time Till Backside | ~Period | ~Depth |

| 1973 | 4 months | 6 months | -50% |

| 1974 | 6 months | 18 months | -60% |

| 1978 | 4 months | 8 months | -37% |

| 1981 | 4 months | 15 months | -49% |

| 1984 | 6 months | 18 months | -46% |

| 1985 | 2.5 years | 6 years | -59% |

| 1994 | 1 yr | 4 years | -60% |

| 1999 | 6 months | 18 months | -38% |

| 2001 | 8 years | 14 years | -78% |

| 2018 | 5+ years | ? | -61% right now |

Sometimes, with deep cyclical investments, I plan to purchase a inventory when it’s a sure proportion off its highs, after which promote it when it recovers that previous excessive. What I wish to know is what kind of returns I would count on if I purchase LUV at sure ranges off its excessive value. Normally, I solely wish to purchase it if I believe the returns might be superior to the market. I’ve shared this knowledge and calculations in earlier articles, however right here they’re once more:

Given what we all know from Southwest’s previous cycles, I will backtest entry factors after -35% and -60% declines. Investing after a -35% decline would have gotten us into all 9 of Southwest’s earlier main declines. Embedded in that entry level is the secular bull story that airways have now consolidated, gasoline costs keep decrease for longer, extra individuals wish to fly, and so forth. Investing after a -60% decline would have gotten us into 3 out of the 9 main downturns.

The desk beneath exhibits the outcomes one would have had they invested after a -35% decline in value throughout Southwest’s earlier downturns. The returns within the desk don’t embody dividends. I annualized the returns after which in contrast them to the S&P 500 if purchased and bought on the identical dates, annualized. The objective is to see if traditionally shopping for after a -35% decline could be an alpha-producing technique, so the final column is the alpha produced by the funding annualized relative to the S&P 500. All the chances needs to be handled as estimates and are primarily based on the approximate months held. If one buys after a ~35% decline and sells after the inventory makes a full restoration, it produces a ~55% easy return, so that’s the easy return for every of the investments within the desk beneath. I’ve excluded the years from the Nineteen Seventies as a result of the inventory was so thinly traded throughout these years, however they’d have produced stable alpha.

| Yr the Decline Started | Buy Date | Promote Date | Months Held | Annualized Good points | S&P 500 Annualized Good points | Annualized Alpha to the S&P 500 |

| 1981 | 7/29/81 | 9/1/82 | 14 | 47.14% | -7.24% | 54.38% |

| 1984 | 7/16/84 | 7/8/85 | 12 | 55.00% | 26.60% | 28.40% |

| 1985 | 5/1/86 | 1/18/91 | 56 | 11.79% | 8.85% | 2.94% |

| 1994 | 5/16/94 | 1/20/98 | 44 | 15.00% | 32.78% | -17.78% |

| 1999 | 9/22/99 | 7/24/00 | 10 | 66.00% | 14.08% | 51.92% |

| 2001 | 7/10/02 | 2/24/14 | 139 | 4.75% | 8.69% | -3.94% |

From 1980 onward, Southwest has been a blended bag by way of producing alpha if one invested after a -35% decline off the highs. In 1994 it will have considerably underperformed the S&P 500, and in 2001 it took over a decade to recuperate its earlier highs and likewise underperformed the S&P 500 throughout that point interval. As a common rule, I would like cyclical investments to recuperate inside 5 years, so the 2001 downturn is a significant difficulty for me.

Subsequent, let’s examine what kind of impact investing after a -60% drawdown in 1994, and 2001 would have had.

| Yr the Decline Started | Buy Date | Promote Date | Months Held | Annualized Achieve | S&P 500 Annualized Achieve | Annualized Alpha to S&P 500 |

| 1994 | 12/20/94 | 1/20/98 | 37 | 48.65% | 37.00% | 11.65% |

| 2001 | 11/19/08 | 2/24/14 | 63 | 28.57% | 25.69% | 3.98% |

Alright, the excellent news is that purchasing LUV after -60% would have produced nice returns and produced alpha through the 1994 and 2001 downturns. Moreover, the 63 months held through the decline that started in 2001, is fairly near my 60-month most popular time horizon as a result of although the downturn began in 2001, we would not have purchased till 2008. One can see from the information above why I’ve all the time been sluggish to purchase LUV. When shopping for -60% off its highs, the inventory nonetheless would have outperformed the S&P 500, however provided that one did not make an earlier buy.

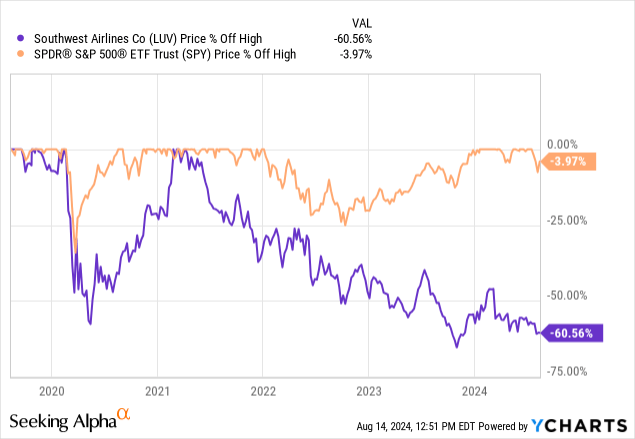

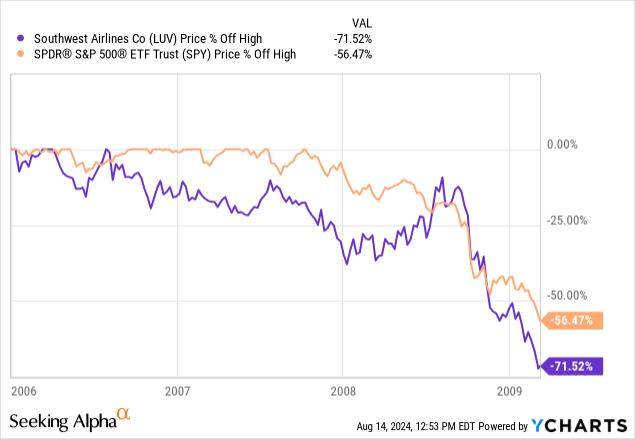

In my final LUV article, I made a decision I’d purpose to purchase after a -65% decline off the excessive as a substitute of -60%. I’ve since modified my thoughts and determined it is affordable to go forward and purchase after the -60% decline. There are three causes for this. The primary is that SPY hasn’t adopted LUV down this cycle.

The S&P 500 is close to all-time highs whereas LUV is down about -60%.

Now let’s examine the drawdowns to 2008:

Close to the underside of the Nice Recession, SPY had truly fallen practically as deeply as LUV off its excessive. This made it tougher for LUV to outperform popping out of the recession. This dynamic has modified this time round. The chances of LUV producing important alpha if it recovers are a lot increased.

The second I believe it is affordable to purchase now could be that it appears to be like just like the Fed is poised to begin reducing rates of interest, and there’s some probability (although not my base case) that we would get a mushy touchdown within the US. My portfolio, which holds roughly 1/third money proper now, is positioned significantly properly for a real mushy touchdown, so I believe it is affordable so as to add a couple of shares that would outperform underneath these circumstances.

And the third cause is we now have an activist investor, Elliot Administration, pushing for wanted modifications at Southwest.

Activist Buyers

Many instances previously I’ve had activist traders are available in when shares are barely above my purchase costs, and as soon as it grew to become publicly identified the activists had taken a stake, it successfully put bottoms underneath the shares earlier than I may purchase them. A few of the time, activist traders are simply searching for a fast turnaround within the inventory value and do not deliver something of substance to the desk (I am not mentioning names). These cases have a tendency to bother me essentially the most as a result of they’ll forestall me from getting the costs I would like when a inventory is down. There are one or two activists, nonetheless, who deliver some constructive concepts to the desk and genuinely purpose for a medium-term turnaround within the enterprise. Typically talking, I consider Elliot as one that usually legitimately has one thing to supply. So, we now have a case right here, the place not solely would possibly I not get my decrease purchase value, however we would even have a constructive catalyst for the enterprise over the medium time period.

As I wrap up the writing of this text, it was introduced at the moment that Elliot is planning to appoint 10 new administrators to LUV’s board. My view is that Southwest’s administration has made errors. On the very least, they’ve been extremely reluctant to adapt to the instances as we noticed with their scheduling fiasco in December 2022 when 60% of flights have been canceled. It is clearly an organization in want of change, and they’re persevering with to stubbornly combat it.

Conclusion

Southwest is prone to have persistent headwinds over the subsequent yr. The financial system is slowing, the primary provider of their plane, Boeing (BA) is in shambles, and administration is underneath strain to alter issues which have historically labored for Southwest, however which have been uncovered to have severe points. Nevertheless, one among Southwest’s issues relative to friends is that post-pandemic, many vacationers selected to journey internationally the previous two years as a substitute of domestically. It is probably this worldwide journey growth shifts again extra towards home journey, and this could assist Southwest’s worth proposition for home flights. Moreover, decrease rates of interest would possibly have the ability to cushion a slowing financial system sufficient to keep away from a 2008-like recession, which Southwest inventory is near being priced for proper now. So, we would have a slowdown slightly than a recession. And eventually, most different shares are nonetheless fairly costly, so if the financial system does discover a method to muddle by over the subsequent 5 years, the potential good points in a inventory like Southwest dwarf the typical S&P 500 inventory. I believe aiming for a 100% return in Southwest inventory is affordable inside 5 years. It is uncertain there’s any situation the S&P 500 comes near that stage of return.

All that mentioned, cyclical shares are unstable and dangerous if there’s a dangerous recession. Most different airways have gone bankrupt in some unspecified time in the future previously 20 years. For that cause, I restrict particular person place weighting for deep cyclical shares to 1% weighted positions and select to unfold that danger round just a little bit slightly than think about a single cyclical inventory. That is the weighting I just lately took with my Southwest inventory buy. Now it is time to watch for a medium-term restoration.