Oh No! The Penalties Of My Personal Actions…

Ah, Sunday, Sunday — so nice to me!

Time to take a seat down and chow down on the Sunday simmer-down. How does it really feel, Nice Ones?

To be alone? With no course dwelling?

Umm … no. How does it really feel to be via the most important, best, most jam-packed week in earnings season? I imply, how usually can we get to cowl just about each Massive Tech identify in a single week?!

The remainder of the market’s nonetheless digesting final week’s reviews, and subsequent week’s earnings lineup is a veritable feast in its personal proper…

Huh, in order that’s why I’m so bloated this morning.

Welp, get that feed bag again on, Nice Ones — we ain’t out of the Massive Tech woods simply but!

There are a number of free ends to tie up … a number of leftovers on the earnings plate to clear … earlier than we get a soar on an entire new week of company reporting.

Proper off the bat, did you see that ludicrous show the opposite night time?!

The very second Amazon.com (Nasdaq: AMZN) entered the earnings confessional, you would hear the DINGs within the distance as 1,000,000 Robinhood accounts cried out in terror: “Amazon is down 8% after hours. Nope, now 9%. 10%!”

You get the gist. You’ve gotten my condolences, AMZN merchants … however you had been warned.

You had been warned a number of instances all through the week, truly. Final Saturday’s Nice Stuff predicted that Amazon may need its first quarterly loss since 2015, ought to the losses of Rivian’s rip tide come a-calling. And oh, it did.

Like Ford (NYSE: F) earlier than it, Amazon’s funding in Rivian dragged on the corporate’s in any other case “meh” earnings, sinking the inventory … just about as Nice Stuff anticipated.

In order that’s one fortune cookie prediction come true … what else ya acquired?

Nicely, did you are expecting that we’d nonetheless be speaking concerning the Twitter (NYSE: TWTR) takeover two three weeks later? Shock: There’s extra.

Earlier this week, Nice Stuff identified that point when Tesla’s (Nasdaq: TSLA) administration warned: “If Elon Musk had been pressured to promote shares of our widespread inventory that he has pledged to safe sure private mortgage obligations, such gross sales may trigger our inventory worth to say no.”

With TSLA inventory plummeting over 15% within the wake of the Twitter buyout, this distant early warning was all however confirmed. And we solely needed to wait till Friday for official filings to come back out: Elon’s TSLA sell-a-thon is on, with the Tesla CEO promoting about $8.4 billion in TSLA inventory this week alone.

Wonderful work from Mr. Musk, as traditional.

Now that simply wraps it up and — oh, wait a second. Who’s this latecomer to the celebration right here?

Ah, that figures: Unfashionably late as all the time, Intel (Nasdaq: INTC) determined it wanted a while within the tech roundup highlight too. One in every of as of late, I’ll be an actual chipmaker, simply you watch!

To shut out the week’s earnings with each a bang and a whimper — don’t assume an excessive amount of into that — Intel reported declining income and earnings that in some way nonetheless limped previous analysts’ estimates.

The opposite different unhealthy information? Outlook was blended at greatest, and Intel predicts the chip scarcity will final till 2024.

On the brilliant facet, information heart gross sales had been up 22%, and should you’ve been following the duel of the info heart fates between Intel, Nvidia (Nasdaq: NVDA) and AMD (Nasdaq: AMD) … you understand how necessary it’s for Intel to start out taking part in ketchup and achieve again market share right here.

You additionally would possibly keep in mind Nice Stuff lamenting Intel’s slipping information heart dominance final summer season — that’s what occurs whenever you’re busy specializing in redefining nanometers as a substitute of, you already know, ramping up your manufacturing capability like the large boys, Nvidia and AMD.

Whereas it’s good to see Intel have some confidence in subsequent quarter’s information heart gross sales (Let’s face it: Any confidence from Intel is a shocker in itself), Intel’s in bother if it thinks this paltry report can stand as much as the beat-and-raise outcomes that AMD’s been dropping.

Additionally … known as it.

Don’t break your arm patting your again now, Nice Stuff. For those who’re within the temper to prophesize, gimme one thing new!

We’re getting ready to an existential improvement that may very well be mankind’s greatest invention. Acquired your consideration now?

Proper now, tech leaders are dashing to roll out their very own variations of this new expertise. As a result of they know that whoever brings their radical new innovations to the market the quickest could have a first-mover benefit within the highest-growth business of the twenty first century.

And proper now, there’s a little-known inventory on the heart of all of the motion.

Ace Of Coinbase

Cathie Wooden’s ARKK could have some holes in its hull, however with crypto making a comeback, ARKK’s fifth-biggest holding is buying and selling at a beautiful low cost…

You, Me & EV Affordability?

One tiny inventory is crucial to the upcoming electrical car increase — and Ian King says now’s the time to get in.

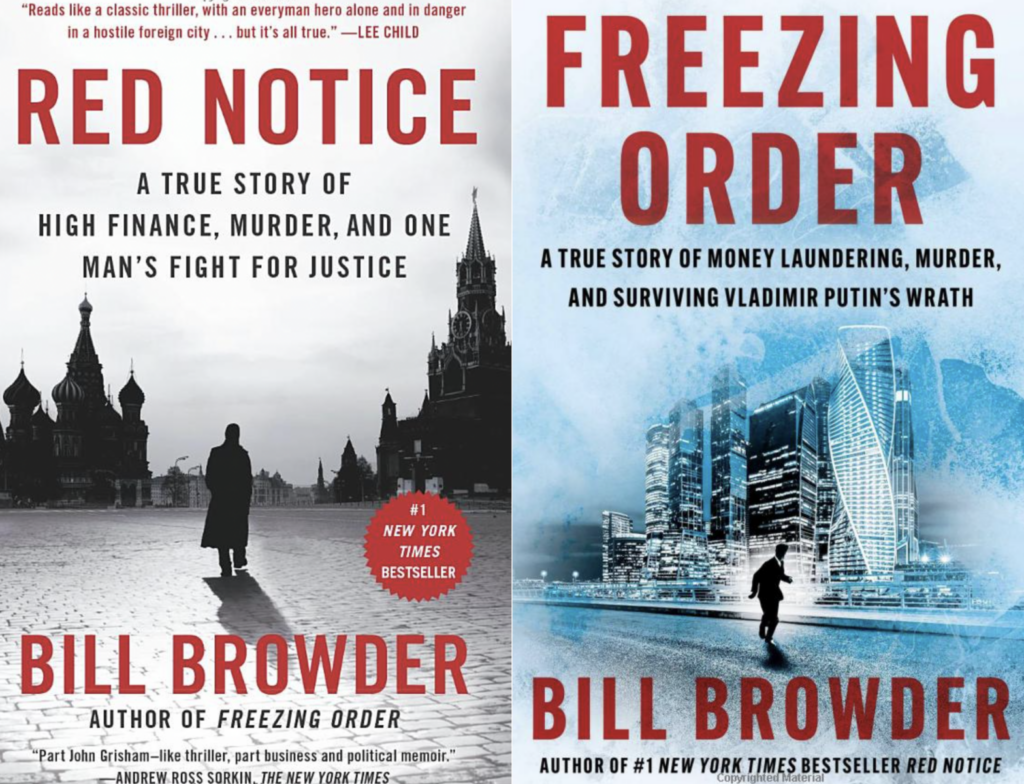

Massive Mac’s Massive Burrito Mistake

Nowadays, the mere point out of Chipotle is sufficient to give McDonald’s execs heartburn. However traders who held these candy spinoff shares? Nicely, that’s a distinct story…

Synthetic Intelligence — Actual Earnings

These tech titans imagine AI will change into the most important breakthrough in all of human existence — much more so than the web!

Tenacious MSFT & The Tech Inventory Of Future

Be you angel traders? Nay, we’re however Nice Ones! Microsoft isn’t the best inventory on the planet. No! It’s only a tribute!

Get pleasure from the remainder of your weekend, Nice Ones! We’ll be again with you tomorrow to … properly … do it over again.

Within the meantime, write to us at any time when the market muse calls to you! [email protected] is the place you may attain us greatest.

You may as well try our again pages right here:

Till subsequent time, keep Nice!