The economy is beginning to stall as the Fed has repeatedly increased its discount rate over the past few months to fight inflation. As Jerome Powell put it, “We have got to get inflation behind us,” even “if the chances of a soft landing are likely to diminish.”

Inflation did edge down last month and has possibly peaked. Unfortunately, if it has peaked, it is likely because we are on the edge of or in a recession. Mass layoffs have been announced at multiple large companies (11,000 at Facebook, 10,000 at Amazon, etc.), and new housing starts have plummeted.

A survey by the National Association of Business Economics found 72% of economists predict a recession in 2023 (and one with high unemployment, unlike the technical recession of Q1-Q2 2022), and the Bloomberg Economics model puts the odds at 100%.

So, we can expect relatively high inflation and a recession in 2023 while interest rates on the average 30-year mortgage have more than doubled over the past year.

While a housing crash like 2008 is extremely unlikely, real estate prices have already started to decline (at least month-over-month prices have), and needless to say, this isn’t a particularly ideal market to be buying in.

And we should remember that historically speaking, the Federal Reserve’s discount rate as of this writing (4%) is still low by historical standards.

U.S. Federal Funds Rate Over Time – Trading Economics

On the other hand, housing prices have gone up substantially faster than inflation. Bill McBride at Calculated Risk has put together a “housing affordability index” that takes into account median income, housing price, and interest rates, and this is what it looked like back in June.

This shows that housing is as unaffordable as it’s been since just before the Great Recession, and that was back in July. It’s certainly gotten worse in the past few months. But even still, affordability is better than it was back when Volker broke the back of inflation in 1982 by jacking interest rates through the roof.

So how should investors approach this volatile real estate market? Well, as I like to say, every market has pluses and minuses. In a buyer’s market, it’s easy to buy, not sell. In a seller’s market, it’s easy to sell, not buy. In this odd market, creativity could be the key. But first, let’s look at the straightforward advice for flippers and homeowners.

Advice for Flippers and Wholesalers

Six months ago, the market was on fire and assuming you could find a motivated seller or value-add property, it wasn’t usually tough to find an end buyer for it. That is rapidly starting to shift. And it’s likely to shift more. For flippers who need to rehab a property and won’t likely list it for sale again for 2-6 months, you should assume the market will be worse than it is now. It would be wise to reduce your maximum acceptable offer from 5-10% as a contingency.

Wholesalers need to realize they need a better deal than in the past to entice end buyers. In addition to lowering your offers, you should also consider asking for longer closing times, as it may take longer to find one. And, of course, you should be honest and open about what you’re doing with the seller. Don’t pretend you’re the end buyer.

Need to Move? Rent Your Home

Whether you are a real estate investor or not, if you own your home and need to move for work or other reasons, selling your home is not the way to go.

Instead, it makes more sense to rent out your current home and then rent where you are moving (assuming it doesn’t make sense or is unaffordable to buy there).

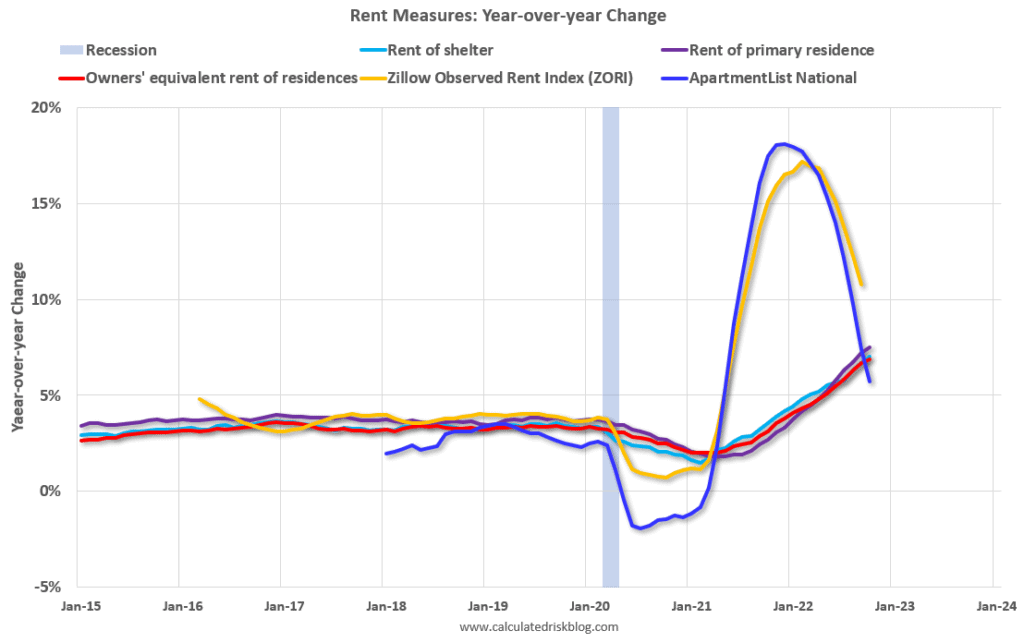

Rent prices across the country are trending back down after skyrocketing in 2021. Indeed, the graph for rent prices is quite the roller coaster:

While this will make it less profitable to rent out your current property, it will also make it much more affordable to find a place to rent where you’re going. And the benefits of holding real estate accrue over time, whereas renting is temporary.

Whenever rates go back down, you can simply buy a home where you have moved to. Although I know, that makes for a lot of moving, and moving sucks, it’s the price we pay for financial freedom.

Subject To and Seller Financing

The last time we had high-interest rates (and again, they were much higher than now) was in the 1970s and early 1980s. And that was when seller financing first became popular. As interest rates make traditional lending options less attractive, seller financing can again become a useful tool.

One of the best groups to market to is those without any debt on their properties. About 37% of homeowners have no mortgage. For such owners, seller financing at a lower interest rate can be an important point of negotiation. Indeed, many such owners are older and would rather have a stream of income than a lump sum.

Subject to deals is an even more attractive possibility. Subject to means you buy the property “subject to the existing financing.” In other words, the seller’s name stays on the mortgage, but the buyer begins making the mortgage payments.

It should be noted that this technically triggers the due on sale clause in every bank’s mortgage documents. This would give the lender the right to foreclose, and while it’s rare they do this, it’s something you need to be aware of.

The vast majority of mortgages these days are fixed-rate, and most were taken out between 2018 and early 2022 when rates were very low. Being subject to one of these low-interest loans is an enormous boon. Remember, a great deal can be made with terms. It isn’t all about the price.

One other point to be mindful of here is that the last time subject to deals was popular was shortly after the housing crash in 2008 when credit markets were tight. The advantage was predominantly that it allowed a buyer to purchase the property without much cash down or without having to seek a bank loan.

Today, the advantage has to do with the interest rates of the loans. That means most buyers will want to hold those loans for a long time and likely the duration. The seller will likely not be okay with this, especially since being stuck with a mortgage in their name could interfere with a future attempt to get a new mortgage on a different property. You should be honest and forthright about how long you intend to hold the loan in their name and stick to your word.

Cash Purchases and Partners

When interest rates are high, cash is king. Of course, “have money” isn’t particularly helpful advice, as this tweet amusingly points out:

But even if you don’t have money, that doesn’t mean you can’t buy with cash. Whereas private loans may have been the best way to raise money a few years ago, partnerships may be more enticing now; i.e., you do the work and bring the deal, the partner brings the cash, and you split the deal. You can find such partners the same way you would find private lenders.

For these, the pitch should include a plan to refinance with a bank loan and pay off most of the equity partner’s investment whenever rates come back down.

Buying Portfolios

This one is a bit more speculative, but we have seen a notable uptick in the number of sellers liquidating portfolios of houses and small multifamilies. Indeed, we have purchased four such portfolios in 2022 alone and have sort of made this our specialty.

From what I can tell, a combination of reasons have led to this, which I believe are:

- Many owners of portfolios (particularly between 5-30 units) couldn’t keep up with rent increases over the past few years and now have quite under-rented portfolios, which they don’t want to deal with.

- In this interest-rate environment, it doesn’t make sense to refinance, and it would be difficult and take a long time to sell many scattered sites individually.

- The general difficulty of managing a group of spread-out houses and small multifamily units.

I should also point out that they usually sell these portfolios at significant discounts. The four we bought this year were, from my estimates, between 75%-80% of their value.

If you are fairly well established and can handle low cash flow on a newer purchase for the immediate future while you get the rents up, this could be an opportunity to explore.

Conclusion

It’s important to remember that every real estate market has its advantages and disadvantages. When it’s hard to find good deals, it’s usually easy to sell. The same goes for a market teetering on the edge of a recession with high inflation and high-interest rates.

You just might have to be a bit more creative.

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

Learn more about Fundrise

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.