Joa_Souza

In my view, Itaú Unibanco Holding (NYSE:ITUB) is essentially the most strong monetary establishment in Brazil backed by its custom, excessive variety of clients, and constantly excessive internet revenue. After being overtaken by Nu Holdings (NU), it is now not the most important financial institution in market cap however nonetheless deserves a distinguished standing for its consolidation and custom within the banking sector.

In Q2 earnings, this continued to be strengthened, with Itaú reporting R$10bn in internet revenue, whereas Banco do Brasil (OTCPK:BDORY) was its closest peer, with R$9.72bn, Nu Holdings and Banco Bradesco (BBD) did not even attain half that stage.

With excessive profitability and aggressive dividends, the obstacles to Itaú’s thesis are primarily twofold. The primary is present in all corporations uncovered to the Brazilian home state of affairs, that are fiscal, financial, and alternate price dangers. The second is its margin of security, which is now not so enticing in contrast to a couple latest quarters since Itaú Shares (ITUB4) have superior 38% within the final 12 months, with a spotlight being the ~11% advance because the starting of August.

Even so, Itaú’s shares are at a really affordable stage contemplating all its moats, making it a high quality transfer.

Overview of Itaú’s Sturdy Q2 Earnings

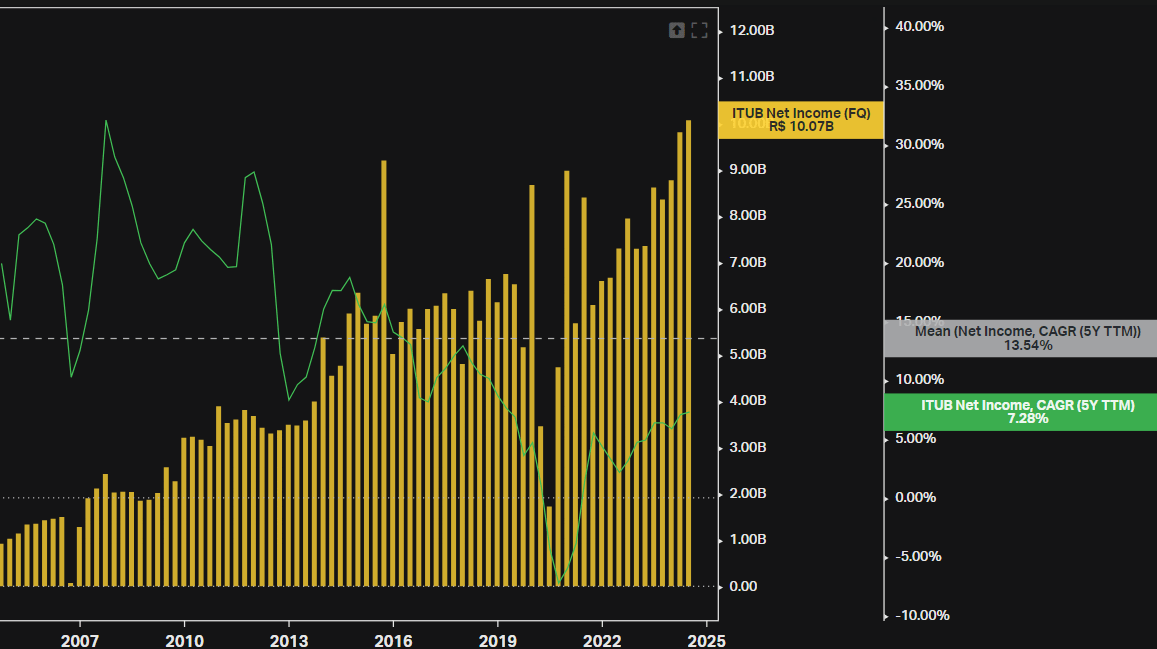

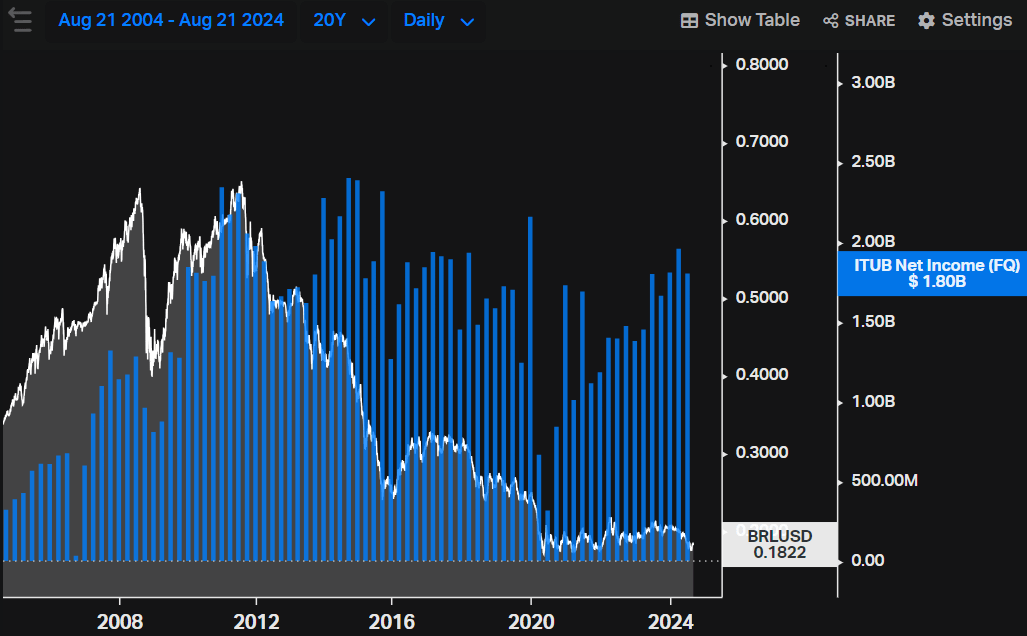

Itaú’s Q2 earnings had been fairly robust and solidified a wonderful latest observe document. Within the aftermath of the pandemic, even in a stronger aggressive surroundings in opposition to fintechs, Itaú proved able to innovating and constantly elevated its internet revenue quarter after quarter. With this, the Web Earnings CAGR of the final 5 years was 7.28% even with an already very excessive internet revenue quantity, whereas the common of the final 20 years was 13.5%.

Koyfin

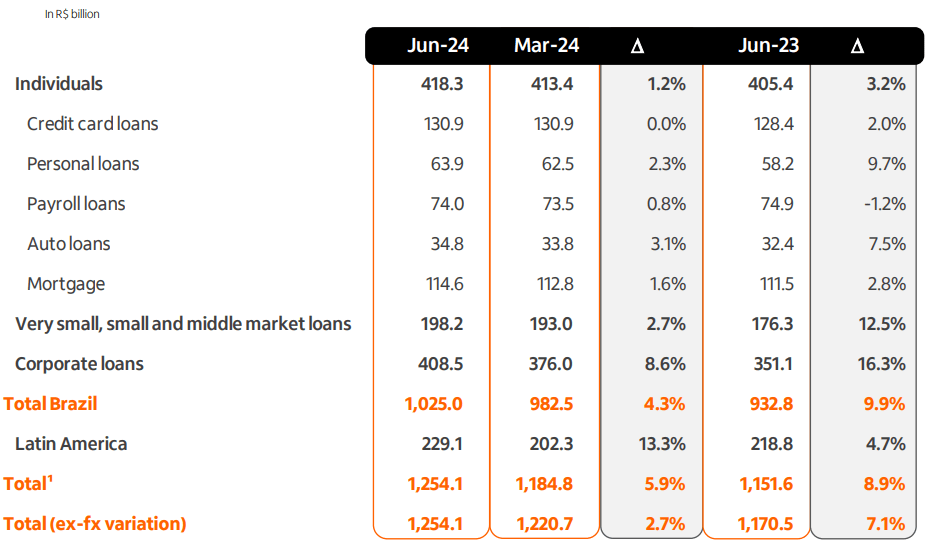

Operational indicators and higher monetary margins with purchasers and with the market drove this internet revenue. In Q2, Itaú’s whole credit score portfolio superior 5.9% in opposition to Q1, reaching R$1.25 trillion, with a spotlight for company loans which superior 8.9%, and Latin America, which grew 13.3% pushed by alternate price components.

Itaú Unibanco’s Q2 Presentation

Regardless of this progress, the consolidated 90-day NPL remained secure at 2.7%, whereas the consolidated 15-90-day NPL fell from 2.4% to 2.3%. The renegotiated portion of the portfolio additionally fell and shrank to three%, in opposition to 3.2% in Q1. The protection ratio fell barely, from 221% to 215%. Lastly, CET I additionally fell as a result of increased internet revenue, from 13% to 13.1% (14.6% with further tier I). In different phrases, the primary high quality indicators are nonetheless very strong and provides confidence to the shareholder.

As for effectivity and profitability indicators, monetary margin with purchasers rose from R$22.8bn to R$23.4bn, boosted by each increased quantity and better unfold. Commissions and insurance coverage additionally superior 5% in opposition to Q1, pushed by a progress of greater than 33% in advisory companies and brokerage. This, mixed with good expense administration, illustrated by an effectivity ratio that reached 37% within the first half of 2024, meant that the recurring managerial consequence reached R$10.1bn, with an ROE of twenty-two.4%.

It’s value mentioning that the financial institution has a steerage for 2024 of progress between 6.5% and 9.5% for the credit score portfolio, a progress for the monetary margin with purchasers between 4.5% and seven.5% whereas core non-interest bills develop in line/beneath inflation. Based on administration, the expectation is that by the tip of this 12 months, there will likely be a greater imaginative and prescient, prospects, and a few alternatives that ought to permit calibration and perform a brand new (extraordinary) dividend distribution, particularly after the uncertainties concerning laws, IFRS9 discussions, and the like.

“Our expectation is to finish the 12 months with a great imaginative and prescient, potential, 4 alternatives of regulatory, points, good operation of capital capability of producing natural capital. So we will do a great calibration and do one other funds of extraordinary dividends. With the knowledge that I’ve at present, the fee will likely be finished. There will likely be a unprecedented dividend. However we additionally see as a bonus that we’ve got a capital base that could be very strong, as a result of the alternatives will come up.”

– Milton Maluhy, Itaú Unibanco’s CEO

Itaú Stands Out within the Banking Sector

Itaú’s thesis differs drastically from some corporations I’ve written about lately, reminiscent of Nu Holdings and PagSeguro (PAGS). Not like these fintechs the place the main focus is on progress and, within the case of Nu Holding, sacrificing a horny valuation, and within the case of PagSeguro, sacrificing higher security, in Itaú’s thesis the main focus is on high quality and safety (whereas not shedding all the expansion). In relation to its conventional friends, Itaú additionally stands out when it comes to high quality, with the next and extra constant ROE than Bradesco, and with out the state threat of Banco do Brasil.

Presently, the Selic rate of interest is at 10.5% and as Itaú is a predictable money cow, many buyers see Itaú Shares as a spot to earn barely above this price, one thing like this stage with a small fairness threat premium (for instance, a return of 13% per 12 months in Brazilian Reais).

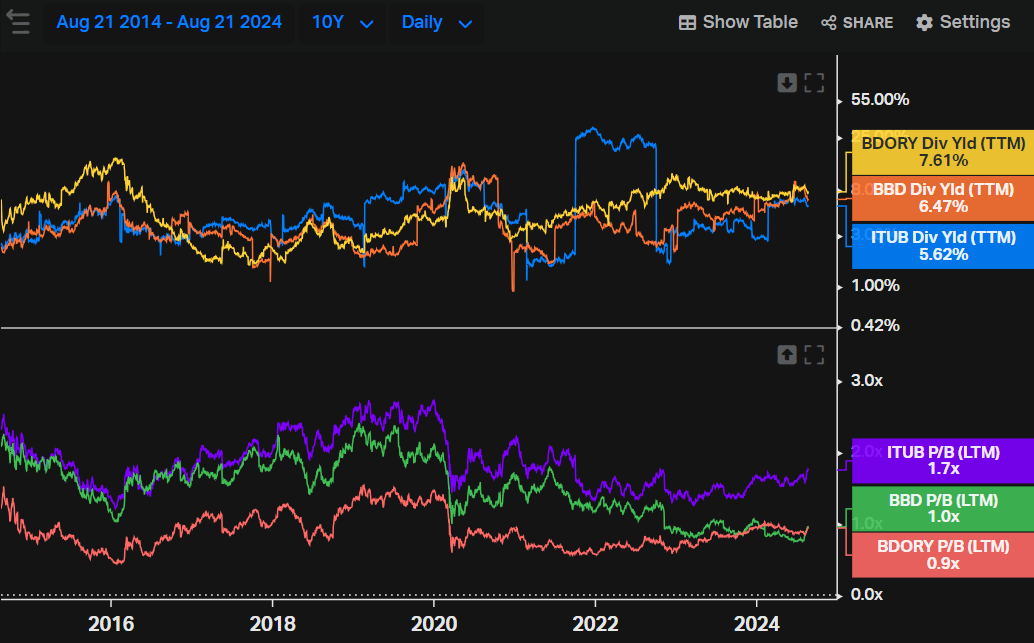

Combining this predictability, increased high quality, and decrease threat than its important friends, Itaú is buying and selling at a premium. Its price-to-book is 1.7x, an affordable stage for a financial institution with an ROE above 20%, whereas Bradesco’s is 1x and Banco do Brasil’s is 0.9x. The dividend yield for the final 12 months was 5.6%, whereas BBD’s was 6.47% and BDORY’s was 7.6%.

Koyfin

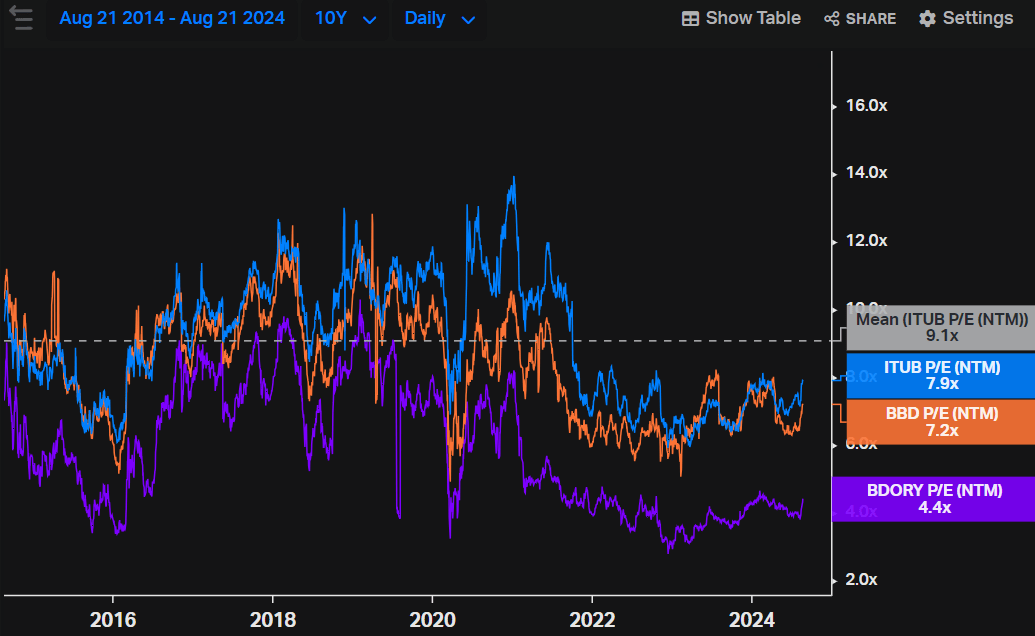

For ahead price-to-earnings, Itaú can also be buying and selling above these different two, with a stage at the moment at 7.9x, beneath its common of the final 10 years which was 9.1x. It is value noting that Itaú is reporting pretty constant earnings (i.e. it’s miles from being in its “low” cycle), and if there aren’t any detrimental macroeconomic surprises that forestall this advance from persevering with, it is attainable to anticipate a small upside via the normalization of those multiples.

Koyfin

In different phrases, this “premium” valuation stage is totally justifiable, and 8x earnings for a financial institution that delivers progressively constant earnings and a month-to-month dividend yield is an fascinating stage.

Itaú’s Valuation Is Stable However Not a Large Discount Anymore

Within the first chart of Itaú’s internet revenue, it may be seen that from mid-2014 to 2019 there was a sure stagnation in its internet revenue, partly attributable to the financial disaster. That is the true threat of the thesis, Itaú not with the ability to develop its internet revenue on the anticipated price as a result of macroeconomic obstacles. That is much more pronounced when considered in US {dollars}. Within the final 5 years, the Brazilian Actual has devalued (in opposition to the US greenback) by ~24%. This makes the American investor’s place riskier and reinforces the warning wanted when shopping for rising nation shares. As an example this, the graph of internet revenue per quarter seems very completely different in {dollars}, with stagnation since mid-2010.

Koyfin

That is a two-edged sword. If there’s a robust appreciation within the BRL, international buyers would profit. Though this isn’t the bottom state of affairs – with the Brazilian Central Financial institution having extra secure estimates for the alternate price, and a problematic fiscal coverage, however rates of interest nonetheless at a restrictive stage and inflation okay – this might occur because of the cyclicality of the Brazilian financial system, being instantly and not directly affected by commodity cycles (be aware the appreciation of the Brazilian Actual up till the subprime disaster in 2008).

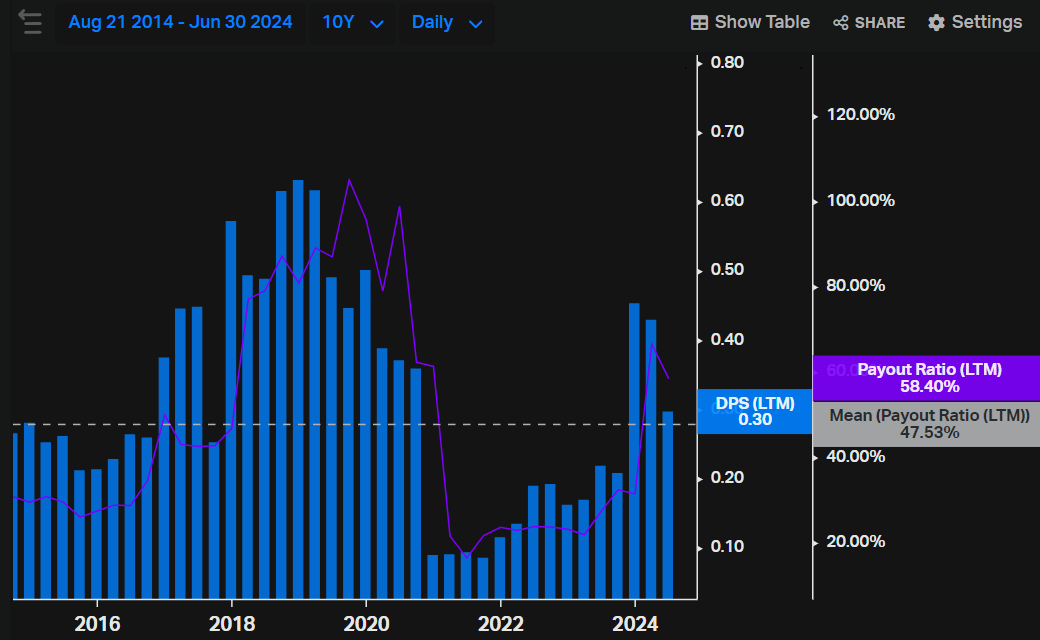

With these dangers, it’s essential to undertake conservative assumptions when valuing Itaú, each when it comes to the financial institution’s future progress and the low cost price. Traditionally, Itaú has distributed round 50% of its internet revenue, which has already offered an fascinating stage, with a dividend per share imply of $0.32. Presently, these indicators stand at 58.4% and $0.30, respectively.

Koyfin

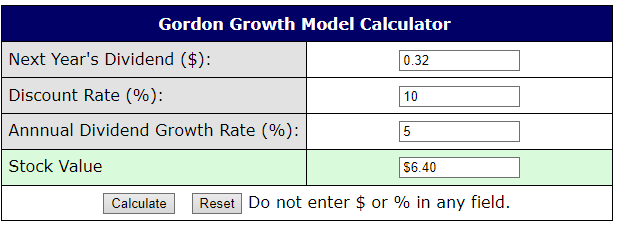

Contemplating the dangers in Brazil and fewer aggressive progress for Itaú’s operations (given its consolidation), we are going to undertake conservative assumptions in a dividend low cost mannequin. With subsequent 12 months’s dividend of $0.32 barely above the present DPS, reflecting the evolution of earnings; a reduction price of 10% which is a wonderful stage and already pays effectively even contemplating the alternate price threat; and a progress price of 5%, affordable contemplating the latest historical past and the power to extend the payout in secure eventualities. These assumptions mirror a good worth of $6.40 for ITUB Shares.

buyupside.com

This honest worth could be barely beneath the present worth, which already demonstrates a correction within the margin of security. However, though I see this worth as a greater entry-level, the ~$6.80 at which the shares are buying and selling at present shouldn’t be costly both, and contemplating the conservative assumptions, they’re nonetheless able to producing shareholder worth through dividends.

Closing Ideas

Even after the beneficial properties in ITUB shares, a really conservative dividend low cost mannequin is ready to discover a honest worth barely beneath, which supplies that though the margin of security shouldn’t be big, it nonetheless exists. This turns into much more true after we examine it with different alternate options in Brazil, reminiscent of Nu Holdings, Petrobras (PBR), or Vale (VALE), which, though good corporations, provide higher volatility and fewer predictability when in comparison with Itaú.

Thus, Itaú seems to be a secure method to acquire publicity to Brazil, which comes with macroeconomic and alternate price dangers, however that are partially offset by month-to-month dividends and a horny dividend yield, serving to with the price of carry.