ewg3D/E+ by way of Getty Pictures

Latest occasions have naturally piqued investor curiosity within the protection sector. Regardless of the final result of the Ukrainian battle, evidently the democracies, generally, have acknowledged the truth that the world has develop into much less peaceable and that considerably increased ranges of protection spending will likely be wanted sooner or later. Even perennial laggards Japan & Germany have accepted that actuality – with the ruling social gathering concentrating on a rise in protection spending from the post-war cap of 1% to 2% within the case of Japan and Germany additionally elevating to 2% however with the addition of a one-off rearmament program of E100 billion (approx. $110 billion). Whereas the US has to date lagged behind, it appears seemingly that the subsequent Congress and the subsequent administration will likely be much less recreant.

Many buyers have due to this fact develop into extra within the protection sector. Nevertheless, it is a notably tough sector during which to decide on particular person shares. Not solely are the applied sciences arcane and tough to investigate, however the equally tough points of presidency budgeting, pork barrel contracts, and nationwide procurement insurance policies have to be thought of. Many buyers (together with this one) are due to this fact inclined to make use of index funds to get broad sectoral publicity to the US protection sector. At this time I evaluate two such funds – the iShares U.S. Aerospace & Protection (BATS:ITA) and the SPDR S&P Aerospace & Protection (NYSEARCA:XAR).

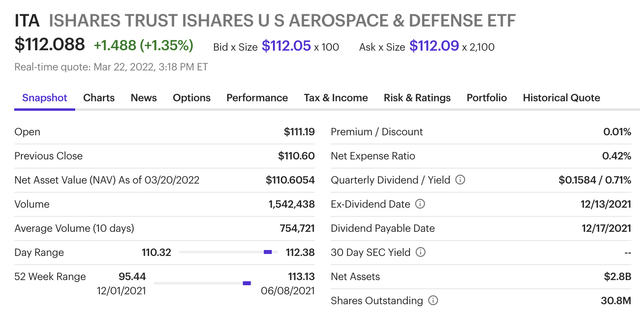

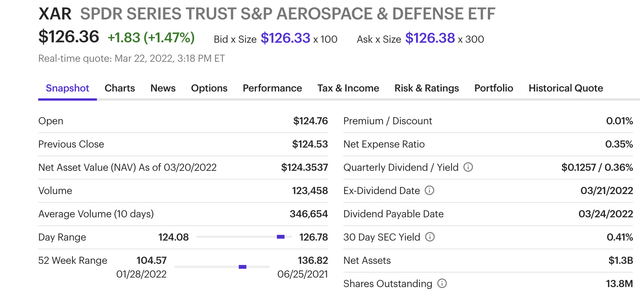

ITA (E*Commerce) XAR (E*Commerce)

These funds are superficially comparable – since they each monitor, to a big diploma, the S&P Aerospace & Protection Choose Business Index. Nevertheless, buyers might want to think about three areas of distinction.

Yield

ITA’s yield of 0.71% is considerably increased than XAR’s ).41%, regardless that ITA has materially increased charges (0.41% vs. 0.35%). Since a major variety of protection corporations are comparatively younger and/or in emerging–technologies, the sector as an entire doesn’t usually pay out a excessive yield, however in evaluating two considerably comparable funds, the distinction is essential – Benefit ITA.

Liquidity

Each funds are comparatively giant and liquid, and each have listed choices. Nevertheless, ITA’s internet property (each funds are unleveraged) of $2.8 billion are greater than twice XAR’s $1.3 billion, and ITA’s liquidity is proportionately increased, with a present ten-day common quantity of 755,000 vs. XAR’s 347,000 (the unit costs are comparable. Once more, benefit ITA.

Portfolio Choice

Whereas each funds monitor the identical index, there’s an apparently minor however truly very consequential distinction of their inventory choice methodology.

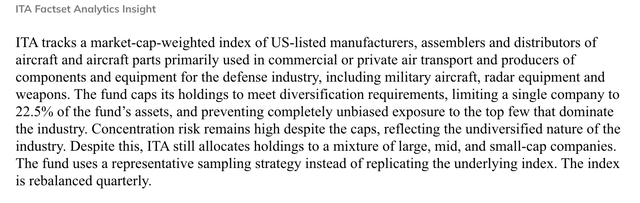

ITA describes their coverage as follows:

ITA Inventory Choice (and so on.com)

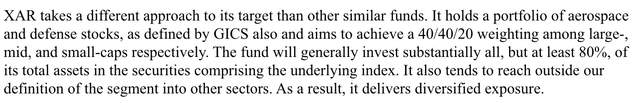

Whereas XAR says

XAR Inventory Choice (and so on.com)

The consequence of that is fairly totally different portfolios (each funds present each day updates).

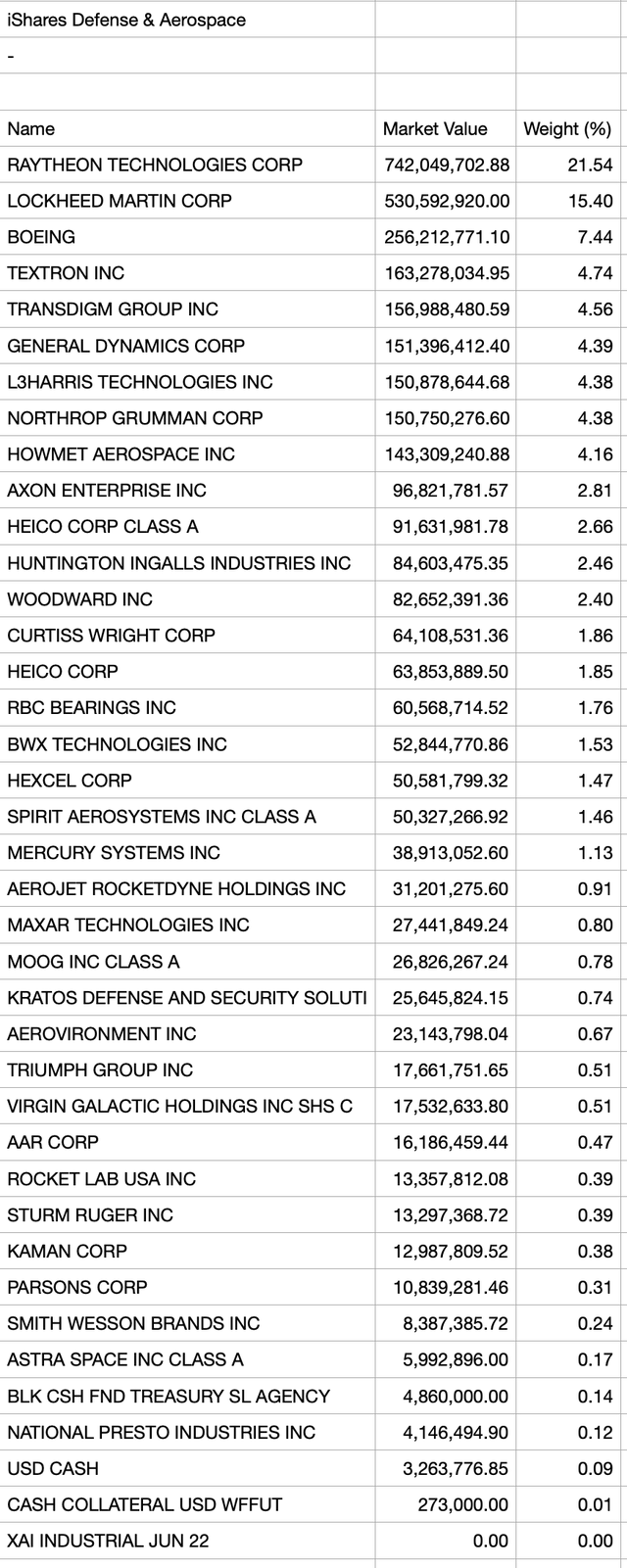

ITA has:

ITA Holdings (iShares)

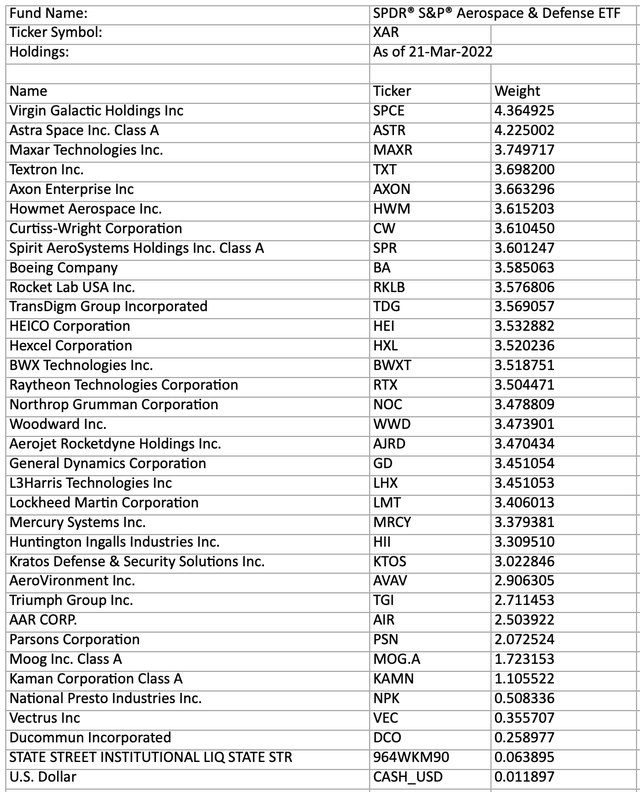

and XAR has:

XAR Holdings (State Avenue)

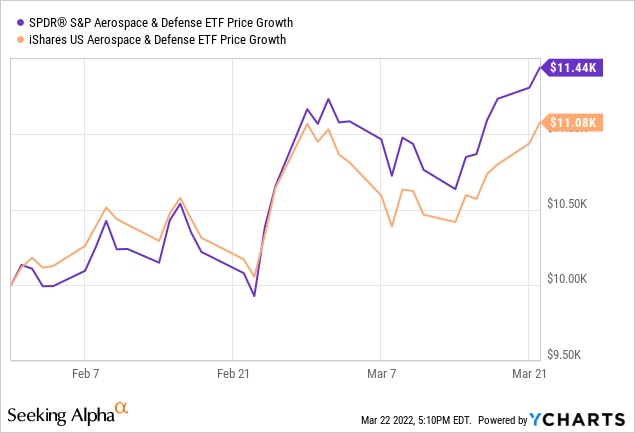

There are a number of variations, however essentially the most vital one and, in my opinion, the one which explains the relative out-performance (proven above) of XAR for the reason that Ukraine disaster flared up, is the relative weighting of Boeing (BA). XAR has 3.59% Boeing, whereas ITA has much more at 7.44%. Boeing is, after all, a protection firm, however it’s way over that. Its troubled industrial plane division, whereas smaller in revenues than the protection phase, has been solely liable for the corporate’s large working losses over the past a number of years.

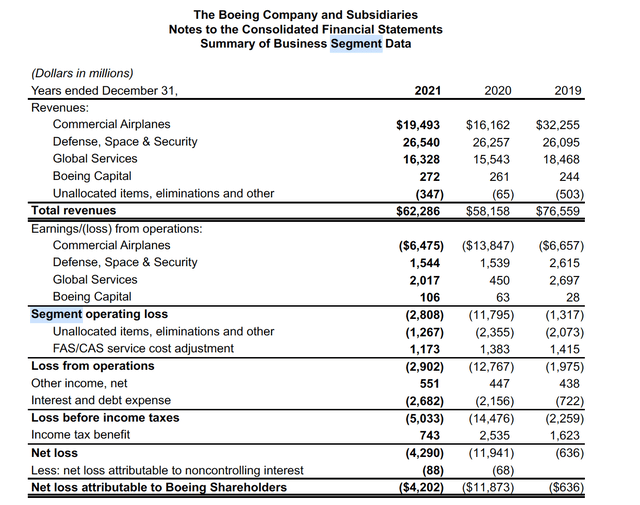

Boeing segments (Boeing Annual Report 2021)

Moreover, the industrial plane enterprise as an entire is negatively correlated to the protection enterprise, as Boeing World Providers phase is now demonstrating. Whereas Boeing’s leasing arm (Boeing Capital) has comparatively little publicity to Russia & Ukraine, the whole industrial plane enterprise may be very uncovered to any battle (navy or diplomatic) with China.

Boeing & China (Boeing Q2 ’21 10-Q)

The issue with Boeing shouldn’t be that it’s a dangerous firm (for my part) however that the cut up of its enterprise makes it neither fish nor fowl. The industrial enterprise will prosper if the world financial system expands and turns into extra peaceable, and in that circumstance, the protection enterprise will decline and act as a dead-weight impeding the inventory worth. Conversely, in troubled instances, the state of affairs will reverse and the protection enterprise will cost forward, whereas the industrial plane enterprise will maintain the inventory worth again. This makes it undesirable as a fund holding for buyers who’re in search of to learn from both circumstance.

Due to this fact, XAR’s lesser publicity to the industrial plane enterprise makes it a purer protection play. For these buyers in search of primarily protection publicity, benefit XAR.

Conclusion

It’s tough to keep away from fully publicity to Boeing when investing in protection. Nevertheless, I want to attenuate that publicity, and due to this fact, I want XAR to ITA, regardless of the latter’s slight benefits in yield & liquidity.