tadamichi

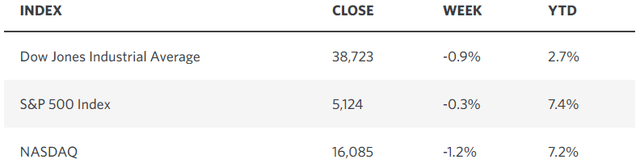

Last week may have marked a pivotal moment in this bull market cycle, and it is not because the S&P 500 finished lower for the week for only the third time in the past 19 weeks. On the contrary, there was an abundance of good news. A stellar jobs report for February showed continued job creation alongside softer wage growth for a labor market that is gradually cooling. That is what we need to maintain the disinflation trend that leads to a soft landing and the beginning of an easing cycle by the Fed. As a result, the probability in the futures market that the first rate cut comes in June increased meaningfully, and the consensus expectation is back to a full percentage point reduction by the end of 2024.

Edward Jones

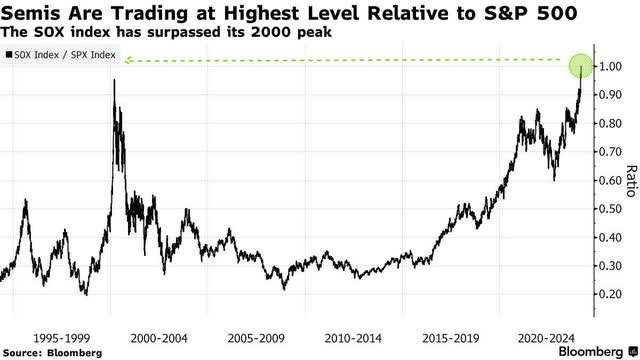

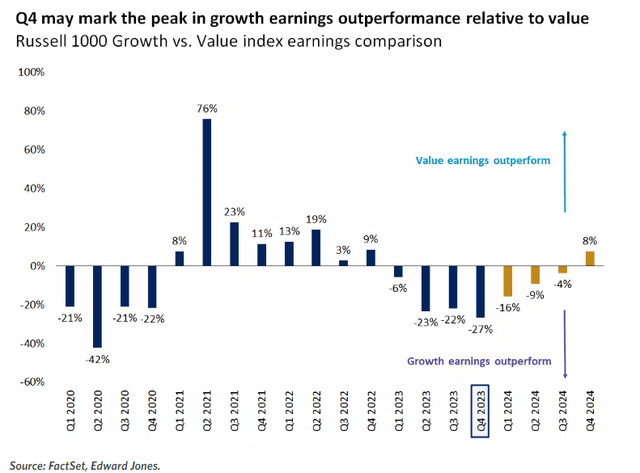

The reason last week was pivotal is because growth may have hit its peak in terms of outperformance relative to value. I find it notable that Nvidia (NVDA), which is the poster child for the AI boom, rose more than 5% on Friday morning to a new all-time high before giving back those gains and closing more than 5% lower from its opening price by the end of the day. Perhaps that was just profit taking from a parabolic move up this year, but it is the kind of event that makes me wonder if the speculative fervor is overdone. According to EPFR Global data, last week’s $4.4 billion outflow from technology funds through March 6 was the largest on record. Semiconductors stocks are also trading at their largest premium to the S&P 500 on record.

Bloomberg

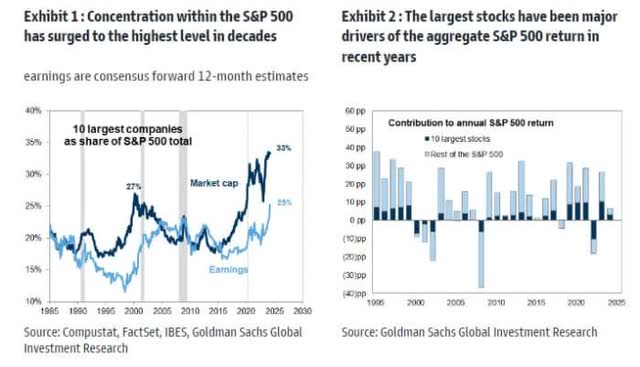

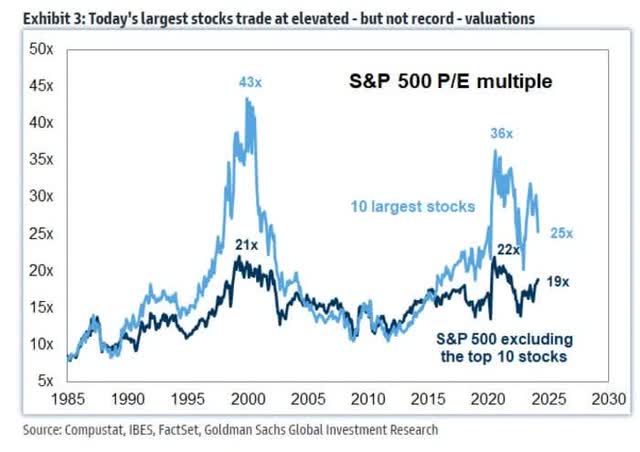

I am not trying to call a top in the technology stocks, but there is mounting evidence that the degree of outperformance for this sector relative to the broad market has reached its peak, and new investment dollars may be better served in other areas. The ten largest stocks, predominantly tech related, now account for 33% of the S&P 500 index, which exceeds the 27% peak in 2000. The big difference is that today’s top ten command much stronger fundamentals that argue against a bear market decline.

MarketWatch

Additionally, these stocks have multiples that don’t come close to the nosebleed levels we saw in 2000 or 2020, which suggested imminent danger ahead.

MarketWatch

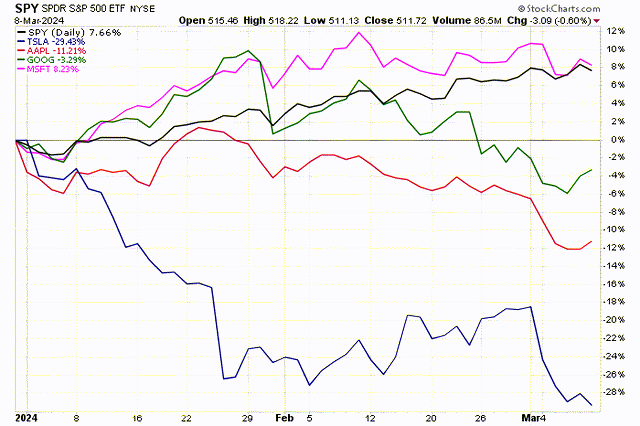

Some of the Magnificent Seven names are starting to lose their luster. Apple (AAPL), Alphabet (GOOG) (GOOGL), and Tesla (TSLA) are underperforming the S&P 500 and showing losses year to date. Microsoft (MSFT) is on the cusp of trailing the benchmark index.

Stockcharts

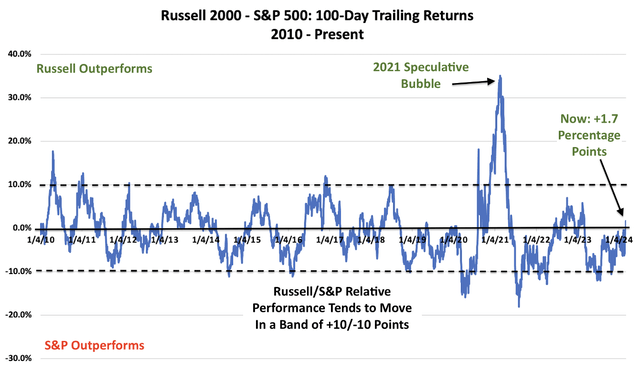

Meanwhile, small-cap stocks are starting to outperform. The bears have been riding the fact that small-cap underperformance is the Achilles’ heel of this bull market, but that no longer appears to be the case. I have been expecting a resurgence in small caps because of the underlying strength of the economic expansion that the consensus has underestimated. The Russell 2000 index has now outperformed the S&P 500 over the past 100 days and is gaining momentum. This is the rotation I have been looking for since the beginning of this year. If you focus exclusively on waning technology stock momentum, you may anticipate a correction or bear market later this year, but this rotation into small-cap stocks suggests otherwise.

DataTrek

Furthermore, the rate of change in earnings outperformance is at a critical juncture whereby value is starting to outperform growth as we embark on 2024. The proxies for this comparison are the Russell 1000 growth index and the Russell 1000 value index, which are the 1000 largest companies in the market, respectively.

Edward Jones

This improving rate of change suggests that value could experience a period of outperformance, which would be led by sectors like healthcare, financials, materials, industrials, and energy. Additional catalysts to the rotation I see coming will be the beginning of the Fed’s rate-cut cycle, which should be a tailwind for the more value-oriented and interest-rate sensitive sectors of the market, along with the ongoing recovery in the manufacturing sector, which can be seen in the renewed expansion from the PMI manufacturing surveys.

I think now is the time to rebalance portfolios with more emphasis on value and less on growth. There are a plethora of signposts indicating that the shift is already underway. Such a rotation probably stymies a more significant increase in the overall S&P 500 index because of the large weighting the top ten names have today. Still, there are plenty of opportunities for investors in this market when they look past the technology leadership to date.