Maximusnd

The US bond market has had a rough ride for much of the past two years, but the powerful rally over the last two months suggests the worst is over. Cherry-picking analytics from the recent crop of 2024 outlooks that are seasonal standards this time of year provides inspiration for thinking that the new year could reverse more (all?) of the damage inflicted on fixed income since the Federal Reserve started raising interest rates in March 2022.

An ETF proxy for the US bond market, Vanguard Total Bond Market Index Fund ETF Shares (BND), has rallied sharply, but it’s still far below 2021 levels. The bullish interpretation: there’s still plenty of room to run, assuming macro conditions are supportive.

The critical factor for bond prices in the year ahead, of course, is inflation’s path. Recent history provides support for expecting that pricing pressure will continue to ease and move closer to the Federal Reserve’s 2% target.

The Wall Street Journal reports: “The Federal Reserve is winning its fight over inflation, boosting Americans’ spirits and offering greater reassurance that the U.S. economy can avoid a recession while bringing prices under control. The Fed’s preferred inflation measure, the personal consumption expenditures price index, fell 0.1% in November from the previous month, the first decline since April 2020, the Commerce Department said Friday. Prices were up 2.6% on the year, not far from the Fed’s 2% target.”

Andrew Hunter, deputy chief U.S. economist at Capital Economics, advises: “Adding in the further sharp slowdown in rent inflation still in the pipeline, it’s hard to see any credible reason why the annual inflation rate won’t also return to the 2% target over the coming months.”

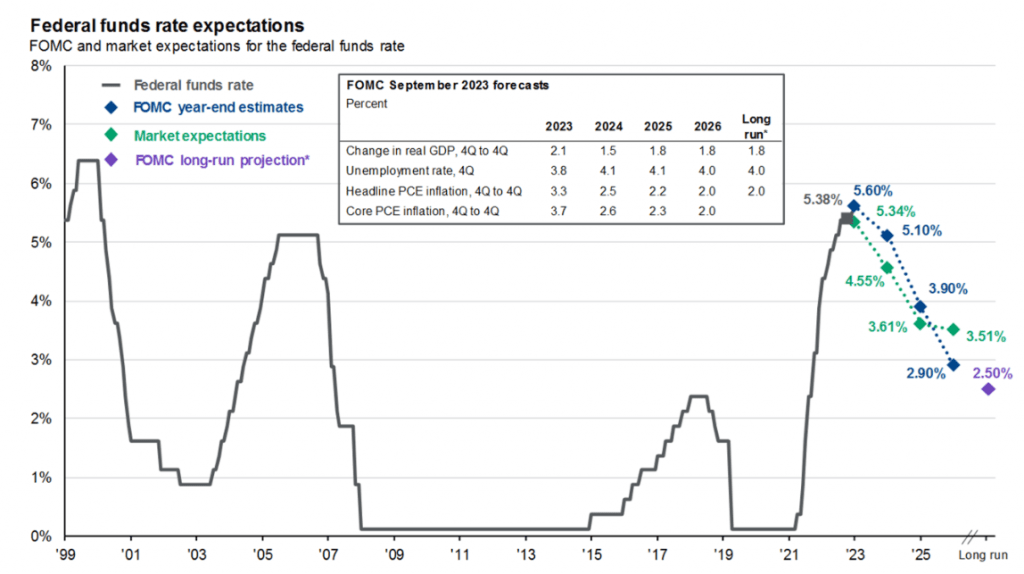

The Federal Reserve appears to be on board with the upbeat outlook. Courtesy of a chart from J.P. Morgan, the Fed’s current outlook sees inflation and its target rate sliding in the months ahead.

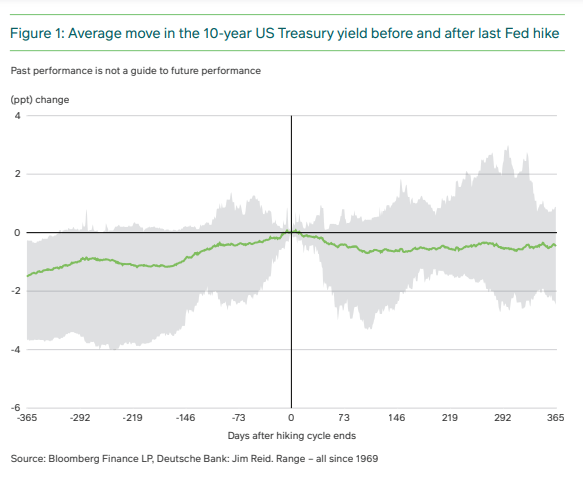

MG Investments sees an opportunity in the expected trend. “The rationale for adding duration now is underpinned by our belief that both the timing and valuations are favorable for investing in government bond markets,” the firm explains in its 2024 outlook. “Historically, the 10-year US Treasury yield has tended to rally after the Federal Reserve (the Fed) ends its hiking cycles. Research from Deutsche Bank shows that the biggest fall is typically seen within three months of the last hike – this has even been as much as 3 percentage points, equivalent to a capital gain of around 7% (Figure 1).”

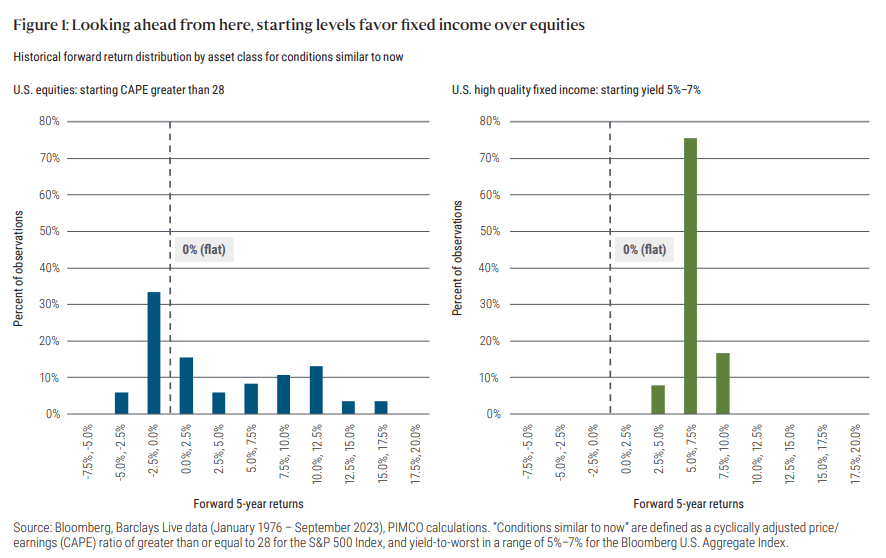

PIMCO advises that this is “Prime Time For Bonds.” In its November asset allocation report, analysts wrote: “We strongly favor fixed income in multi-asset portfolios. Given current valuations and an outlook for challenging economic growth and diminishing inflation, we believe bonds have rarely appeared more compelling than equities. We also look to maintain portfolio flexibility in light of macro and market risks.”

A key part of PIMCO’s reasoning for favoring bonds over stocks: valuation. “Although not always a perfect indicator, the starting levels of bond yields or equity multiples historically have tended to signal future returns.”

The one-two factors of lower expected inflation and projections of Fed rate cuts are at the core of the bulls’ forecasts for higher bond prices. Fed funds futures are pricing in a 77% probability that the first rate will arrive at the March 20 FOMC meeting.

If there’s a joker in the deck, it will reveal itself in the form of upside surprises in incoming inflation data. For the moment, however, a number of inflation projections and surveys suggest the fix is in for 2024 and pricing pressure will continue to ease.

“Although some volatility may continue, we believe interest rates have peaked,” predicts Kathy Jones, chief fixed income strategist at the Schwab Center for Financial Research. “We expect lower Treasury yields and positive returns for investors in 2024.”

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.