South Africa has one of the highest rates in the upper-income tax brackets (45%) in the world, and has been increasing personal rates for many years.

Authorities have also succumbed to continuously hiking consumption taxes like the petrol levy and excise duties as well, and even upped the value-added tax (VAT) rate from 14-15% in recent years. New taxes like on sugar and carbon have also entered the mix.

Although these taxes have gone a long way to balance the national budget, together with some additional windfalls recently, like additional revenue from increased commodities prices, and higher than expected tax collections by the South African Revenue Service (Sars), economists said that the expenditure side of the budget, particularly interest spending and the national wage bill, however, remained under pressure and a major concern.

This year National Treasury might also have to scramble to find additional sources of income to fund not only that but basic service delivery and other initiatives like the proposed NHI and the various turnaround plans for failing SEOs.

Finance Minister Enoch Godongwana already tabled a Special Appropriation Bill late last year to provide a combined R30 billion additional funding to Denel, Transnet and the SA National Roads Agency in a bid to allow these entities to adjust their business models and restore their long-term financial viability. He also said funds would be set aside for the unallocated reserve as a buffer against other fiscal risks that may materialise in 2024/25 and 2025/26 financial years.

But with 2023 already in full swing, tax pundits are already predicting how the new calendar year will play out, especially with the 2023 National Budget to be delivered by Godongwana on February 22.

Pieter Janse van Rensburg, director at AJM – a specialist tax consulting and litigation firm – took a moment to gaze into the tax crystal ball for the year ahead.

He said the focus in 2023 is likely to be more on balancing the books rather than legislative and technical tax amendments, however he foresees limited bracket creep adjustments and higher sin taxes, which, he said, “also appear to be made under the guise of social issues.”

He also expects a phasing out of allowances such as learnership allowances, industrial development zone allowances and energy efficiency allowances. “They appear only to distract from larger issues, and uptake in the market has not always been at expected levels; and controversially, could we see a special energy levy introduced to support Eskom.

“Political support is also growing for introducing a wealth tax in the country. While many tax practitioners are doubtful of its implementation, both from a policy perspective and practical implementation, it would not be the first time political interference had driven tax policy,” said Van Rensburg.

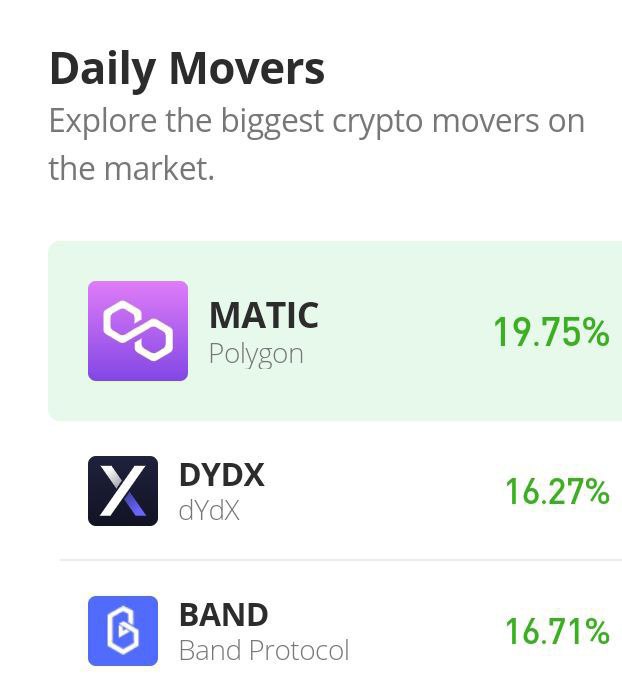

He also expects more interaction and guidance between SARS and the South African Reserve Bank on regulating crypto assets, particularly in the arbitrage trading field. “Taxpayers are currently caught in the middle of in-action between these organisations, and this position needs to be revised,” he said.

But despite an increase in taxes sounding like an easy way for the government to collect more money, a recent blog in the Daily Investor says the “reality is that higher taxes may lead to lower revenue collection.”

It stated that the Laffer curve showed the relationship between tax rates and the amount of tax revenue collected by governments. The Laffer curve is an economic theory that shows a hump-shaped correlation between tax revenue as a function of a country’s tax rate. It indicates that revenue initially increases with tax hikes, but then goes down if taxpayers start reducing market labour supply and investments, switching to non-taxable-forms of compensation and other tax-evading efforts.

“When the tax rate is raised beyond this point, individuals have greater incentives to do tax planning and arrange their finances in such a way as to pay as little tax as possible,” the Daily Investor writes.

“As the tax rate continues to increase, productivity would deteriorate as individuals would prefer to stay at lower tax brackets as the reward for hard work would be too low to pursue.”

Businesses that pay less tax have more funds available to expand operations and employ more people, leading to a greater tax base and higher tax revenue, while lower individual taxes mean greater spending output within an economy.

Although it may be difficult to determine the optimal tax rate to generate the highest tax revenue, future employee and business behaviour might be based more on tax morality heading for historic lows as failing public infrastructure, state corruption and rolling blackouts will make earning a living harder than ever before.

BUSINESS REPORT