That is on no account the worst economic system we’ve ever seen. However except for the primary few months after the start of COVID-19, it’s virtually definitely the strangest and most risky.

Inflation is the best it’s been because the early Nineteen Eighties and can probably stay for the foreseeable future. Actual property costs have elevated at a charge that exceeds the pre-2008 crash. There’s an enormous housing disaster, varied provide shortages, rising rates of interest, an inverted yield curve, and financial progress in the course of the first quarter of 2022 was unfavourable.

Certainly, a recession could also be upon us. Some assume one other housing market collapse could also be coming quickly.

Wherever we’re going, one clear factor is that we’re in a really risky economic system the place traders ought to proceed with warning. However, they need to nonetheless proceed.

I’m not a fan of sitting on the sidelines and “ready for the market to appropriate.” I believed the market would appropriate round 2018. I used to be unsuitable. Had I finished shopping for, I’d be regretful about it. Had I offered our portfolio, I’d be much more regretful.

Certainly, I’ve recognized individuals who have been saying that since 2015. For sure, they’re nonetheless ready.

Put together for a market shift

Modify your investing ways—not solely to outlive an financial downturn, however to additionally thrive! Take any recession in stride and by no means be intimidated by a market shift once more with Recession-Proof Actual Property Investing.

20-Mile Marching

Jim Collins is finest recognized for his traditional Good to Nice, however I imagine his e book on how you can spend money on a risky economic system, Nice by Selection, is even higher. Certainly one of Collins’s key factors is the significance of a constant strategy by means of each good and dangerous occasions. He refers to this as “20-mile marching,” an analogy to the famed explorer Roald Amundsen.

In 1911, Amundsen and his workforce confronted off towards Robert Falcon Scott in a contest to see who might attain the South Pole first. Scott’s workforce would go so far as they might on good days after which hunker down on dangerous days. This appears intuitive, however it didn’t work. Sadly, not solely did Scott and his workforce not attain the South Pole, they didn’t make it again alive.

Alternatively, Amundsen had a dogmatic perception in preparation and consistency. As Collins writes in Nice by Selection,

“Amundsen adhered to a regime of constant progress, by no means going too far in good climate, cautious to remain far-off from the purple line of exhaustion that would go away his workforce uncovered, but urgent forward in nasty climate to remain on tempo. Amundsen throttled again his well-tuned workforce to journey between 15 and 20 miles per day…When a member of Amundsen’s workforce steered they might go quicker, as much as 25 miles a day, Amundsen mentioned no.”

The relation to enterprise is straightforward, “The 20 Mile March creates two sorts of self-imposed discomfort: (1) the discomfort of unwavering dedication to excessive efficiency in troublesome circumstances, and (2) the discomfort of holding again in good circumstances.”

Collins discovered seven firms that beat the Dow Jones and their trade by at the very least 10-fold over 15 years throughout a turbulent surroundings. All seven, together with Southwest Airways, Microsoft, and Intel, adopted the 20-Mile March philosophy.

Hunkering down destroys momentum and creates apathy and even perhaps paranoia concerning the future. No pleasure comes with sitting round and ready. In case you have a workers, the very best staff will in all probability imagine that there received’t be a lot in the best way of progress alternatives and transfer on.

Alternatively, increasing like loopy can create further issues, from outgrowing your programs to overleveraging to creating careless errors because the variety of your commitments outpace the time you must vet them correctly.

Development ought to be constant, in good occasions and dangerous. Roughly, that is the thought behind greenback price averaging. After all, you shouldn’t take this as dogma. There are occasions to cease increasing (for instance, if a number of staff give up, or your financial institution received’t renew a giant mortgage) or broaden shortly (a killer deal comes round). Nonetheless, the plan ought to be for constant and high quality progress.

Not the Time to Attain

20-Mile Marching doesn’t specify a specific technique, although. It doesn’t say you shouldn’t promote a property or two now in case your money is tight or money movement is low. And it definitely doesn’t say you need to attain if you happen to can not discover a deal in a sizzling market like this.

Certainly, when the market seems a bit irrational (on this occasion, too sizzling), it’s a very good time to sharpen your pencil and solely take offers which might be sure to make sense. This may scale back the variety of properties you might be shopping for. You may not even have the ability to discover one for some time.

However not discovering a property is just not the identical as hunkering down. In spite of everything, you’re nonetheless trying, and ultimately, you can see one.

Money is King

One other key level Collins makes is that firms that held massive money reserves did considerably higher than people who didn’t. It is because these firms have ample funds for a wet day and come up with the money for to pounce on golden alternatives after they come round.

I made the same level when reviewing Nicholas Nassim Taleb’s nice e book Antifragile in a earlier article,

“Taleb believes that attempting to foretell such uncommon occasions is generally a idiot’s errand. As a substitute, one ought to attempt to change into ‘antifragile.’ Antifragility doesn’t describe one thing that may survive dysfunction or perhaps a downturn. For that, he makes use of the time period ‘sturdy.’ As a substitute, antifragility is one thing that beneficial properties from dysfunction.”

“So whereas most firms wrestle in a recession, an organization that thrives in a downturn can be antifragile… Those that ‘thrive from dysfunction’ can usually develop exponentially whereas others are declaring chapter.”

Having cash to purchase property after they’re low-cost could make an actual property investor antifragile.

After all, “have cash” is just not essentially the most useful recommendation. It’s notoriously troublesome to take care of robust money reserves with actual property specifically. I’ve usually joked that you simply’re not an actual property investor except you’re money poor.

That being mentioned, in risky financial circumstances, it’s not the time to journey the road. If refinancing or promoting a property will get you some respiratory room that you simply don’t at present have, it might be one thing to strongly think about.

Likewise, in case you are contemplating quitting your job and going into actual property full time, I’d be sure you have saved up a considerable rainy-day fund. If not, it might be price holding off on that call in the intervening time.

Coping with Inflation

After all, we’re in a excessive inflation surroundings, so that you don’t wish to maintain an excessive amount of money, or at the very least, you don’t wish to maintain an excessive amount of money as money. Now can be a very good time to look into funding automobiles that provide at the very least a small return to assist offset inflation.

Sadly, these are laborious to come back by. A 3-month treasury bond, for instance, nonetheless solely supplies a paltry 0.95% return as of this writing.

That being mentioned, the good half about holding actual property is that inflation erodes debt whereas property proceed to (often) enhance in worth. So long as most of your wealth is in laborious property corresponding to actual property, inflation shouldn’t damage you too badly.

However inflation does make it tougher to money movement. Costs for supplies, wages, insurance coverage, and taxes all go up, making it all of the extra vital for landlords to maintain up with lease will increase (at the very least till the market cools).

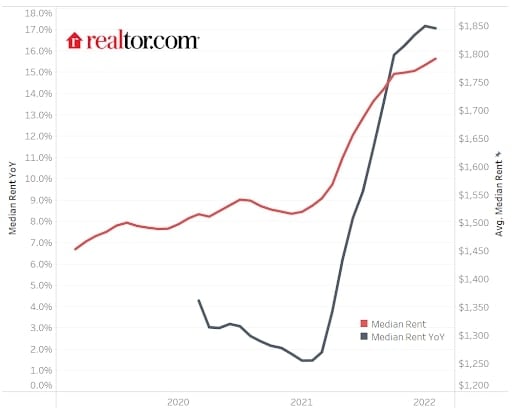

Certainly, final yr, rents went up some 15%.

Sure, these are difficult occasions. When you can afford to supply your tenants a break, achieve this. However provided that you’re assured you may afford to.

In any other case, you could be extra aggressive with lease will increase. Most leases are renewed yearly, and locking in a below-market lease might severely have an effect on your money movement as costs on every little thing else proceed to extend month over month.

In the identical vein, you could make tenant screening a precedence. This could all the time be the case, however in risky occasions, it is going to be the tenants on the sting who cease paying first if we tumble right into a recession. Thus, it’s much more important now to display screen prospects totally.

The Actual vs. Nominal Distinction

In a low inflationary surroundings, you may take returns at face worth. 8% curiosity is 8% curiosity.

In excessive inflationary intervals, this isn’t the case. When inflation is excessive, you could account for actual vs. nominal costs. For instance, in case your annual return is 8% and inflation is 9%, you then actually misplaced 1% in actual phrases.

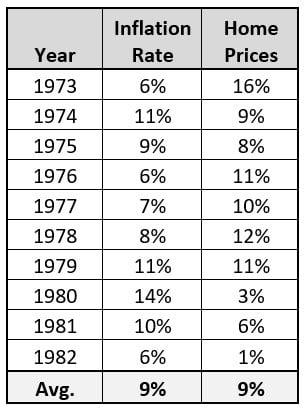

That is one cause I imagine it’s unlikely that the true property market will collapse. I do imagine that in actual phrases, it is going to probably decline as actual property appreciation will fall behind worth inflation. However if you happen to have a look at what occurred the final time there was excessive inflation and low progress, actual property nearly saved tempo with inflation:

However whereas this reveals that actual property didn’t collapse in the course of the stagflation of the Nineteen Seventies and early Nineteen Eighties, it additionally reveals actual property didn’t do notably properly both. Nonetheless, if you happen to had regarded solely on the appreciation charge with out contemplating inflation, it might appear to be actual property did nice.

Thereby it’s important to begin considering in actual phrases as a substitute of nominal.

Fastened Curiosity Charges

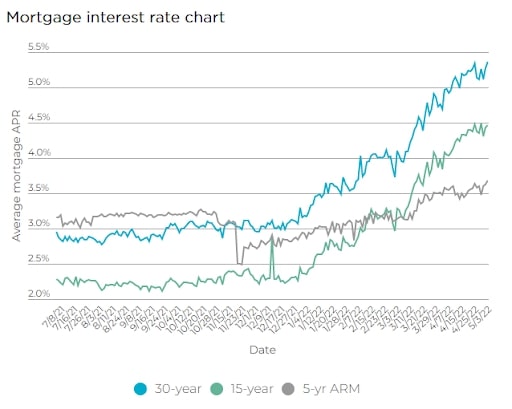

Rates of interest could really feel excessive now because the 30-year mounted mortgage simply crossed 5% after hovering close to an absurdly low 3% for all of 2021.

However simply because it feels excessive doesn’t imply it’s. Keep in mind, we have to assume when it comes to actual vs. nominal. Rates of interest are nonetheless considerably beneath inflation, which doesn’t make a lot sense.

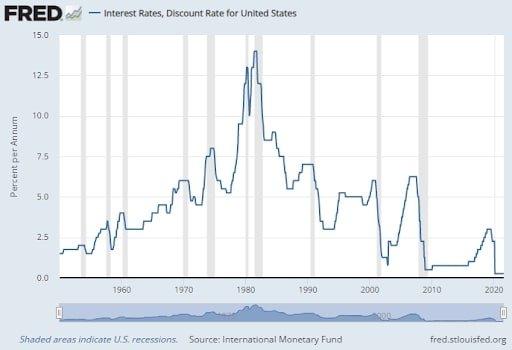

Traditionally talking, the Fed’s low cost charge (what it lends to banks at) remains to be very low, and even when it will get that charge as much as 2.8 % by the tip of 2023, because it says it is going to, it is going to nonetheless be on the decrease finish of the historic common. The low cost charge is nowhere close to the charges that Paul Volker introduced it as much as with a view to “break the again of inflation” within the early Nineteen Eighties.

In different phrases, rates of interest are nonetheless low.

The extra certainty you may have in a risky economic system, the higher. So, the ethical of the story is that this: No adjustable-rate mortgages proper now. Be sure that your loans are mounted for at the very least 5 years, 10 if attainable.

And you probably have loans arising for renewal within the subsequent yr or two, I’d extremely think about refinancing them now (assuming the prepayment penalty is just not too excessive) at these “high-interest charges.” Belief me, except you may have lived by means of the rates of interest of the Nineteen Seventies, Nineteen Eighties, and even the Nineteen Nineties, you haven’t any thought what “high-interest charges” really are.

Conclusion

Unstable and fragile economies could be scary, however they will additionally convey alternatives. It’s been extraordinarily troublesome to search out properties to purchase within the final couple of years. When the market begins to chill, that ought to change.

Certainly, the very best traders usually do the very best throughout recessions or risky economies. They don’t achieve this, nonetheless, by sitting on the sidelines. As a substitute, they hold their reserves excessive, alter to the surroundings, sharpen their pencils, and proceed 20-mile marching.