BackyardProduction

Northern Belief (NASDAQ:NTRS) is certainly one of America’s major three large unbiased custodian and belief banks. That is to not say that they are the one custodian banks on the market; companies like JPMorgan (JPM) even have giant operations on this subject.

Nonetheless, buyers have been drawn to the massive three unbiased custodian and belief banks, specifically State Avenue (STT), Financial institution of New York Mellon (BK) “BNY Mellon”, and Northern Belief. Any such banking is engaging as a result of it’s low-risk and generates income from managing and safekeeping property moderately than taking a lot danger on the lending facet of the ledger.

All three of the custodian banks listed above fared fairly nicely through the monetary disaster, and averted any crushing losses or dilution that will have completely impaired buyers. That is smart, as these custodian banks aren’t slinging round MBS securities, lending to rising market international locations, or something unique like that.

Moderately, custodian banking is fundamental blocking and tackling. Accumulate property, present stable again workplace and private relationship providers, and cost an inexpensive charge for that. With the banking sector, together with the custodian banks, in a giant sell-off in 2022, let’s test in on Northern Belief particularly.

NTRS Inventory Fundamentals

Northern Belief isn’t the most important custodian financial institution on the market. As per Institutional Investor, BNY Mellon is the most important custodian financial institution on the earth. State Avenue is #2, adopted by JP Morgan at #3. Nonetheless, Northern Belief is the following largest of the unbiased banks, and folk generally consider the State Avenue, BNY Mellon, and Northern Belief grouping as three shut friends.

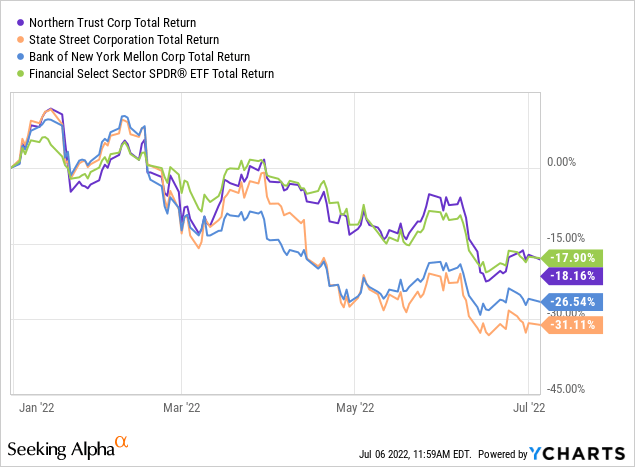

Yr-to-date, all three belief banks — just like the broader banking sector — have fared poorly:

The Monetary Choose Sector ETF (XLF) is down 18% year-to-date, as is Northern Belief. In the meantime, BNY Mellon is down 27% and State Avenue is off 31%.

At first look, that may appear stunning. In any case, a serious piece of earnings for custodian banks is from internet curiosity earnings since they make investments giant sums of cash in low-risk securities comparable to authorities treasuries. With rates of interest transferring up sharply in 2022, this could present a tailwind for the belief banks. And certainly, Northern Belief noticed its internet curiosity margin transfer to its highest level this decade in 2019 amid the final mini-rate climbing cycle. Greater rates of interest ought to supply a equally helpful impact this time round.

Nonetheless, that optimistic impact has been considerably offset because of falling fairness and bond markets. Custodian banks deal with property and cost charges on them, that is their major objective. With most bond and fairness markets down sharply year-to-date, the whole quantity of property below administration for companies like Northern Belief will probably be below important strain, thus trimming the agency’s potential charge earnings.

That provides the context to elucidate the selloff in custodian banks comparable to Northern Belief this yr. With the worth coming down, nonetheless, the attractiveness of Northern Belief as a dividend inventory is rising. Let’s have a look.

What Is Northern Belief’s Dividend Now?

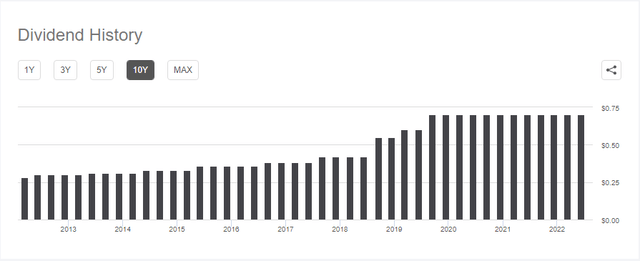

Traditionally, Northern Belief was a major dividend development story. Between 2012 and 2019, the corporate elevated its quarterly dividend from 28 cents to 70 cents. Since 2019, nonetheless, Northern Belief has left its dividend steady at 70 cents as a substitute of accelerating it:

NTRS Dividend Historical past (Looking for Alpha)

With the dividend at $2.80 yearly and the inventory ticking down beneath $100 not too long ago, Northern Belief is now yielding 2.9% on a trailing foundation. That is a stable premium to the financials ETF, which is yielding simply 2.1%. Nonetheless, Northern Belief’s 2.9% trailing dividend does lag BNY Mellon at 3.2% and State Avenue at 3.6% immediately. Nonetheless, a change is coming.

When Will Northern Belief Improve Its Dividend?

After halting dividend development since 2019, Northern Belief is returning to an rising dividend coverage.

On June 27, Northern Belief introduced its Federal Reserve stress check outcomes. The corporate’s regulatory capital simply met necessities, giving Northern Belief the latitude to interact in extra returns of capital to its shareholders.

Because of this, Northern Belief introduced a 7% dividend improve, bumping its quarterly fee from 70 cents to 75 cents. This may go into impact for the corporate’s Q3 dividend fee, which is usually paid on October 1 annually.

With the brand new greater dividend coverage, Northern Belief’s ahead dividend yield will soar to three.2%.

Is NTRS Inventory A Purchase, Promote, Or Maintain?

There are two associated questions when deciding whether or not Northern Belief is a purchase or not. The primary is whether or not the custodian banks as a class are price shopping for immediately. The second is whether or not Northern Belief is probably the most engaging of the custodian banks or different shut friends specifically.

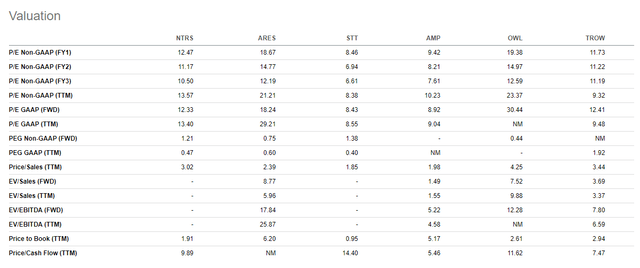

On a valuation foundation, Northern Belief slots in as not the costliest, however actually not the most affordable of its friends as proven by this Looking for Alpha comparability desk:

NTRS Friends Profitability Information (Looking for Alpha)

Northern Belief’s 12.5x P/E, for instance, is engaging by itself, however isn’t notably low-cost given the depressed valuations we see throughout a lot of the banking sector immediately. Equally, Northern Belief’s 1.9x worth/guide ratio is beneath its historic norm, however nicely above the place different too-big-to-fail banks are buying and selling immediately.

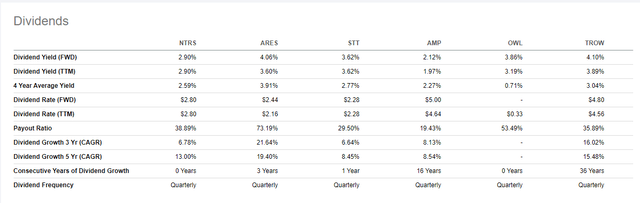

Turning again to earnings, right here is Looking for Alpha’s comparability desk for dividends amongst Northern Belief’s friends:

NTRS Dividend Desk (Looking for Alpha)

The two.9% dividend yield will advance to three.2% in October with the scheduled dividend hike. Northern Belief’s dividend is protected and well-covered out of earnings. It isn’t a foul selection by any means. Nonetheless, there are arguably extra engaging choices on supply through the present bear market.

This will get again to the broader query: Is Northern Belief inventory a purchase immediately? I might say it is a purchase, in that every one the custodian banks are at engaging costs immediately. Nonetheless, I might view peer State Avenue as a robust purchase, given its decrease valuation ratios, larger year-to-date drop, and higher historic efficiency. To that final level…

What Is Northern Belief’s Lengthy-Time period Forecast?

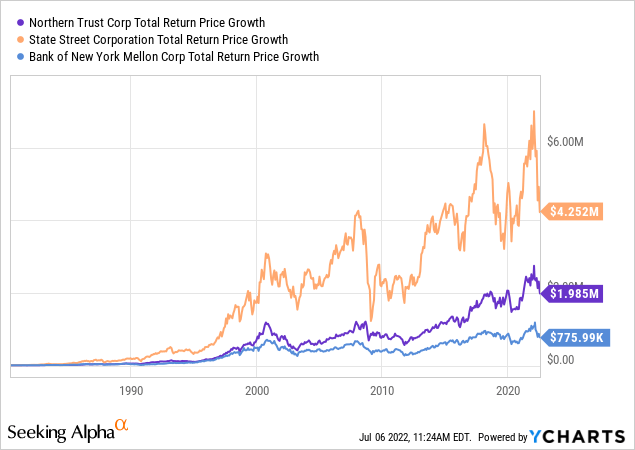

Over the long-term, the belief banks have been super performers. A $10,000 funding within the three major American belief banks again in 1980 would have carried out as adopted via to immediately:

State Avenue has been the clear winner of the three, however Northern Belief turned $10k into $2 million and even the laggard Financial institution of New York Mellon turned the identical sum into virtually $800,000.

The difficulty, as you may most likely see, is that returns have been a lot much less spectacular since 2000. The mixed forces of decrease rates of interest and passive low-fee investing have pushed down profitability significantly and thus restricted these banks’ previously prodigious skill to ship shareholder worth.

Can Northern Belief recuperate its former magic? Price initiatives have helped it outpace State Avenue and BNY Mellon for the reason that monetary disaster. Particularly, Northern Belief has gotten its non-interest expense as a proportion of its non-interest earnings right down to 89% in comparison with 102% in 2011.

Northern Belief has carried out an amazing job of creating extra out of much less, delivering bettering outcomes even in a low rate of interest surroundings. Add within the strain from passive investing, and Northern Belief has proven superior operational ability to navigate the previous decade whereas producing appreciable shareholder worth.

So, there is a legitimate case for betting on the administration crew right here and shopping for on the presently engaging valuation and beginning dividend yield. That mentioned, for my very own cash, I personal State Avenue as a substitute as I see it as each cheaper and better-positioned to thrive over the long-term. That mentioned, I am bullish on all of the custodian banks at present costs, and thus Northern Belief is an inexpensive purchase right here.