JHVEPhoto

Mondelez International, Inc., (NASDAQ:MDLZ) through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe.

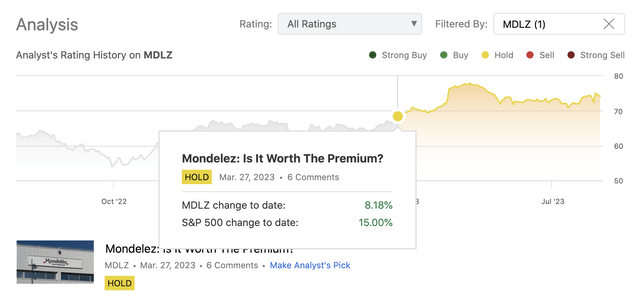

We have started coverage on the firm in March 2023, with an initial “hold” rating. The primary reasons back then for our neutral view have been:

- Deteriorating profitability, including declining return on equity and declining net profit margin

- Improving asset turnover, driven by revenue growth

- Increasing leverage in the capital structure

- Overvaluation based on a set of traditional price multiples

Since our previous writing the stock price has increased by 8%, underperforming the broader market, which has gained 15% in the same period.

Analysis history (Author)

Today we will be looking at the firm’s Q2 results and discuss whether the most recent numbers are showing any improvement in terms of profitability and efficiency and whether it could be enough to justify the current price levels.

Q2 results

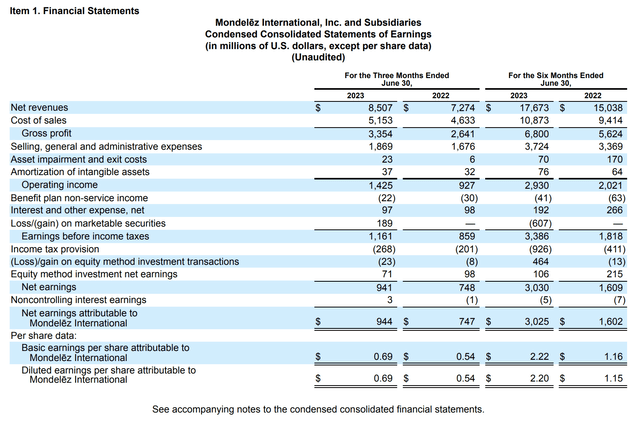

The following table shows MDLZ’s most recent income statement.

Income statement (MDLZ)

It is clearly visible that the firm has achieved significant growth both in terms of revenue and EPS. This 17% improvement in net revenues can be attributed to several factors:

- the higher demand for MDLZ’s products, which may be driven by the improving macroeconomic environment

- acquisitions of Clif Bar and Ricolino in 2022

- favourable volume/mix

These positive impacts have been partially offset by the unfavorable FX environment and the impact of divestitures in 2022.

Also important to note, that all segments (regions) have been contributing to the revenue growth.

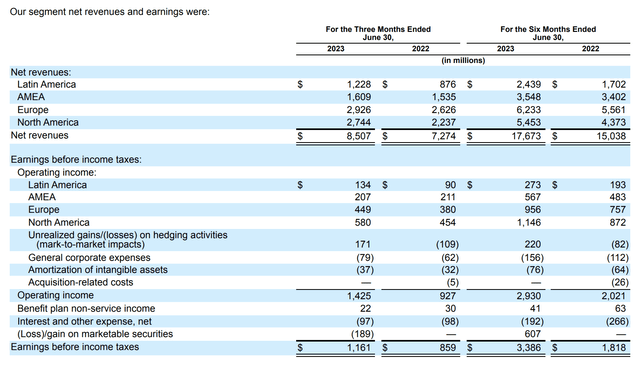

Segment results (MDLZ)

In our opinion, the demand for MDLZ’s products is likely to remain strong in the coming quarters, as the macroeconomic environment, including consumer confidence and inflation rate have been improving gradually across the globe in the past months. The firm’s updated outlook on 2023 also confirms our thesis:

For 2023, the company is updating its 2023 fiscal outlook and now expects 12+ percent Organic Net Revenue growth versus the prior outlook of 10+ percent, which reflects the strength of its year-to-date performance.

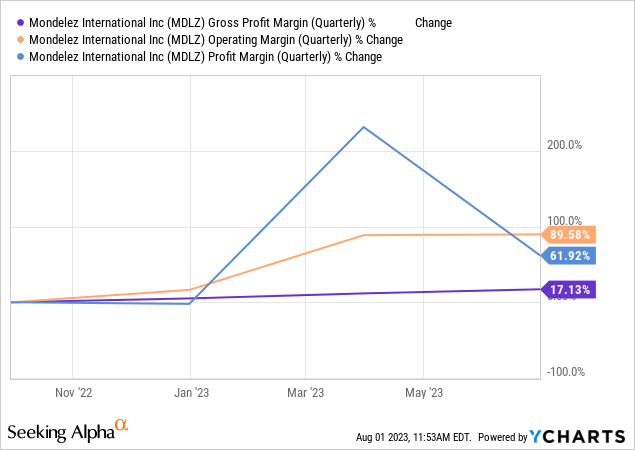

The higher revenue has not been the only positive for MDLZ in the previous quarter. The firm’s profitability has significantly improved compared to the prior year. The following chart shows, how the three key margins have developed in the past 12 months.

While input costs have improved due to several factors, the rate of increase has been slower than the rate of revenue growth. The main contributors to the cost increases have been the higher raw material costs, including energy, sugar, dairy, grains, packaging, cocoa, edible oils and other ingredients costs.

These have been however, partially offset by lower manufacturing costs driven by productivity.

SG&A expenses have also increased, but again at a slower pace than the revenue growth. This leads to an operating margin expansion from 12.7% to 16.8% YoY.

Total selling, general and administrative expenses increased $193 million from the second quarter of 2022, due to a number of factors noted in the table above, including in part, the impact of acquisitions, higher divestiture-related costs, higher remeasurement loss of net monetary position and lapping prior-year decrease in estimated allowances and reserves associated with incremental costs incurred due to the war in Ukraine, which were partially offset by a favorable currency impact related to expenses, lower acquisition integration costs and contingent consideration adjustments, lapping prior-year acquisition-related costs and lower implementation costs incurred for the Simplify to Grow program.

All in all, we believe that the firm’s Q2 financial performance represents a significant improvement to the previous quarters. Looking forward, we would like to see the margins further expanding, along with revenue and EPS growth, which may well be driven by the improving macroeconomic environment.

The financial performance however, has not been the only pleasing news for investors in the second quarter.

Return to shareholders

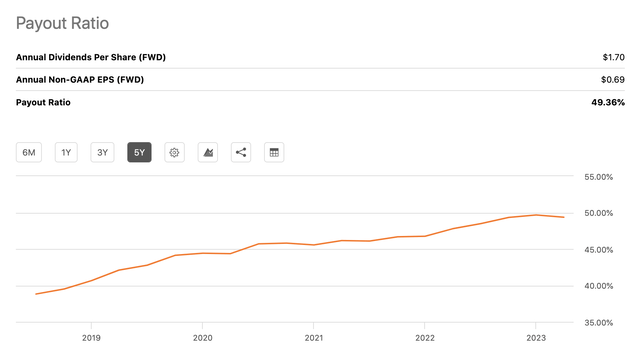

The firm in the first half of the year has returned as much as $1.7 billion to its shareholders. They have also managed to increase their dividends by as much as 10%. As of now, the firm pays a quarterly common dividend of $0.43 per share, equivalent to an annual yield of 2.3%.

By looking at the payout ratio we can see that the dividend remains well covered and likely to remain sustainable in the coming months due to the stronger demand for MDLZ’s products.

Payout ratio (Seeking Alpha)

Conclusions

Double digit revenue and EPS growth in the second quarter, beating both top- and bottom line estimates of analysts.

The improving macroeconomic environment, including improving consumer confidence, moderating inflation levels and falling energy prices, is likely to create further tailwinds to MDLZ’s business. The margins may keep expanding further in the coming months.

The firm has been also rewarding its shareholders with attractive returns in the first half of the year, including a 10% dividend increase.

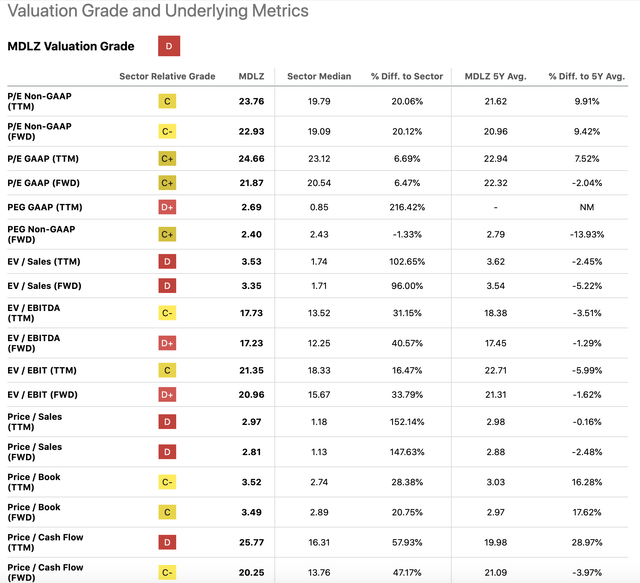

While the valuation of the firm has not improved since our last writing according to the same set of price multiples, we believe that the premium is much more justified now as it was before, driven by the strong Q2 growth.

Valuation (Seeking Alpha)

For these reasons, we upgrade Mondelez to “buy”.