For almost a half century, world inflation charges have been headed a technique: down. For the reason that early Nineteen Seventies, supported by structural components that included globalization, higher coverage frameworks, massive demographic modifications, and speedy technological advances, the world achieved a outstanding decline in inflation. However since late 2020, the worldwide inflation charge has risen sharply to over six p.c on account of unprecedented coverage assist for inflation, the discharge of pent-up demand, persistent provide disruptions, and surging commodity costs. The commodity worth surge triggered by Russia’s invasion of Ukraine final month is including to those worth pressures. The results for progress, stability, and poverty are more likely to be horrible.

The tip of the final and former durations of sustained low world inflation are a reminder that low inflation is on no account assured. Inflation has been low and steady earlier than: throughout the Bretton Woods fastened change charge system of the post-war interval as much as 1971 and throughout the Gold Customary of the early 1900s (Determine 1). However these two earlier episodes have been additionally adopted by excessive inflation. For instance, following the low inflation interval till the early Nineteen Seventies, a number of oil worth shocks throughout the the rest of the last decade accompanied a speedy acceleration in world inflation.

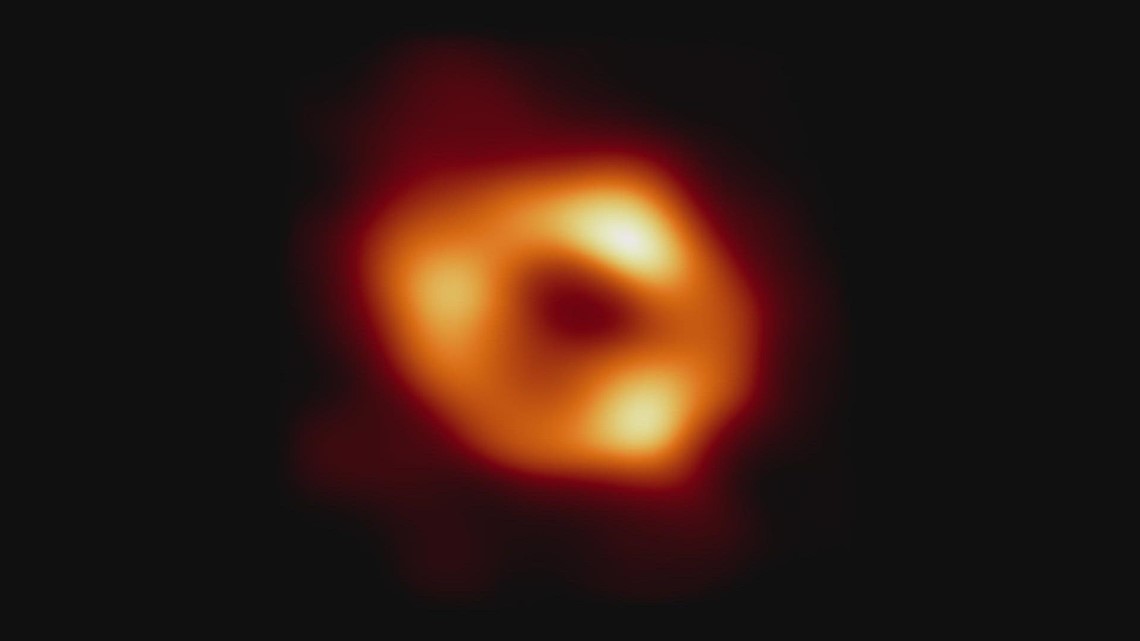

Determine 1. World inflation, 1900-2022

Supply: Ha, Kose, and Ohnsorge (2019); World Financial institution.

Be aware: This determine represents the median of annual common inflation in 24 international locations the place information can be found throughout the complete interval. 2022 inflation is predicated on the common of January and February 2022.

The worldwide financial system as soon as once more stands at a crossroads the place latest inflationary shocks may mix with a fading of structural forces of disinflation to usher in an period of upper inflation. What are the prospects for these disinflationary structural forces? And what can policymakers in rising market and creating economies (EMDEs) do to get forward of inflationary pressures? We consider that financial historical past helps to reply these questions.

Prospects for disinflationary structural forces

Globalization, sturdy coverage frameworks, demographic modifications, structural components, and technological advances have been instrumental in retaining inflation low till 2020. These components present clues to questions on whether or not the present surge in costs is transitory or extra long-lasting. Ought to these forces recede, will increase in short-term inflation could change into rather more persistent.

- Globalization. Over the previous three many years, the entry of China and Jap Europe into the worldwide buying and selling system has drastically diminished the costs of many manufactured items. World worth chains have contributed to decrease inflation via outsourcing and higher competitors. International locations which might be extra open to commerce and monetary flows have typically skilled decrease inflation (Determine 2A). Over the previous decade, nevertheless, the maturing of worldwide worth chains has contributed to slowing commerce progress. New tariffs and import restrictions have been put in place in superior economies and EMDEs over the previous six years. Up to now, however these issues and a few extreme logistical bottlenecks, world worth chains seem to have remained resilient. Nonetheless, rising protectionist sentiment and geopolitical dangers could sluggish and even reverse the tempo of globalization.

- Coverage frameworks. Over the previous 4 many years, many superior economies and EMDEs carried out macroeconomic stabilization packages and structural reforms, improved fiscal frameworks, and gave central banks clear mandates to manage inflation. Within the context of inflation, these reforms have produced clear dividends: International locations with stronger financial coverage frameworks and extra impartial central banks have tended to expertise decrease inflation (Figures 2B and 2C). A shift from a mandate of worth stability to targets associated to the financing of presidency would undermine the credibility of financial coverage frameworks and lift inflation expectations. Mounting private and non-private debt in EMDEs up to now decade may weaken dedication to disciplined fiscal and financial coverage frameworks. EMDE sovereign credit score scores have continued to deteriorate, with some falling beneath funding grade, reflecting issues about rising debt and deteriorating progress prospects. Populist sentiment may encourage a transfer away from prudent fiscal and financial insurance policies.

- Demographic modifications. Speedy labor pressure progress, on account of inhabitants progress and elevated participation of girls, helped dampen will increase in wages and enter prices. The disinflationary advantages reaped from this course of could, nevertheless, now be at an inflection level because the share of the working-age inhabitants stabilizes even in EMDEs. World getting older is anticipated to decrease saving charges and lift inflationary pressures. Growing old in some giant rising markets could amplify this pattern. As well as, latest information from superior economies point out {that a} rising proportion of inhabitants is selecting to depart the labor pressure early—the “Nice Retirement.”

- Structural components. In each superior economies and EMDEs, the large-scale shift of labor and different assets from agriculture to higher-productivity manufacturing supplied productiveness beneficial properties. Over the previous decade, nevertheless, momentum for productivity-enhancing issue reallocation has light. Declining unionization of the labor pressure, smaller collective bargaining protection, and higher labor and product market flexibility have dampened wage and worth pressures over the previous decade.

- Technological advances. Automation, the rising adaptability of computer systems, robotics, and synthetic intelligence have improved manufacturing processes in lots of sectors. On the similar time, these components have lowered demand for routine manufacturing and clerical staff and lowered wage and worth pressures. In some superior economies, disinflation has additionally been attributed partly to cost transparency and aggressive pressures launched by the rising digitalization of companies, together with e-commerce or sharing companies. In distinction to the opposite structural components listed right here, the pandemic is more likely to have given renewed impetus to technological advances that will proceed to dampen inflationary pressures.

Determine 2. Components related to disinflation

Sources: Ha, Kose, and Ohnsorge (2019); Haver Analytics; IMF Worldwide Monetary Statistics and World Financial Outlook databases; OECDstat; World Financial institution.

Be aware: “AEs” = superior economies; “EMDEs” = rising market and creating economies. A. Hyphens point out median inflation in international locations with excessive trade-to-GDP ratios (“Commerce”) or monetary belongings and liabilities relative to GDP (“Finance”) within the prime quartile (“excessive openness”) of 175 economies throughout 1970-2017. Horizontal bars point out international locations within the backside quartile (“low openness”). Variations are statistically important on the 5 p.c degree. C. Hyphens point out median inflation in country-year pairs with a central financial institution independence and transparency index within the prime quartile of the pattern (B) or with inflation focusing on financial coverage regimes (C). Horizontal bars denote medians within the backside quartile (B) or with financial coverage regimes that aren’t inflation focusing on (C). Variations are statistically important on the 5 p.c degree.

What ought to creating economies do?

EMDE policymakers are dealing with the primary critical world financial coverage tightening cycle after greater than a decade of extremely accommodative exterior monetary situations. The tightening cycle is likely to be coinciding with shifts in some structural forces which have been instrumental in retaining inflation low over the previous 4 many years. Ought to these forces recede, latest will increase in short-term inflation could change into extra persistent, and thus threaten the anchoring of long-term inflation expectations.

In mild of the a number of sources of uncertainty—and the time lags within the transmission of financial shocks—EMDEs could discover themselves in a steep and extended financial coverage tightening cycle. Speaking financial coverage choices clearly, constructing and leveraging financial coverage credibility, and strengthening financial coverage frameworks—together with by safeguarding and additional buttressing central financial institution independence—shall be essential to handle inflation.

Financial coverage doesn’t function in a vacuum. Inflation expectations are unlikely to stay nicely anchored when fiscal sustainability is in danger. The withdrawal of pandemic-related fiscal assist must be finely calibrated and intently aligned with credible medium-term fiscal plans. Policymakers want to deal with investor issues about long-run debt sustainability by strengthening fiscal frameworks, enhancing debt transparency, upgrading debt administration, mobilizing authorities revenues, and enhancing spending effectivity.