In lower than a month, Russia has moved from an rising market nation to a pariah nation. They’ve been minimize off from western markets, faraway from the monetary system, and basically remoted economically. The pondering amongst NATO leaders is that their financial system will crumble, and their folks –oligarchs and populace alike – won’t tolerate this example.

Their greatest lifeline? An enormous neighbor to the south, with whom they share a 2,615-mile border: China.

The Individuals’s Republic of China has a voracious urge for food for uncooked supplies, vitality, and financial progress. Even when Russia is minimize off from many of the industrialized economies of the world, they nonetheless have a prepared market in China’s financial system – the second largest and one of many fastest-growing economies on the earth.

This might not be a everlasting association. I can not think about Vladimir Putin permitting Russia to develop into a consumer state, subservient to Xi’s China; his motivation for invading Ukraine appeared to be premised on recapturing the glory days of the previous Soviet Union.

But it surely raises the fascinating query of how absolutely built-in into the western monetary and financial system China is. Whether or not their very own particular wants and relationships with the assorted international locations on their borders — together with North Korea and Russia — will eclipse Western values.

We’ve got thought of this unresolved query earlier than, most not too long ago in “How a lot is the rule of regulation price to markets?

Every time a problem erupts in some rogue state, my go-to professional is Perth Tolle. She runs the Freedom 100 Rising Markets index/ETF (FRDM).1 The premise for the index she manages relies upon “quantitative private and financial freedom metrics,” and her ETF selects the ten greatest firms in every of the ten highest-ranked international locations.

Putin’s unprovoked invasion of one other sovereign nation, the video that we’ve seen of indiscriminate shelling of civilians (together with ladies and youngsters) and the true chance of battle crimes, has made Russia within the phrases of MSCI, “uninvestable.”

Would possibly China undergo an analogous destiny?

The nation is way extra highly effective than Russia, with larger financial ties to the West than the previous Soviet Union has. Given the dimensions of their inhabitants and their progress trajectory, it’s inevitable that China will finally be the most important financial system on the earth. This makes it extremely unlikely that they could possibly be economically remoted in ways in which Russia is going through.

However what does this imply for traders?

However what does this imply for traders?

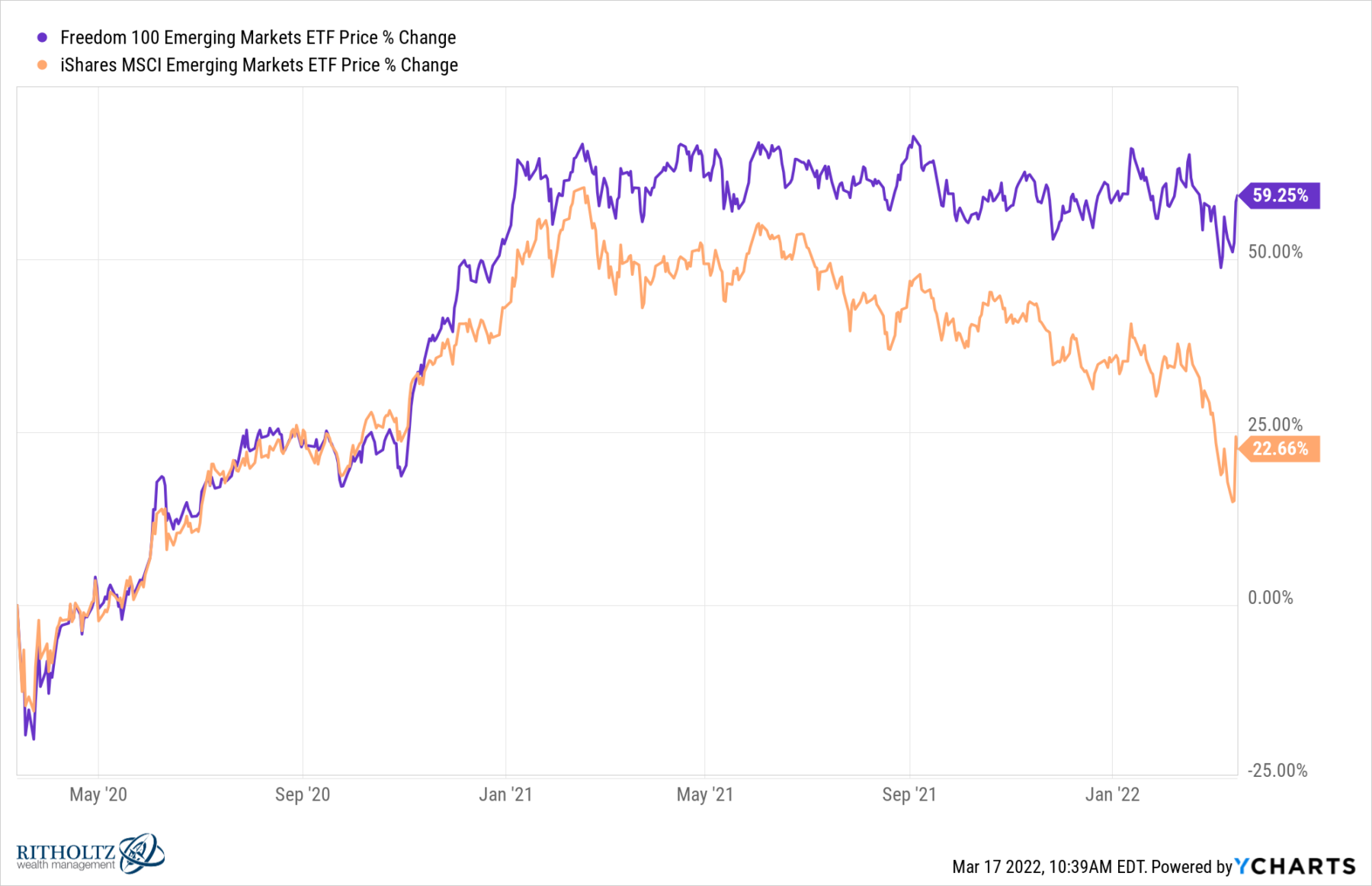

China is about 30% of most rising market indices. If we have a look at how nicely EM markets have finished these funds which have prevented nations like Russia and China have been outperforming. Think about Perth’s ETF, which has opened a couple of ~35% efficiency hole between itself and rivals that also have holdings in Russia (written all the way down to zero) and China since mid-2020. 2

Yesterday China introduced assist for its tech trade and its markets bounced 7%, and the Cling Seng Tech Index jumped 22%.

A query going through traders is whether or not or not they need to take part in China’s markets. Will Xi supply a lifeline to Putin? Will they proceed to subsidize Russian aggression? Are they funding the battle machine attacking ladies and youngsters and civilians?

I don’t know what traders will do collectively. The potential for progress makes investing in China very tempting; however the danger of presidency intervention has – at the very least over the previous two years – been a large problem. It has additionally led to underperformance.3

However the counter-argument is solely China’s financial progress has not been captured by stock investors, regardless of the intense progress they’ve had over 40 years. Perth makes the argument that:

“China’s progress is a narrative of the previous. Watch what they do, not what they are saying. Simply as with their response to the Russian invasion, they’re typically talking out of each side of their mouth. Their financial freedom has declined drastically underneath this present regime, there’s a reversal of the insurance policies that made China affluent. And their Tech firms at the moment are a risk to the regime, due to the info they seize.”

This can be a quandary that can be going through traders over the subsequent few years. I actually have no idea the way it resolves, however its one thing price being attentive to as occasions abroad increase quite a few challenges.

How A lot is the Rule of Legislation Value to Markets? (August 2, 2021)

________________

1. You will discover the paperwork for this ETF right here.

2. See, e.g., iShares rising market ETF, EEM.

3. RWM doesn’t have a place in FRDM, nor any curiosity within the Life + Liberty Indexes agency.