Tero Vesalainen/iStock by way of Getty Photos

When issues go proper, individuals are likely to ascribe the excellent efficiency of an organization on their superior stock-picking abilities. Quite the opposite, when issues go terribly flawed, we are likely to blame exterior elements which are outdoors of our management or just labelling the market as being irrational.

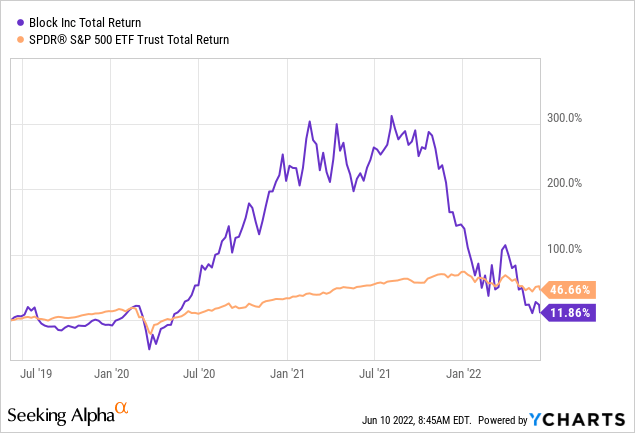

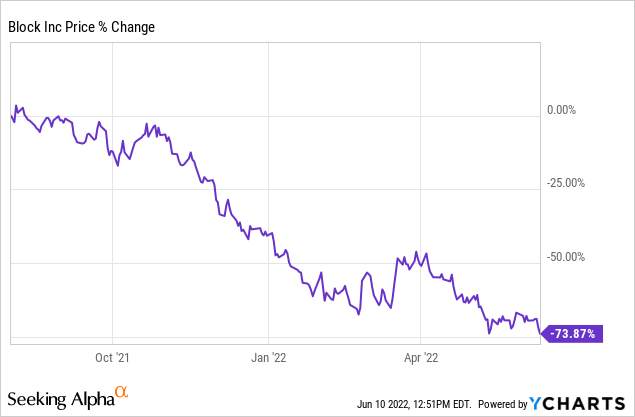

This holds true when judging the current efficiency of Block (NYSE:SQ). The corporate’s share achieved almost 300% return from mid-2019 to mid-2021 interval, solely to plunge down over the current months. Consequently, the corporate has now considerably underperformed the broader market on an absolute foundation over this 3-year interval. Adjusted for threat, the conditions is even worse.

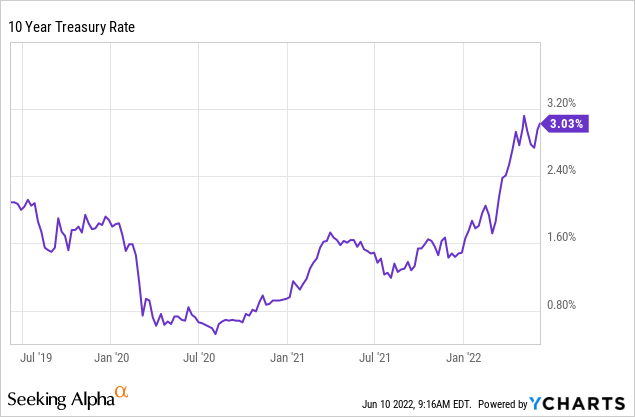

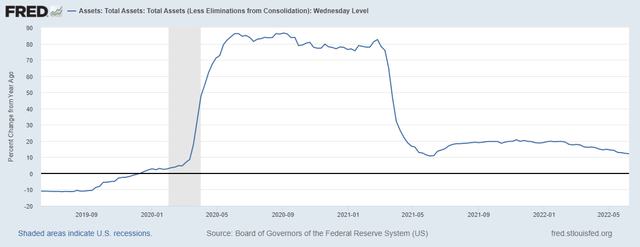

Merely observing this pattern, ought to elevate a significant purple flag for any shareholder. Block’s excellent share worth efficiency as much as mid-2021 appears to have been completely pushed by the unfastened financial situations, versus a superior enterprise mannequin and company technique. Even with out extra in-depth analysis, the impression of low yield and ample liquidity on excessive momentum shares, comparable to Block, is obvious to see.

FRED

After all, there’s a risk that this unprecedented financial experiment is much from over. Though it’s much less possible in an inflationary setting and a world heading to deglobalization, the probabilities of one more huge quantitative easing or yield curve management aren’t zero.

However we won’t choose out long-term investments primarily based on such hopes. What any long-term oriented investor needs to be taking a look at is the standard of the enterprise mannequin, the sustainability of aggressive benefits & margins, the relevance of the company technique, the stewardship function of administration, monetary dangers and at last valuation.

Block Web site

Due to this fact, when judging the attractiveness of Block’s share worth I’ll abstain from the potential of future liquidity injections by the federal government or central bankers and also will keep away from thrilling narratives that always depend on ever rising optimism in regards to the future. As a substitute, I’ll concentrate on three main areas of the enterprise that for my part maintain vital dangers for future returns, whilst Block will get nearer to its short-term truthful worth equilibrium.

Block’s profitability downside

As we talked about earlier, Block’s share worth misplaced almost three quarters of its worth in a matter of simply few months.

This occurred at a time when the S&P 500 fell by about 10%. Such abysmal efficiency is feasible both if the corporate in query is having monetary well being issuer, or there are vital discrepancies between the profitability & development expectations and actuality. In case of Block, the problem seems to be the latter.

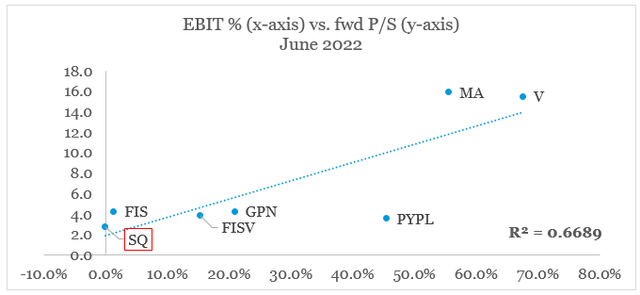

As of right now, the corporate’s ahead price-to-sales a number of of two.5x is in-line with its working margin of a adverse 0.1% on a cross sectional foundation.

ready by the creator, utilizing knowledge from Looking for Alpha

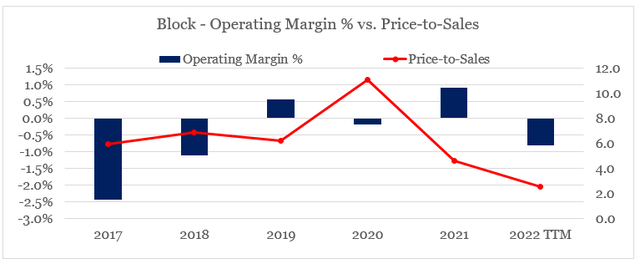

Whereas each variables have been shifting in unison over the previous, that doesn’t imply that EBIT margin of barely 1% was sufficient to help price-to-sales a number of in extra of 10 (see the graph beneath). We already established that the exuberant costs of Sq. achieved in the course of the 2020-21 interval had been as a result of extreme liquidity pumped into the system that resulted in unsustainable valuations not just for Block, but in addition for a lot of excessive momentum shares.

ready by the creator, utilizing knowledge from Looking for Alpha & SEC Filings

Primarily based on all that, it’s now cheap to imagine Block’s valuation will probably be extra in-line with these of its friends, as soon as we management for future development and margins. I’ll develop extra on the problem of income development within the subsequent part.

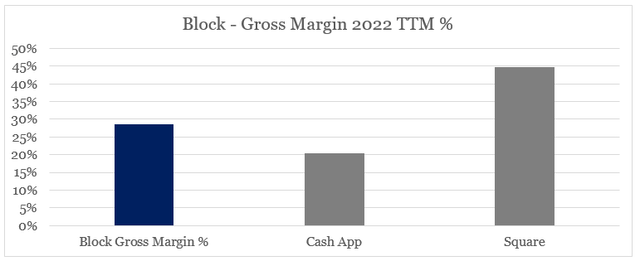

To generate excessive EBIT margins, an organization’s enterprise mannequin wants to have the ability to help these by way of excessive gross profitability. From thereon bigger scale and effectivity is normally sufficient to realize the a lot wanted working profitability.

Having mentioned that, the 2 main enterprise models of Block generate vastly completely different gross margins, with the Money App at present churning solely 20% gross margin.

ready by the creator, utilizing knowledge from SEC Filings

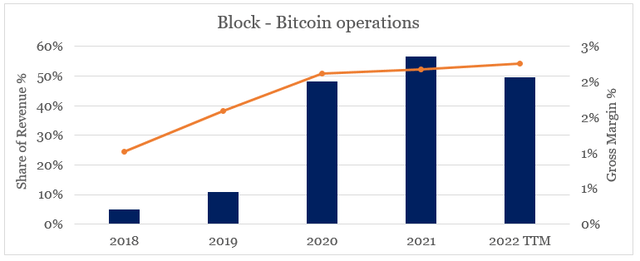

We should always acknowledge that this low margin of the Money App got here predominantly on account of the corporate’s bitcoin operations, which generate a mere 2% gross margin and elevated considerably since 2020.

ready by the creator, utilizing knowledge from SEC Filings

The rationale for that’s that Block studies its bitcoin operations on a gross foundation, however extra on that later.

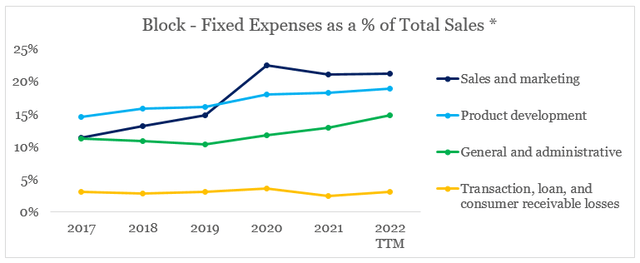

If we ignore Bitcoin operations and alter the corporate’s whole gross sales determine for all crypto-related income, we’ll see that the majority of Block’s fastened bills proceed to will increase as a share of income. That is very regarding given the massive development tailwinds skilled in the course of the pandemic that at the moment are subsiding.

ready by the creator, utilizing knowledge from SEC Filings

* excluding income from Bitcoin operations

The issue with gross sales development

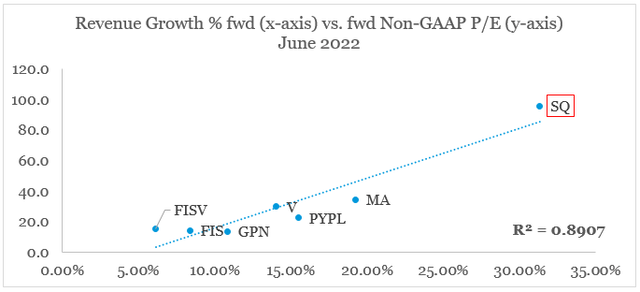

One remark that’s usually made is that profitability does not matter so long as Block continues to develop at such excessive charges. To an extent this assertion is true because the market may flip a blind eye on the dearth of profitability so long as an organization continues to seize market share. This view is supported by the graph beneath, the place Non-GAAP ahead P/E ratios are plotted towards corporations ahead income development charges.

ready by the creator, utilizing knowledge from Looking for Alpha

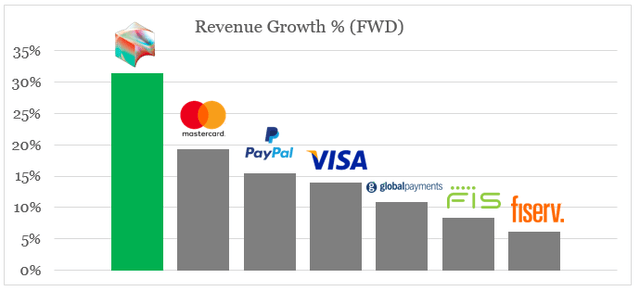

In comparison with different giant companies within the digital funds house, Block is an absolute chief by a really huge margin.

ready by the creator, utilizing knowledge from Looking for Alpha

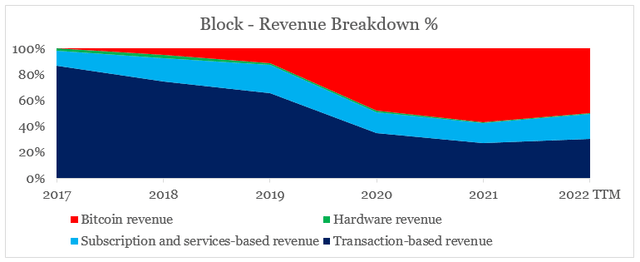

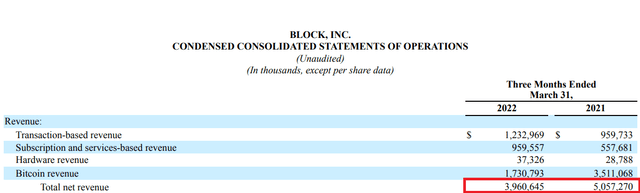

However there are two issues right here. Aside from this quantity being affected by the large deal for Afterpay, which I’ll cowl afterward, Block topline development was additionally largely impacted by its bitcoin operations. A breakdown of the corporate’s income exhibits that from non-existent in 2017, bitcoin now makes up almost half of whole gross sales.

ready by the creator, utilizing knowledge from SEC Filings

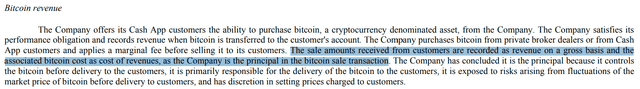

If we dig into Block’s SEC Filings, nevertheless, and extra particularly take a look on the income recognition half, we’ll perceive why that is. It isn’t as a result of, the corporate all of the sudden tapped right into a phase that brings billions of {dollars}, however slightly on account of accounting remedy. In its bitcoin operations, Block permits Money App prospects to purchase and promote bitcoins and for that it prices a fee. Nevertheless, these transactions are recorded on a gross foundation, that means that the corporate data the complete quantity of bitcoins bought by a consumer as income and is then expensing the price to acquire these bitcoins.

Block 10-Okay SEC Submitting Block 10-Okay SEC Submitting

From an accounting perspective, there’s nothing flawed with this remedy since Block assumes possession of those bitcoins, earlier than they’re bought to purchasers.

Deloitte

From a monetary perspective, nevertheless, these transactions considerably inflate Block’s topline development and likewise end in a lot decrease gross margins for the Money App as we noticed above. However, so long as P/E ratios are predominantly pushed by future anticipated development, this trade-off between income development and margins appears justified.

The issue with Afterpay

Giant M&A offers are sometimes frowned upon by the funding group as they have an inclination to backfire within the long-run or might be interpreted as an indication of desperation as topline development cools off. The final level may be very delicate for Block since future anticipated development issues an amazing deal for the corporate’s excessive buying and selling multiples.

I can’t speculate whether or not or not the deal was made on account of slowing development of Sq. and the Money App, however the deal for Afterpay is marked by a lot of main purple flags that want addressing.

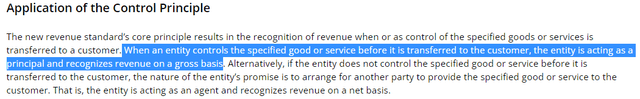

To start with, an organization comparable to Afterpay, is essentially made up of intangible belongings with belongings comparable to property, plant & gear and inventories being a tiny proportion of its general enterprise worth. That’s the reason the full worth of intangible belongings of solely $2bn is a priority for such a big deal.

Block Q1 2022 10-Q SEC Submitting

Furthermore, goodwill that’s used as a balancing quantity between whole consideration and recognized belongings & liabilities is a staggering $11.7bn. Because of this not solely Block’s administration was not capable of determine a major quantity of intangible belongings, but in addition that a big proportion of the worth paid for the corporate is predicated on future expectations in regards to the enterprise.

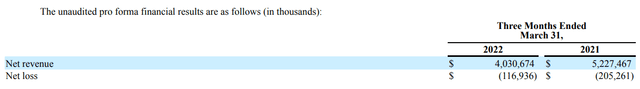

To get an thought of what sort of enterprise did Block purchase, we must also have a more in-depth take a look at the notes of Block’s SEC filings. The desk beneath, exhibits SQ professional forma web income and web loss figures, as if Afterpay deal had occurred on 1st of January 2021.

The next desk summarizes the unaudited professional forma consolidated monetary info of the Firm as if the Afterpay acquisition had occurred on January 1, 2021.

Supply: Block 2022 Q1 10-Q SEC Submitting

Block Q1 2022 10-Q SEC Submitting

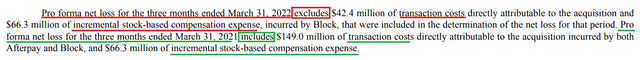

Primarily based on Block’s precise reported web revenue (loss) figures of -$207m and $39m for Q1 2022 and Q1 2021 respectively, it seems that Afterpay has swung from giant loss to revenue over the course of 1 12 months. Nevertheless, the notes reveal that sure transaction prices and stock-based compensation bills had been excluded from a kind of figures and included within the different.

Block Q1 2022 10-Q SEC Submitting

This makes comparability between durations extraordinarily troublesome for anybody counting on publicly accessible info.

Whereas Afterpay income seem as a black field at this cut-off date, we may get an thought of the place the corporate’s revenues are at present standing by subtracting Block’s precise reported figures for the 2 quarters from their respective pro-forma outcomes we noticed above.

Block Q1 2022 10-Q SEC Submitting

This provides us gross sales figures of $70m throughout Q1 2022 and $170m throughout the identical quarter of the prior 12 months. Whereas quarterly outcomes are hardly a pattern, these numbers needs to be a priority for anybody believing in Afterpay’s huge development potential.

Final however not least, there may be the problem with the worth tag that Block paid for its largest acquisition ever. Though, Afterpay appears to suit properly inside Block’s service choices to prospects and sellers, the $29bn deal for a corporation with roughly $650m value of gross sales for FY 2021 resulted in a transaction worth to gross sales a number of of almost 45 instances. After all, because the deal was paid by utilizing Block’s shares, because the share worth of SQ fell, so did the transaction worth for Afterpay. Nevertheless, even when we use the $13.8bn whole consideration for Afterpay recorded on Block’s Q1 2022 monetary accounts, the a number of remains to be exceptionally excessive. The gross sales a number of already takes under consideration years, if not many years of excessive income development and excessive margins, which as we noticed above are each questionable already.

Conclusion

Block’s share worth decline of almost 75% over lower than a 12 months was extraordinary. From considered one of Wall Avenue’s excessive flyers, the corporate was all of the sudden caught between a rock and a tough place brought on by decrease market liquidity on one hand and idiosyncratic dangers on the opposite. Block’s exceptionally excessive valuation additional exacerbated the issues that the corporate was all of the sudden confronted with.

Given all these dangers that all of the sudden materialized, Block may now simply turn into oversold over the short-term as pessimism takes maintain. Any short-term reversal, nevertheless, is unlikely to be sustainable for my part given the issues described above. After all, financial situations may as soon as once more flip favorable for Block and all momentum shares, however such a state of affairs doesn’t appear interesting for anybody who goals to determine strong long-term investments.