Jon Feingersh/The Image Bank via Getty Images

We previously covered Iron Mountain Incorporated (NYSE:IRM) in November 2023, discussing its mixed near-term prospects, as the management aggressively expanded its data center capacity to capitalize on the generative AI boom at a time of elevated interest rate environment.

Despite the REIT’s increased reliance on debt and moderately impacted bottom lines, we had maintained our Buy rating, since its dividend income investment thesis remained robust.

In this article, we shall discuss IRM’s excellent record management/ data center monetization thus far, as observed in its sustained top/ bottom line expansions in FQ4’23, further aided by promising FY2024 guidance.

Combined with Nvidia’s (NVDA) excellent guidance in the latest earnings call, it is apparent that the generative AI demand remains robust, with the uplifted market sentiments likely to persist for a little longer.

The Generative AI Investment Thesis Is Still Robust – Thanks To NVDA

For now, IRM has reported a bottom line beat in its FQ4’23 earnings call, with total revenues of $1.42B (+2.8% QoQ/ +11.8% YoY) and AFFO per share of $1.11 (+12.1% QoQ/ +8.8% YoY), with FY2023 numbers of $5.48B (+7.4% YoY) and $3.97 (+4.4% YoY), respectively.

Much of the tailwinds are attributed to the 124 MWs of Data Center capacity leased in FY2023, way exceeding the original guidance of 80 MWs, contributing to the REIT’s expanding storage rental revenues of $3.37B (+11.2% YoY) for the full year.

If anything, IRM’s legacy storage business can not be ignored as well, with the REIT reporting multiple records management/ digitization contract wins across hospitals, industrial gas suppliers, and asset management companies in FQ4’23.

It is also apparent by now, that the “generative AI demand knows no bounds,” with NVDA recently reporting FQ4’24 (Q4’23) revenues of $22.1B (+21.9% QoQ/ +265.3% YoY) – beating its previous guidance of $20B (+10.3% QoQ/ +230.5% YoY).

This is on top of NVDA offering an excellent FQ1’25 (Q1’24) revenue guidance of $24B (+8.5% QoQ/ +233.7% YoY), sustaining the hype surrounding the generative AI platform.

As a result, it is unsurprising that IRM similarly offers a promising FY2024 revenue guidance of $6.07B (+10.7% YoY) and AFFO per share guidance of $4.45 (+12% YoY) at the midpoint.

At the same time, the REIT has offered FY2024 capex guidance of $1.35B (+12.5% YoY), with “the vast majority of the growth capital to be dedicated to data center development,” thanks to the insatiable demand and continued pricing strength, as similarly reported by Digital Realty Trust (DLR) in the latest earnings call.

Despite IRM’s growing long-term debts of $11.81B (+2.3% QoQ/ +12.6% YoY) and consequently, elevated annualized interest expenses of $607.12M (inline QoQ/ +10.9% YoY), we are not overly concerned, since we believe that these investments may eventually be accretive to its top/ bottom lines.

This is also because the REIT reports growing annualized adj EBITDA generation of $2.1B (+5.1% QoQ/ +11.2% YoY) and expanding adj EBITDA margins of 37% (+0.1 points QoQ/ +1.2 YoY).

With the increasing profitability well balancing the debt obligations, it is apparent that the IRM management’s laser focus on growth is well warranted.

This is further aided by the REIT’s moderating debt-to-EBITDA ratio of 5.62x by FQ4’23, compared to 5.97x in FQ3’24 and 6.32x in FQ4’22, while finally nearing the 5.6x reported in FY2019 and the diversified REITs’ average Net Debt to EBITDA ratio of 5.63x.

The same prudence may also be observed in IRM’s TTM AFFO payout ratio of 65.39%, well below the sector median of 74.45%.

This is significantly aided by the stable share count over the past few years, with the management also avoiding the dilutive nature of equity raises and naturally expensive dividend obligations.

The sustained share count has allowed the REIT to offer an excellent 3Y Dividend Per Share Growth rate of +3.02%, higher compared to the sector median of +2.28%.

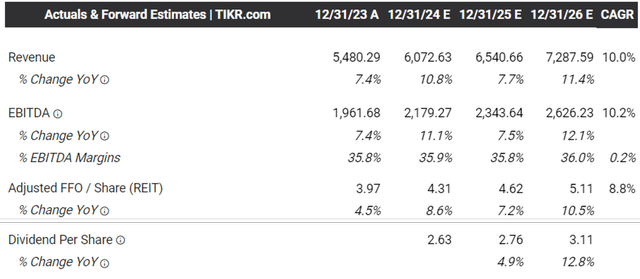

The Consensus Forward Estimates

Tikr Terminal

Perhaps this is why the consensus have moderately raised their forward estimates, with IRM expected to generate an exemplary top/ bottom line expansion at a CAGR of +10% and +8.8% through FY2026.

This is compared to the previous estimates of +8.6%/ +7.1% and the historical growth of +6.6%/ +6.1% between FY2016 and FY2023, respectively, thanks to the management’s promising FY2024 guidance.

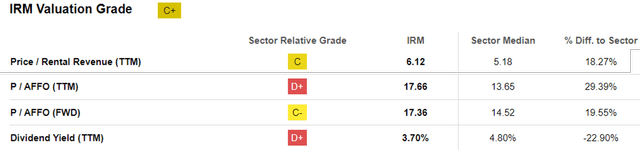

IRM Valuations

Seeking Alpha

As a result of the accelerated growth projections, we can understand why the market has also awarded IRM with the premium FWD Price/ Rental Revenue valuations of 6.12x and FWD Price/ AFFO valuations of 17.36x. This is compared to its 1Y mean of 3.05x/ 14.77x, 3Y pre-pandemic mean of 2.35x/ 11.89x, and sector median of 5.18x/ 14.52x, respectively.

Readers must note that not all REITs are created equal, with Data Center REITs naturally benefiting from the sustained cloud transition post-COVID-19.

Combined with the boost from generative AI, it is unsurprising that IRM remains relatively cheap compared to its Data Center peers, such as DLR at 12.02x/ 21.95x and Equinix, Inc. (EQIX) at 8.37x/ 24.81x, respectively.

Based on the FY2023 AFFO per share of $3.97 and IRM’s FWD Price/ AFFO of 17.36x, it appears that the stock is trading near our estimated fair value of $68.90, with a minimal premium of +4.6% at current levels.

At the same time, based on the FY2026 AFFO per share estimate of $5.11, there seems to be an excellent upside potential of +23% to our long-term price target of $88.70, made sweeter by the forward dividend yield of 3.53%.

So, Is IRM Stock A Buy, Sell, or Hold?

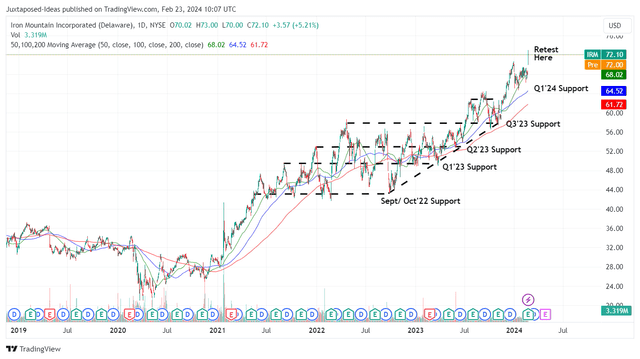

IRM 5Y Stock Price

Trading View

On the one hand, thanks to the multiple tailwinds ahead, IRM has rapidly broken out of its 50 day moving averages while charting new heights at the time of writing.

As “NVDA makes Wall Street history,” it is also apparent that the REIT has been buoyed by the lifting market, despite the fact that part of the latter’s data center revenue contracts are tied to Consumer Price Index rent escalators.

With sentiments also hitting Extreme Greed, it appears that there may be moderate volatility after the market digests much of the optimism.

On the other hand, with the “world already reaching the tipping point of new computing era,” we believe that investors may still add IRM at every pullback, as generative AI is undoubtedly here to stay.

Combined with the prospective dual pronged returns through capital appreciation and dividends, we believe that investors may still add IRM at every pullback for an improved margin of safety, preferably at its previous support levels of $66.