By David Randall

NEW YORK (Reuters) – A week of heavy selling has rocked U.S. stocks and bonds, and many investors are bracing for more pain ahead.

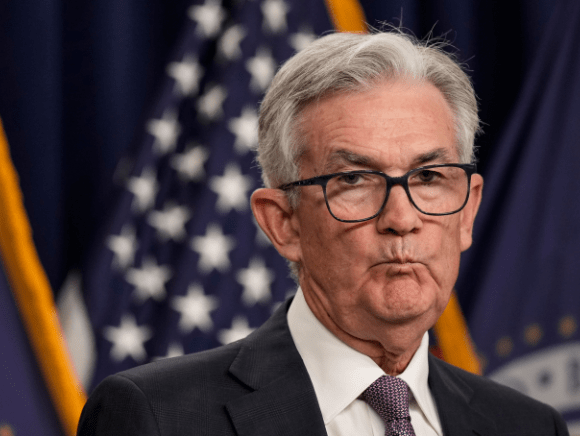

Wall Street banks are adjusting their forecasts to account for a Federal Reserve that shows no evidence of letting up, signaling more tightening ahead to fight inflation after another market-bruising rate hike this week.

The is down more than 22% this year. On Friday, it briefly dipped below its mid-June closing low of 3,666, erasing a sharp summer rebound in U.S. stocks before paring losses and closing above that level.

With the Fed intent on raising rates higher than expected, “the market right now is going through a crisis of confidence,” said Sam Stovall, chief investment strategist at CFRA Research.

If the S&P 500 closes below the mid-June low in the days ahead, that may prompt another wave of aggressive selling, Stovall said. This could send the index as low as 3,200, a level in line with the average historical decline in bear markets that coincide with recessions.

While recent data has shown a U.S. economy that is comparatively strong, investors worry the Fed’s tightening will bring on a downturn.

A rout in bond markets added pressure on stocks. Yields on the benchmark 10-year Treasury, which move inversely to prices, recently stood at around 3.69%, their highest level since 2010.

Higher yields on government bonds can dull the allure of equities. Tech stocks are particularly sensitive to rising yields because their value rests heavily on future earnings, which are discounted more deeply when bond yields rise.

Michael Hartnett, chief investment strategist at BofA Global Research, believes high inflation will likely push U.S. Treasury yields as high as 5% over the next five months, exacerbating the selloff in both stocks and bonds.

“We say new highs in yields equals new lows in stocks,” he said, estimating that the S&P 500 will fall as low as 3,020, at which point investors should “gorge’ on equities.

Goldman Sachs (NYSE:), meanwhile, cut its year-end target for the S&P 500 by 16% to 3,600 points from 4,300 points.

“Based on our client discussions, a majority of equity investors have adopted the view that a hard landing scenario is inevitable,” wrote Goldman analyst David Kostin.

Investors are looking for signs of a capitulation point that would indicate a bottom is near.

The Cboe Volatility Index, known as Wall Street’s fear gauge, on Friday shot above 30, its highest point since late June but below the 37 average level that has marked crescendos of selling in past market declines since 1990.

Bond funds recorded outflows of $6.9 billion during the week to Wednesday, while $7.8 billion was removed from equity funds and investors plowed $30.3 billion into cash, BofA said in a research note citing EPFR data. Investor sentiment is the worst it has been since the 2008 global financial crash, the bank said.

Kevin Gordon, senior investment research manager at Charles Schwab (NYSE:), believes there is more downside ahead because central banks are tightening monetary policy into a global economy that already appears to be weakening.

“It will take us longer to get out of this rut not only because of slowdown around the world but because the Fed and other central banks are hiking into the slowdown,” Gordon said. “It’s a toxic mix for risk assets.”

Still, some on Wall Street say the declines may be overdone.

“Selling is becoming indiscriminate,” wrote Keith Lerner, co-chief investment officer at Truist Advisory Services. “The increased probability of breaking the June S&P 500 price low may be what it takes to invoke even deeper fear. Fear often leads to short-term bottoms.”

A key signal to watch over the coming weeks will be how steeply estimates of corporate earnings fall, said Jake Jolly, senior investment strategist at BNY Mellon (NYSE:). The S&P 500 is currently trading at around 17 times expected earnings, well above its historical average, which suggests that a recession is not yet been priced into the market, he said.

A recession would likely push the S&P 500 to trade between 3,000 and 3,500 in 2023, Jolly said.

“The only way we see earnings not contracting is if the economy is able to avoid a recession and right now that does not seem to the odds-on favorite,” he said. “It’s very difficult to be optimistic on equities until the Fed engineers a soft landing.”