IvelinRadkov/iStock by way of Getty Photographs

Funding Thesis

The variety of corporations which have elevated dividends for not less than ten consecutive years is rising, and with every passing 12 months, this once-admirable dividend progress streak will get much less spectacular. The Invesco Dividend Achievers ETF (NASDAQ:PFM) tracks these 373 corporations, however resulting from its market-cap-weighting scheme, it finally ends up being too much like an S&P 500 Worth Index fund. For 0.53% in annual charges with no high quality screens, it is sensible that PFM has been an average-at-best long-term performer. I count on it’s going to stay that manner sooner or later, and due to this fact, I’m limiting my score on PFM to a maintain.

ETF Overview

Technique and Fund Fundamentals

PFM passively tracks the NASDAQ US Broad Dividend Achievers Index, choosing constituents with not less than ten years of accelerating annual common dividend funds. Evaluations are as soon as per 12 months in March, and the Index is market-cap-weighted with a cap of 4% per safety at every quarterly rebalancing. In consequence, PFM is extra concentrated than you would possibly suppose. I’ve listed some further statistics beneath for simple reference:

- Present Worth: $38.68

- Property Underneath Administration: $735 million

- Expense Ratio: 0.53%

- Launch Date: September 15, 2005

- Trailing Dividend Yield: 1.87%

- 5-12 months Dividend CAGR: 7.79%

- Ten-12 months Dividend CAGR: 6.08%

- Dividend Frequency: Quarterly

- 5-12 months Beta: 0.85

- Variety of Securities: 373

- Portfolio Turnover: 28% (6%, 5%, 13%, 20% From 2017-2020)

- Property in Prime Ten: 25.05%

- 30-Day Median Bid-Ask Unfold: 0.05%

- Tracked Index: NASDAQ US Broad Dividend Achievers Index

- Brief-Time period Capital Positive factors Tax Price: 40%

- Lengthy-Time period Capital Positive factors Tax Price: 20%

- Tax Kind: 1099

One optimistic function is that PFM is a low-turnover ETF. It is sensible, on condition that qualifying corporations are more likely to keep their dividend progress standing. There is a good probability PFM could have lots of the identical securities in 5 years because it does at this time, so passive buyers will admire not having to examine in every year because the Index reconstitutes. On the draw back, the Index is changing into so watered down that ten consecutive years of dividend will increase are now not spectacular. In my opinion, buyers want further high quality or valuation screens.

Sector Exposures and Prime Ten Holdings

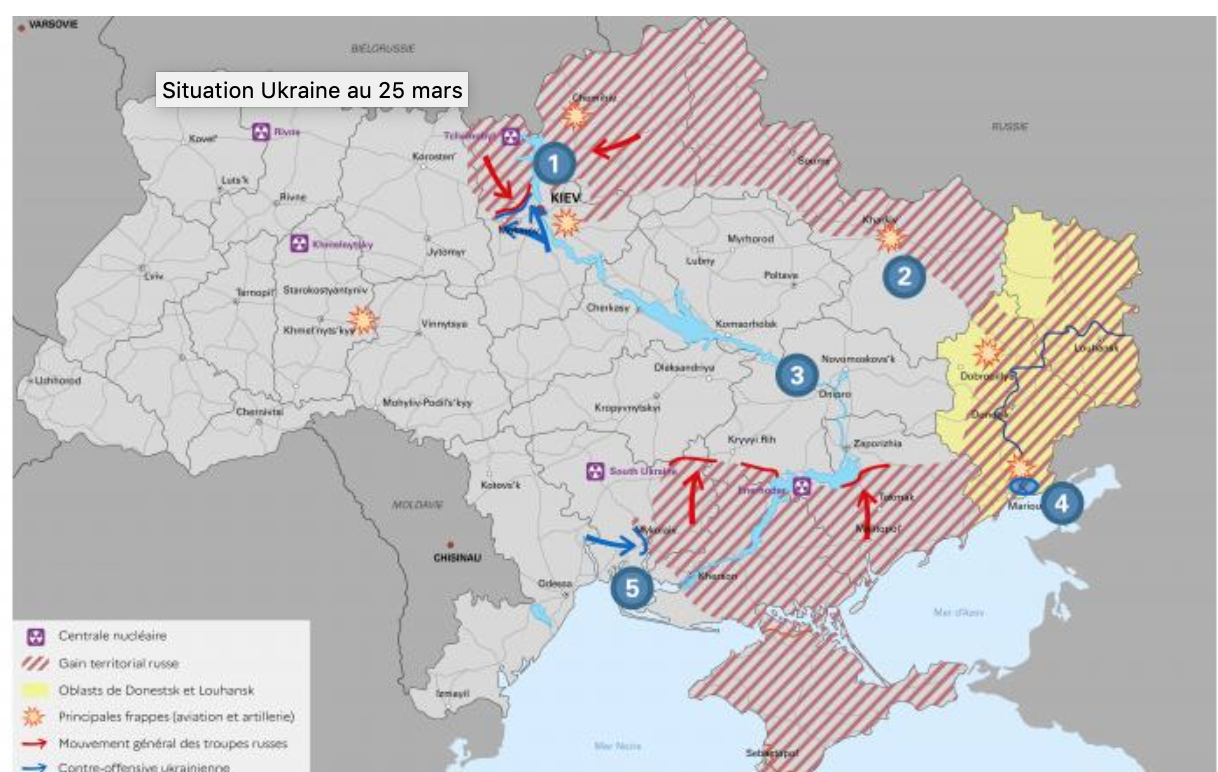

The desk beneath highlights sector publicity variations between PFM and three different funds: the SPDR S&P 500 ETF (SPY), the SPDR S&P 500 Worth ETF (SPYV), and the ProShares S&P 500 Dividend Aristocrats ETF (NOBL). NOBL requires 25 consecutive years of dividend will increase, so it is the following stage up for these valuing dividend consistency.

Morningstar

Based mostly on these publicity ranges, PFM could also be thought of a cross between SPY and SPYV, primarily due to its excessive publicity to Expertise and Shopper Staples shares. Notably, it lacks any significant publicity to Power and Supplies shares, which are sometimes commodity-driven. This function is a key cause for PFM’s latest underperformance towards different large-cap dividend ETFs. This can in all probability proceed, too. Shares in these sectors are much less more likely to attain ten consecutive years of rising dividends as a result of commodity costs are cyclical.

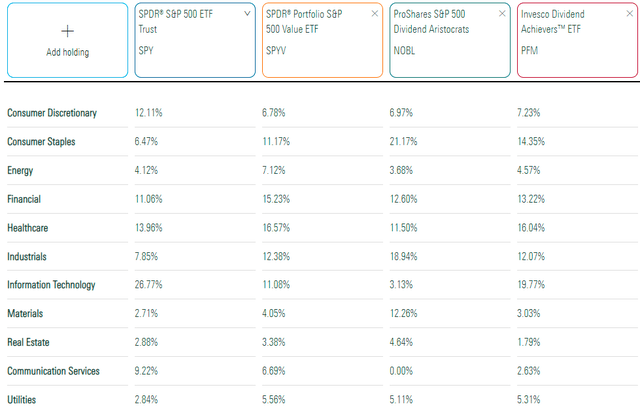

PFM’s high ten holdings, which whole one-quarter of the ETF, are proven beneath. Microsoft (MSFT) is considered one of 26 Expertise shares within the Index, whereas three Well being Care shares make the checklist. They’re UnitedHealth Group (UNH), Johnson & Johnson (JNJ), and Procter & Gamble (PG). In response to World Trade Classification Requirements, Visa (V) and Mastercard (MA) are additionally thought of Expertise shares.

Invesco

Historic Efficiency

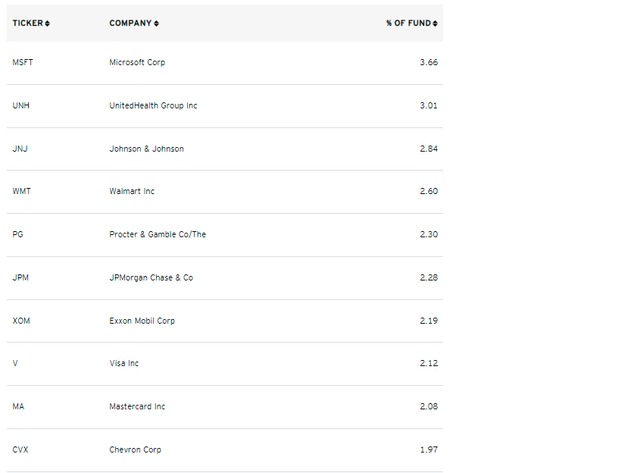

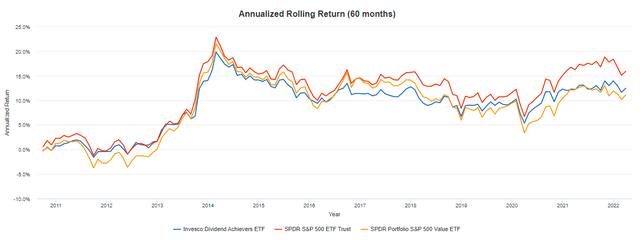

Traditionally, PFM appears nearer to an S&P 500 Worth fund greater than something. Its annualized returns are virtually similar, however it did expertise much less volatility. In consequence, its risk-adjusted returns (Sharpe and Sortino Ratios) had been barely higher. Nonetheless, PFM trailed SPY by 2.89% per 12 months, which, over 16.5 years, means an underperformance of 124%.

Portfolio Visualizer

In equity, most of this underperformance got here within the final 5 years, and PFM was a stable product up till then. The graph beneath exhibits the abrupt change in five-year rolling returns round 2016.

Portfolio Visualizer

ETF Evaluation

Dividend Development and Yield Historical past

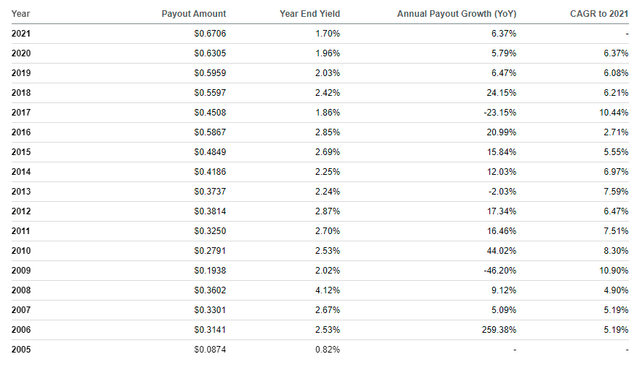

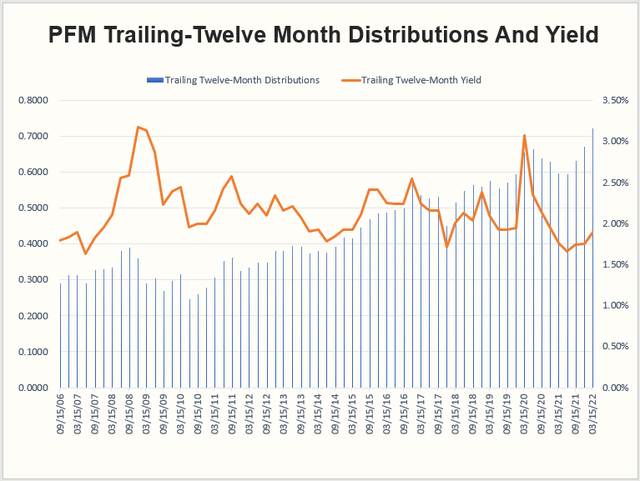

Since all constituents have grown dividends for an prolonged interval, I doubt dividend security and consistency are a difficulty. Nevertheless, the diploma of dividend progress is commonly an issue. PFM’s trailing yield is only one.87%, so I believe buyers want some regular progress over time to be a worthwhile long-term funding. The graph beneath exhibits that this progress is meager – solely 5.19% annualized within the final 15 years.

In search of Alpha

The expansion in 2017-2018 virtually offsets one another, so the figures could also be tough to interpret. As a substitute, I’ve graphed the distributions on a trailing twelve-month foundation and included the yield on every ex-dividend date to offer a greater image. You may see that distribution progress is not linear however has elevated at an affordable charge during the last ten years. From March 2012 to March 2022, trailing distributions rose from $0.3339 to $0.7216, or an annualized 8.01%. Yield has been extra risky, after all, however it’s value noting that the yield hasn’t been this low since December 2017.

The Sunday Investor

Dividend Scorecard

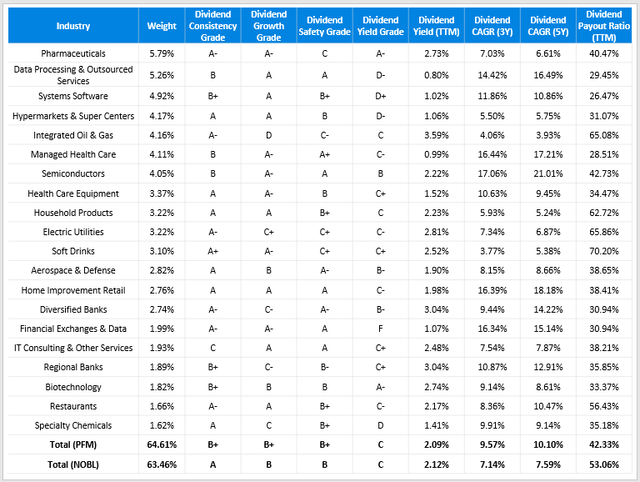

In search of Alpha’s Dividend Grade for PFM is an “A-,” however as talked about earlier than, dividend progress is my predominant concern as a result of I do not suppose there’s a difficulty with security and consistency. To research this in additional element, I’ve calculated weighted-average rankings for PFM’s high 20 industries, which whole about two-thirds of the ETF. The online rankings for your complete ETF are on the backside, alongside rankings for NOBL, which might be an affordable different for those who favor an extended dividend progress streak.

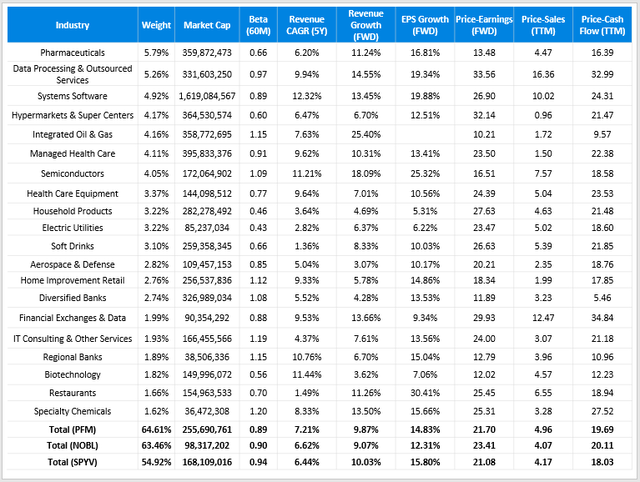

The Sunday Investor

Although PFM has 373 constituents, it has roughly the identical focus in its high 20 industries as NOBL, which takes an equal-weight method. In my opinion, selecting PFM over NOBL for diversification functions would not make sense. Nevertheless, PFM seems to be a more sensible choice for dividend progress and security, as mirrored by its “B+” grade in comparison with NOBL’s “B” grade.

Constituents even have an analogous gross dividend yield of two.09% however have stronger three- and five-year dividend progress charges. This extra strong progress is anchored by shares within the Information Processing & Outsourced Providers, Techniques Software program, Managed Well being Care, Semiconductors, and Well being Care Tools industries. Collectively, these account for 21.71% of PFM in comparison with 6.31% in NOBL.

One other optimistic function is PFM’s decrease dividend payout ratio (42.33% vs. 53.06%). I exploit 60% as a ballpark determine for what I think about secure (75% for Utilities), and solely 13.99% of PFM’s constituents by weight cross this threshold. That determine will increase to 23.42% for NOBL, so I believe PFM has extra room to develop their dividends, all issues being equal.

Elementary Evaluation

For my basic evaluation, I’ll take a look at every ETF’s income and earnings progress charges and their valuations. I’ve added SPYV to the combination resulting from its historic efficiency similarities.

The Sunday Investor

The above desk suggests that every one three funds have related income and earnings progress charges, although SPYV is cheaper than PFM primarily based on its ahead price-earnings ratio (21.08 vs. 21.70), trailing price-sales ratio (4.17 vs. 4.96), and trailing price-cash move ratio (18.03 vs. 19.69). These variations are minor, however they counsel there isn’t any cause to be paying 0.53% per 12 months in bills for what seems to be an inferior portfolio.

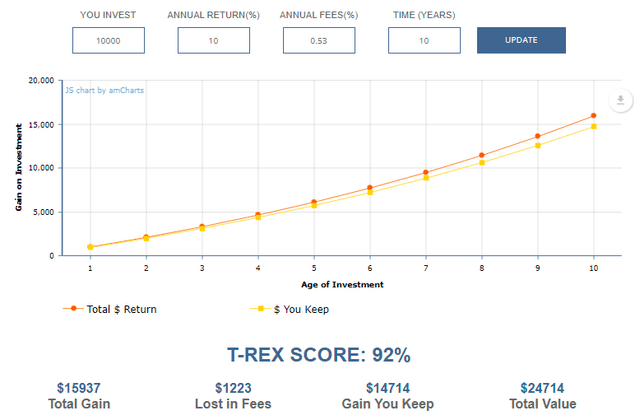

Towards NOBL, PFM does seem to have an edge. It has a bigger market capitalization, which normally suggests higher profitability, and it has higher progress charges and valuations (apart from price-sales). In case you worth dividend consistency, select PFM, however this might not be my method. Except an ETF has significantly better fundamentals, I default to the lowest-cost possibility. SPYV’s expense ratio is barely 0.04%, leading to simply 0.59% of your whole positive factors misplaced to charges over ten years (assuming a ten% annual return). In distinction, based on Larry Bates’ calculator, you will lose 7.67% of your income to charges with PFM.

Larry Bates

Funding Advice

PFM definitely appears higher than NOBL for these valuing dividend consistency. Nevertheless, I warning towards this method, contemplating how PFM’s historic returns are almost similar to SPYV. Its present portfolio is weaker on progress and valuation, and the 1.87% dividend yield is near its lowest level ever and is unlikely a promoting level for dividend buyers.

The variety of corporations which have elevated their funds for ten consecutive years is just too massive, and it is now not a metric that means superior high quality. PFM is an average-at-best dividend ETF with excessive charges with none further high quality screens. I do not suggest it and suppose you are higher off going with low-fee worth ETFs as a substitute.

:max_bytes(150000):strip_icc()/GettyImages-1245096289-5385401fabec447d8239c821a545c66e.jpg)