juststock/iStock by way of Getty Photographs

Standardized efficiency (%) | as of September 30, 2024 | ||||||||

Quarter | YTD | 1 Yr | 3 Years | 5 Years | 10 Years | Since inception | |||

Class A shares inception: 06/23/05 | NAV | 2.53 | 25.80 | 43.77 | 7.80 | 16.72 | 13.54 | 11.10 | |

Max. Load 5.5% | -3.11 | 18.90 | 35.86 | 5.79 | 15.40 | 12.90 | 10.77 | ||

Class R6 shares inception: 09/24/12 | NAV | 2.60 | 26.14 | 44.25 | 8.17 | 17.12 | 13.98 | 15.01 | |

Class Y shares inception: 06/23/05 | NAV | 2.59 | 26.07 | 44.13 | 8.08 | 17.01 | 13.83 | 11.37 | |

Russell 1000 Development Index (USD) | 3.19 | 24.55 | 42.19 | 12.02 | 19.74 | 16.52 | – | ||

Complete return rating vs. Morningstar Giant Development class (Class A shares at NAV) | – | – | 22% (249 of 1144) | 58% (587 of 1079) | 43% (439 of 1008) | 57% (466 of 793) | – | ||

Expense ratios per the present prospectus: Class A: Internet: 0.99%, Complete: 0.99%; Class R6: Internet: 0.64%, Complete: 0.64%; Class Y: Internet: 0.74%, Complete: 0.74%.

Efficiency quoted is previous efficiency and can’t assure comparable future outcomes; present efficiency could also be decrease or greater. Go to Nation Splash for the latest month-end efficiency. Efficiency figures replicate reinvested distributions and adjustments in web asset worth (NAV). Funding return and principal worth will differ in order that you’ll have a achieve or a loss whenever you promote shares. Returns lower than one 12 months are cumulative; all others are annualized. Index supply: RIMES Applied sciences Corp. Please remember that excessive, double-digit returns are extremely uncommon and can’t be sustained. Had charges not been waived and/or bills reimbursed previously, returns would have been decrease. Efficiency proven at NAV doesn’t embody the relevant front-end gross sales cost, which might have diminished the efficiency.

Class Y and R6 shares haven’t any gross sales cost; subsequently efficiency is at NAV. Class Y shares can be found solely to sure traders. Class R6 shares are closed to most traders. Please see the prospectus for extra particulars.

Supervisor perspective and outlook

- Regardless of a decline in early August, US fairness markets posted positive aspects within the third quarter as inflation cooled and the US Federal Reserve (Fed) started its long-awaited financial easing cycle.

- Inflation hit its lowest stage since 2021, with the 12-month Shopper Value Index (CPI) for August (launched in September) coming in at 2.5%, down from 2.9% in July.

- Nonetheless, the financial system remained resilient, with the third estimate of second quarter GDP development reported at 3.0%, stronger than anticipated and above first quarter development of 1.4%.

- Nonetheless, a weaker-than-expected payroll report appeared to shock traders in August and employment knowledge was largely unchanged in September, prompting the Fed to chop the federal funds fee by 0.50% at its September assembly.

- With higher certainty about rates of interest, traders rotated out of the unreal intelligence and technology-related shares that had led for a lot of 2024 and into small-cap and worth shares that will profit from decrease rates of interest.

- Given the setting, we search to maintain the fund extra balanced, with elevated emphasis on greater high quality firms with resilient earnings development and the pliability to regulate as acceptable.

- Whereas there are a number of short-term situations attainable, we imagine a slow-growth world financial system is probably going for the following few years. Such an setting sometimes rewards the progressive, natural development firms that we embrace.

Prime issuers | ||

(% of complete web belongings) | ||

Fund | Index | |

NVIDIA Corp (NVDA) | 10.87 | 10.31 |

Microsoft Corp (MSFT) | 9.50 | 11.61 |

Apple Inc (AAPL) | 9.13 | 12.29 |

Amazon.com Inc (AMZN) | 7.36 | 6.28 |

Meta Platforms Inc (META) | 5.24 | 4.55 |

Alphabet Inc (GOOG)(GOOGL) | 3.85 | 6.53 |

Broadcom Inc (AVGO) | 3.72 | 2.85 |

KKR & Co Inc (KKR) | 2.96 | 0.09 |

Eli Lilly & Co (LLY) | 2.93 | 2.57 |

Blackstone Inc (BX) | 2.68 | 0.39 |

As of 09/30/24. Holdings are topic to alter and will not be purchase/promote suggestions. | ||

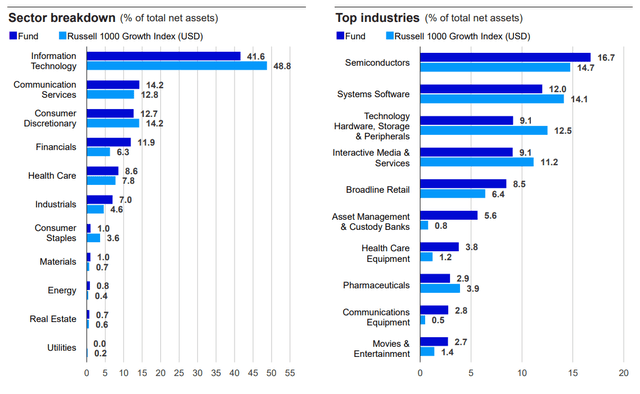

Portfolio positioning

The fund’s largest overweights embody financials, industrials and communication companies. Financials are in our view uniquely poised to learn from decrease rates of interest, and we presently favor capital markets and securities exchanges over cost firms and banks. Industrials publicity is balanced with a combination of top of the range defensive and earlier cycle shares.

Communication companies is concentrated on three predominant areas: firms with publicity to AI-driven enhancements, subscription media companies positioned for revenue enlargement and media content material creators, together with online game builders, approaching new content material cycles. We elevated the fund’s Apple place however maintained the underweight. The fund remained underweight in IT, largely as a result of underweights in Apple and Microsoft. The fund was additionally underweight shopper staples and shopper discretionary.

New Positions

Flutter (FLUT)(OTC:PDYPY): We imagine traders underestimate the worth of the “moat” of sustainable aggressive benefits in on-line sports activities betting. The business has been setting as much as be a duopoly of Flutter’s FanDuel and DraftKings (not a fund holding).

DoorDash (DASH): This market chief and best-in-class restaurant supply operator has been approaching 70% US market share. The corporate is investing in greater development verticals of worldwide markets and US speedy supply past eating places.

Goldman Sachs (GS): This funding financial institution is in our view poised to learn because the Fed rate-cutting cycle is anticipated to reopen capital markets. We imagine a rise in mergers and acquisitions and IPOs ought to meaningfully speed up income for the cyclically tilted large-cap financial institution.

Notable Gross sales

Edwards Lifesciences (EW): A newly permitted coronary heart valve substitute was anticipated to speed up gross sales development, however the firm’s core enterprise plateaued shortly, inflicting a drag on general development.

IDEXX Labs (IDXX): We nonetheless regard IDEXX as one of many highest high quality well being care companies with a close to monopolistic place within the animal diagnostics market. Nonetheless, a decline in vet visits and shopper weak spot has apparently weighed on the inventory.

O’Reilly Automotive (ORLY): Trade development has slowed as a result of decrease inflation, stress on discretionary gross sales and weak spot amongst low-end customers. We reallocated the capital to shares the place now we have greater conviction.

Prime contributors (%) | ||

Issuer | Return | Contrib. to return |

Apple Inc. | 10.75 | 0.83 |

Meta Platforms, Inc. | 13.64 | 0.68 |

KKR & Co. Inc. | 24.27 | 0.60 |

Blackstone Inc. | 24.41 | 0.43 |

S&P World Inc. (SPGI) | 16.04 | 0.29 |

Prime detractors (%) | ||

Issuer | Return | Contrib. to return |

Alphabet Inc. | -8.83 | -0.65 |

ASML Holding NV (ASML) | -26.57 | -0.41 |

Microsoft Company | -3.55 | -0.40 |

DexCom, Inc. (DXCM) | -40.87 | -0.40 |

Amazon.com, Inc. | -3.58 | -0.31 |

Efficiency highlights

The fund had a optimistic return for the quarter however underperformed its benchmark, primarily as a result of inventory choice in IT, shopper discretionary and well being care. Inventory choice in financials, industrials and communication companies added to relative return, as did overweights in financials and industrials.

Contributors to efficiency

Apple inventory has risen on potential for its most important {hardware} improve cycle because the pandemic as the corporate has been constructing AI into all its units from iPhones to MacBooks.

Meta is realizing optimistic outcomes from its AI investments via higher suggestions, greater engagement, improved advert instruments and extra environment friendly advert focusing on. We imagine Meta is uniquely positioned to achieve momentum as AI assistants develop into a big a part of shopper interactions and merchandise.

KKR, another asset supervisor, had a wonderful quarter as a result of acceleration in fundraising, notably following sturdy relative efficiency throughout virtually all of its funding methods.

Blackstone, another asset supervisor, benefited from the beginning of the Fed fee slicing cycle given its sizeable actual property portfolio, doubtless will increase in actual property mergers and acquisitions, and potential for higher relative efficiency from actual property belongings usually.

S&P World is a diversified data companies agency with a big company rankings enterprise that we imagine ought to profit as decrease rates of interest result in elevated fastened earnings issuance.

Detractors from efficiency

Dexcom declined as administration of this steady glucose monitoring gadget firm forecast a gross sales slowdown following a gross sales power reorganization.

Alphabet reported stable quarterly earnings, however traders appeared to count on much more following its giant working revenue from the prior quarter. Google’s mother or father firm has been going through a number of regulatory headwinds, together with anti-trust lawsuits associated to its promoting enterprise, its place as Apple Safari’s default search engine, and its App retailer limitations. Additionally, future search question development is clouded by potential competitors from AI chatbots. We trimmed the place.

ASML confronted export restrictions on superior semiconductor manufacturing gear that affected its means to promote sure merchandise to China and constrained its development. We offered the inventory.

Microsoft reached an all-time excessive in early July, then the inventory corrected. Whereas Microsoft is among the many fund’s long term holdings and one in every of our excessive conviction shares, its AI capabilities have been constrained by a scarcity of GPU capability and our analysis revealed that its Azure cloud platform could also be behind expectations for the corporate’s upcoming earnings launch. We trimmed the place.

Amazon’s latest earnings outcomes got here in towards the excessive finish of its steering however revealed weaker income development in e-commerce that was partially offset by power in Amazon Internet Providers. A latest improve in bills tied to its Kuiper satellite tv for pc broadband enterprise additionally appeared to weigh on the inventory.

For extra data, together with prospectus and factsheet, please go to Invesco.com/VAFAX Not a Deposit Not FDIC Insured Not Assured by the Financial institution Might Lose Worth Not Insured by any Federal Authorities Company |