No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at the immersive Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the roaring future, and join us at Connect.

Long-term interest rates climbed Friday after Federal Reserve Chairman Jerome Powell delivered some tough talk on inflation at the Jackson Hole Economic Symposium, but soon leveled off as investors digested whether Powell’s message was much of a departure from past statements.

“It is the Fed’s job to bring inflation down to our 2 percent goal, and we will do so,” Powell said right off the bat, addressing critics who have questioned whether that remains a realistic benchmark in the face of the economy’s resilience.

“We have tightened policy significantly over the past year,” Powell continued. “Although inflation has moved down from its peak — a welcome development — it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

Take Inman’s Inaugural Survey On Agent Commissions

As Powell delivered his remarks, yields on 10-year Treasurys — which often predict where mortgage rates are headed — surged six basis points to 4.28 percent.

But by Friday afternoon, 10-year yields were back to where they’d closed on Thursday as markets digested Powell’s recognition that inflation data has been headed in the right direction lately and that future decisions on how high and how long to keep interest rates elevated will be data dependent.

Powell started with a clear message: That the Fed is prepared to raise rates further if appropriate and hold them there until it’s confident that inflation is moving toward its 2 percent goal, Pantheon Macroeconomics Chief Economist Ian Shepherdson said in a note to clients.

Ian Shepherdson

But “markets have heard [that message] before, many times, with few variations,” Shepherdson said. “Our take is that the speech breaks no new ground. The Fed believes it is tight, but is open to the idea that it might have to be tighter. The data are headed in the right direction, but not yet definitively. It’s all about the data.”

While Pantheon analysts think the Fed is done raising rates, it’s a 60-40 call, Shepherdson said, “not least because we don’t yet see clear evidence of a serious break in job growth … and that will keep the Fed nervous.”

The worry among some economists is that the Fed won’t begin to reverse course until the economy is on the path to recession. But after Powell’s speech, Chicago Fed President Austan Goolsbee told CNBC he still sees the potential for a soft landing.

“I still feel like there’s a path, I keep calling it the “golden path,” that we could get inflation down without having a big recession,” Goolsbee said. “That would be virtually unprecedented for inflation to come down as much as we need it. But thus far, it’s been going okay. We still need more information coming in, but nothing’s happened in the last two months that would make me think that the golden path’s impossible.”

In their latest forecast, economists at Fannie Mae said they are expecting a “mild recession” in the first half of 2024, but that the larger risk to housing is that inflation picks up again, forcing the Federal Reserve to resume interest rate hikes.

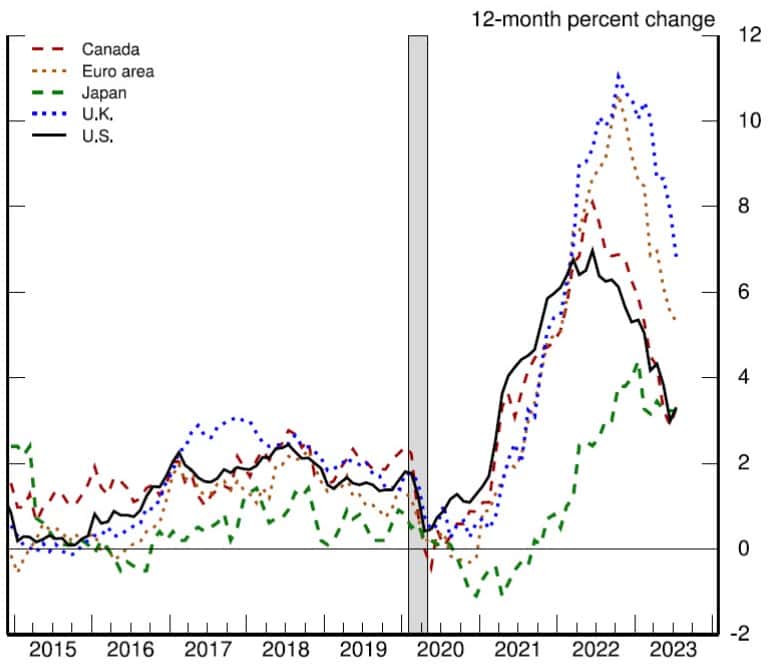

Headline inflation

Source: Bureau of Economic Analysis, Haver Analytics via Federal Reserve

After peaking at 7 percent in June 2022, annual “headline” inflation — personal consumption expenditures (PCE) including food and energy — has mostly been headed in the right direction but bounced to 3.3 percent in July.

“The effects of Russia’s war against Ukraine have been a primary driver of the changes in headline inflation around the world since early 2022,” Powell said. “Headline inflation is what households and businesses experience most directly, so this decline is very good news. But food and energy prices are influenced by global factors that remain volatile, and can provide a misleading signal of where inflation is headed.”

Core PCE inflation

Source: Bureau of Economic Analysis, Haver Analytics via Federal Reserve

The Fed’s preferred measure of inflation, core PCE, omits the food and energy components and remains further from the central bank’s goal of bringing inflation down to 2 percent per year. At 4.3 percent in July, annual core PCE inflation was down from a peak of 5.4 percent in February, and monthly declines in June and July were welcome, Powell said.

But “two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal” of achieving 2 percent inflation, Powell said.

On an annual basis, “core goods inflation remains well above its pre-pandemic level,” he said. “Sustained progress is needed, and restrictive monetary policy is called for to achieve that progress.”

Housing still an inflation worry

The Fed is looking closely at three components of core PCE inflation: Inflation for goods, for housing services and for all other “nonhousing services” like health care, food services, transportation and accommodations, Powell said.

Inflation has fallen sharply for durable goods like cars as “the pandemic and its effects have waned, production and inventories have grown and supply has improved,” while higher interest rates weigh on demand Powell said.

While inflation in nonhousing services has shown improvement when measured over the past three and six months, it’s moved sideways in the last year.

“Part of the reason for the modest decline of nonhousing services inflation so far is that many of these services were less affected by global supply chain bottlenecks and are generally thought to be less interest-sensitive than other sectors, such as housing or durable goods,” Powell said.

The housing sector is “highly” sensitive to interest rates, but it takes some time for falling rents and home prices to impact inflation measures, Powell noted.

The impacts of the Fed’s interest rate hikes “became apparent soon after liftoff,” Powell acknowledged. “Mortgage rates doubled over the course of 2022, causing housing starts and sales to fall and house price growth to plummet. Growth in market rents soon peaked and then steadily declined.”

Powell — who warned at last year’s Jackson Hole conference that the Fed was determined to get inflation under control, even if higher rates would “bring some pain to households and businesses” — said the housing sector could still frustrate the Fed from reaching its inflation target.

“After decelerating sharply over the past 18 months, the housing sector is showing signs of picking back up,” Powell said. “Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

Goolsbee, who was a University of Chicago economics professor before being appointed president of the Chicago Fed in January, said he thought Powell struck the right tone.

Austan Goolsbee

“I think he was properly sober,” Goolsbee said. “Let’s not conclude too much. We’ve gotten a couple of good months of improvement in the data on inflation. We saw progress in the areas that we’ve been wanting to see progress — on goods, on the beginning of housing — but there’s still a long way to go. So I think if the chair had gotten up and said ‘mission accomplished,’ that seems like it’d be premature.”

But Shepherdson took issue with Powell’s assertion that the housing sector is showing signs of picking up.

“Mortgage applications are still falling, pointing to lower total home sales,” Shepherdson said. “New home sales are rising because homebuilders are taking market share due to the lack of existing home inventory, but that does not mean the overall market is starting to recover. Total home sales likely will hit new lows over the winter.”

On Wednesday, the Mortgage Bankers Association reported that homebuyer demand for purchase mortgages fell to the lowest level since 1995 last week as mortgage rates hit new post-pandemic highs.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter