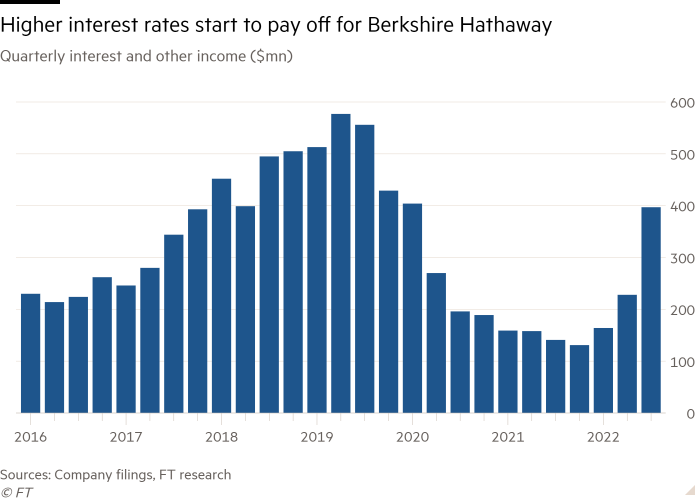

Warren Buffett’s Berkshire Hathaway is quickly becoming one of the principal beneficiaries from the sharp increase in interest rates in the US, as its fortress-like balance sheet begins to generate hundreds of millions of dollars in income for the sprawling conglomerate.

The interest the company earns on its $109bn cash pile nearly tripled from a year before to $397mn in the third quarter, it disclosed on Saturday, noting the gain was “primarily due to increases in short-term interest rates”.

Berkshire holds the vast majority of its cash in short-term Treasury bills, deposits at banks and in money market accounts, where interest rates have been rapidly rising as the Federal Reserve has tightened monetary policy. Last week the US central bank lifted rates to between 3.75 and 4 per cent, up from near zero at the year’s start, and traders expect that rate to top 5 per cent next year.

While tighter policy has sent shockwaves through financial markets — even bludgeoning the value Berkshire’s mammoth stock portfolio — it is finally beginning to pay dividends for companies and consumers holding cash.

Data from the Investment Company Institute showed that cash parked in money market funds that cater to everyday retail investors has swelled to a record high.

Buffett and Berkshire vice chair Charlie Munger have over the past decade presided over a significant expansion in Berkshire’s cash holdings, which they believe is critical given the potential catastrophic payouts the company’s insurance businesses could one day need to make.

It was a point underlined by third-quarter results that showed Berkshire was hit by a $3.4bn pre-tax loss from Hurricane Ian, which killed more than 100 people as it tore through parts of Florida. US president Joe Biden has said it will take years, not months, for the region to recover.

Berkshire’s insurance unit suffered an operating loss of $962mn during the quarter, with Geico warning that higher used auto parts prices and an increase in accidents were weighing on its results.

Buffett and Munger have long been able to stomach large losses in its insurance division because of the sizeable “float” — insurance premiums it collects before it must ultimately pay claims on obligations. That float has helped fuel its investments in stocks and fund the company’s acquisitions of businesses.

The sell-off in financial markets hampered Berkshire’s equity portfolio, which includes large stakes in Apple, American Express, Chevron and Bank of America. The company said its portfolio slid in value to $306.2bn from $327.7bn at the end of June.

Those declines pushed it to a net loss of $2.7bn in the period, or $1,832 per class A share, from a profit of $10.3bn a year before, worth $6,882 a share. Buffett has long characterised the swings in its investment portfolio — which it must recognise in its profit and loss statements due to accounting rules — as “meaningless”.

The dozens of businesses it owns, which are widely-watched for signs of the health of the American industrial and business complex, laid bare the resilience of the US economy while also signalling the potential slowdown engineered by the Fed. Berkshire’s results also showed the effects of inflation and the fights over better wages as real living standards come under pressure from higher prices.

Revenues at its BNSF railroad surged 17 per cent to $6.5bn, but profits slid as the volumes of freight it shipped declined and it paid higher wages to its employees. The railroad became a flashpoint earlier this year as more than 30,000 unionised workers at BNSF threatened to strike, pushing back against conditions and demanding a boost to pay.

A tentative agreement in September delivered concessions to employees and BNSF said pay costs rose 27 per cent in the third quarter from a year earlier.

The energy businesses within Berkshire’s utility division reported a 17 per cent jump in revenues, boosted by higher power costs.

But the company’s real estate brokerage unit saw sales tumble by nearly a fifth, and operating profits at the unit plummeted 72 per cent from the year before as the housing market cooled and it sold fewer homes.

Berkshire said higher mortgage rates were also expected to pressure its handful of businesses in the housing sector. During the quarter, however, those businesses — including the brick maker Acme and flooring group Shaw — were able to raise prices and registered strong demand.

Overall, operating earnings rose to $7.8bn from $6.5bn a year earlier. The results were helped by larger profits in its manufacturing and services business lines.

Berkshire, which this year bought a 21 per cent stake in energy company Occidental’s common stock, disclosed that in the fourth quarter it would begin reporting earnings from the oil and gas giant as part of its results.

The company also said it had spent just over $1bn in the quarter buying back its own stock.

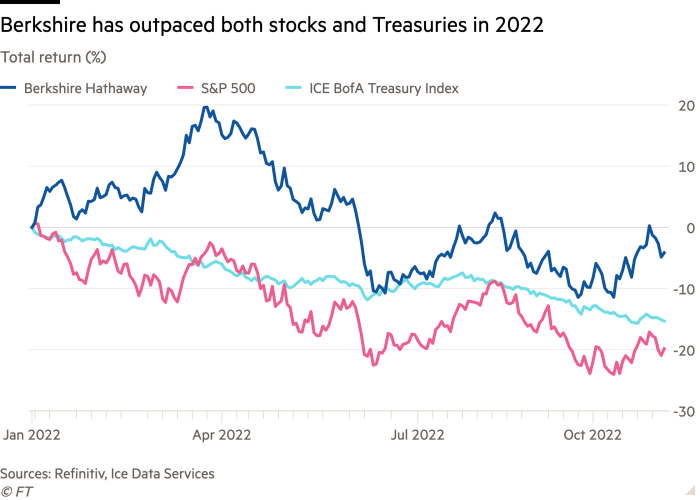

Berkshire’s class A shares, which are down 4.1 per cent this year, have far outperformed the broader market. The benchmark S&P 500 has declined 20.9 per cent while an investor in US Treasuries has lost 15.3 per cent, according to Ice Data Services.