Leon Neal

Business History and Overview

Intel (NASDAQ:INTC) was once the darling stock of American equities. A unique fusion of manufacturing dominance and technological leadership, Intel had it all. They pioneered the still-dominant chip scaling idea known as “Moore’s Law” which posits that semiconductor transistor density will double every two years. With density doubling, so too does performance and energy efficiency. For a while, this held true and Intel remained the pinnacle of American chip dominance. This is a far cry from the debt-laden monster with shrinking revenues and a major dividend cut that we have now. How did we get here?

In 2005, Intel was approached by Apple (AAPL) to supply chips for their new product, the mobile phone. CEO Paul Otellini simply did not see the path forward for smartphones. He didn’t think Intel would benefit from diverting its focus from its core businesses and decided to turn down the opportunity. How wrong he was.

This decision started the years-long erosion of Intel’s dominance and began Apple’s ascent to global ubiquity. Apple built its mobile processors on the reduced instruction set (“RISC”) ARM (ARM) architecture, which allowed for ongoing iterations and Apple’s constant innovation in iPhones. Now, Apple is a major force in fabless silicon design in its own right, with the A-series chips being a leading mobile processor. Worse yet for Intel, Apple has since shifted its Mac line of desktops and laptops off the x86 CPU architecture onto their propriety “M” series of chips, also built on an ARM design.

By the mid-2010s, Intel faced delays and challenges with its 10nm process node, falling behind competitors TSMC (TSM) and Samsung (OTCPK:SSNLF), who had since advanced to 7nm and 5nm process nodes. These delays lead to competitive disadvantages in both performance and power efficiency and a consistent erosion of market share.

Through the late 2010s to early 2020s, Intel’s struggles continued. AMD (AMD), the only other company with a license to sell x86 CPUs, began eating market share in the Intel-dominated CPU market. AMD partnered closely with TSMC and pioneered the chipset architecture to become, perhaps, the far better option for x86 CPUs in servers and desktops today. Meanwhile, TSMC and Samsung continued to solidify their fab leadership. Their sole focus on chip manufacturing allowed them to extend their lead considerably over Intel. At the time, Intel only made internally designed chips; they didn’t pursue external customers.

Entering the 2000’s, Intel looked to be the safest long-term investment available. Instead, the industry began leaving them behind. AMD is now a formidable competitor in the CPU market while Apple successfully pioneered its line of chips on the ARM architecture. Microsoft (MSFT) has yet to transition its Windows OS off x86 chips, but this remains a considerable risk for Intel’s CPU segment in the 2020s.

Intel was and remains an IDM. An IDM is an “Integrated Device Manufacturer” – a company that both designs and manufactures its chips. While this was the leading business model from the 1970s-1990s, the 2000s would see the rise of fabless chip companies that were explicitly focused on developing their chip designs. Chip manufacturing was becoming far too capital-intensive, and the economics only made sense for dedicated fabs that didn’t focus on chip design.

This dismal recent history and risky outlook led to Intel’s IDM 2.0 announcement in 2021. They hope to reclaim manufacturing leadership by delivering four process nodes in five years and reorganizing their internal operations.

The strategy has three key components:

Continued Commitment to Internal Manufacturing: Intel is significantly investing in its internal manufacturing to advance process technology. This includes the development and refinement of next-gen process nodes.

Expansion of Intel’s Foundry Services: Intel aims to become a major provider of foundry services globally through Intel Foundry Services (“IFS”). This involves opening up its manufacturing facilities to produce chips for external clients, competing directly with foundry giants TSMC and Samsung.

Use of External Foundries: Intel will be open to the strategic use of third-party foundries for certain products to ensure flexibility and responsiveness to market demands. This marks a key shift and will allow Intel to leverage the strengths of other foundries.

They elaborated on some key internal organizational restructuring in their recent 10-K, saying:

A key component of our overall strategy is our internal foundry model. Under this model, we intend to reshape our operational dynamics and establish transparency and accountability through standalone profit and loss reporting for our manufacturing group in 2024. We expect this model to enable increased efficiencies across a number of aspects of our organization that we believe are integral to achieving our financial and operational goals. At the same time, we continue to prioritize capital investments critical to our efforts to regain process leadership and establish a leading-edge, at-scale foundry business.

In real terms, this means Intel’s internal chip design teams will work with IFS “at an arm’s length”. This will more closely resemble a fabless chip designer working with a dedicated foundry.

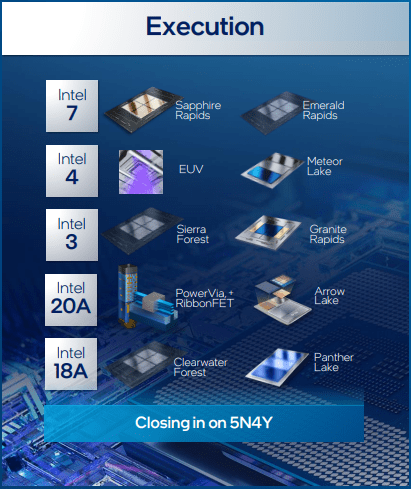

In the pursuit of regaining fab process leadership, Intel announced several planned advancements, including:

Intel 7: Previously known as 10nm Enhanced SuperFin

Intel 4: Previously referred to as 7nm, this marks a significant leap in transistor density and performance, incorporating extreme ultraviolet (EUV) lithography.

Intel 3: This node posits further performance improvements and efficiency gains

Intel 20A and 18A: Intel has also outlined plans for 20A and 18A (where “A” stands for angstrom, a unit smaller than nanometer), introducing new transistor architectures such as RibbonFET and new interconnect technologies like PowerVia.

Based on Intel’s recent earnings shareholder presentation, Intel 3 manufacturing is ready and they are on track to deliver 20A by the end of 2025. They also recently announced a partnership with UMC and the opening of an advanced packaging fab. These announcements come on the heels of the very first ASML (ASML) high-NA EUV lithography module being delivered to Intel.

Intel Shareholder Presentation January 2024

There’s been wide debate on whether Intel is actually on track to disrupt TSMC’s dominance. It’s still unclear if 18A will keep pace with TSMC’s process roadmap, but one thing is clear: they are in relentless pursuit.

Risks Abound

IDM 2.0 is a bold strategy. Businesses with a dismal recent history like Intel need to be bold to regain dominance. With ambitious business goals come an abundance of risk, though.

While Intel has enjoyed an abundance of government subsidies with semiconductor legislation across the US and Europe, this is a drastically capital-intensive undertaking. They will likely be operating cashflow negative in the coming years for a strategy in which success is all but guaranteed. TSMC guided for over $25b in CapEx in 2024 on the low end. That is nearly half of Intel’s 2023 revenue alone, and TSMC has geopolitical motivations underpinning its desire to remain globally dominant.

The server industry, which historically has been dominated by x86 Intel CPUs, is shifting spend increasingly toward Nvidia (NVDA) GPUs and other AI accelerators. Intel simply isn’t competitive with the likes of Nvidia’s GH200 and AMD’s MI300X yet. While Intel’s own AI accelerator lineup (Gaudi) shows promise, Nvidia and AMD will continue to dominate in the years to come.

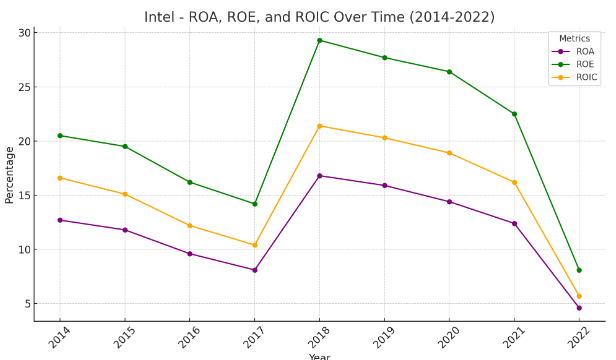

Meanwhile, Intel’s return metrics have been in a secular downtrend:

Authors Creation, Morningstar Data

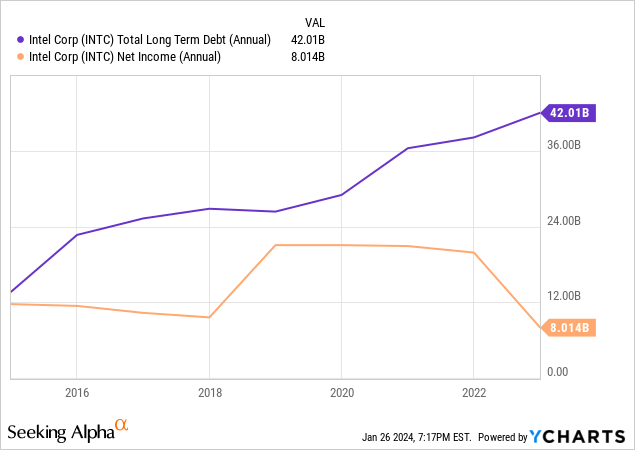

This is not to mention the outright declines across all of Intel’s reportable segments and a hefty dividend cut in 2023. The extremely capital-intensive nature of scaling chip manufacturing globally while attempting to regain lost ground in process technology has also ballooned Intel’s long-term debt without corresponding earnings growth:

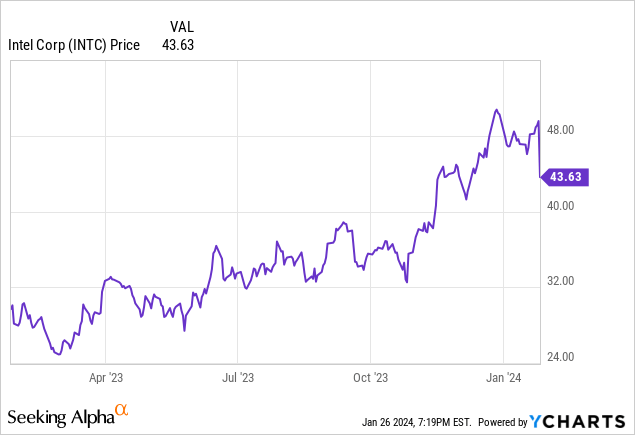

These trends are troubling. Despite these flailing fundamentals, Intel has been on a run recently driven mostly by hype around IDM 2.0 and AI:

Investment Thesis

I do not believe Intel presents a very compelling risk/reward profile currently. The recent post-earnings sell-off is likely to continue grinding Intel down in the short term, while major execution risks make the long-term thesis quite cloudy. Despite all this, IDM 2.0 does provide a very compelling long-term opportunity. Even if Intel fails to regain outright process leadership, it should become a formidable competitor to TSMC and Samsung. Also considering TSMC’s China risk and the global desire for onshored chip manufacturing, Intel looks to be the best positioned business for American and European fab dominance. These are not bad markets to lead.

Regardless, I believe investors can find much better opportunities in the short term. There is not enough clarity on Intel’s path forward currently. For this reason, I’d recommend semiconductor manufacturing equipment providers like Applied Materials (AMAT) and ASML, which can provide much safer growth opportunities than at current levels. These companies will benefit from Intel’s and competitors’ global fab buildouts.

While 2023 was mostly characterized by a hype-driven rebound, 2024 will be characterized by a “wait-and-see” mentality around Intel’s turnaround efforts. For this reason, I think investors should opt for businesses elsewhere in the semiconductor ecosystem to benefit from the secular growth we are likely to see until 2030.