robynmac

We beforehand lined Intel (NASDAQ:INTC) in April 2024, discussing its underwhelming Foundry prospects after the discharge of its new phase reporting, because the IDM 2.0 introduced forth the unsure money burn and drag on its general profitability.

This was on prime of its delayed node roadmap in comparison with its foundry peer, signaling Intel Foundry’s unsure prospects as a consequence of its nascency.

Whereas we had been optimistic in regards to the inventory’s US-made sentiments, it remained to be seen when its foundry phase would have the ability to ship the vital mixture of node development, quantity manufacturing, and profitability, leading to our reiterated Maintain score.

Since then, INTC has already pulled again tremendously by -44.4%, nicely underperforming the broader market at +2.5%, triggered by the underwhelming FQ2’24 monetary efficiency, dividend suspension, and drastic layoffs.

Mixed with the continued market rotation from excessive progress semiconductor shares and the intensifying market pessimism surrounding generative AI, we consider that there could also be extra ache throughout its unsure turnaround, leading to our reiterated Maintain score.

We will talk about additional.

INTC’s Funding Thesis Has Turned Out Poorly Certainly

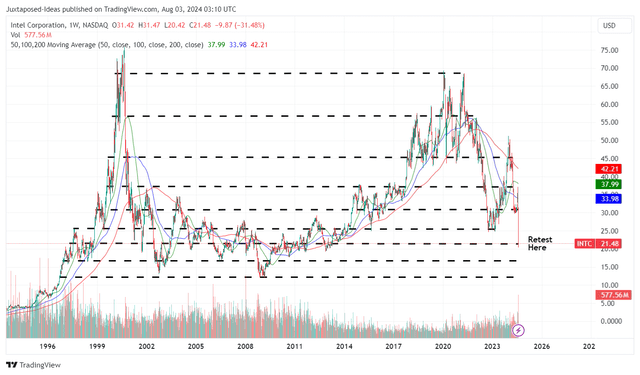

INTC 30Y Inventory Value

Buying and selling View

Except one had been residing below a rock, it went with out saying that INTC, as a legacy semiconductor firm, had didn’t capitalize on its earlier x86 market management and the continued AI increase.

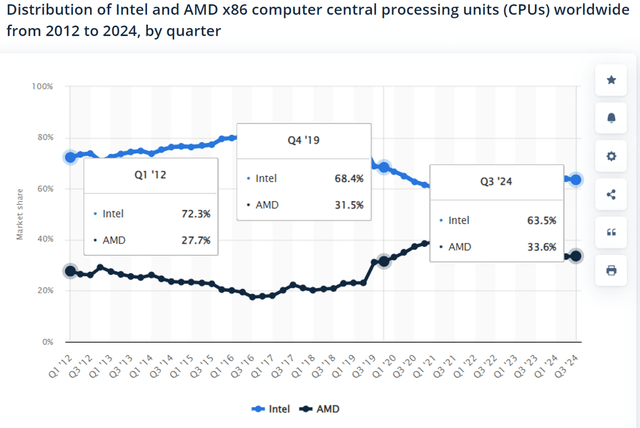

x86 Laptop Central Processing Items Share

Statista

For instance, INTC has reported moderating x86 CPU market share of 63.5% by Q3’24 (-0.4 factors QoQ/ +0.9 YoY/ -13.4 from FQ2’19 ranges of 76.9%), as its direct competitor, Superior Micro Units (AMD) continues to develop to 33.6% (+0.2 factors QoQ/ -1.5 YoY/ +10.5 from F2’19 ranges of 23.1%).

On the identical time, in an try to develop x86 market shares and Shopper Computing Group revenues to $7.41B in FQ2’24 (-1.5% QoQ/ +9.2% YoY), the administration has went on drastic value cuts, naturally impacting the phase’s working margins to 33.6% (-1.4 factors QoQ/ +4.4 YoY/ -7.3 from FY2019 ranges of 40.9%).

Moreover, it goes with out saying that through the ongoing generative AI increase, Nvidia (NVDA) has already emerged because the clear chief.

That is because of Jensen Huang’s visionary present of a DGX-1 supercomputer to OpenAI again in 2016 and the following nurturing of a “massive group of AI programmers who constantly invent utilizing the corporate’s know-how.”

This improvement has triggered NVDA’s sturdy knowledge heart income progress to $22.6B (+23% QoQ/ +427% YoY) within the newest quarter and the main share of as much as 90% within the AI GPU chip market/ 80% of the whole knowledge heart AI chip market.

How about INTC?

Nicely, the Pat Gelsinger led firm reported solely $3.04B of Knowledge Heart/ AI associated revenues in FQ2’24 (inline QoQ/ -3.4% YoY), whereas solely guiding FQ3’24 revenues of $3B (inline QoQ/ -3% YoY), exemplifying its incapacity to capitalize on the continued AI increase.

That is regardless of the Intel® Gaudi® 3 AI accelerator on monitor to launch in FQ3’24, with “roughly two-times the efficiency per greenback on each inference and coaching versus the main competitor,” implying that NVDA’s GPU/ AI accelerator choices stay inherently extra enticing to hyperscalers regardless of the hefty price ticket.

Whereas NVDA’s Blackwell launch could also be reasonably delayed, it’s obvious that a number of hyperscalers have positioned additional belief in its superior AI accelerator choices, based mostly on GOOG’s (GOOG) order value $10B, Meta (META) at $10B, and Microsoft (MSFT) at $1.62B.

These developments are additionally why INTC has reported underwhelming FQ2’24 revenues of $12.8B (+0.7% QoQ/ -0.7% YoY) and adj EPS of $0.02 (-88.8% QoQ/ -84.6% YoY).

Mixed with the hefty FY2024 capital expenditure steering of $26B (+1% YoY/ +60.3% from FY2019 ranges) and FY2025 at $21.5B (-17.3% YoY), attributed to its Foundry goals, it’s unsurprising that the corporate has reported adverse Free Money Circulation of -$12.58B during the last twelve months (+24.8% sequentially/ -174.3% from FY2019 ranges of $16.93B).

That is why we consider that the administration’s choice to droop dividends from This fall’24 onwards has been prudent, constructing upon the earlier reduce introduced in early 2023 – one which we consider ought to have occurred earlier, with the administration “seemingly financing its dividend payouts with debt.”

That is particularly since INTC’s stability sheet has been constantly deteriorating, with rising (present and long-term) money owed of $53.02B (+1.1% QoQ/ +7.6% YoY/ +82.8% from FY2019 ranges of $28.99B).

Shifting ahead, with a lot of the unhealthy information already baked in and the height capex depth behind us, we consider that the administration could also be higher positioned to slowly flip the legacy ship round.

That is partly aided by the projected discount of -$1.6B in Working Bills in 2024 and -$4.1B by 2025, down from the $21.6B reported in FY2023, and the capex discount – ensuing within the supposed $10B in price financial savings.

Even so, if we could also be painfully trustworthy, it’s unsure how profitable their eventual turnaround could also be, since INTC’s legacy companies have didn’t innovate and keep forward of the quickly altering semiconductor panorama.

With different gamers already gaining large headways within the x86, knowledge heart, and CPU/ GPU finish markets, amongst others, the administration must miraculously “pull a rabbit out of the hat” to not solely survive the extremely aggressive business, however to ultimately thrive and regain the market’s/ shareholders’ belief.

For now, solely time could inform.

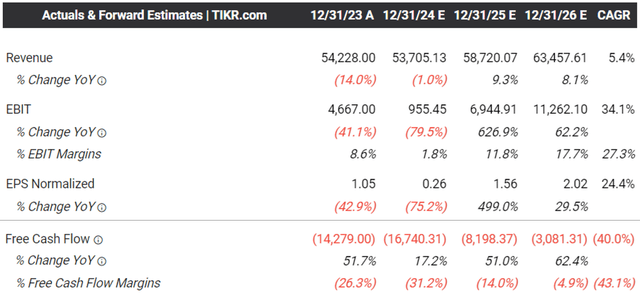

The Consensus Ahead Estimates

Tikr Terminal

For now, a quiet optimism is already noticed within the promising consensus ahead estimates, with INTC anticipated to report trough FY2024/ FY2025 years and FY2026 more likely to convey forth drastically improved numbers.

Even so, with bloated stability sheet and adverse Free Money Flows, we consider the administration is unlikely to reinstate dividends within the intermediate time period, successfully placing an finish to the 31 years of consecutive dividend payouts.

So, Is INTC Inventory A Purchase, Promote, or Maintain?

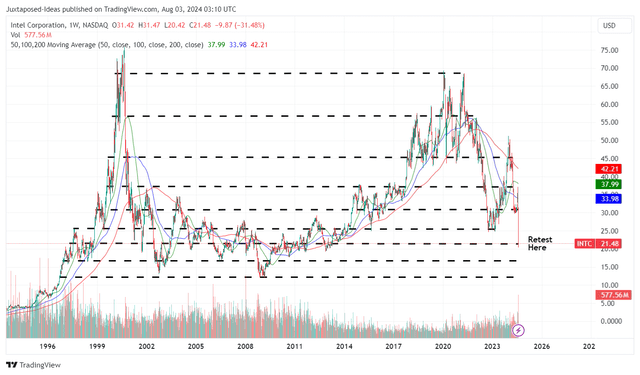

INTC 30Y Inventory Value

Buying and selling View

Because of these pessimistic developments, it’s unsurprising that the market has opted to punish INTC first, as noticed within the drastic two day pullback by -30.1%, or the equal -$39B in market capitalization.

For context, we had provided a good worth estimate of $30.10 in our final article, based mostly on the annualized FQ4’23 adj EPS of $1.36 (after adjusting for the $1.2B litigation profit for improved accuracy, versus the reported sum of $2.52) and the 5Y P/E imply valuations of twenty-two.15x.

Whereas INTC is lastly cheaper, we’re unsure whether it is smart to suggest a Purchase score right here, since there could also be six extra quarters of uncertainty till its headcount reductions are accomplished.

On the identical time, whereas the administration has highlighted a sturdy general AI PC market share progress from lower than 10% in 2024 to over 50% by 2026, it stays to be seen how a lot beneficial properties the legacy semiconductor firm could report, with the CPU market more and more aggressive as QUALCOMM (QCOM) enters the image with ARM-based processor.

Mixed with the unsure monetization of its foundry ambitions, as mentioned in our earlier article right here, and different extra skilled foundry leaders establishing geopolitically safe operations in Japan/ the US, we consider that it might be extra prudent to keep up our earlier Maintain score right here.

Lastly, with Pat Gelsinger failing to ship (in hindsight) the overly formidable turnaround story, we consider that there could also be extra uncertainty forward, particularly since INTC now not pays out dividends whereas boasting minimal near-term progress prospects.

Endurance could also be extra prudent right here.